As the construction sector plays a key role in the Croatian economy, accounting for approximately 5% of the total GDP, we decided to bring you an overview of how the sector is currently performing.

Looking back in the past, the Croatian construction sector has always played a crucial role as both the driver of GDP growth as well as the “enabler” of other economic activities (think about all the infrastructure projects, hotels and restaurants, offices which couldn’t have been created without a solid construction sector). The sector experienced its height before 2008’s financial crisis and has been slowly recovering ever since, only picking up its pace in the last couple of years.

Currently, the Croatian construction sector accounts for app. 5% of the Croatian GDP. This represents a recovery from the period following the financial crisis when it hoovered around 3.5-4% of the GDP. The recovery was steady from the period of 2015 onwards, peaking in 2020 before the start of the pandemic. Even though the slowdown in the economic activity should have influenced the construction sector as well, this has thus far not proven to be the case. First of all, the strong investment cycle initiated by the Croatian Govt. and partially funded by the EU has created a large number of projects for the construction companies, which usually take several years to complete. Secondly, the earthquakes that affected Croatia in 2020 also created an even larger incentive, but this time into reconstruction. The projects include both investments into residential, tourism-related as well as industrial real estate.

To better understand what is going on in the sector, we took a look at several key construction sector indicators. First of all, the volume of construction works indices, which show how much construction was done in a year compared to the year before.

Volume of construction works indices (2015 – 2021, YoY, %, 2015=100)

As can be seen from the graph above, the volume of construction has steadily been increasing YoY, both for buildings and civil engineering works. Even though this index increased by 3.3% YoY in total in 2016, if we look at its components, building construction grew by 8.7% YoY, while civil engineering remained below 100%. This trend continued, with 2019 being the year that civil engineering construction finally caught up with building construction. By 2021, the index increased by 9.3% YoY, with both building and civil engineering construction increasing by 9.9% and 8.4% YoY, respectively.

Value of completed construction works (2015 – 2021, HRK bn)

Even though this increase on a YoY basis seems kind of “flat”, looking at the value of these constructions tells a different story. In 2015, the total value of completed works amounted to HRK 13.4bn. In the period until 2021, this number has been steadily increasing, amounting to HRK 21.8bn in 2021. In total, the value grew at a compound annual growth rate (CAGR) of 8.4%.

Several other indicators should also be taken into account. First of all, the issued building permits. In 2015, this number amounted to 6,328, increasing to 10,553 in 2021. What this can show us is that with the higher number of issued permits, a lot more construction is to be done in the coming period, at least in the short term. The expected value of these works has also increased proportionally, growing from HRK 20.87bn in 2015 to over 31.9bn in 2021.

Building permits issued and the expected value of these works (2015 – 2021, HRK bn)

So, having all of this in mind, what are some of the drivers of this growth? First, we should look at the supply side of the equation. One of the main issues that the Croatian construction sector has faced in the last several years is the lack of workers, especially when a strong investment cycle starts and there are more projects to be done than there are construction companies available to do those projects. Getting new workers takes time and is in the short term fixed by importing foreign workers, while in the long term it can be stimulated by education. Also, wage pressures from neighboring countries like Germany and Austria are also making this more challenging, which combined leads to a workforce shortage, especially for new projects beyond current construction companies’ capacities. Secondly, rising material costs are also presenting a challenge, something that has been exacerbated in the last couple of years with inflationary pressures, supply chain disruptions, as well as the current war in Ukraine, which acts as a kind of “multiplier” for all of these issues. This point is evident if we look at building material producer prices provided below, seeing a steady increase in the last couple of years, but a huge surge by 2022, amounting to a 14% increase YoY in March.

Building material producer prices, (March 2015 – March 2022, %, 2015=100)

On the other hand, there has been a large demand for reconstruction efforts in the wake of the earthquakes, the building and maintenance of infrastructure, the construction of new tourism real estate, and finally, the construction of new residential buildings. The residential buildings’ construction is particularly interesting, as this method is not only used for its basic purpose, that is to provide a place to live, but also as a form of investment in Croatia. All of these factors combined, both on the supply and demand side, had an effect on the prices of new construction.

