Tomorrow’s Jackson Hole speech is likely to end the recent summer lull. Markets are expecting that the FOMC should keep on cutting rates as the external headwinds continue to mount. On the other hand, President Trump has recently been quite active in telling Jerome Powell how to do his job and US central bank might be inclined to emphasise it’s independence, especially in the prelude to US presidential election next year. To get some insight how to navigate this demanding environment, glance through this brief article.

Minutes from the July 31st FOMC meeting were released yesterday and they paint a picture of a very softly hawkish FED, but basically the message read from the minutes is quite similar to the one delivered by the FOMC Chairman on the press conference following the rate cut decision. First of all, these minutes could be labeled as irrelevant since on the day following the meeting (August 1st) President Trump announced plans to enact further tariffs on the remaining 300bio USD of Chinese exports to the United States. Nevertheless, the minutes revealed a split FED in which most of the members thought of the last 25bps cut as a „mid cycle adjustment“. Translated in simple English: most of the FOMC members probably thought about cutting the FED fund rate by 25bps or 50bps tops to keep the economy running – and that’s all, folks. If this explanation is correct, then the markets might be overreacting to FOMC’s intent to cut the interest rates further.

This is the reason why everybody’s so eagerly awaiting Powell’s Jackson Hole speech tomorrow. President Trump’s influence on the FED is also a matter of concern: his threat to escalate the trade war even further would imply that the FOMC should cut rates more aggressively to keep the economy on track of continuous expansion; on the other hand, Trump’s direct criticism of the FED’s monetary policy might warrant a counter reaction from Washington in order to confirm that the central bank is truly independent from the president’s whims. Either way, the deck has been reshuffled and Powell’s speech would be the first signpost of how the central bank looks at the current economic conditions. On top of the new tariffs, external environment has worsened significantly: German economy is on the brink of a technical recession, Italian government collapsed, European PMIs have continued worsening and now the ECB action on 12th September meeting becomes set in stone… It’s also worth mentioning that the Fed fund futures expiring in November (FFX9 Comdty on BBG) added one more 25bps rate cut following Trump’s announcement (the futures contract currently implies a 1.66% FED fund rate, corresponding to a 50bps cut of the target band) and so far the FED was not so eager to fight market expectations.

As usual, if the markets seem to be overreacting, then actually it’s the FOMC that seems to be underdelivering.

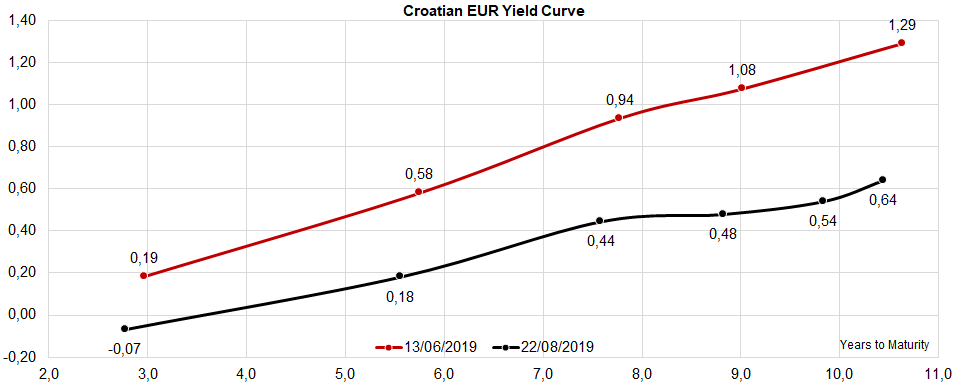

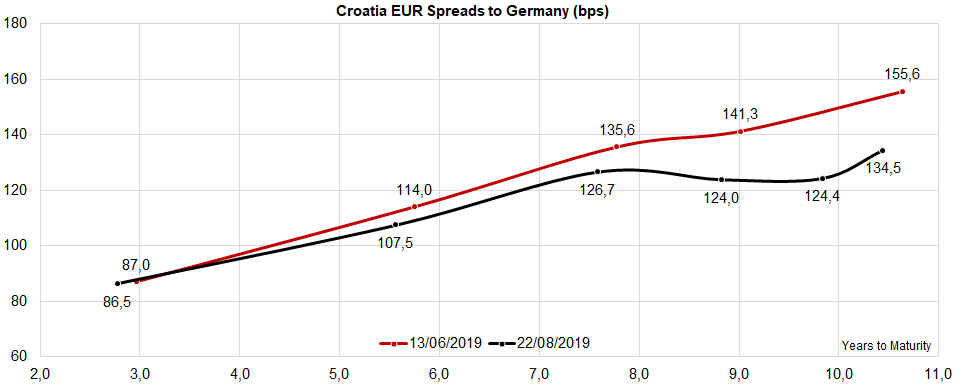

Speaking about Croatian EUR international bonds, a combination of scarcity and benchmark yields going down means that both yields and spreads have been gradually contracting. Currently two bonds stand out in particular as relatively good buys: CROATIA 2030 EUR (@ Germany+134.5bps = 0.645% YTM) and CROATIA 2027 EUR (@ Germany+126.7bps = 0.480% YTM). The numbers should be taken with a grain of salt since the supply of the paper is very dry some concessions should be made in terms of price. However, it seems like CROATIA 2030 EUR could still be purchased at a level close to 0.60%, which still looks quite good relative to the rest of the curve. Comparing the returns with the ones reported one month ago, the largest yield drop was evident on CROATIA 2029 EUR, about 41bps lower.

According to the writing of Croatian media, Croatia’s Government has decided to go through another round of privatisation which will include 90 companies, among the will also be some of the largest listed companies in Croatia.

According to the writing of Croatian media, Croatia’s Government has decided to go through another round of privatisation which will include 90 companies. The process will take part in three phases with the first one occurring as soon as September, while the second one will follow by the end of the year. Meanwhile, the final phase of the privatization process is scheduled to occur sometime next year. However, one should note that the Government only intends to sell their share in companies in which they hold a very small minority stake, usually a low single digit percentage.

Among the companies whose share are expected to be sold in the first phase one also find some major tourist companies such as Arena Hospitality where the Government holds an 0.77% share. Another major company whose shares are expected to be sold is HT, where the Government holds a 1.5% share which, at current prices, would result in a sale worth HRK 200m.