The Croatian Ministry of Finance is ending another successful placement of retail fixed-income instrument and now it’s time to focus on institutional demand. Smart money likes duration these days since it minimizes the reinvestment risk in times when a global macro picture looks a bit gloomy. The orderbook for the new Croatian local 10Y will be open tomorrow morning. What can You expect? Read in this brief research piece.

It’s been a big week for Croatian public finances, at least from the funding perspective. Yesterday was the last day for submitting binding orders from retail investors for the inaugural retail treasury bill, 1Y duration at 3.74% YTM. Ministry of Finance planned to place a total of 440mm EUR, but the demand ended up at 985mm EUR and this is coming from households alone, not including institutional investors grouped under the sobriquet smart money. It’s very likely that an additional 100mm EUR would be scooped up by institutional investors (the results are still pending), putting the total notional amount to about 1.1bn EUR. So what are the implications of such a successful inaugural T-bill placement?

Well, first of all, the Ministry needs to place a smaller notional size of new local bond than initially thought. The orderbook for the new institutional bond (RHMF-O-33BA) opens tomorrow morning and we expect the placement size to reach 1bn EUR with a small chance of exceeding it. It seems that the supply would be met with quite a heavy demand from the institutional buy-side (pension funds and insurance), implying a very tight new issuance premium.

