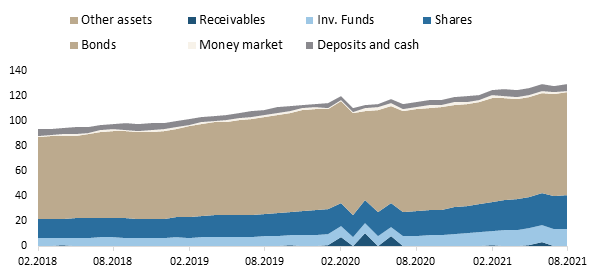

As of end August 2021, NAV of Croatian Mandatory Pension funds amounted to HRK 128.73bn.

As pension funds could be seen as the key player on the Croatian capital market, it is worth seeing how they have performed in the recent period.

NAV of pension funds has witnessed a steady increase for the 17th consecutive month, and as of end-August stood at HRK 128.73bn (+12.3% YoY or HRK 14.1bn). Meanwhile, on a YTD basis, NAV is up by 8.1%, while on a MoM basis, NAV of Mandatory Pension funds is up by 0.9%. We also note that net contributions in August amounted to HRK 628.6m, reaching a total of HRK 4.8bn YTD.

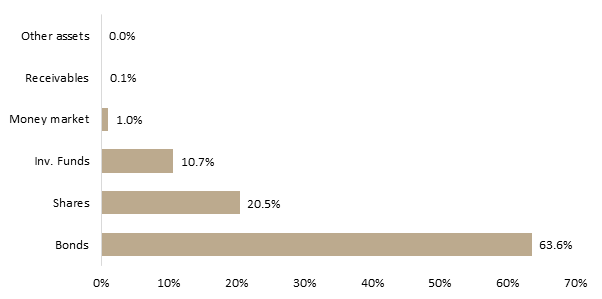

Looking at the asset composition of pension funds, one can notice that bonds account for the vast majority of total assets (63.6%) which as of end-August amounted to HRK 82bn. We note that bond holdings observed a MoM increase of 0.2% (or HRK 177.17m).

AUM Structure – Mandatory Pension Funds (August 2021)

Source: HANFA, InterCapital Research

Shares come next, with 20.5% or HRK 26.5bn, representing an increase of 2.7% MoM (or HRK 457.5m). The majority of the mentioned increase came from foreign equity (+3.1% MoM or HRK 689.2m). Meanwhile, domestic equity witnessed an increase of 3.2%. Note that domestic equity accounts for 55.9% of total equity holdings. On the other hand, in the bond market, the domestic bonds hold vast majority with 95.04%.

Total Assets of Croatian Mandatory Pension Funds (2018 – August 2021) (HRK bn)

Source: HANFA, InterCapital Research

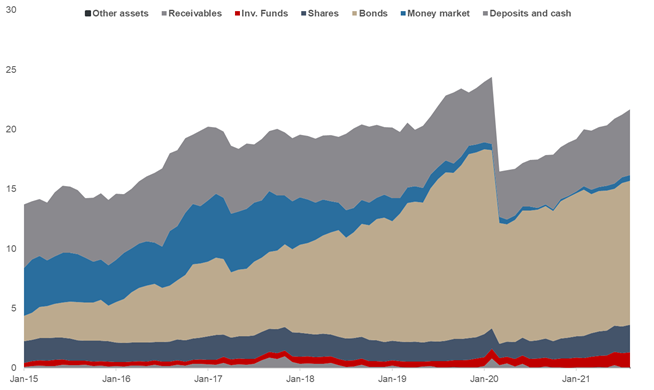

NAV of Croatian UCITS funds reached HRK 21.2bn, indicating a 25.4% YoY increase.

Croatian asset managers are large investors in the Croatian equity and bond market and they hold a significant amount of retail investments so they have an important role on the Croatian financial market. It is interesting to see how they have performed lately and the last reporting period is for August. As visible from the graph below, NAV of all funds has witnessed a steady increase for the 17th consecutive month, and as of end-August stood at HRK 21.2bn (+2% MoM). This represents an increase of 16.1% YTD, and is gradually converging towards pre-pandemic times. However, this still represents a decrease of 8.3% compared to the pre-pandemic highs (Feb 2020). On a positive note, this represents the 10th consecutive month of positive net contributions to funds. Meanwhile, in August net contributions amounted to HRK 355.2m. Of that 51% comes from bond funds, while 21% comes from equity funds.

On a YTD basis, the biggest absolute increase of AUM was observed in deposits and cash by HRK 1bn (+23%). Shares follow with an increase by as much as HRK 558.7m (+32%). On a MoM basis, deposits have observed the highest absolute increases by HRK 232m (+4%). Looking at the asset composition of Croatian UCITS funds, shares account for 10.6% of the total AUM, the highest seen since 2016. We also note that domestic shares account for 26.2% of total equity holdings. Domestic equity has so far in 2021 has seen a 18.8% YTD increase, while foreign equities have observed a 37.5% YTD increase.

Bond holdings continue to be the largest asset class of Croatian UCITS funds accounting for 55.6% of the total AUM. We note that this does represent a decrease by as much as 6.6 p.p. YTD.

Total Assets of All Croatian UCITS Funds (2015 – August 2021) (HRK bn)

Source: HANFA, InterCapital