With all Romanian companies publishing their Q1 2021 results, we decided to bring you a short overview of their performance.

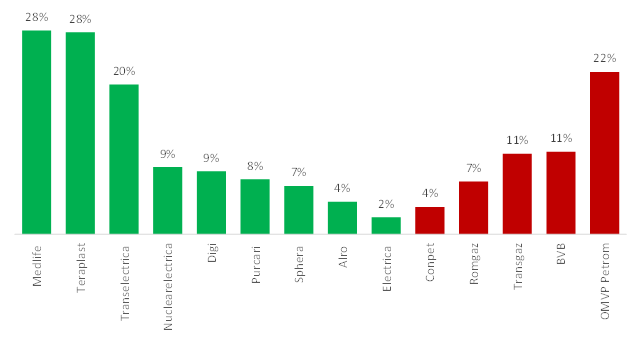

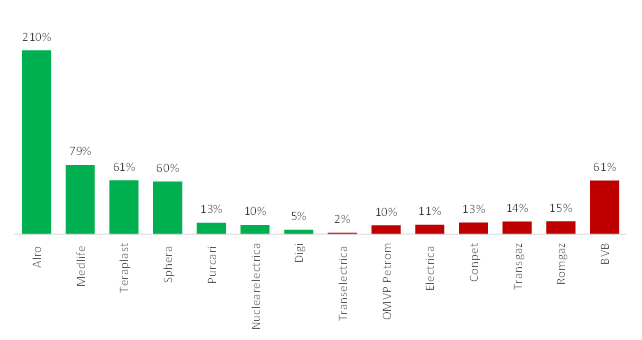

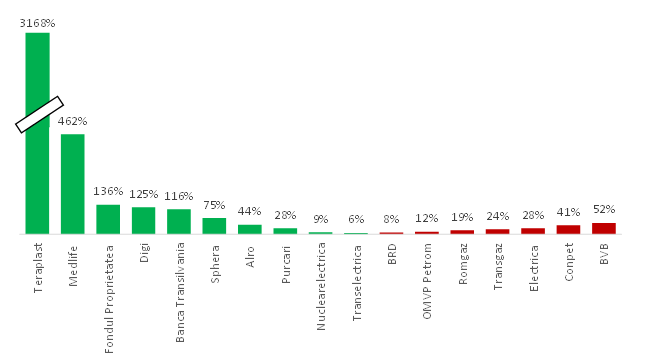

Among all BET components, Medlife posted the strongest Q1 sales increase. Namely, the company’s sales were up 27.9% YoY on the back of significant growth in all business lines, except pharmacies, and due to acquisitions completed by the group so far this year. With OPEX up only 15.6% YoY, EBITDA jumped 79% YoY. As a result, net profit soared and was up by 462% YoY to RON 36m.

BET Components YoY Change in Sales

Teraplast followed in second with sales up by 27.6% YoY. Meanwhile their EBITDA soared 61% on the back of higher sales coupled with operational efficiency based on economies of scale. However, while the improved top line and EBITDA did certainly have a positive impact on the bottom line, the main contributor to the high YoY increase was the profit from the sale of the company’s steel products division worth RON 373m. Note that the results do not account for Somplast, TeraPlast’s latest acquisition, since the approval of the competition council was received in the Q2 2021.

Transelectrica’s sales were up by 20% YoY mainly due to higher electricity quantities delivered to consumers, by indexed average transmission tariff and higher balancing market revenues. However, OPEX followed thus dragging EBITDA down by 1.7% YoY. Meanwhile net profit was up 6.2% on the back of lower D&A costs and an improved net financial result.

The Bucharest Stock Exchange posted lower results on all lines as trading in Q1 2021 was lower than in Q1 2020 when panic selling occurred due to the outbreak of the COVID-19 pandemic.

Transgaz posted an 11% YoY decrease in sales as higher commodity revenue was somewhat offset by lower commodity transmission tariffs. Furthermore, the company recorded a 65% YoY decrease in revenue from the international transmission activity. Lower sales transferred down the P&L resulting in a 14% YoY decrease in EBITDA and a 24% YoY decrease in net profit.

