Canadian ice skater Wayne Gretzky is often credited for the saying: “I skate to where the puck is going to be, not where it has been.” This is exactly how we felt when FED’s Jerome Powell said yesterday that they’re getting closer to Taylor rule implied FED fund rate. Are they really? What does Powell think where the puck will be in December? Find out in this brief research piece.

Yesterday’s Humphrey Hawkins testimony delivered by FED Chairman Jerome Powell in front of the Senate banking committee was inconspicuous in content but eventful in effect. The latter we attribute to positioning before the event since it’s clear a lot of market participants had a bit larger fixed income short positions than they could have handled.

The wording of the statement and subsequent Q&A session was largely in line with what we have heard before. Massachusetts senator Elizabeth Warren questioned Powell on the effects high inflation and possible recession are going to have on the worst well off, but Powell stated that „We know from history that that will hurt the people we’d like to help, the people in the lower income spectrum who suffer now from high inflation.“ This is exactly what a central bank governor with a dual mandate would need to say in an environment of inflation hovering close to 10.0% YoY (8.6% YoY was the last print) and subdued unemployment. Powell also argued that although soft landing prospects look slightly dim, the economy is resilient enough to weather higher interest rates. So let’s have one thing completely clear: there was really nothing dovish in the wording of the testimony. The FED is still determined to hike rates as high as it takes to bring soaring prices under control.

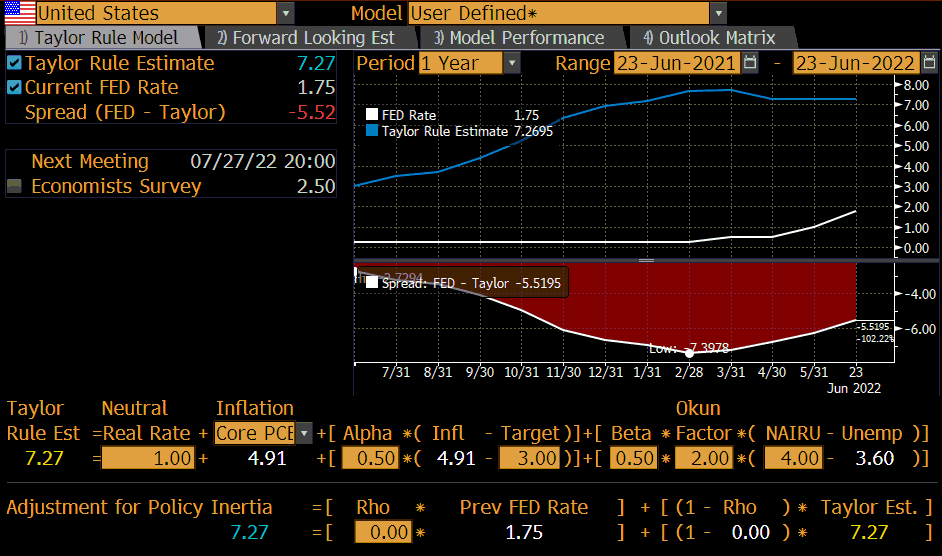

Regarding rule-based guidance, Powel stated that „by the end of the year we will be pretty close to where some of the Taylor Rule iterations are“. This sentence has a particular ring because of the BBG TAYL function:

Taylor rule implied rate is currently 7.27% (with core PCE @ 4.91% and unemployment @ 3.60%), meaning that after the implied July 27th hike in size of 75bps (FED fund range @ 2.25%-2.50%) the central bank will still be some 477bps below the target. Currently, FFZ2 (FED fund futures maturing in December 2022) prices a 3.55% FED fund rate, still some 370bps below the Taylor rule. What we’re trying to tell is that getting pretty close to the target would require unemployment getting at least 2 percentage points up and core PCE dropping to about 2.0%. This is where the puck might be in six months’ time – well at least Powell is skating towards it.

