The European Union issued EUR 17bn worth of 10 and 20Y bonds this week. The transaction was a long-awaited EU’s debut under SURE program. It received the biggest demand ever recorded in Europe with books above EUR 230bn and net issuance premium being pressed to the bottom. For more details on this monstrous transaction, read today’s article.

In the midst of the first coronavirus wave, European Commission proposed to create EUR 100bn heavy SURE program (Support to mitigate Unemployment Risks in an Emergency). In September 2020 program was activated in total amount of EUR 87.3bn that will be distributed to 16 countries in the form of loans aimed to cover the costs directly related to the financing of national short-time work schemes, such as the ones PM Plenkovic announced this week. To finance the instrument, EC had to issue social bonds (“The Social Bond Framework” is meant to provide investors in these bonds with confidence that the funds mobilized will serve a truly social objective) and we saw their debut this week which spurred a lot of investors’ interest. SURE program should be financed in full by the end of Q2 2021 when NGEU funding is supposed to start, according to EU Commissioner Hahn. Considering NGEU’s total amount of EUR 750bn, SURE funding is only an introduction.

New EU bonds were issued at favorable conditions, i.e., EUR 10bn of 10Y paper was issued at -0.238% (MS+3bps) while EUR 7bn of 20Y paper was issued at 0.131% (MS+14bps). This was the highest amount ever borrowed in the history of the EU. Both spreads were tightened compared to initial spread guidance which in the morning stood at MS+6bps for 10Y and 17bps for the longer one. Not surprising since only 48 minutes after the books were opened, book size was already above EUR 95bn for 10Y paper and above EUR 55bn for 20Y, while 17 minutes later books were closed in excess of EUR 233bn in total for dual-tranche, reflecting the largest bid ever recorded in the history of Sovereign and Supranational debt capital markets, according to the EC. Furthermore, according to EC’s report, new issuance premium calculated on existing EU curve stood at only 1 and 2bps and respective yield stood at 36.7bps and 52.1bps above 10 and 20Y German papers. After the auction both papers were high in demand and their price skyrocketed by more than 100pips immediately on the so-called grey market.

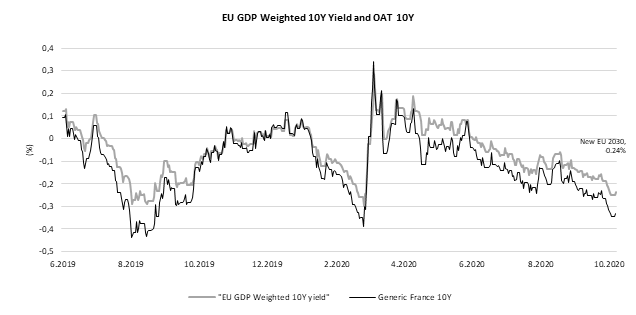

To get a clearer view about pricing, on the chart submitted below, we calculated artificial 10Y EU yield using sovereign EUR 10Y yields weighted by GDP (grey line) and it shows that new EU 10Y bond was issued only 1 basis point above the line, as stated by European Commission. However, secondary market showed that EU 10Y should be traded below GDP weighted yield of EU sovereigns and today it could be bought at MS-10bps reflecting tightening of 12bps versus levels compared to the day of issuance.

Looking at the investors’ distribution, there are some interesting findings as well. Fund managers bought the largest part of the 10Y paper (41%) while second largest part was seized by central bank (37%). The rest belongs to banks, insurances, and pensions funds. Fund managers also took the biggest chunk in 20Y issuance, but second largest type of investors there were bank treasuries while ‘only’ 13% of the paper went to central banks/official institutions. Looking at the geographic distribution, most of the papers went to Germany, UK and France while the rest was spread all over Europe and some small part in Asia and US.

Some of the analysts are already saying that there is „new sheriff in town“ that could replace Bund as a main EUR benchmark. There is still a long way for that, although the step was obviously made in that direction.

Source: Bloomberg, InterCapital

As of September 2020, Slovenian mutual funds manage EUR 2.987bn, representing a decrease 0.4% MoM and a decrease of -1.1% YTD.

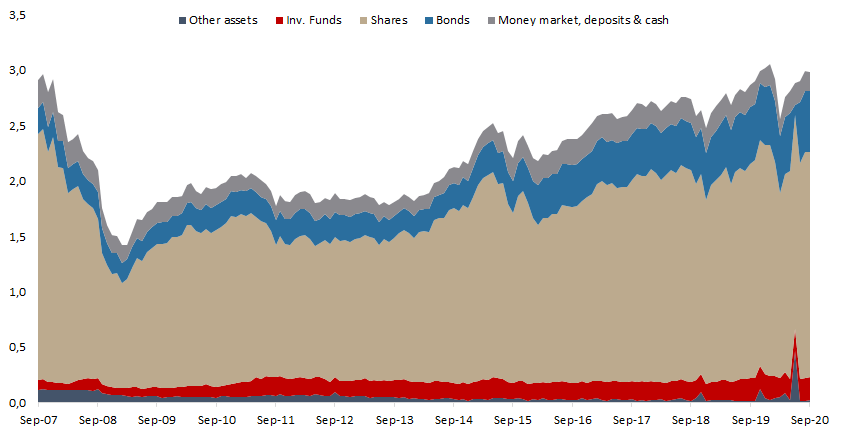

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their assets structure during COVID-19 crisis.

As of September 2020, Slovenian mutual funds manage EUR 2.987bn, observing a slight decrease of 0.4% MoM, which represents the first time since April that mutual funds experienced a MoM decrease. As a reminder, Slovenian mutual funds observed five consecutive monthly increases (since April). It is also worth noting that mutual funds are experiencing a recovery after a considerable loss in March 2020 (-12.4% MoM) due to crisis caused by the Covid-19 pandemic. As a reminder, in April the AUM partially recovered with a 7.8% increase. Meanwhile, on a YTD basis, AUM is only 1.1% down, indicating that the investors were not withdrawing funds at a significant level during the Covid-19 outbreak, which was not the case in Croatia.

Turning our attention to the asset structure, as of September 2020, shares account for 68% of the total assets (or EUR 2.03bn). Shares observed a slight decrease of 0.3% MoM and were the main driver of the overall decrease. Note that the vast majority (97%) of equity holdings of Slovenian mutual funds come from the foreign market. Meanwhile, total equity holdings are down by 1.8% YTD. Meanwhile, domestic equity holdings, which amount to EUR 59.55m have witnessed a decrease of 16.2%.

Next come bonds, which make up for 18.4% of the total asset structure or EUR 551m. Of that, 94% come from the foreign market. Investment funds’ share in AUM amounts to 6.8% of total assets, while money market, deposits & cash account for 5.9%. In nominal terms, shares have observed the largest decrease of EUR 36.8m since the beginning of the year, while on the other hand, bond holdings are up by EUR 29.1m.

Total Assets of All Slovenian UCITS Funds (Sep 2007 – Sep 2020) (EUR bn)