Today, we’re bringing you an overview of the equity block transactions in Croatia and Slovenia, together with the latest data for Q1 2023.

Block transactions are transactions done directly between a buyer and a seller (so outside normal stock exchange trading), in which one buys directly from the other. The reason this is done in such a way is due to the fact that these transactions are quite large, with the minimum amount in Croatia or Slovenia being EUR 270k. As such, if these transactions were done on the exchange through the normal buy/sell, it would have a large impact on the share price, especially for illiquid stocks. This is because there aren’t enough shares being sold at any given moment at the current market price to completely fulfill the transaction order. The price for these block trades can be agreed upon between the parties and can be different than the market price. Furthermore, due to the size of these transactions, only larger shareholders, usually institutional investors (such as the pension or mutual funds) go through with them. Block transactions are also often used as part of the takeover process of a company, as it allows the acquiring company to obtain a significant amount of shares through a relatively low number of transactions.

Lastly, it has to be noted that all the amounts of all transactions prior to the Croatian adoption of the euro had their amounts transformed into euros, using the CNB’s average EUR/HRK exchange rate for the periods in question. With that out of the way, how large of an impact did these transactions have in Croatia and Slovenia?

Yearly block transactions in Croatia (2017 – Q1 2023)

Source: ZSE, InterCapital Research

As we can see in the chart above, equity block turnover plays a significantly larger role in Croatia than they do in Slovenia. On average since 2017, block trades in Croatia amounted to 23.7% of the total equity turnover. Before 2020, this average was somewhat lower at 20.6%, and afterward, it was higher at 26.3%. This excludes the effects of Q1 2023 (during which block transactions accounted for only 5.7%) due to the fact that Q1 is usually a slower quarter of trading in general. With that exclusion, we can see a trend of increases in block transactions. In fact, 2022 was a record year for this, during which block transactions accounted for 36.8% of all transactions on the exchange. This is somewhat to be expected, however, as Croatia does face liquidity issues, especially for larger transactions.

Yearly block transactions in Slovenia (2019 – Q1 2023)*

Source: LJSE, InterCapital Research

*Data for Slovenia available from 2019 onwards

Moving on to Slovenia, the average for block transactions since 2019 is lower, amounting to almost 12%. Furthermore, block transactions haven’t surpassed 17% of the total equity turnover, reaching only 16.5% in 2019 and 16% in 2021. There are several reasons for this. Overall, the Ljubljana Stock Exchange records a higher turnover on average than ZSE. Also, LJSE has significantly fewer listed companies than ZSE (24 vs. 92), meaning that there are fewer opportunities for block transactions to take place. Likewise, LJSE’s average turnover is a lot more concentrated in its top 10 most traded companies, with the most traded stock, Krka, often averaging 25% of the total turnover on the exchange.

Quarterly block transactions in Croatia (Q1 2017 – Q1 2023)

Source: ZSE, InterCapital Research

On the quarterly data, Q1 2023 recorded a total of EUR 64.5m of turnover on ZSE, with block transactions accounting for only 5.7% of it. Looking at the longer time periods, we can see that both the turnover and block transactions are quite cyclical. On average, since Q1 2017, block transactions in Croatia accounted for 21.8% of the total equity turnover, with equity turnover from before COVID-19 averaging almost 24%, while afterward, averaging 19%. This is somewhat counterintuitive compared to the yearly data, but one has to take into account that not a lot of trading, in general, is done in Q1 2023, and macroeconomic conditions impact the trading activity significantly. This might be one of the main reasons why Q1 2023 is recording a somewhat lower block turnover, as remember, most of the block trades are done by larger institutional investors, and during times of higher risk such as these, they’re unlikely to change their positions in shares by a large amount.

Quarterly block transactions in Slovenia (Q1 2020 – Q1 2023)*

Source: LJSE, InterCapital Research

*Data for Slovenia available from Q1 2020 onwards

In Slovenia, we have data since Q1 2020 for block trades only, and here we can see a similar story as in the yearly data for the country. On average, block trades account for 12.7% of the total equity turnover, and in Q1 2023, we can see a general reduction in both the overall turnover, but also block turnover. In fact, the equity turnover recorded in Q1 2023 is 49% lower than the average of the 1st quarters since 2020.

With all of this in mind, which of the stocks were sold the most through these transactions?

