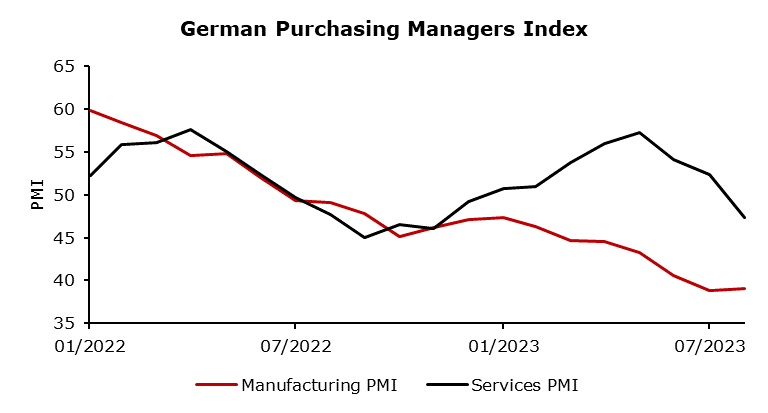

This summer, yields have been drifting higher as the economy is growing strongly and the inflation pressures due to wage growth remain high. Long-term yields have been going up strongly and partially reduced the inversion of the German yield curve. Yesterday, the recessionary narrative seemed to be back in place after the released PMI for Germany, the United Kingdom, and France which indicated a major slowdown in services. Once again, German services PMI stepped into contractionary territory which was seen in December of 2022. Furthermore, the manufacturing sector has been in contractionary territory for a year already. According to soft data, everything seems to indicate recession or stagnation in Europe. Furthermore, the Jackson Hole symposium this week is going to impact markets majorly and may direct markets into the autumn and winter of 2023 along with released PMI data.

Yesterday, the Purchasing Managers Index for Germany, France, and the United Kingdom indicated higher than expected contraction in the services sector. In Germany, 51.5 was expected, but the data came at 47.3 which was a major miss and the reaction of the market was particularly strong. Comments of the chief economist of the Hamburg Commercial Bank which publishes PMI for Germany in cooperation with S&P Global were deeply negative – “Any hope that the service sector might rescue the German economy has evaporated.”. In France, the situation is similar, the contraction in the third quarter might be seen as the new orders continue to deteriorate. It seems that rate hikes are getting embedded in the economy and the recession risk is heightened again as the labor market may soften due to the slowing of the services sector. Hopefully, that should ease the wage pressures in the services sector and prove that the European Central Bank is on its way to defeating inflation and bringing it down to 2%. Also, exposure to the Chinese economy in Europe might hurt the European economy as exports to China may drop further as the Chinese economy deteriorates further without adequate stimulus. On the contrary, the US economy seems to be much better than the European with manufacturing in much better condition than European and services in expansionary territory as well which might be a buffer for the European economy to prevent simultaneous recession across the Atlantic. Across the market, the reaction to PMI is severe due to the huge negative surprise in the services sector. German 2-year yield plummeted by 10bps, German 10-year yield by 17 bps, EURUSD also plunged as further hikes seem unlikely, or at least there might be a rate hike pause in September. Concerns of hard landing in Europe are back in the spotlight which is directly seen in OIS which indicates that the chance of ECB hiking in September is halved after the release of PMI in comparison with the day before the release of PMI (22nd August).

The recent summer yields uptick and inflation concerns driven by robust economic growth are facing a potential twist. The release of PMI data for Germany, France, and the United Kingdom has sparked recessionary fears as the services sector contracts, aligning with a persistently contracting manufacturing sector. Germany’s negative surprise in particular has triggered market reactions, with yields and EURUSD plunging. This unexpected downturn intensifies worries about a looming economic slowdown or stagnation in the region. The labor market’s vulnerability due to the services sector’s slowdown raises recession risks, possibly prompting the European Central Bank to reconsider rate hikes and focus on taming inflation through easing wage pressures. Furthermore, the European economy’s exposure to China’s deteriorating economy adds to concerns. The upcoming Jackson Hole symposium’s impact on markets, which is starting today and ending on Saturday, could offer clarity on the path forward, influencing market sentiment as the year progresses.

Source: Bloomberg, InterCapital

By the end of July 2023, the total AUM of Slovenia mutual funds amounted to EUR 4.54bn, an increase of 9.4% YoY, and 2.3% MoM.

Recently, the Slovenian Securities Market Agency, ATVP has published the latest report regarding the changes recorded by the Slovenian mutual funds, for July 2023. According to the report, the total AUM of the Slovenian mutual funds amounted to EUR 4.54bn, representing an increase of 2.3% MoM, 14.8% YTD, and 9.4% YoY. Breaking this down further, and starting off with the yearly data, the largest growth was recorded by shares, which increased by EUR 374m, or 12.9%. Following them we have bonds which increased by EUR 52m, or 7.9% YoY, money market holdings, which increased by EUR 25m, or 45.7%, and finally, investment funds, which increased by EUR 22m, or 7.9%. It should be noted that the vast majority of investments in Slovenian mutual funds are into shares, both domestic and foreign.

Moving on to the monthly data, the largest absolute increase was recorded by shareholdings, which increased by EUR 93m, or 2.9%, while bonds, money market, and investment fund holdings all recorded smaller increases, of EUR 4.3m (or 0.6%), EUR 4.1m (or 5.4%), and EUR 1.5m (or 0.5%), respectively. This would mean that the vast majority of increases in mutual funds came from investments into shareholdings.

Total assets of Slovenian mutual funds (June 2007 – July 2023, EURbn)

Source: ATVP, InterCapital Research

Breaking the shareholdings further by origin, foreign issuers’ equity securities amounted to EUR 3.21bn, which accounts for 99.4% of the total shareholdings. This category grew by 13.3% YoY, and 3% MoM, and it would also mean that the vast majority of investments of the Slovenian mutual funds are into foreign equity holdings. Domestic issuers’ equity securities meanwhile, amounted to EUR 58.5m, a decrease of 4.7% YoY, but an increase of 2.3% MoM.

Equity holdings of Slovenian UCITS funds (October 2007 – July 2023, EURm)

Source: ATVP, InterCapital Research

Besides the changes in the value of assets themselves, the increase/decrease can stem from the net contributions to the funds. In July 2023, the net contributions amounted to EUR 22.8m, representing a decrease of 21% MoM, and 1.9% YoY. Meanwhile, on a TTM basis, the net contributions amounted to EUR 242.5m, representing a decrease of 24.4% compared to the same period a year ago. Moving on to the number of subscribers to the funds, they amounted to 521.9k, representing an increase of 3.6% YoY, and 0.4% MoM, meaning that there is continued interest in investing in the mutual funds, which is a piece of positive news.

Net contributions into the Slovenian mutual funds (January 2016 – July 2023, EURm)

Source: ATVP, InterCapital Research

Lastly, in terms of the prevalence of the asset classes in the total AUM of the funds, shares still hold the majority at 72%, which is an increase of 0.4 p.p. MoM, and 2.2 p.p. YoY. Following them we have bonds, which accounted for 15.7% of the total, decreasing by 0.3 p.p. MoM, and 0.2 p.p. YoY, as well as investment funds, which accounted for 6.6% of the total, decreasing by 0.1 p.p. both YoY and MoM. Finally, we have the money market, deposits & cash, which accounted for 5.3% of the total, remaining the same MoM, but decreasing by 1.9 p.p. YoY.