Another ECB day giving you a headache? Worry not because we have compiled a research paper sketching the distribution of risks and what might come out of today’s ECB meeting. Also, we revisit the current trends on CROATI international bonds.

Today’s focus of fixed income investors would definitely be on the press conference following the ECB GC monetary policy meeting (14.30 CET) in Frankfurt. Quite recently ECB President Christine Lagarde became vocal about ECB adjusting it’s monetary policy to support climate and environmental goals, and since today is also global Earth Day (April 22nd) you can certainly expect a some of the rhetoric targeting climate goals. As a matter of fact, ECB’s climate pivot is similar to FED’s focus on reducing the unemployment in vulnerable segments of the population (African Americans in particular) in terms of decoupling from typical single or dual mandate the central banks usually have, meaning that it’s quite understandable that we would be hearing more about it in the future.

The climate pivot from Frankfurt is also a useful deterrent tool since it might shift at least some of the attention away from difficult issues, one of them being what will the ECB do with augmented PEPP purchases in June. A little bit of context if you just decided to tune in: there was a major bond sell off in the United States that came with two legs, the first one was higher inflation expectations and the second speculation about FED being forced to tighten sooner than expected. At least some of the second leg sell off (concerning FED fund lift off expectations) has been scaled back and market speculates that buying flows coming from Asian insurance companies might have provided the backstop. ECB saw what was going on when the US rate sell off was in early stages and decided to act in order to curb premature tightening, so Madam Lagarde came up with a statement that PEPP would be propped up to decouple from US rates. If European rates would closely follow US benchmarks, higher interest rates would come on top of slow EU vaccination and weak fiscal support compared to the one applied by the Americans, constructing an environment all of the ECB members would like to avoid (albeit some of the think not at all cost). Something had to be done and the ECB did it right – bond sell off in Europe was not as nearly so deep as on the other side of the Atlantic.

But just as we said, the rates meltdown eased in April as bond traders said: OK, this was all about inflation/rates expectations, now let’s see if economic data confirms that our worries were not misplaced. As trend reversed and rates went down, the real question that warrants answering today is not green investing, but rather is there any need for stronger PEPP in the third quarter as well? On one hand, Fabio Panetta (Spain) and Yannis Stournaras (Greece) remind that ECB should not be satisfied with 1.2% inflation in 2022 and 1.4% in 2023 because that would cause a re-anchoring of inflation expectations and loss of growth potential in the future. On the other hand, central bank heads of core states such as Klaas Knot (Netherlands) see real estate market in their home countries that is nothing short of overheating and are aware that accommodative monetary policy that doesn’t foster economic growth causes the bifurcation between wages and real estate prices and in turn prevent millions of young people from buying their own home. However, even Klaas Knot is aware of after effects of pandemic in terms of even weaker GDP growth, so he’s suggesting that PEPP should run it’s course and expire in March 2022 (the statement was made on April 07th). So you can see it’s about hawks versus doves, core versus periphery, TARGET2 lenders versus TARGET2 borrowers. What can we expect from today’s meeting?

We think vaccination data tells a lot about the distribution of the risks. In the United States, about 26% population was vaccinated by two doses, while 65% of people received at least one dose. In Europe, the vaccine distribution goes much slower: 6.8%/27.4% for Germany, 7.2%/26.8% for France, 7.7%/26.3% Italy and 7.4%/28.0% Spain. Countries ahead of the pack are UK that received ample doses of Pfizer early on and Hungary that’s vaccinating its citizens with Russian vaccine. The slow vaccine rollout give a minor advantage to the ECB doves, but remember the GC members are not discussing phasing out enhanced PEPP starting from today, but rather in the third quarter. By then the EU vaccination rates would probably resemble the ones we see in the United States today. This adds to the further insecurity around press conference and it’s no wonder that fixed income hedging caused Bund to tumble at the beginning of the week.