Average prices of newly sold apartments per m2 (EUR) (2015 – 2021)

As can be seen from the graph, in 2015, the average price per m2 sold was EUR 1,416. For Zagreb, this number was EUR 1,563, while for other settlements, this number amounted to EUR 1,274. This has been increasing steadily over the last couple of years, growing at a CAGR of 4.24% for the entire country, 3.7% for Zagreb, and 4.6% for other settlements. This would mean that by 2021, the average selling price per m2 in Croatia amounted to EUR 1,817, an increase of 28.3% since 2015, while in Zagreb this number amounted to EUR 1,973, an increase of 24.4%, and finally, in other settlements, it amounted to EUR 1,673, an increase of 30.1%.

All of these trends are expected to continue, especially in the short term, as rising input costs, labour costs, as well as strong demand for real estate continues. One other thing that could have a more significant impact on the construction sector as a whole in the coming period is the potential reduction in available EU funding, which could be caused by the current humanitarian crisis in Ukraine, combined with strong inflationary pressures across Europe that could reduce EU’s overall spending on investment projects.

Telekom Slovenije published its FY 2021 results on Thursday, showing roughly the same revenue YoY, a 5.2% YoY increase in EBITDA, and a net profit of EUR 37.8m, an increase of 52.3% YoY.

In 2021, Telekom Slovenije recorded sales in the amount of EUR 648.2m, representing a 0.17% YoY increase, representing the first time it experienced an increase in sales in the last five years. The main drivers of the revenue increase were IPKO, a higher number of expatriates vacationing in Slovenia due to milder COVID restrictions in 2021, and revenues in the wholesale market coupled with the end-user market mobile segment performing well.

IPKO recorded higher revenues in 2021 than in the previous year, the company is attracting new users through intensive marketing activities. Even though Covid restrictions affected the company in 2021 they were far less strict than in 2020, which resulted in a higher number of expatriates coming back to Slovenia during the vacationing periods and thus increasing the overall traffic and revenue. Furthermore, revenues in the wholesale market were higher than in 2020, primarily due to higher revenues from the roaming of foreign users in the mobile networks of Telekom Slovenije and IPKO as well as higher revenues from incoming international traffic at IPKO. Also, the sale of mobile merchandise also had a positive effect on the Company’s revenue.

On the other hand, international voice traffic and traffic from the roaming by foreign users in the Company’s mobile network were still lower than in the pre-pandemic period. Revenues were also lower in the fixed segment of the end-user market due to a decline in revenues from traditional voice telephony. This came as a result of the falling number of traditional connections and their replacement with mobile and IP telephony. Finally, revenues were lower due to a stagnating sale of licenses, which resulted in lower costs of subcontractors.

EBITDA increased by 5.18% YoY, amounting to EUR 220.7m. The increase in EBITDA resulted from the overall 1.7% decrease in OPEX, which when we take a close look was supported by the large decrease in Cost of Services, which amounted to -9.5% YoY. Apart from that, labour costs remained almost unchanged while COGS and Cost of materials and energy increased by 3.9% and 13.4%, respectively.

Meanwhile, net profit increased from EUR 24.8m to 37.8m in 2021 (+52.3% YoY), as there were no negative effects from discontinued operations recorded in this period. As a reminder, in 2020 Telekom Slovenije was heavily impacted by the loss from discontinued operations and the effect of the sale of Planet TV, which is one of the reasons that explain such a surging increase in net profit in 2021. IPKO – Kosovo’s net income amounted to EUR 11.8m, representing 31% of the total net profit of the Group.

CAPEX-wise, Telekom Slovenije invested EUR 208m during 2021, marking a 20.3% YoY increase. The majority of investments in 2021 were allocated for the expansion of the fiber optic access network, which will provide users with a superior user experience in terms of broadband content and high-speed internet access. Investments were also made into the modernization of the mobile network and the establishment of the first national 5G mobile network, as well as the development of new services and the further optimization of operations.

Telekom Slovenije key financials (2017 – 2021, EURm)

Business Strategy 2022 – 2026 and 2022 Financial Objectives

Telekom Slovenije also reaffirmed its strategy for the 2022 – 2026 period, outlining the most important objectives for the Company. Firstly, the Company wants to be the leader in the user experience, further digitalizing its operations by digitalizing key business processes involving users. Furthermore, the Company plans to grow its ICT services, and stabilize the level of revenue from the core activity in Slovenia.