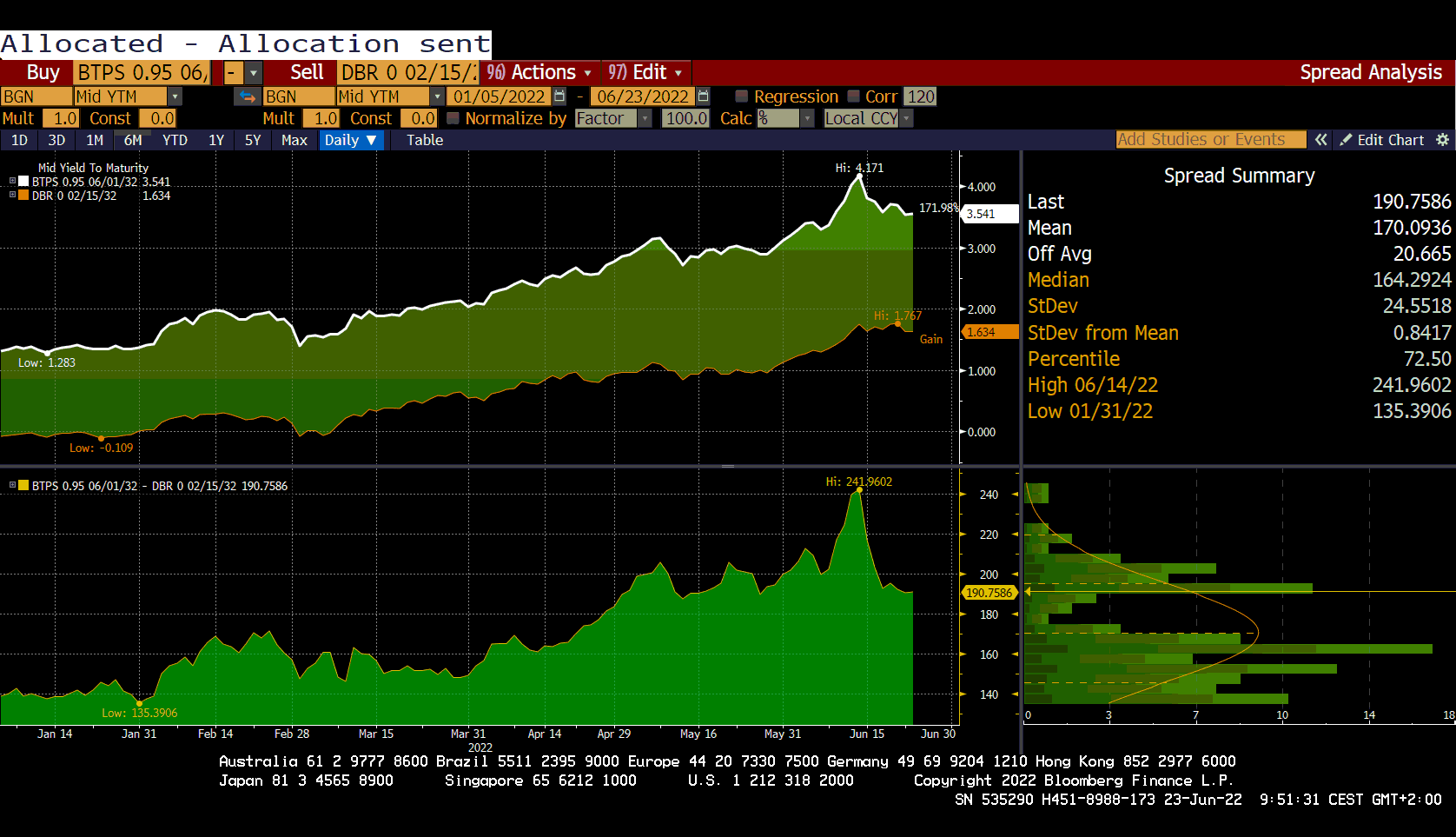

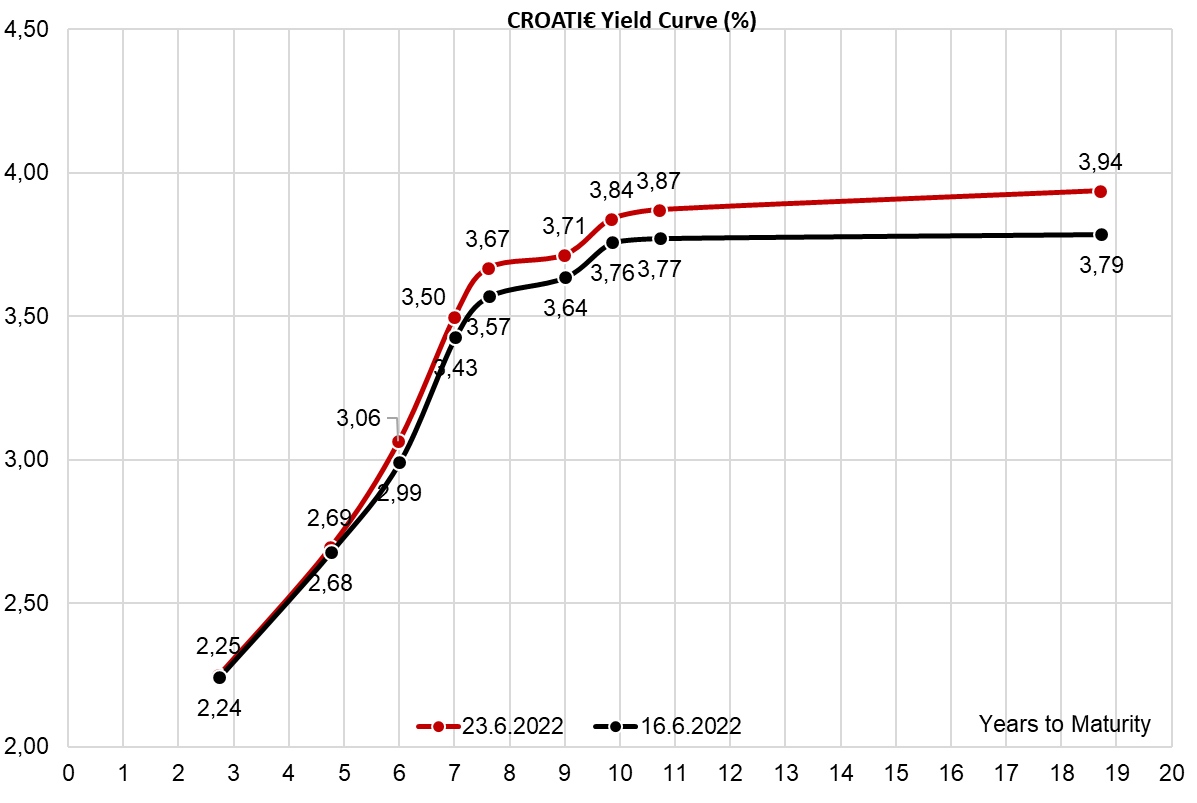

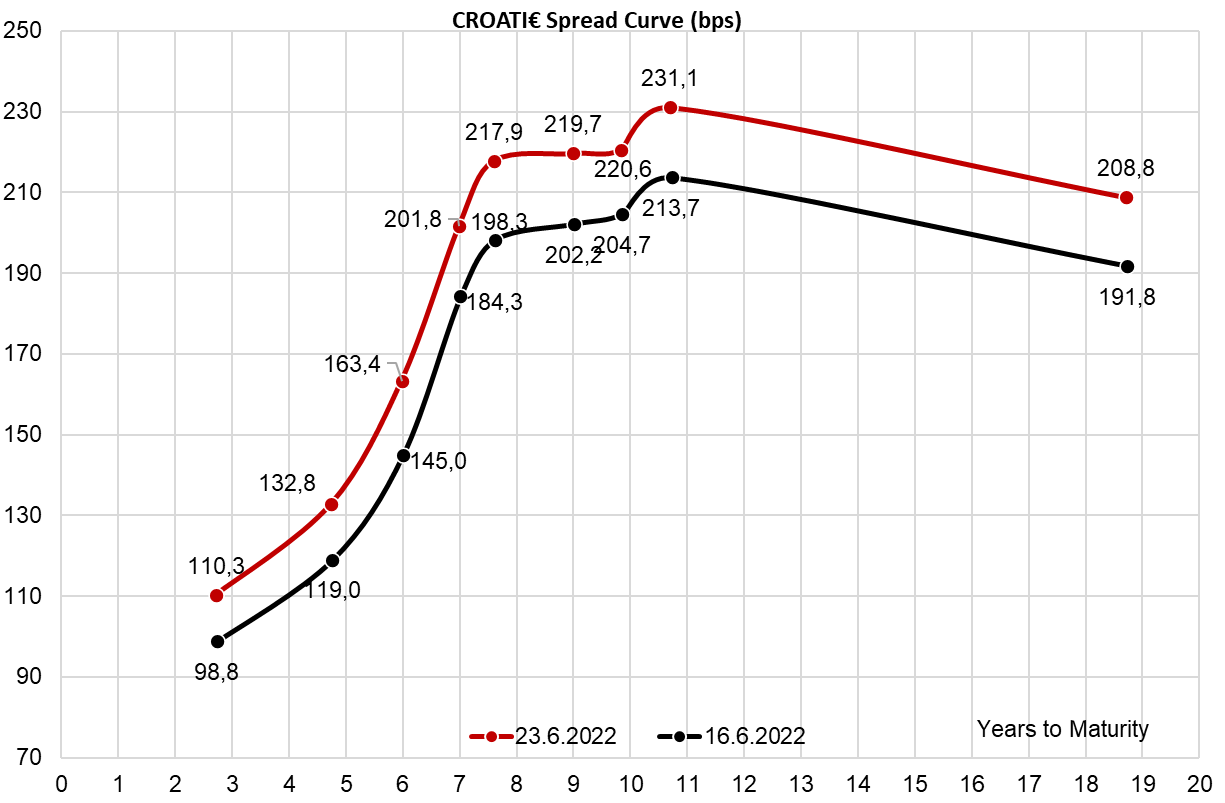

Global rates rallied based on short positioning and perceived dovishness in Powell’s testimony so currently, German 10Y just broke below 1.50% YTM. Ahead of a large BTP auction lo spread (BTPS-DBR) is once again traded below 190bps (188bps spotted this morning) and all of this comes against the backdrop of falling equities and widening iTraxx (take a look at the ITRX XOVER CDSI GEN 5Y Corp on BBG). This effectively means that ECB’s antifragmentation tool is working, at least from the rhetorical point of view. That’s all the Frankfurt officials were looking for in the first place – for the market to take them seriously. However, eventually, they will have to deliver on that rhetoric, so keep on monitoring closely.

