Croatia is close to placing the dual tranche of 12Y and 20Y € paper – where would we price such long maturities? Find out in this brief research piece.

Croatia is scheduled to place a dual tranche of € international bonds (12Y/20Y) any time soon, possibly even today. On the yesterday’s roadshow we found out that the Ministry of Finance has penciled in about 1.8bn EUR of eurobond placement in the days ahead, while about 1.09bn EUR would be required to settle the maturing CROATI 6.375 03/24/2021 at the end of March. Although the outstanding amount of the maturing paper is 1.5bn USD, it has been placed with underlying FX swap, turning this into about 1.09bn EUR. We are convinced that the Ministry of Finance would not issue less than 1.8bn EUR, but cannot exclude placement going as high as 2.25bn EUR if investor demand turns up higher than expected.

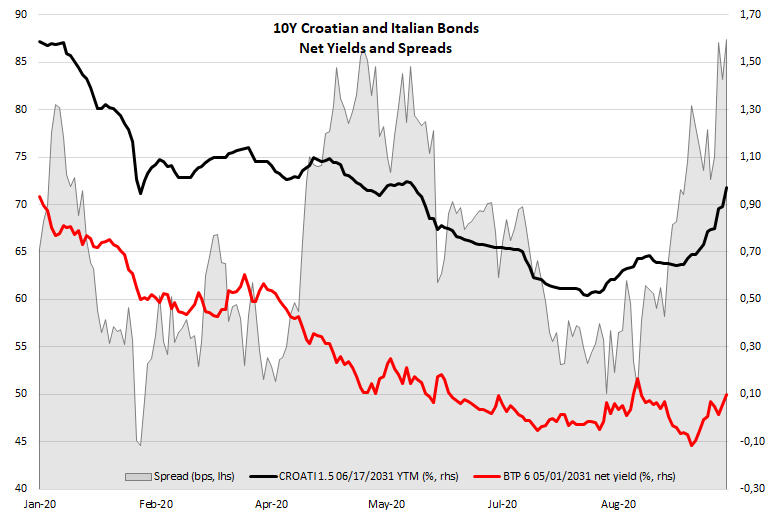

How are Croatian bonds faring this morning? First of all, the information about eurobond placement caused the existing Croatian bonds to sell off significantly and this morning CROATI 1.5 06/17/2031 could be bought very close to 1.0% YTM (we were receiving offers this morning a thad away from 105.00, which is 0.9867% YTM). The move was focused only on Croatian eurobonds and we can see that the spread between CROATI 1.5 06/17/2031 and BTPS 6 05/01/2031 widened to the highest level since June 2020 (CROATI placement). When calculating these spreads we use Italian net yield (interest rate tax subtracted) and currently the difference between YTM on CROATI 1.5 06/17/2031 and BTPS 6 05/01/2031 has widened to about +87.4bps (BTPS net YTM @ 0.10%, CROATI YTM @ 0.974%). The spread widening came at an unpleasant time when clearly some of the market participants want to cut their exposure to Croatian outstanding bonds, but dealers on the Street are unwilling to add their long exposure to 10Y+ periphery during the reflation bond sell off. The good thing about this is that Christine Lagarde gave verbal support to long term bond prices on Monday saying that the ECB is closely monitoring long nominal bond yields. On the other hand, back in 2012 when the situation was dire Lagarde’s predecessor Mario Draghi pledged to do whatever it takes, while Lagarde on Monday pledged to monitor whatever there is, which was sufficient to put some support under the bond prices, but not enough to reverse the trend. Jerome Powell during his two day Humprey-Hawkins testimony reiterated that economy is far from recovery, unemployment is still high, inflation pressures relatively subdued, while Powell’s vice chairman Clarida stated that the FED would probably not react in any way if there’s a short term inflation overshoot. Still not enough to reverse the trend masters of the universe (bond dealers) have charted, but at least it relieved some selling pressure from the long term bond space.