Also, they plan wants to consolidate on the individual markets which would further push the whole sector and a company into the latter stages of the mature industry. Moreover, they plan to continue optimizing employee structure and will continue to work on financial stability and optimization of all types of costs while creating a sustainable future.

Telekom Slovenije 2022 Financial Objectives (EURm)

| wdt_ID | Key Performance Indicators | 2022 Objectives |

|---|---|---|

| 1 | Sales | 660,60 |

| 2 | EBITDA | 211,20 |

| 3 | Net profit | 27,90 |

| 4 | CAPEX | 203,10 |

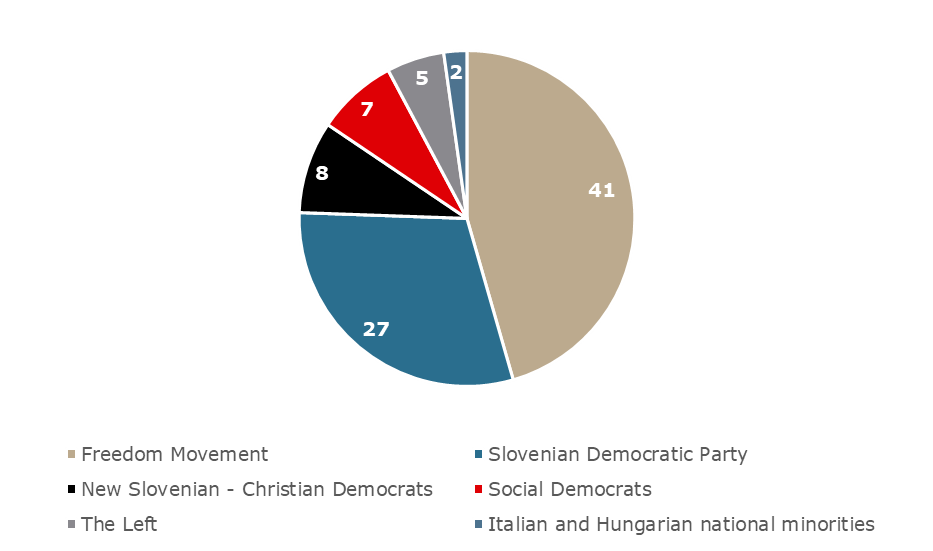

The party that won the most seats was the Freedom Movement (Svoboda), with 41 seats, followed by the Slovenian Democratic Party with 27 seats.

The Slovenian parliamentary elections were held yesterday, 24 April 2022. The majority of the seats in the parliament were won by the green liberal party Freedom Movement (Svoboda) which was until now the opposing party in the parliament. The party has received 34.54% or 403,663 votes, giving them 41 seats out of the 90-seats parliament. Next up, we have the now-former prime minister’s party Slovenian Democratic Party, which received 23.53% or 274,934 votes, giving them 27 seats.

Following them, we have New Slovenia – Christian Democrats with 6.85% of the votes, or 8 seats, Social democrats with 6.65% of the votes of 7 seats, and The Left, with 4.38% of the votes of 5 seats.

Considering 46 seats are needed to form a majority, it remains to be seen how the Government will be formed and who will the new Prime Minister be.