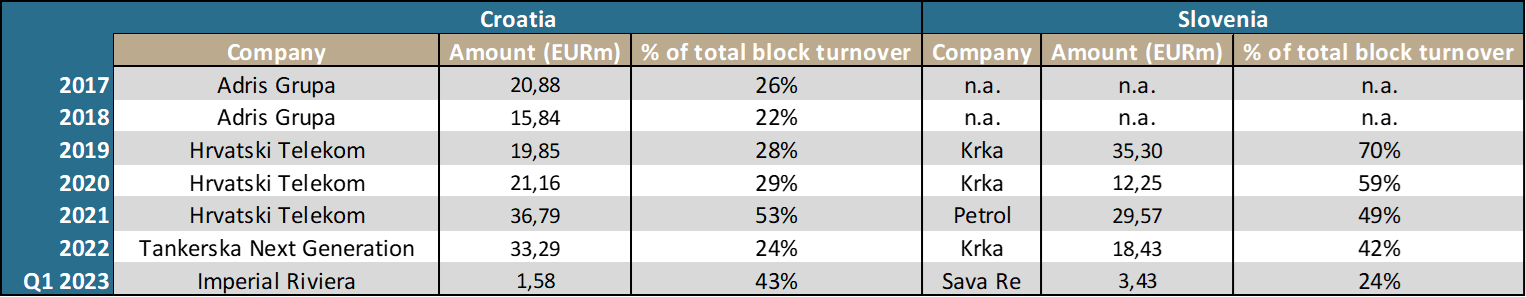

Largest block transactions in Croatia and Slovenia (2017 – Q1 2023)*

Source: ZSE, LJSE, InterCapital Research

*Data for Slovenia available from 2019 onwards

The data provided includes annual data, which could mean that the largest transactions could include several smaller transactions. The largest block transaction in 2022 was that of TPNG, with the amount of EUR 33.3m, accounting for 24% of the total block transaction amount during that year. This transaction was a part of the takeover process of TPNG by its majority shareholder, Tankerska Plovidba, afterward leading to TPNG’s delisting from ZSE. The remaining years however are dominated by some of the most traded shares on the exchange, with HT recording the largest block transactions in 2021 (52.5% of total block turnover), in 2020 (28.9% of the total), in 2019 (28.2% of the total). Meanwhile, in 2018/2017, the top spot is taken by Adris Grupa, whose block trades accounted for 21.6% of the total equity block turnover in 2018, and 26.4% in 2017.

In Slovenia, the largest block transactions since 2019 were made with Krka’s shares, with those transactions accounting for 70.3% of the total equity block turnover in 2019, 59.3% of the total in 2020, and 41.6% in 2022. At the same time, in 2021 the top spot is taken by Petrol, whose block transactions accounted for 48.9% of the total block turnover during the year. Meanwhile, in Q1 2023, Imperial Riviera recorded the largest block transaction in Croatia, accounting for 42.7% of the total block turnover, while in Slovenia, Sava Re takes the spot, with 24.3% of the total equity block turnover.

All in all, block transactions play a crucial role, especially for larger shareholders and bigger investments. Without them, low liquidity and not a lot of depth in terms of shares offered at a given price would cause huge price fluctuations, meaning that in the end there would be even less trading being done. The differences between Croatia and Slovenia can be summed up to the larger liquidity on LJSE, as well as the lower number of available shares and higher concentration of turnover towards the most liquid shares.

Increased liquidity, new IPOs, both from private & public companies and higher retail & foreign investor engagement, are among the many ways that the overall trading conditions on the market could be improved. With these improvements, larger transactions would be more viable outside of block trades, which would certainly benefit all the shareholders and their returns.

On Friday, NLB held its Q1 2023 pre-call with investors & analysts. In this brief overview, we bring you the key takeaways from that call.

Right from the start, NLB pointed out that the strong results we have witnessed in 2022, should also continue in Q1 2023. Even though a decline in the volume of loan issuances is to be expected, hoovering at mid-single digits, the increase in interest rates we have seen since last summer has positively impacted the margins. In fact, according to NLB, the interest rates on newly issued loans are app. 3x higher than they were a year ago (1.5% vs. app. 4.5%). This would mean that even with the lower mid-single loan volume growth, the interest income is still expected to increase.

In terms of the current macroeconomic situation, and especially the situation in the banking sector in general, NLB for itself does not see a strong material or rather any material impact from the Credit Suisse situation and related developments. Furthermore, the SEE region they operate in (excl. Croatia) is according to NLB not facing any major stress to its economic development, with historically low unemployment rates. They also noted that there might be some improvement in the demographic situation, in particular in North Macedonia and Kosovo, with an increase in foreign investments in these countries.