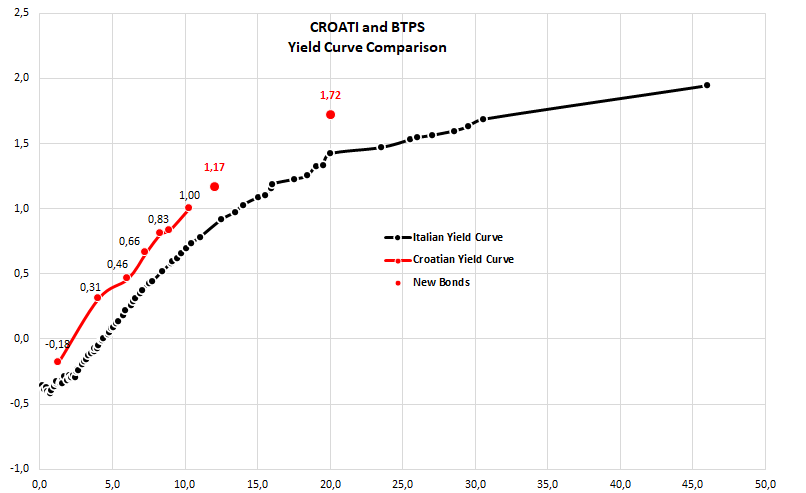

Where do we price the new dual tranche? From our experience, most of the bond dealers use Italy as a good proxy to price CROATIs, some of them even buy CROATIs and sell BTPS when the spread between the two gets too wide. When pricing CROATIs they refer to gross yields and we calculated that on the long part of the curve CROATIs are priced some 30bps-35bps above BTPS. With this in mind we calculated fair value of CROATI 2033 YTM @ 1.17% (MS+104bps) and fair value of CROATI 2041 YTM @ 1.72% (MS+135bps). This pricing should come with a handful of disclaimers and beware that IPTs are likely to come 30bps or even 50bps higher to facilitate book buildup. How much tightening investors would receive in the end would be subject to the movements of global rates, which is not at all easy to forecast or model. It’s also worth bearing in mind that REPHUN 1.75 06/05/2035 (proxy for CROATI 2033) is traded at 1.15% YTM, while regarding REPHUN 1.5 11/17/2050 (proxy for CROATI 2041) the most accurate pricing we received yesterday was about 1.70%. As we stated in our previous blogs, REPHUNs and CROATIs are generally closely traded and used as each other’s proxy on eurobond placements, albeit due to illiquidity sometimes it’s quite difficult to get fair pricing on both. This is the reason we used two methods of pricing – interpolating liquid Italian bond curve (plus some premium) and comparing the results to REPHUNs.

What has yesterday’s Serbian bond placement taught us? SERBIA 1.65 03/03/2033 was placed at MS+180bps (1.92% YTM) against an IPT of MS+210bps-215bps. This was the tighter end of the pricing range and basically right on ROMANI curve. Since Serbian eurobonds are generally traded at a spread to ROMANI, this could be interpreted as a major success, especially once you take into account that the book was 3.2x oversubscribed (1.0bn EUR was placed versus 3.2bn EUR orderbook size). From our understanding most of the auction participants received pro rata allocations (30%-40% of orders given) and early this morning we have seen it trading slightly below reoffer (97.00-97.50 market versus 97.13 reoffer). The moral of this story is that tight placements are still possible, however Serbian success might be interpreted by lower GDP drop last year, swift recovery penciled in this year and finally the notorious, but proverbial, interest of American investors after Serbian fixed income assets.

In 2020, the company recorded an increase in operating revenues of 5.5%, an increase in EBITDA of 33% and a net profit to majority of HRK 61.5m (+125%).

In 2020, Končar Group remained relatively unscathed by the Covid-19 pandemic, as operating revenue witnessed an increase of 5.5% to HRK 3.095bn. Such an increase came hand in hand with a solid increase in orders of 21.3%, while the company concluded significant deals in 2020, which might serve as a solid foundation for continuation of positive results. The mentioned deals can be seen below.

Revenue generated in the Croatian market amounted to HRK 1.123bn, a 3.1% decrease. Revenue generated from sale of products and services to HEP Group companies (HEP Proizvodnja, HEP Operator distribucijskog sustava, HOPS) amounted to HRK 450.3m (40% of total revenue generated from sale of products and services in the Croatian market).

The company supplied HRK 133.6m worth of products and services to the HEP Group indirectly via the companies Brodomerkur and Brodometalurgija, which resulted in total revenue from sale of products and services to the HEP Group amounting to HRK 583.9m.

Revenue from sale of products and services to HŽ amounted to HRK 95.6 million (8.5% of total revenue generated in the Croatian market).

On the other hand, sales on the export market amounted to HRK 1.85bn, representing a solid increase of 12.1%. The most significant export volume pertains to the Swedish market, amounting to HRK 259.6m or 14.1% of total export.

Operating expenses on the other hand reached HRK 3.015bn, representing an increase of 4.3%. Such an increase could be attributed to higher raw material and transport prices. However, we note that, KODT, the Group’s largest company hedges the risk of price fluctuations mostly with forward contracts. In terms of cost structure, virtually all operating expenses have increased aside from other operating expenses (-9.2% YoY). Although the company does not provide further information, the decrease arguably came from lower travel expenses (largest item within other opex).

As a result of the above mentioned, EBITDA increased by as much as 33%, amounting to HRK 177.6m. Such a result shows an improvement of EBITDA margin by 1.1 p.p. to 5.7%.