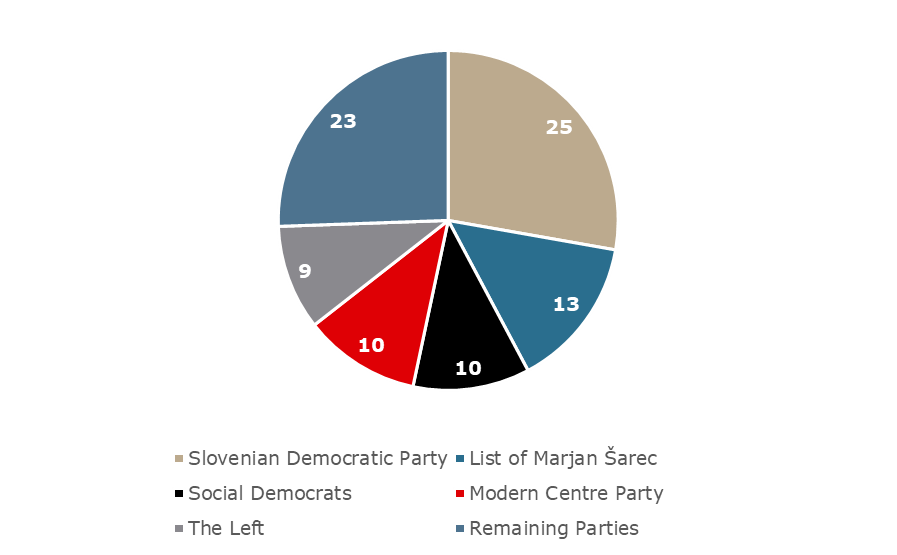

2018 Parliamentary Election Results (Seats)

2022 Parliamentary Election Results (Seats)

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 30 | 28.4.2022 | KOEI | Končar 2021 Annual Report, Q1 2022 Results | Croatia |

| 31 | 28.4.2022 | HT | HT Q1 2022 Results, Investor & Analyst Conference Call | Croatia |

| 32 | 28.4.2022 | ERNT | Ericsson NT Q1 2022 Results | Croatia |

| 33 | 28.4.2022 | ADPL | Annual Report 2021, Q1 2022 Results Presentation | Croatia |

| 34 | 28.4.2022 | SNG | Romgaz Annual General Meeting | Romania |

| 35 | 28.4.2022 | TLV | Banca Transilvania General Shareholders Meeting | Romania |

| 36 | 28.4.2022 | BRD | BRD: Annual Genaral Assembly of Shareholders | Romania |

| 37 | 28.4.2022 | BRD | BRD: Annual Report 2021 - financial results | Romania |

| 38 | 28.4.2022 | TGN | Transgaz General Meeting: Approval of 2021 results | Romania |

| 39 | 28.4.2022 | TEL | Transelectrica General Assembly Meeting: Approval of 2021 annual financial results | Romania |

| 40 | 28.4.2022 | SNN | Nuclearelectrica General Meeting | Romania |

| 41 | 28.4.2022 | ATGR | Atlantic Grupa Q1 2022 results | Croatia |

| 42 | 28.4.2022 | TRP | Teraplast Annual General Meeting | Romania |

| 43 | 28.4.2022 | TRP | Teraplast 2021 Annual Report | Romania |

| 44 | 28.4.2022 | COTE | Conpet Annual General Meeting | Romania |

| 45 | 28.4.2022 | ATPL | Atlantska Plovidba Board of Directors Meeting | Croatia |

| 46 | 28.4.2022 | ARNT | Arena Hospitality Group Q1 2022 Results | Croatia |

| 47 | 28.4.2022 | WINE | Purcari Annual General Meeting of Shareholders 2022 | Romania |

| 48 | 29.4.2022 | SNN | Nuclearelectrica Annual Report for 2021 | Romania |

| 49 | 29.4.2022 | TLV | Banca Transilvania Annual Report for 2021 | Romania |

| 50 | 29.4.2022 | SNG | Romgaz 2021 Annual Report | Romania |

| 51 | 29.4.2022 | TTS | TTS Annual General Meeting, Annual Report for 2021 | Romania |

| 52 | 29.4.2022 | TGN | Transgaz Annual Report for 2021 | Romania |

| 53 | 29.4.2022 | TEL | Transelectrica Annual Report for 2021 | Romania |

| 54 | 29.4.2022 | WINE | Purcari Annual Report for 2021 | Romania |

| 55 | 29.4.2022 | PODR | Podravka Q1 2022 Results | Croatia |

| 56 | 29.4.2022 | SNP | OMV Petrom Q1 2022 Results | Romania |

| 57 | 29.4.2022 | SNP | OMV Petrom conference call - Q1 2022 results | Romania |

| 58 | 29.4.2022 | COTE | Conpet 2021 Annual Report | Romania |

| 59 | 29.4.2022 | ATPL | Atlantska Plovidba Q1 2022 results | Croatia |

| 60 | 29.4.2022 | RIVP | Valamar Riviera Q1 2022 Results | Croatia |

Given the current Covid-19 situation, some of these events might be subject to change (postponed or cancelled).