Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 45 | 28.3.2022 | TTS | TTS 2021 dividend proposal | Romania |

| 46 | 29.3.2022 | ATGR | Atlantic Grupa 2021 Annual Report | Croatia |

| 56 | 31.3.2022 | ZVTG | Triglav Audited annual report for 2021 | Slovenia |

Given the current Covid-19 situation, some of these events might be subject to change (postponed or cancelled).

FED is ready to do whatever it takes, but this time Powell is not talking about the same thing Mario Draghi was referring to exactly ten years ago. In 2012 Mario Draghi said to do “whatever it takes” to preserve the integrity of euro area, while in 2022 Powell stands to do “whatever it takes” to curb inflation. What has changed in Washington that switched doves into hawks? And what effect that has on Croatian eurobonds? Find out in this brief article.

FED’s Chairman Jerome Powell spoke Monday at a conference hosted by National Association for Business Economics and the hawkish tone of his statements amazed even the most seasoned fixed income traders. First of all, he described current inflation rates as “much too high”, while the labour market was “extremely tight”. Here’s the kicker: “There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level and then to move to more restrictive levels if that Is what is required to restore price stability”. Powell was not at all worried about causing the recession along the line, as long as short term interest rates get as close to neutral as possible a.s.a.p. The financial markets took the statement seriously and USD Libor futures contract with December 2022 maturity is implying 2.60% LIBOR versus current value of 0.966%. The less liquid FED fund futures with December 2022 maturity are currently pricing FED funds in a target range of 2.00%-2.25% by the end of the year, while January 2023 futures are already at 2.25%-2.50% levels. Financial markets are basically telling us: “We got you, Joe. It’s 2.40% by turn of the year.”

What has changed compared to last year’s FED’s dovishness? Across the Atlantic second round effects of inflation have started to take shape because post-Covid labour market is as tight as it can be. Then energy prices started to rise globally caused by energy supply chains coming into severe disruption because of Russian invasion on Ukraine. FED is kind of having a perfect storm: energy is going up and labour market is tight. Powell is right in one regard: he hasn’t much time to act if he wants to ease inflation pressures coming from multiple sources and hiking by 50bps in a single shot might be the way to go forward. At least that’s the message the financial markets got.

Many analysts draw comparisons to 1970s Paul Volcker era when inflation was brought under control by aggressive rate hikes. But fixed income veterans that are still moving the bond markets such as Guggenheim’s Scott Minerd are looking further into the past to find an adequate case study. 1970s are not a good comparison, he states in FT article released this week, because back then root causes of inflation are related to delinking the greenback to gold and massive fiscal expansion to fund the Vietnam war and the Great Society project championed by Lyndon B. Johnson. After that the Yom-Kippur War of 1973 and subsequent OPEC actions of 1974 caused oil price to skyrocket and add to the perfect storm scenario. The fiscal expansion of 1970s was a demand side component, while what we see in 2022 in something completely different – we’re actually fighting against supply side shortages that are not going away so easily, in part because of China’s zero-Covid policy. Minerd says the best corollary for the current situation is the brief 1946-1948 recession caused by manufacturing switching from a war economy into supplying consumer goods, causing shortages across the board. Throughout WWII, FED increased its balance sheet from 6.2bn USD (1942, because that’s when the war started in US) to 24.5bn USD (1945). The absolute BS figures look like a joke from today’s perspective, but the rate of change might draw some comparisons to the situation we face today. The comparison still lacks some of the features exhibited today – namely, US was on the gold standard (sort of a monetary policy autopilot) and for instance, the 1948 FED annual report talked nothing about the interest rate changes (wow!).

Minerd’s point is that back then the FED started reducing the balance sheet without raising interest rates, while today Powell is prepared to do whatever it takes to curb inflation. This may be too much and FED might end up cutting interest rates next year if faced with a serious downturn. Time would tell.

