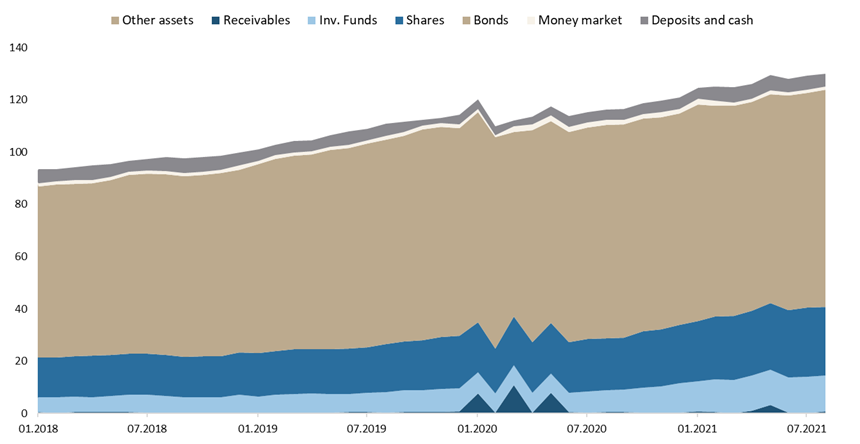

As of end September 2021, NAV of Croatian Mandatory Pension funds amounted to HRK 129.1bn.

As pension funds could be seen as the key player on the Croatian capital market, it is worth seeing how they have performed in the recent period.

NAV of pension funds has witnessed a steady increase for the 18th consecutive month, and as of end-September stood at HRK 129.1bn (+11.5% YoY or HRK 13.3bn). Meanwhile, on a YTD basis, NAV is up by 8.4%, while on a MoM basis, NAV of Mandatory Pension funds is up by 0.3%. We also note that net contributions in September amounted to HRK 650.8m, reaching a total of HRK 5.5bn YTD.

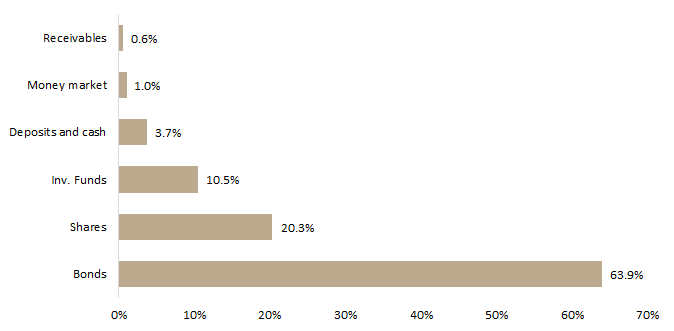

AUM Structure – Mandatory Pension Funds (September 2021)

Looking at the asset composition of pension funds, one can notice that bonds account for the vast majority of total assets (63.9%) which as of end-September amounted to HRK 83bn. We note that bond holdings observed a MoM increase of 0.9% (or HRK 780.7m).

AUM Structure – Mandatory Pension Funds (September 2021)

Source: HANFA, InterCapital Research

Shares come next, with 20.3% or HRK 26.4bn, representing a decrease of 0.2% MoM (or HRK -59.2m). The mentioned decrease came from foreign equity (-2.2% MoM or HRK 258.4m). Meanwhile, domestic equity witnessed an increase of 1.3% or HRK 199m. Note that domestic equity accounts for 56.8% of total equity holdings. On the other hand, in the bond market, the domestic bonds hold vast majority with 94.2%.

Croatian government budget deficit to GDP ratio in 2020 has amounted to 7.4% of GDP. Slovenia has achieved even higher budget deficit of 7.7% of GDP. Both were above EU budget deficit which stood at 6.9% of GDP marked by COVID-19 containment measures in all member states.

Croatian government deficit in 2020 stood at 7.4% of GDP. The reason for such a high government deficit is the decline in overall economic activity due to the COVID-19 pandemic, which primarily had a significant impact on the decrease in tax revenues and social contributions. On the other hand, the Government of the Republic of Croatia has taken significant measures on the expenditure side of the State Budget in order to preserve jobs at employers’ whose economic activity has been disrupted by special circumstances, as well as in order to finance costs to preserve the health of citizens. In 2020, taxes on production and import were collected in the amount of HRK 70.7bn, which was a decrease of 13.0% compared to 2019, while the current taxes on income and wealth were collected in the amount of HRK 24.7bn, which was 7.4% lower than in the previous year. Furthermore, net social contribution revenues amounted to HRK 45.1bn, which was 4.8% less than in 2019. Government revenue decreased 6.4% YoY, while expenditure was up 8.7% YoY. An increase in investments was recorded, which amounted to HRK 21.3bn in 2020, which was 19.3% higher than in 2019. Payments for guarantees called, debt assumptions and capital injections in 2020 were recorded in the amount of HRK 942m, which influenced an increase in deficit as well as inclusion of stimulating housing expenditures.

Public debt in 2020 has increased by 16.2 p.p. to 87.3% of GDP driven by strong state spending for pandemic measures and increase in nominal amount of debt for HRK 37bn to HRK 330bn. In period from 22 February – 17 October 2021 data from tax authorities demonstrate that the total value of taxable invoices reported was 4% higher compared to 2019. This would definitely prop up the revenue side of the budget, nevertheless healthcare spending are mounting, and government was fully supporting businesses affected by Covid-19 for half of the year. Strong summer season will positively affect government revenues but due to still inflated expenditure side, we expect public deficit to drop to in 2021.

Croatia Public Debt & Public Deficit (% GDP)

Slovenia has in 2020 achieved even higher budget deficit amounting to 7.7% GDP, a decrease of 8.1 p.p YoY as last year in government budget was in surplus of 0.4% to GDP and it amounted to EUR 200m. in 2020 budget deficit was EUR 3.6bn. Public debt has increased by 14.2 p.p. YoY to 79.8% of GDP driven by strong state spending for pandemic measures and increase in nominal amount of debt for EUR 5.6bn to EUR 37.4 bn. Public debt is expected to increase further this year and to reach 81.1% GDP by the end of 2021. But as many restrictions in the economy were present throughout this year and there were more fiscal packages, so deficit of budget balance will be evidenced at the level of 2021 again.

Slovenia Public Debt & Public Deficit (% GDP)