Today we decided to update performances of the regional, frontier and emerging market indices in order to put CROBEX’s performance from the beginning of the year into perspective. Furthermore, we compared the historical movement of CROBEX performance to “fear index” VIX in order to analyse whether the domestic index follows global sentiment.

The VIX has definitely been in the spotlight this year, as the global markets have witnessed significant volatility as a result of the Covid-19 pandemic. VIX, also known as the fear index, is calculated based on the S&P 500 options and reflects market expectations on (implied) volatility in the coming 30 days.

Unlike classic indexes, VIX’s growth represents negative sentiment or increased risk of market volatility. VIX levels over 30 could be considered risky as the market is expecting high volatility.

Since, the S&P and VIX are negatively related, this years market conditions (the combination of Covid-19 outbreak and an oil price war between Russia and Saudi Arabia) have led to a surge in the VIX index. It is worth noting that VIX was last time seen at the levels observed this year during the financial crisis in 2008. In March, VIX observed two sharp daily increases this month. The first one was on 12 March, which coincided with President Trump introducing the European travel ban. Meanwhile, on 16 March the index reached 82.69, which is the highest value since the CBOE (Chicago Board Options Exchange) introduced the new methodology for the index in 2003. As of yesterday, VIX is up 81.9% YTD, however note that the index has recently been on a downward trend.

VIX Movement YTD

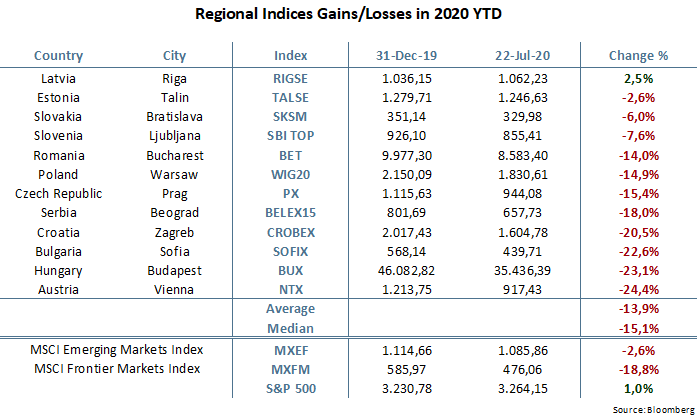

Turning our attention to the region, all but one of the observed indices posted a negative YTD performance with the average value decrease amounting to -15.1%. The Austrian NTX index recorded a -24.4% YTD decrease in value which makes it the biggest laggard among the observed indices. Afterwards come the Hungarian BUX (-23.1%) and the Bulgarian SOFIX (-22.6%). Meanwhile the Latvian RIGSE index is the only index that is currently trading in the green, with YTD performance amounting to +2.5%.

In a statement released on the Zagreb Stock Exchange yesterday, AD Plastik announced two changes in their Supervisory Board.

The changes occurred based on decision of the company OAO Holding Avtokomponenti, which has the right to appoint two members of the Supervisory Board. According to the mentioned decision, the membership of members Dmitry Leonidovich Drandin and Nadezhda Anatolyevna Nikitina in the Supervisory Board has ceased, and the new members are Sergey Dmitrievich Bodrunov and Alina Viktorovna Koretskaya. No specific reason was given to clarify the change in membership.

As a reminder, OAO Holding is the major shareholder of AD Plastik holding 30% of shareholding.