This week Fed announced it will most likely start to taper their asset purchases in November 2021 and could completely shut purchases down by the mid of 2022. Furthermore, dot plot shows that rates could be hiked next year although inflation will have the main word here.

Evergrande crisis that accelerated last week somewhat stole the show from the FOMC as investors were asking themselves whether this could be another Lehman moment. However, it seems that this will rather be long and painful story for Chinese growth and its impact on the financial markets should be limited on high-yield bond holders and China related stocks. On the other side of the Pacific, Fed’s decisions have significant impact on the markets, bonds, equity you name it.

There were two main things to remember from this week’s US monetary policy meeting. First thing is that “if progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.” As Mr Jerome Powell stated on Jackson Hole Symposium, taper should start before year end meaning that official start will be announced on their November’s meeting. Furthermore, in his press conference Mr Powell said that taper should be concluded around the middle of next year implying that Fed could decrease its purchase program by USD 15-20bn every meeting until June 2022 when it could decide to close it in full.

Another important thing to remember is how quickly could FOMC members decide to change their opinion on whether to hike rates. Namely, latest dot plot shows that there are 6 out of 18 members that prefer one rate hike in 2022 and another three that see two hikes in 2022, meaning that there is equal split of officials who would prefer to lift rates at least once next year and the doves who still do not want to change rates until 2023. Just to put things into perspective, in June median dot showed no rate hikes until 2023. Since June, inflation most likely reached its peak but showed to be more stubborn than officials predicted while employment market still did not reach levels that would satisfy Fed’s officials. Talking about inflation, Fed now expects it to reach 3.7% in 2021, 2.3% in 2022 and 2.2% in 2023 meaning that Fed expects inflation to exceed 2.0% which is one of the conditions for the tightening of the policy. As an answer for the inflation reaching their target, Fed’s median interest rate projection increased compared to the one from June and now median projection for 2023 stands at 1.0% while the one for 2024 is at 1.80% implying one rate increase in 2022, and three times in 2023 and 2024.

Although Fed’s decision could be described as surprisingly hawkish due to change of dot plot and intentions to close purchase program until mid-2022, market reaction was rather muted. However, after market forgot about the Evergrande, we saw some weakness in rates as US10y increased from 1.32% to 1.40% while equities marched higher.

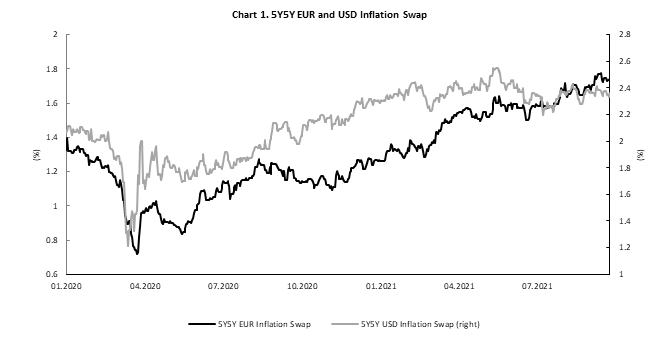

What to take from the latest FOMC? Well, US is the world’s biggest economy hence Fed’s policy is the benchmark for the monetary policies around the globe. Once the Fed said that it will start buying unlimited amounts of bonds in March 2020, almost all central banks around the world started to buy bonds. Today, some of the banks already started tightening their policy, but Fed’s tightening represents possible end of corona era marked by enormous amounts of bonds bought by central banks and seems that rise of central banks’ balances could at least be stopped soon. When or if are they going to start decreasing their balances is still an unanswered question.

Nevertheless, there are some banks that are moving in the opposite direction. Namely, yesterday central Bank of Turkey cut its rates by 1.00% to 18.00% despite seeing inflation rising to almost 20% in August. Of course, there were consequences on Turkish lira which reached all-time low levels.

Source: Bloomberg, InterCapital

This represents an increase of as much as 18.9%, compared to the IPO price.

Yesterday marked the first trading day of SPAN which ended the day at HRK 208 per share. This represents an increase of as much as 18.9%, compared to the IPO price. We also note that the share opened at HRK 218 per share, which also represented its daily peek (representing a 24.6% increase compared to the IPO price). The first trading day of the share was quite active with a daily turnover of HRK 5.77m, accounting for 47% of the total turnover on the ZSE.

As a reminder, the IPO price was confirmed at HRK 175 per share, indicating that the company sold shares to qualified and retail investors for the amount of HRK 101.2m. To be specific, 578.2k shares were offered, representing 29.5% of the share capital. We also note that the oversubscription reached 40% at the price of HRK 175 per share.

Breaking down the allocation, qualified investors were allocated 55.9% of the transaction amount, while retail investors were allocated 35.6% and employees were allocated 8.5%.

The mentioned price represents the upper range of the offering (HRK 160 – HRK 175). The IPO price translates into a market cap of HRK 343m or P/E (2020) of 46x and EV/ EBITDA (2020) of 11.4x. According to the company’s prospectus, Span operated in 2020 with sales of HRK 613.8m, EBITDA of 31.5m (EBITDA margin at 5.1%), and a net profit of HRK 7.45m (profit margin 1.2%).

InterCapital remains dedicated to making investments into the region more attractive by supporting transparency and liquidity, and we thank our partners for supporting us in achieving this goal.

Being a market maker means that InterCapital will continuously put both bid (buy) and ask (sell) orders on NLBR shares at a pre-defined spread. The idea is to enable investors to buy or sell the shares (up to a certain size) at any time within a reasonable volatility range.

In 2019, InterCapital reignited market making in Slovenia after 10 years, and currently provides the mentioned services to 7 Slovenian blue chips: Krka, Triglav, Petrol, Telekom Slovenije, Sava Re, Cinkarna Celje and NLB (as of 1 October).

Besides that, InterCapital is already an established market maker in Croatia, covering 8 blue-chip companies, all part of the CROBEX index and 2 ETFs. According to our experience, the service accounts for a significant portion of the shares’ total turnover. We are proud of having earned the trust of both companies and will do our best to continue providing the best service possible.