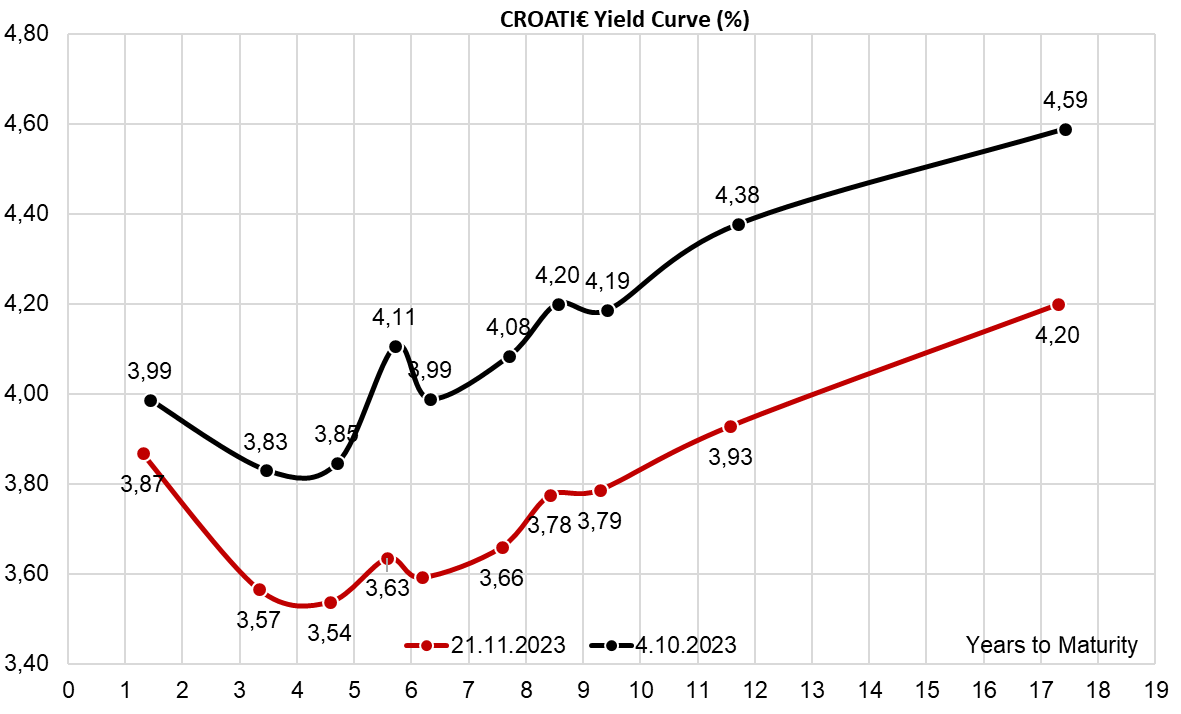

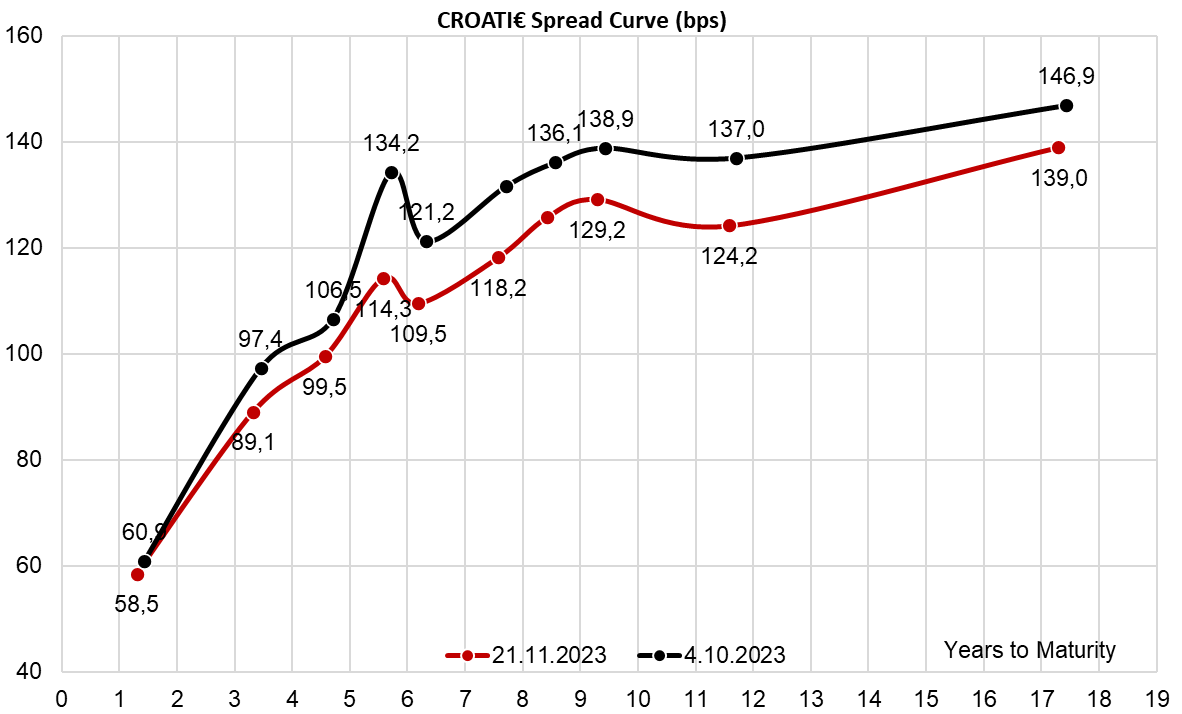

With this we have arrived at the only question worth answering – which yield can we expect on the brand new domestic 10Y? It’s contingent upon the international bond used as a benchmark. CROATI 1.125 03/04/2033€ should be a natural benchmark because of the closest duration, however, this paper is rather illiquid and from our understanding, a handful of dealers are running a short positions that need to be covered by year-end. That’s why this paper is traded relatively rich compared to the rest of the curve – BVAL bid of 79.05 implies a 3.85% YTM and DBR 2.6 08/15/2033€+126bps. Instead, we advise focusing on the most liquid international placement, that is CROATI 4 06/14/2035€. This paper has a BVAL bid of 100.26, 3.97% YTM and it’s DBR 0 05/15/2035€+129bps. It’s merely 3 basis points in the spread, but anybody who traded Croatian international bonds recently can confirm that CROATI 4 06/17/2035€ is much easier to find, trade and price. The 33s are liquid only if you are a seller.

Due to ample demand, we don’t expect much NIP to be plugged into the pricing, so we stick to the expected yield of 3.85%-3.95%, indicated by BVAL bids on the two international bonds we have mentioned. On the secondary market, we do expect additional buying interest to take shape because as the turn of the year gets closer additional buy-side investors might step in to get rid of excess liquidity. These buying interests are tough to settle on the international market because of a lack of supply, so the local market remains the point where supply would meet demand.

During 9M 2023, Nuclearelectrica recorded revenue growth of 15% YoY, an EBITDA decrease of 5%, and a net income of RON 1.94bn, a 2% increase YoY. Furthermore, in Q3 2023, the revenue increase amounted to 6% YoY, EBITDA declined by 5%, while the net income amounted to RON 687.8m, a 4% decrease YoY.