Going further down the P&L, operating profit has almost doubled (+90.5%), reaching HRK 80m. Furthermore, the equity accounted companies of Končar showed a result of HRK 26.9m, representing an increase of 49% YoY, indicating somewhat of a turnaround of very poor performance of KPT in 2019.

In 2020, the Končar Group reported a net profit of HRK 115.2m (+121.3%), while net profit to majority amounted to HRK 61.5m (+125%). Such a high increase could have been expected also be attributed to the base effect of a relatively lower performance of the Group in 2020.

We are happy to see Končar report a solid 2020 result, despite a challenging year. As a reminder the company will be holding a conference call today at 11:00am CET.

Deals Concluded in 2020

• Deal with HŽ Passenger Transport for 21 electric multiple units worth HRK 844.7m, final deadline for delivery of all trains is December 2023.

• Deal with the Croatian Transmission System Operator (HOPS) for “Revitalisation of central remote control systems for the power system by upgrade to a new version”, worth HRK 49.9m. Timeframe for contract performance will be 39 months, plus 36 months of maintenance during the warranty period.

• Deal with Liepajas tramvajs for a delivery of 6 low floor tramcars in Liepaja, Latvija. The deal is is a follow-up of Contract through which KEV contracted delivery of 6 low floor tramcar. The contracted value is EUR 8.84m, while the first tramcar will be delivered in 18 months. Meanwhile, all 6 will be delivered within 24 months from the contract signing (August 2022).

• Deal for the construction of a new 400/110 kV Ohrid substation, as part of an investment cycle of the North Macedonian transmission system operator (MESPO). The deal is worth EUR 14.3m.

• Deal with HŽ Passanger Transport for the delivery of 12 EMTs. The first of 12 new trains will be delivered in 14 months, after which one train is expected to be delivered per month during 2021 and 2022. The value of the transaction under the III Addendum amounts to HRK 464.9m (HRK 581.1m including VAT).

InterCapital remains dedicated to making investments into the region more attractive by supporting transparency and liquidity, and we thank our partners for supporting us in achieving this goal.

We are proud to announce that Cinkarna Celje signed a Market Making agreements with InterCapital Securities. Meanwhile, Petrol renewed the same agreement.

In 2019, InterCapital reignited market making in Slovenia after 10 years, and currently provides the mentioned services to 5 Slovenian blue chips: Krka, Triglav, Petrol, Telekom Slovenije and Sava Re.

Cinkarna Celje will be the 6th company in Slovenia, with the Market Making mandate starting on 1 March 2021.

InterCapital is already an established market maker in Croatia, covering 8 blue-chip companies, all part of the CROBEX index and 2 ETFs. According to our experience, the service accounts for a significant portion of the shares’ total turnover.

Being a market maker means that InterCapital will continuously put both bid (buy) and ask (sell) orders on CICG and PETG shares at a pre-defined spread. The idea is to enable investors to buy or sell the shares (up to a certain size) at any time within a reasonable volatility range.

We are proud of having earned the company’s trust and will do our best to continue providing the best service possible.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Day | Country |

|---|---|---|---|---|---|

| 177 | 25.2.2021 | TLV | Banca Transilvania - Preliminary 2020 Results | Thursday | Romania |

| 178 | 25.2.2021 | SNG | Romgaz - Preliminary 2020 Results | Thursday | Romania |

| 179 | 25.2.2021 | SNN | Nuclearelectrica - Preliminary 2020 Results | Thursday | Romania |

| 180 | 25.2.2021 | COTE | Conpet - Preliminary 2020 Results | Thursday | Romania |

| 181 | 25.2.2021 | ARNT | Arena Hospitality Group - Annaul Report 2020 | Thursday | Croatia |

| 182 | 25.2.2021 | ATGR | Atlantic Grupa - unaudited Financial Report 2020 | Thursday | Croatia |

| 184 | 26.2.2021 | M | MedLife - Preliminary 2020 Results | Friday | Romania |

| 185 | 26.2.2021 | ALR | Alro - Preliminary 2020 Results | Friday | Romania |

| 183 | 26.2.2021 | EL | Electrica - Preliminary 2020 Results | Friday | Romania |

| 194 | 26.2.2021 | WINE | Purcari - Preliminary 2020 Results | Friday | Romania |

| 195 | 26.2.2021 | SFG | Sphera - Preliminary 2020 Results | Friday | Romania |

| 196 | 26.2.2021 | DLKV | Dalekovod - unaudited financial report 2020 | Friday | Croatia |

| 197 | 26.2.2021 | PODR | Podravka - Non-audited financial statements for 2020 | Friday | Croatia |

| 198 | 26.2.2021 | RIVP | Valamar Riviera - Audited Annaul Report FY 2020 | Friday | Croatia |

Given the current Covid-19 situation, some of these events might be subject to change (postponed or cancelled).