NLB released a statement yesterday in which they announced that they are currently in discussions with MIGA for obtaining additional guarantees for optimizing its capital on consolidated basis. The transaction which is scheduled to be concluded later this year could reduce the RWAs of NLB on consolidated level by up to EUR 108m.

NLB published an announcement on the LJSE stating that they are in discussions with Multilateral Investment Guarantee Agency (MIGA) on obtaining additional guarantees for optimizing its capital on consolidated basis. Note that the contracts of guarantee that are discussed relate to five of NLB Group banking members.

The transactions which are scheduled to be carried out later this year could reduce the risk weighted assets of NLB d.d. on consolidated level up to EUR 108m. To put things into a perspective, this accounts for 1% of the consolidated RWAs as of 31 March 2021.

According to the statement, the potential implementation of this transactions will further commit the NLB Group to enhance the management of environmental and social risks of its operations and the commitment to sustainability.

As a reminder, last month NLB announced their initial discussion with MIGA for obtaining a guarantee for optimizing their capital worth EUR 252.13m. To read more about it please click here.

Today we take a look at the recent performance of the Baltic Dry Index which has shown a strong recovery after the outbreak of the COVID-19 pandemic.

The Baltic Dry Index or BDI index is a composite of various shipping rates used to transport dry bulk containers on merchant ships. Although the index is useful to determine the demand for dry bulkers, it can also be used as an important economic indicator. Namely, the use of this index as an indicator is a variation on the theme Charles Dow employed a century ago: transportation activity implies future commerce.

A change in the Baltic Dry Index can give investors insight into global supply and demand trends. Many consider a rising or contracting index to be a leading indicator of future economic growth. It’s based on raw materials because the demand for them portends the future. These materials are bought to construct and sustain buildings and infrastructure, not at times when buyers have either an excess of materials or are no longer constructing buildings or manufacturing products.

BDI Index Historic Performance

As witnessed from the chart, the BDI index almost hit its decade low in 2020 amid the outbreak of the COVID-19 pandemic as global trade was put on halt. However, as optimism spurred with the introduction of the vaccine, the index successful recovered. Not only that, but the index closed yesterday at 3,119 points which is significantly above the 10-year average of 1,296.52 and 128% higher than at the beginning of the year.

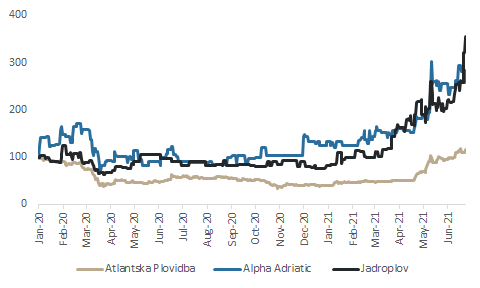

The sharp rise in the BDI index also reflected positively on the share prices of Croatian Dry-Bulkers. When compared to their prices at the beginning of 2020, Jadroplov is up 254.6%, while Alpha Adriatic is up 183.1%. Meanwhile, despite being up 192% since the beginning of the year, Atlantska Plovidba’s share price is up only 15.2% when compared to price at the beginning of 2020.

Share Price Performance of Croatian Dry-Bulk Companies