They also note that the Ukraine war, nor the interest rate hikes themselves, haven’t had an adverse effect on NLB. This is especially evident on the deposit front, as they note that they do not see any losses on retail deposits, and some small and immaterial losses on the corporate side. They also noted that on the loan side, 60% of their loans are tied to the 6M EURIBOR, which as it grew positively impacted the top-line developments. In terms of the corporate clients, there is a reduction in growth, especially in volume, but this is more due to the fact that the demand was so high in 2022, especially for the energy-intensive industries. As the situation in the energy market has mostly stabilized, these clients are continuing to pay their loans and as such do not require that many new issuances. Lastly, deposit pricing remains pretty contained.

In terms of risk, they noted that Q1 2023 should continue the strong trend seen in 2022, as they said that they expect some positive developments and no negative developments. As such, despite the current situation, they do not expect any negative developments on the risk side.

They also touched upon their current developments, including the issuance of the senior preferred bond as well as their M&A activities. The M&A activity in this sense, even though no concrete details were provided and NLB themselves pointed out that they are to receive more information in the coming weeks, is still interesting. They noted that this would mainly pertain to the acquisition of the lease assets left over after OTP’s integration of Nova KBM in Slovenia, with assets amounting to app. EUR 800m. They further noted that EUR 100m of these assets are present in Croatia. This acquisition, if it does go through, would make NLB a market leader in the leasing business in Slovenia. Of course, none of this is set in stone, and at this point is only speculation.

The funding, however, is more concrete. As mentioned several times already by NLB, the plan is to issue a senior preferred bond in the range from EUR 300m to EUR 600m. The EUR 300m is the minimum required that has to be issued to fulfill the MREL requirement, which has to be done by 1 January 2024. The remaining amount, as noted by NLB, would be issued to help fund the aforementioned lease business acquisition. The issuance of the bond should happen somewhere in Q2 2023. NLB also noted that this is the first green bond they’re issuing, and in terms of the rate at which it will be issued, they hope that this will have a downward effect on the interest rate. Furthermore, they also noted that the rate at which it will be issued, of course, subject to market conditions, should not exceed the amount at which their last bond was issued.

All taken together, NLB repeated several times that they might have to revisit and upgrade their outlook and guidance, on the base of these positive developments.

Several other tidbits were provided during the Q&A session. NLB is benefitting greatly from the interest hike developments, which they see as a return to normal. In fact, at the ECB, they’re holding app. EUR 2bn of assets, which are yielding 3% returns as compared to 0% a year ago.

Furthermore, they noted that the only real risk that worries them is the current inflation rate, and especially the persistence of core inflation growth. However, they do note that because of the loan, deposit, and interest rate developments, revenue growth should be extremely strong and more than enough to compensate for this.

Lastly, they note that they frontloaded some regulatory charges to Q1 2023, which should have been done in Q2 2023. As such, an impact of this should be seen on the financial statements, but should also not come as a surprise. Overall, they noted that the bottom line development should also come very strong.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 49 | 28.4.2023 | TTS | Transport Trade Services General Assembly Meeting | Romania |

| 50 | 28.4.2023 | TTS | Transport Trade Services 2022 Annual Report | Romania |

| 51 | 28.4.2023 | EL | Electrica 2022 Annual Report | Romania |

| 52 | 28.4.2023 | M | MedLife 2022 Annual Report | Romania |

| 53 | 28.4.2023 | TEL | Transelectrica 2022 Annual Report | Romania |

| 54 | 28.4.2023 | AQ | Aquila 2022 Annual Report | Romania |

| 55 | 28.4.2023 | AQ | Aquila General Assembly Meeting | Romania |

| 56 | 28.4.2023 | WINE | Purcari 2022 Annual Report | Romania |

| 57 | 28.4.2023 | TRP | Teraplast General Assembly Meeting | Romania |

| 58 | 28.4.2023 | TRP | Teraplast 2022 Annual Report | Romania |

| 59 | 28.4.2023 | SNP | OMV Petrom Q1 2023 Results, Conference Call | Romania |

| 60 | 28.4.2023 | COTE | Conpet 2022 Annual Report | Romania |

| 61 | 28.4.2023 | RIVP | Valamar Riviera Q1 2023 Results | Croatia |

| 62 | 28.4.2023 | PODR | Podravka Q1 2023 Results | Croatia |

| 63 | 28.4.2023 | HT | Hrvatski Telekom Q1 2023 results, Conference Call for analysts and investors | Croatia |

| 64 | 28.4.2023 | ATPL | Atlantska Plovidba Audited 2022 Annual Report, Q1 2023 Results | Croatia |

| 65 | 28.4.2023 | TLSG | Telekom Slovenije 2022 Annual Report | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).