Sphera was able to increase their sales by 6.6% YoY despite the ongoing restrictions caused by the COVID-19 pandemic. With restaurant expenses kept in check, mostly due to lower payroll expenses due to state aid received from governments and lower FTE, coupled with lower advertising costs, EBTIDA soared 60% YoY. Meanwhile the bottom line remained negative, but the loss was significantly lowered to RON -3.1m (from RON -12.3m).

BET Components YoY Change in EBITDA

Romgaz’s revenue fell due to a decrease of sales in natural gas by 4.8% YoY, while revenues from underground gas storage operations shrank by 28% YoY. Also, revenue from electricity sales fell by 20% YoY. EBITDA fell 15% YoY due to rising cost of commodities sold as well as changes in inventory of finished goods and work in progress.

Nuclearelectrica’s sales were up by 9.2% YoY, mostly due to a 13.5% rise of the weighted average price of the electricity sold in the period. This translated to a 10.4% YoY increase in EBITDA. Below the operating line, the company’s net financial results deteriorated to RON -0.4m from RON 16.9m in Q1 2020. However, despite this, the bottom line went up by 9% YoY to RON 234.5m.

OMV Petom’s sales fell by 20% YoY due to lower sales volumes of natural gas, petroleum products and electricity, as well as lower prices for natural gas, partially offset by higher prices for electricity. This in turn drove both remaining lines downwards as well.

Digi’s Q1 sales rose due to an increase in in sales in Romania and Spain. In Romania, growth was mainly the result of the increase of cable TV and fixed internet and data RGUs in the period, due to organic growth, as well as the entering into force of the Networking agreement between RCS & RDS and Digital Cable Systems, AKTA Telecom, respectively ATTP Telecommunicatios in 2020. The increase in Spain was due to an increase in mobile telecommunication services RGUs. Higher sales translate down do a higher EBITDA, but the surge in net profit which more than doubled in Q1 2021 was due to an improved net financial result (EUR -25.9m Vs. EUR -98.1m). The improvement was due to an absence of strong negative FX movement as seen in Q1 2020.

Alro’ sales edged up 4% due to an increase in amount of goods sold, coupled with an increase in aluminium price. However, this was partially offset by an unfavourable exchange rate, in spite of an international economic environment still fighting the coronavirus pandemic. EBITDA turned positive, amounting to RON 33.5m from RON -30.6m, primarily due to the decrease in the purchase prices of raw materials and utilities. However, this still wasn’t enough for the company to record a net profit, but only to decrease the net loss by 44% YoY.

BET Components YoY Change in Net profit

When observing the net profit of Romanian banks one can notice a mixed performance with Banca Transilvania doubling their net profit, while BRD Bank saw an 8% YoY decrease in net profit.

Fondul Proprietatea managed to post a net profit of RON 701.4m, which marks a considerable improvement from a loss of nearly RON 2bn witnessed in Q1 of last year. This is of course due to the recovery of the financial markets which saw a strong decline last year amid the outbreak of the COVID-19 pandemic.

Last Week, Dalekovod released an invitation to a GSM in which the company proposes a reverse stock split at a ratio of 100:1 followed by a joint cap hike by Koncar and Construction Line in the amount between HRK 150m and HRK 410m. The proposals are part of a plan to financially restructure the company.

After issuing an invitation for interested parties to participate in the financial restructuring of the company back in February, Dalekovod finally released the results of the invitation. According to the statement released on the ZSE, Dalekovod received only one offer and that in the form of a joint deal by Koncar and Construction Line. The offer includes a cap hike ranging between HRK 150m and 410m by subscribing shares in three rounds, by cash payments, and/or contributions by entering rights (claims).

As part of the deal, Dalekovod would first reduce their share capital from HRK 247.2m to HRK 2.5m in order to cover losses from previous periods. At this point the company would also perform a reverse stock split by consolidating every 100 shares into 1. Since the issuance of new shares will follow the stock split and since new shares will be issued at the nominal value of HRK 10 per share, the value of the cap hike basically amounts to HRK 0.10 per share at the moment. This of course did not resonate well with current investor, leading to a -59.1% price decrease during Friday’s session, ending at HRK 2.37 per share.