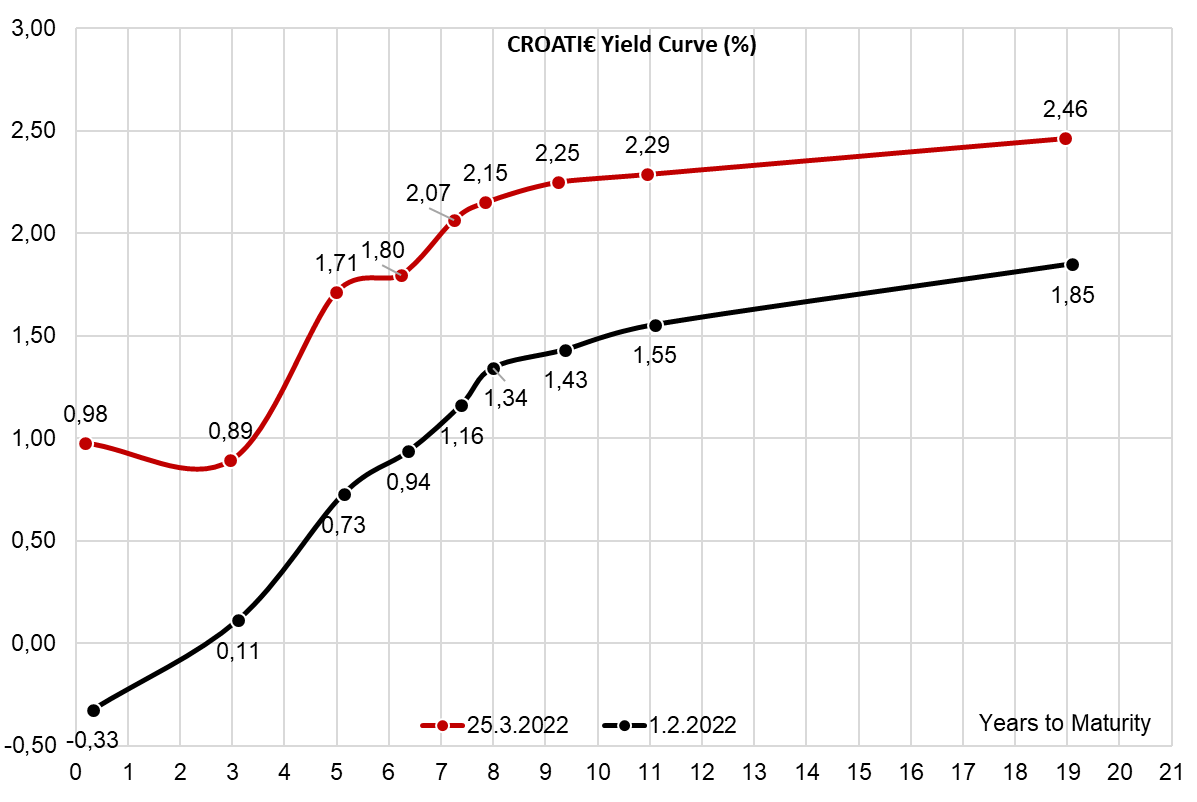

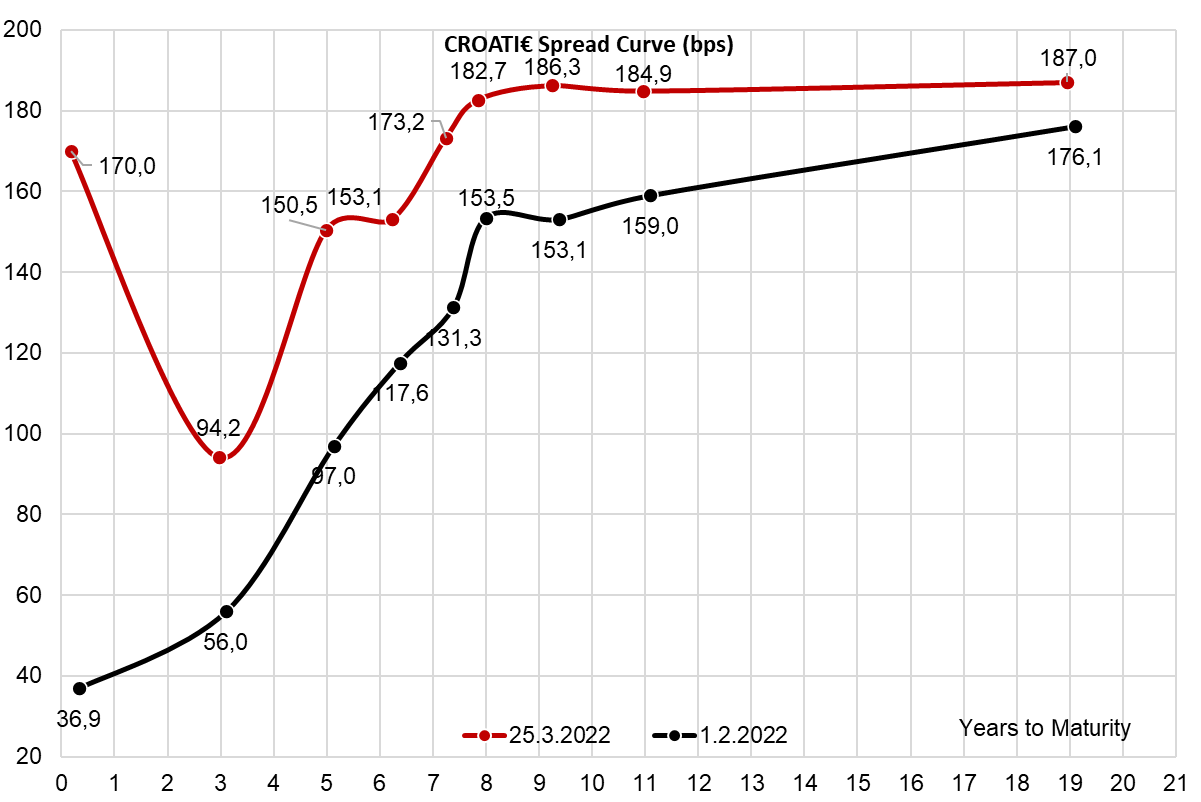

Croatian international bonds have finally caught a bid and our feeling is that it’s in part thanks to domestic investors who were preparing for an international bond auction that was postponed by the war in Ukraine, so they had to cut their cash positions ahead of the turn of the quarter and get invested into existing paper. That would explain all that demand for CROATI 1.75 03/04/2041€ coming from pension funds and LDIs. The second source of demand are Croatian banks and UCITS funds which are also hoping on the same bandwagon but targeting shorter maturities. This type of investor is looking at maturities between CROATI 3 03/11/2025€ and CROATI 2.75 01/27/2030€. The net effect of these bids and German bonds staging another leg up in terms of yields is that the spread curve tightened and currently no Croatian Eurobond trades above B+200bps. Best buys from the spread perspective are currently CROATI 1.5 06/17/2031€ (B+186.3bps) and CROATI 1.75 03/04/2041€ (B+187bps), the former probably because investors targeting this duration are aware that new Croatian eurobond (probably some sort of CROATI 2.00 05/2032€, ceteris paribus) would have to be placed in two months’ time.

The spread between BTPS 0.6 08/2031€ and CROATI 1.5 06/17/2031€ is back to 27bps (submitted below), meaning the situation is returning to normal. Beginning March the spread was as high as 102bps, underlining the structural difference between bonds with implied ECB put and bonds without one. Croatian bonds are still trading without one. That should change in the future.

At the closing price before the announcement, this would amount to a DY of 2.98%.

During its Supervisory Board meeting held on 23 March 2022, the SB gave its consent to the proposal of the Management Board to profit allocation for the year 2021, in the amount of HRK 1.27bn.

