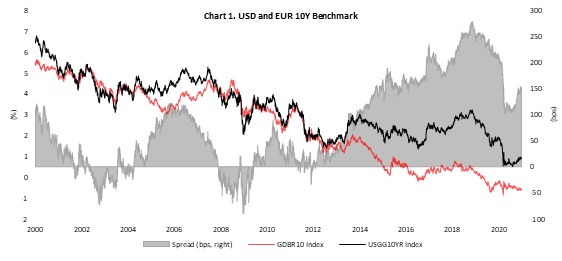

Central banks all over the world were in „whatever it takes“ mode for almost whole 2020. Fed cut its reference rate aggressively in March 2020, showing the way to central banks all over the world. Besides decreasing rates, central banks introduced many other tools out of which most aggressive were asset buying programs. In this article we are looking at the most important events in 2020 and what could we expect from central banks in 2021.

A year ago, when we were looking at the most significant risks for 2020, US presidential election and messy Brexit were among top picks. Central banks on both sides of the Atlantic cut their rates in the last quarter of 2019 and market was looking how yield curves are falling and equity markets were marching further. Nevertheless, in Q1 2020 Coronavirus crisis kicked in and put world economy into chaos. Financial markets reacted as one would expect, with equity indices falling by 10% a day while safe-haven assets soared.

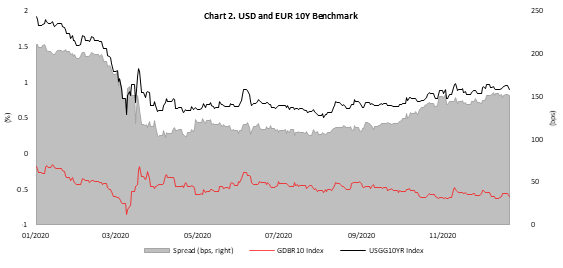

On its regular FOMC, March 3rd, Fed decided to cut its reference rate by 50bps, but that easing was already priced-in and did not have much effect on the markets. Less than two weeks later, on March 15th, Sunday, Fed surprisingly decided to cut its rates to zero, i.e., by 100bps and launched massive USD 700bn QE program. After that move, its was obvious that Fed will do whatever it takes to save the economy with any tools that it could use. To confirm the above, Mr Powell back then stated that Fed could buy as much as needed government bonds and MBS’s to keep financial markets functioning. That was Powell’s “whatever it takes” moment.

On the other side of the Atlantic, ECB was not keen to use its bazooka in the first place but when Italian 10Y yield overjumped 3.0% in March, Ms Lagarde and her team realized that if they do not close the spreads, they will become enormous obstacle for the governments and the markets. On March 18th ECB announced its PEPP program that calmed EUR markets. In the following months, ECB enlarged PEPP package two times and implemented several other tools that have driven EUR curve South. ECB’s policies coupled with EU’s agreement on large fiscal package that showed some positive steps toward fiscal union pushed peripheral spreads close to the all-time lows.

Fast forward to the end of this wild year, on its last meeting, Fed stated that it will maintain its purchases at USD 120bn per month or higher „until substantial further progress has been made toward the maximum employment and price stability goals“. As this looks more like qualitative target rather than quantitative, there were mixed interpretations. Some of the analysts think that Fed will not lift its reference rates until 2024 while there are others who think that already in 2021, we will see large increase of inflation which will drive Fed’s officials to react. Despite we think there could be larger than expected jumps of inflation next year due to several factors, we do not expect Fed to tighten its policy next year, at least. As economy is most likely to recover somewhat, it should pass several quarters before we come to pre Covid levels, meaning that gap should be closed in 2022 or even beyond.

In December, ECB had similar moment, increasing its PEPP envelope and introducing easier terms on its TLTRO meaning that ultra-loose policy will be continued next year. As inflation in euro area is nowhere close to US, rather below zero, analysts agree that inflation does not pose much risk in Europe like it is the case in USA and they expect EUR curves to stay close to their current levels. At periphery, analysts agree once again, saying that peripheral spread should tighten due to NGEU and economic recovery.

Both ECB’s and Fed’s last meeting showed that two central banks will continue with their loose policies and economy will have to reach 2019’s levels at least before some tightening occurs. Furthermore, both EU and USA will have to finance their large deficits for the next two years meaning that it will be crucial for economy that central banks do not withdraw their QEs. From today’s perspective, it looks like central banks will not change their policies much next year while 2021 should be the year for real economies that should recover most of what they lost in one of the most extreme years in the history. However, if you only looked at financial markets twice, at the beginning of the year and at the very end, you would not have a clue what a roller coaster this year was.

Source: Bloomberg, InterCapital

Yesterday, CROBEX and SBITOP ended the day in red, with a decrease of 0.50% and 1.88%, respectively.

Yesterday, virtually all major European indices ended the trading day in red, which could be attributed to the discovery of a new strain of COVID-19 virus in the UK. The aforementioned caused concern for investors on whether the economies around Europe will (fully) reopen in the foreseeable future. To put things into a perspective, DAX dropped by 2.8%, while FTSE 100 decreased by 1.7%.

Furthermore, the concern for a no-deal (no free-trade agreement) Brexit is rising with the deadline for a deal coming around the corner, potentially meaning that the EU and UK will have to trade according to WTO terms which will lead to higher taxes and tariffs on imports increasing the prices for consumers. The delay in reaching an agreement can mostly be attributed to the issue of fishing rights, as the UK wants to the British quota share on the volume of fish that can be caught from each species in their waters.

Looking at the Slovenian and Croatian stock market, SBITOP and CROBEX are down by 1.88% and 0.50%, respectively. The top losers of the SBITOP index are Triglav (-3.34%), Krka (-2.40%) and Telekom Slovenije (-2.33%). Krka ended the trading day at EUR 89.60 per share, putting it at EV/EBITDA of 5.2x.

On the Croatian market, Atlantic Grupa observed the highest share price decrease (-2.3%) among CROBEX10 constituents. Podravka and HT follow with a decrease of 1.45% and 1.39%, respectively. On the bright side, The European Medicines Agency has approved Pfizer and BioNTech’s Coronavirus vaccine for conditional use for people ages 16 and over in the EU.