As of end March 2021, NAV of Croatian UCITS funds stood at HRK 19.3bn (+23.4% YoY)

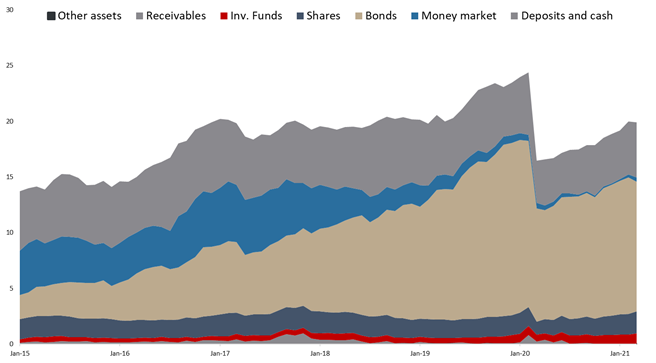

Since asset managers play a significant role in the Croatian capital market, it is particularly interesting to see how they have been performing since the beginning of 2021. As visible from the graph below, NAV of all funds has witnessed a steady increase for 12th consecutive month, and as of end March stood at HRK 19.3bn (+2.1% MoM or +23.4% YoY). Meanwhile NAV of Croatian mutual funds increased by as much as 6% YTD (Q1 2021).

As a reminder, in March of 2020, UCITS funds observed a sharp decrease in their NAV of 32.2% or HRK 7.42bn. We note that most of the mentioned decrease could be attributed to the withdrawals from the funds, while a smaller portion reflects the change in value of assets in which the funds invest in.

The biggest (nominal) YTD increase was observed in deposits and cash by HRK 502.4m (or 11%) and Money market by HRK 246.5m. Shares follow with a very solid increase of 12.8% or 224m. On the flip side, bonds observed a slight decrease of 72m or 0.6%.

Looking at the asset composition of Croatian UCITS funds, bonds remain the largest asset class, accounting for 58.6% of total assets. Shares come next with 9.9% or HRK 1.97bn. Of that, domestic shares account for 28.5% or HRK 560m. Note that domestic equity holdings observed a solid increase of 10.5% YTD.

Total Assets of All Croatian UCITS Funds (2015 – March 2021) (HRK bn)

Dividend yield is 0.5%, while Ex-date is 12 May 2021.

BRD published the resolutions of the GSM in which the shareholder approved a dividend payment. To be specific, the shareholders approved a gross dividend of RON 0.0749 per share.

At the current share price, dividend yield is 0.5%, while ex-date is 12 May 2021. As a reminder, in 2020, the bank approved no dividend payment.

In the graphs below, we are bringing you an overview of BRD’s historic dividend payout and dividend yield.

Dividend per Share (RON) and Dividend Yield (%) (2016 – 2021)

The Governing Council will conduct net asset purchases under the PEPP, with a total envelope of EUR 1,850bn, at least until the end of March 2022. The Council also expects purchases under the PEPP over the current quarter to continue to be conducted at a significantly higher pace than during the first months of the year.

As expected by the market, the Governing Council decided to reconfirm its very accommodative monetary policy stance.

First, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.50% respectively. The Governing Council expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

Second, the Governing Council will continue the purchases under the pandemic emergency purchase programme (PEPP) with a total envelope of EUR 1,850bn. The Governing Council will conduct net asset purchases under the PEPP until at least the end of March 2022 and, in any case, until it judges that the coronavirus crisis phase is over. Since the incoming information confirmed the joint assessment of financing conditions and the inflation outlook carried out at the March monetary policy meeting, the Governing Council expects purchases under the PEPP over the current quarter to continue to be conducted at a significantly higher pace than during the first months of the year.

Furthermore, the Governing Council will continue to reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2023. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance.

Third, net purchases under the asset purchase programme (APP) will continue at a monthly pace of EUR 20bn. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.

The Governing Council also intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

Finally, the Governing Council will continue to provide ample liquidity through its refinancing operations. In particular, the third series of targeted longer-term refinancing operations (TLTRO III) remains an attractive source of funding for banks, supporting bank lending to firms and households.