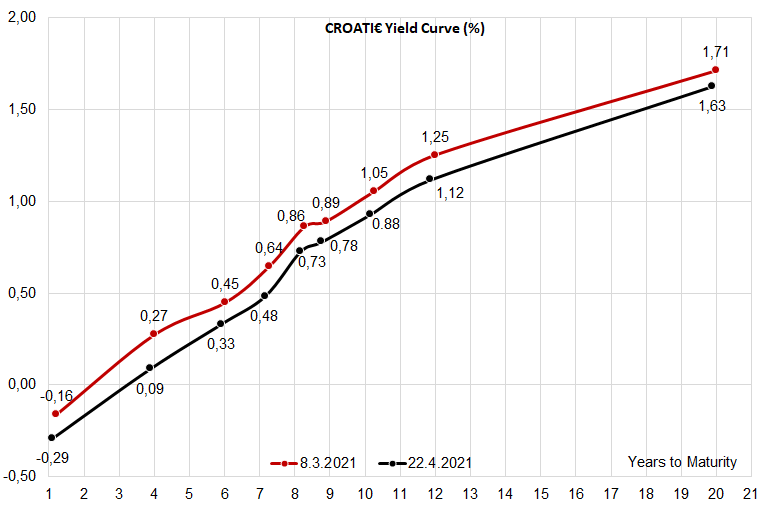

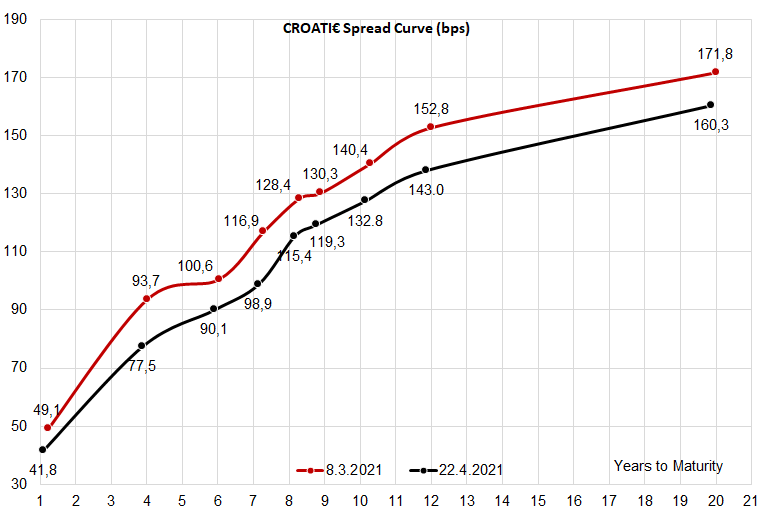

How are CROATI€ going through this conundrum? Actually, the periphery has benefited from lower rates volatility since demand for periphery bonds tends to strengthen in lower volatility environment. The reason for this is that long EGB periphery bonds is a typical carry trade that gets scaled down in times of high volatility and scaled up when volatility is low. The G-spread on Italian 10Y is currently at 101bps (BTPS 0.9 04/01/31 @ 0.737%, DBR 0 02/15/31 @ -0.281%) and it hasn’t moved much since the beginning of March. On the other hand the spread on CROATI 1.125 03/04/2033 managed to contract by full 10bps (from 152bps to 143bps, as depicted on the spread chart). We can reasonably expect the spread between Croatia and Italy to continue to tighten if the Italian G-spread remains well anchored in 90bps-110bps (ECB is taking care of that). Apart from that, we see strong demand on the front part of the curve coming mostly from ALM departments of European banks, which is the reason why CROATI 3.875 05/30/2022 spread dropped to about 41.8bps, while CROATI 3 03/11/2025 trades at 77.5bps above the Bund. We believe UCITS funds still have ample positions in the two, but their selling and rolling into better yielding CROATI 3 03/20/2027 has been somewhat weaker these days. One explanation is that there simply isn’t enough of CROATI 3 03/20/2027 to go around for everybody to switch away from CROATI 3.875 05/30/2022 and CROATI 3 03/11/2025 because a lot of 27s rests either on insurance companies HTC portfolios or in matched liability bank ALM department. Either way, spreads on CROATIs are poised to remain stable in the coming weeks and probably tighten in the longer run while factors such as euro area accession get gradually factored in.

The proposal is subject to approval at the GSM, which will be held on 1 June 2021.

Končar published the convocation to the GSM in which the Management board of the company proposed that the retention of the net profit of the parent company in the amount of HRK 6.8m, implying no dividend payment. As a reminder, the company did not pay out a dividend in 2020 as well.

The proposal is subject to approval at the GSM, which will be held on 1 June 2021.

We note that we have estimated a dividend payment in 2021, given a quite a solid 2020 result and a high cash position both within the Group and the parent. However, we understand such a decision under an assumption of a larger CAPEX cycle or a potential M&A.

In the graph below, we are bringing you a historic overview of the company’s dividend per share and dividend yield.

Dividend per Share (HRK) and Dividend Yield (%) (2015 – 2019)