Starting off with the revenue, it amounted to RON 5.55bn during 9M 2023, a 14.8% increase YoY. Meanwhile, during Q3, it amounted to RON 1.85bn, a 6% growth YoY. This increase came on the back of a 15.5% increase in the weighted average price, including Tg, of electricity sold compared to the same period in 2022, as well as a 2.9% increase in quantities of electricity sold. A key change in the sales mix during 9M 2023 is represented by the introduction of the Centralized Electricity Purchase Mechanism “MACEE”, set up from 1 January 2023 until 31 March 2025, which SNN is a part of. This refers to the sale of electricity to OPCOM S.A., a sole purchaser, for the price of RON 450/MWh. During 9M 2023, SNN sold via MACEE 3.38m MWh at the price of RON 450/MWh, accounting for 44% of total electricity sold. On the other hand, the quantity of electricity sold by SNN on the spot market (PZU and PI) grew by 0.5%, accounting for 13.7% of the total sold quantity, and the avg. selling price that was 57% lower. A similar trend was recorded during Q3, and as such the revenue grew by 6% YoY to RON 1.85bn.

In terms of operating expenses, in total, they amounted to RON 3.6bn during 9M, a 33% increase YoY, and to RON 1.14bn during Q3, a 17% increase YoY. The largest increase came from the tax on additional income, which increased by 136% YoY during 9M to RON 2.06bn, and by 108% YoY during Q3 to RON 597.6m. This tax refers to the regulation that was applied due to the energy shocks caused by the war in Ukraine, but also the energy transition. This regulation applied an 80% tax on additional revenue above RON 450/MWh during 9M 2022, and 100% during 9M 2023. As a result, the tax increased significantly. On the other hand, growth was offset by the lower electricity purchased cost, which decreased by 92% YoY to RON 38.7m during 9M, and by 89% YoY to RON 24.6m during Q3. Personnel expenses also grew, by 18% YoY to RON 449m during 9M, and by 22% YoY to RON 167m during Q3, above the inflation in Romania.

In fact, excluding the effect of the additional income tax, OPEX decreased, by 15.6% and 21.2% during 9M and Q3, respectively. Due to the faster overall OPEX than revenue growth, EBITDA amounted to RON 2.5bn during 9M, and RON 890m during Q3, a 4.9% and 5.3% decrease, respectively. This would also mean that the EBITDA margins declined on both 9M and Q3 basis, by 9.5 p.p. and 5.8 p.p., to 45.4% and 48.2%, respectively. Moving on to the net financial result, it improved by 154% YoY to RON 291m during 9M, and by 27% YoY to RON 81m during Q3, on the back of higher financial income (9M 2023: +127% YoY, Q3 2023: +23%), and lower financial expenses (9M 2023: -8% YoY, Q3 2023: -2% YoY). As a result, the net income also improved, at least on the 9M basis, growing by 1.9% YoY to RON 1.98bn. On the other hand, it declined by 4.2% YoY to RON 687.8m during Q3. Due to these developments, the net income margins declined, on both 9M and Q3 basis. During 9M, it amounted to 35.6%, a 4.5 p.p. decline, while during Q3, it amounted to 37.2%, a 4 p.p. decrease YoY.

Nuclearelectrica key financials (9M 2023 vs. 9M 2022, RONm)

Source: Nuclearelectrica, InterCapital Research

Nuclearelectrica key financials (Q3 2023 vs. Q3 2022, RONm)

Source: Nuclearelectrica, InterCapital Research

In terms of investments, during 9M 2022, they amounted to RON 455.5m, a 17% increase YoY, and 64% of the FY 2023 target (RON 710.3m). These investments include projects required at the Cernavoda NPP Branch, the Pitest NPP Branch, and the Head Office which is estimated to be completed by the end of 2023, as well as investment objectives to be completed in the coming years.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 37 | 30.11.2023 | CICG | Cinkarna Celje Q3 2022 Results, Business Plan for 2024 and business assessment of 2023 | Slovenia |

| 38 | 30.11.2023 | CICG | Cinkarna Celje 2024 Financial Calendar | Slovenia |

| 39 | 30.11.2023 | ZVTG | Triglav Q3 2023 Results | Slovenia |

| 40 | 30.11.2023 | UKIG | Unior Q3 2023 Results | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).