The GSM will be held June 30th, in order to read the full invitation please click here

SHD proposed EUR 1.14 DPS, while VZMD proposed EUR 1.4 DPS.

Luka Koper has received 2 dividend counterproposals from SDH (Slovenski Državni Holding) and VZMD (Pan-Slovenian Shareholders’ Association).

To be specific, SDH as the majority shareholder (representative of Republic of Slovenia) proposed a dividend payment of EUR 15.96m, which translates into a dividend of EUR 1.14 per share. At the current share price, dividend yield is 4.8%. Meanwhile, ex-date is 25 August 2021.

On the other hand, VZMD proposed a dividend payment of EUR 19.6m, which translates into a dividend of EUR 1.4 per share. At the current share price, dividend yield is 5.9%. Meanwhile, ex-date is 25 August 2021.

As a reminder, the Management and Supervisory Boards proposed that EUR 14m is to be used for dividend pay-out in the gross value of EUR 1 per share. Such a dividend payment is EUR 0.07 per share lower than the one paid in 2020.

Luka Koper Dividend per Share (EUR) & Dividend Yield (%) (2013 – 2021)

Fitch expects Croatian economy to expand by 5.5% in 2021.

On Friday, Fitch Ratings has, as expected by the market, affirmed Croatia’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘BBB-‘. The Outlook is Stable.

Reasoning:

Croatia’s ratings balance strong structural features, including higher human development, governance indicators and GDP per capita than peers, with high public sector debt and a record of low GDP growth, partly due to the slow adoption of structural reforms. The Stable Outlook weighs large short-term downside risks related to pandemic developments against stronger medium-term growth prospects linked to substantial EU fund support and Fitch’s fiscal consolidation and debt reduction baseline that is underpinned by the authorities’ commitment to fulfilling convergence criteria under the ERMII.

Fitch expects the economy to expand by 5.5% in 2021, from a combination of base effects (growth was stronger than expected in 2H20), the resilience of sectors such as construction and goods exports, and a gradual recovery in consumption. Fitch’s forecasts rest on an improved tourism sector outlook (at around two-thirds of 2019 levels), assuming a pick-up in summer tourism as the health crisis in Europe continues to abate. However, renewed travel restrictions due to the still uncertain evolution of the pandemic, including the spread of new variants, cannot be discounted and constitute a key short-term downside risk, given the importance of the sector to the economy.

Fitch would still expect some growth in 2021, even if tourism levels remained at 2020 levels (50% of 2019), but the weaker recovery could increase the risk of longer-term scarring and put pressure on public and external finances.

The rating agency forecasts GDP growth to accelerate to 6.1% in 2022 before averaging 4% in 2023-25, driven largely by investment. Croatia will receive around EUR 6.3bn (12.8% of 2020 GDP) in grants from the Recovery and Resilience Facility (RRF), in addition to EUR 1bn (2% of GDP) from the EU Solidarity Fund for earthquake reconstruction and EUR 12.6bn (25.6%) in the 2021-27 Multi-Annual Funding Facility (MFF). Annual EU fund inflows could reach up to 5% of GDP, with the authorities calculating an additional growth impact from RRF of 0.5-1.5pp of GDP per year.

If Fitch’s growth projections materialise, Croatia will likely reach pre-crisis output in early 2022 (as opposed to the eight years it took after the global financial crisis), limiting the risks of labour market hysteresis and corporate sector bankruptcies. Nevertheless, rapid labour tightening in sectors such as construction could delay some of the investment momentum, as could the need to pass a large number of reforms, including some politically sensitive, in a short timeframe in order to get RRF fund disbursement. Moreover, Croatia´s absorption capacity lags the EU average and the sheer size of funds accentuates the implementation challenges. However, if the authorities are successful at adopting long-standing reforms, this could mitigate major growth challenges such as adverse demographics.