This profit would be distributed in the following manner: HRK 241.2m towards covering losses from prior years, HRK 51.6m for legal reserves, HRK 980m for a dividend pay-out, and HRK 513.9k for retained earnings.

This would amount to a dividend of HRK 98 per share. At the closing price before the announcement, this would give a DY of 2.98%. The ex-date and the payment date are yet to be announced.

INA Dividend Per Share (HRK) and Dividend Yield (%) (2015 – 2022)

Today we bring you an overview of Fondul Proprietatea and other Romanian close-end funds’ current price to NAV discount.

Current Price To NAV Discount (%)

Among the observed funds, the highest discount was recorded by SIF Banat with a discount rate amounting to 57%, followed by SIF Oltenia (55%), SIF Muntenia (53%), SIF Transilvania (49.4%). Meanwhile, Fondul Proprietatea managed to achieve a price to NAV discount which stands at 12.6%.

We can notice that Fondul Proprietatea clearly has the lowest price to NAV discount, while a discount of price to NAV reports a small deviation within SIF funds. Although the discount to NAV varies among the observed SIF it could be explained by the quality of assets that they hold. Namely, while SIF Banat holds 62.9% of their assets in listed shares, roughly half are listed on the BVB’s most demanding and premier segment, while the rest are in less quality segments. On the flip side, SIF Transilvania, who trades at the smallest discount to price among the observed SIFs (49%) has rather a favorable asset class structure with the highest amount of portfolio invested in listed equities accounting for 81% of the fund’s assets, while another 11% of assets are held in unlisted or listed but untraded financial instruments.

Historic Price To NAV Discount (%)