Bear in mind that this morning we have still seen CROATI€ trading around 200bps above the German benchmark. For instance, CROATI 2.875 04/22/2032€ was offered at 92.625 (3.787% YTM, B+229bps), albeit not in decent size.

Today, we decided to present you with a brief overview of CROBEX constituents’ free float.

In our analysis we considered free float to equal all individual shareholdings lower than 5%, while pension funds and UCITS funds were considered as free float regardless of their shareholding percentage.

Free Float of CROBEX Constituents (%)

23 CROBEX constituents have a free float higher than 50%, indicating that two-thirds of CROBEX constituents are still held by a small group of majority shareholders. Of the constituents, there are two companies that have free float over 90% – Ingra with a free float of 93.6% and Adris (preferred) with 91.6% of free float.

On the other hand, only ZABA has less than 10% of free float. ZABA has free float of 3.8% and is almost completely owned by Unicredit 84.48% and Allianz 11.72%. ZABA is followed by Saponia, Plava Laguna and Brodogradilište Viktor Lenac with a free float of 12.7%, 15.8% and 18%, respectively.

Prime market is the most demanding market on the Zagreb Stock Exchange regarding the requirements set before the issuer. It is worth noting that it requires the issuer to have a free float of at least 35%. If we were to compare CROBEX to that parameter, a few of the constituents would not meet the criteria (ZABA, Saponia, Plava Laguna, Brodogradilište Viktor Lenac, Dalekovod and HPB).

If we were to calculate free float of CROBEX constituents while excluding pension funds, the results would be slightly different for some, but significantly different for other companies. Namely, Croatian pension funds hold HRK 15.8bn of the total market capitalization of ZSE, meaning a considerable part of free float of some constituents is technically “locked in”.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 13 | 24.06.2022. | KOEI | Ex-dividend date | Croatia |

| 14 | 24.06.2022. | NLBR | Ex-dividend date | Slovenia |

| 15 | 24.06.2022. | CICG | Dividend payment | Slovenia |

| 16 | 25.06.2022. | TRP | Half-yearly financial statements 2022 | Romania |

| 17 | 26.06.2022. | TRP | Conference call – H1 financial results | Romania |

Due to the nature of these events, they are subject to change (might be postponed or canceled).

In May 2022, BET decreased by 1.7%, while in the first 5 months of 2022, it decreased by 5.2%, ending May at 12,509.77 points.

The Bucharest Stock Exchange has published its monthly trading data for May 2022. In the report, they highlight the fact that almost 118,000 transactions were made (+44.6% YoY). Also, number of retail investors keeps going up – almost 90,000 Romanian investors are currently trading on the stock exchange. In total, the equity turnover in May amounted to EUR 138.6m, which would translate into an average daily turnover of EUR 6.30m.

It should also be noted that the largest volatility was experienced by the BET-NG index, an index that tracks energy and related activities. In total, this index increased by 5.5% in May 2022. Looking at the Romanian blue chips (which constitute the BET index), on a MoM basis, only 3 out of 20 experienced positive change in May, with Romgaz being the only one to remain unchanged MoM.

Breaking this down further, Banca Transilvania experienced the largest increase, growing by 6.3%, followed by One United Properties with 4.0%, and Nuclearelectrica, with 1.1% MoM increase. On the flip side, BRD lost -18.7%, Sphera lost -15.7%, while Alro lost -11.6%. If we were to look at how the companies performed in the first five months of 2022, there are some changes. If we looked at it this way, only 5 out of 20 BET constituents experienced growth. First among them is Romgaz, with a 18.9% increase, followed by BVB with 11.6%, Transgaz with 7.2%, One United Properties, with 8.8% and Transgaz with 7.2% YTD. On the other hand, Purcari lost -39.3%, BRD lost -30.5%, Teraplast lost -29.5%, Alro lost -29.3%, Sphera lost -22.3% and Aquila lost -14.6%.

Performance of BET constituents in May 2022 (%)

In total, the BET index ended May with 12,509.77 points, reporting a slight MoM decrease (-1.7%), but losing -5.2% of its value from the beginning of the year till the end of the month. The high volatility and uncertainty recorded on the Romanian market is something that is also evident in other Stock Exchanges across Europe, but also the US. With high inflation, the Russia-Ukraine conflict as well as the proximity of Romania to Ukraine, there are a lot of factors that are negatively influencing the Romanian equity market.