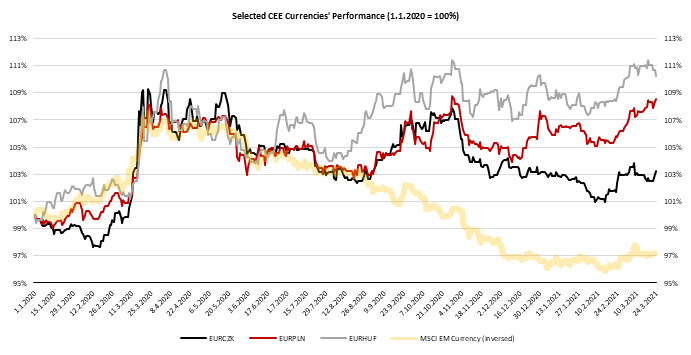

Third and fourth coronavirus waves have driven some of the CEE currencies to their lows from 2020. Economies are still below 2019 levels while inflation is expected to skyrocket in the next few months and each central bank has its own methods to fight it. In this brief article we are looking at the recent trends of CEE currencies and their main drivers.

We start this article with the least volatile currency in the region, namely Croatian kuna. After EURHRK has seen some volatility last year when it rose from 7.40 to above 7.60 due to first coronavirus wave, it settled slightly below 7.60. In December 2020, kuna appreciated to 7.52 but Croatian central bank decided to curb too much appreciation and maintained FX auction on which it bought EUR 130m, pushing EURHRK towards 7.58. Since then, mentioned pair was traded around that level, with few episodes of 100-200 pips in either side but coming back to 7.58 rather fast. Looking at the following period, the pair will be mostly driven by tourism sector and its FX inflows so one should have both eyes on covid passports, vaccine process and political will in Europe.

Going a bit north, Hungarians have witnessed much larger volatility and their currency is now close to its all-time lows. In more details, EURHUF is currently at 365, only 1pp below its highs, while it is 9% above the level where it stood a year ago when corona kicked in. Expected rate hikes in US which drove EM flows lower, covid situation in Europe, Hungarian policy towards EU and unconventional monetary policies are just some of the drivers that led forint to the current levels. Furthermore, CPI stood at 3.1% in February and MNB expects it to reach 5.0% in Q2 due to base effects. In its latest inflation report, MNB stated that it expects inflation to reach 3.8% in 2021 but then to moderate towards their target of 3.0% next year, reflecting similar thoughts as Mr Powell and Ms Lagarde. In any case, MNB states that “..the increase in risk aversion and potential second-round effects following the restart of the economy pose the greatest risk in terms of outlook for inflation” and that “..it has clear intention to prevent the current uncertain environment from causing a sustained rise in inflation.” This means that central bank is ready to lift its base and one week deposit rates in case it sees inflation rising above their projections. The main question here is whether it could be too late or will weakness of HUF make them to react even before higher inflation data.

EURPLN is also trading close to its highs and drivers are almost the same as in Hungary. However, Polish central bank had a bit different view on their currency as it intervened on the FX market to depreciate PLN to support Polish large export sector. Furthermore, Polish central bank maintains its large bond purchases programs and in its latest meeting stated that it will continue doing so together with possible interventions on FX markets to support the economy. On the other side, central bank does not see any threats from higher inflation in 2021 and beyond meaning that they are putting their best efforts to support the economy. Despite we think that most of the inflation pressures will be only transitory (especially in Europe), there is chance of higher inflation for the whole 2021 and some months beyond which could question priorities of Polish central bank in the following period.

Czech koruna on the other hand stands quite better versus euro compared to its neighbors zloty and forint. At the chart submitted below you could see that EURCZK is “only” 3.0% above the level from January 2021 while being 6% below highs when EURCZK almost reached 28.00. Although Czech Republic witnessed the largest third wave of covid in Europe and its health system almost collapsed, its currency seems to be safe due to its central bank. Namely, Czech central bank is frequently called the most hawkish bank in Europe and its monetary policy is rather consistent. This week we saw PM Andrej Babis and Czech president asking central bank to refrain from any monetary policy tightening due to economic situation while also asking CNB to share some of their profits with the government budget instead of putting it to bank’s reserves. We did not have to wait long for Rusnok’s answer in which he said that central bank is independent, and that monetary policy should be tailored within their first mandate which is stability of prices. Nevertheless, CZK did depreciate on the news as market calculated whether CNB could hike in the second half of 2021 (as written in their statement from February) considering pressures from the government. On yesterday’s monetary policy meeting CNB decided to leave rates unchanged as expected and stated they will wait covid uncertainties to fade before tightening their policy. In a bit optimistic scenario, that could still lead CNB to hike in Q4 2021 in case vaccine rollout accelerates in the following months.

Source: Bloomberg, InterCapital

For today we decided to present you with a share price performance of listed European football clubs since 1.1.2020.

It has been exactly a week since Dinamo Zagreb knocked out Tottenham from Europa League and thus qualifying into the quarterfinals of the tournament. The victory will definitely go into history books as one of the biggest wins in the club’s existence, as the club did not stay this far in the competition for more than 50 years.

As a result, we decided to revisit the share price performance of listed European football clubs since 2020.

Market Cap of Selected Football Companies

Back in the 1990s when competition prizes, sponsorship and TV rights were not as lucrative as today, many clubs decided to raise capital through an IPO in order to secure the funds need to purchase the best players and finance future results. European football clubs that decided to offer their shares to investors can be found in the STOXX FCTP index (which has been discontinued back in August of 2020).

The ongoing pandemic has very negatively affected football clubs in many ways, such as the ticket sales and broadcasting revenues as well as compensations received from UEFA. In the graph below, you can see the performance of certain FTCP index constituents with the addition of Manchester United, which show mixed results. As visible from the graph, on the gainers side one can notice that, since the beginning of 2020, 4 out of top 5 gainers are Turkish clubs, with Besiktas leading the list (+138.4%), followed by Galatasaray (+79.8%). On the flip side, 12 clubs have witnessed a double-digit decrease, with Roma leading the losers (-57.9%).

Share price performance since 1.1.2020

If we were to observe the share price performance on a YTD basis the situation is somewhat different. On the top gainer side, we still see Besiktas as the leader (+44.6%), however, the other 3 Turkish clubs found their place among the losers.

When looking at the clubs which qualified to the quarterfinals of the Europa league, 3 are listed – Roma (-6.4% YTD), Ajax (-1.9% YTD) and Manchester United (+1.4% YTD).