Today, we are bringing you the key takeaways of the recently published ECB Financial Stability Review.

The bi-annual ECB Financial Stability Review (published in May and November each year) contains a plethora of data on the financial and credit environment, the financial markets, the data on the Euro area banking sector, as well as the Non-bank financial sector. The report is used by many European institutions, and due to its broad data range contains many interesting data points. The latest version, published on 16 November 2022, can be accessed in full here.

Without further ado, here are our key takeaways:

Recession risks are rising due to higher energy prices and tighter financial positions

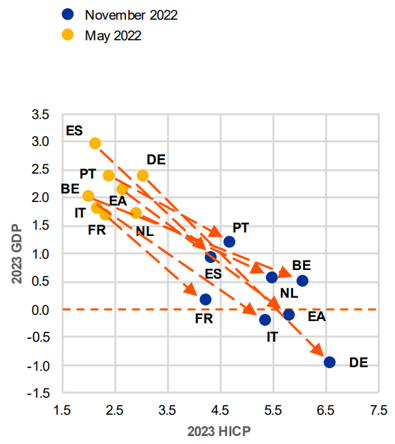

According to the report, the recession risks in the euro area have increased as energy prices have soared. This came as a result of mounting pressure from gas supply disruptions, supply chain disruptions, elevated energy prices, and weaker global trade. In fact, private sector forecasts downgraded their growth expectations for 2023 (to -0.1% vs. 3.0% in May 2022), while higher expectations for elevated inflation (5.8% vs. 2.4% in May 2022) were also recorded.

2023 Consensus inflation vs. economic growth expectations for select euro area countries (%)

Source: European Financial Review, November 2022

Furthermore, the severity of the energy crisis in the euro area has impacted the area’s terms of trade, weakening economic growth prospects. Even though commodity prices have come down from their recent peaks, they still remain elevated, especially for natural gas and other energy commodities. As the euro area economy is a larger net importer of energy, the terms of trade have worsened in 2022. Maintaining the current import volumes at higher prices is resulting in a transfer of purchasing power from the area to the rest of the world. As a result, the negative income impact is significantly higher in the euro area than in the US or the UK, as these economies are less dependent on energy imports. This weaker trade position has also had a significant impact on the depreciation of the euro’s exchange rate against its major global peers.

Higher energy prices and higher borrowing costs are affecting corporations

Even though the corporations in the euro area experienced a sharp recovery and high profits over the past year, they are currently facing stagnating activity and tightening financial conditions. Backward-looking measures of aggregate corporate vulnerabilities, such as gross profits (which are 8% above pre-pandemic levels in Q2 2022), have remained below their long-run average. Furthermore, govt. support measures have helped mitigate the adverse effects of the COVID-19 pandemic. Despite the tightening of financial conditions, lower indebtedness and a high-interest coverage ratio are keeping corp. vulnerabilities below their long-term average.

However, corporates are facing new challenges over the coming quarters, due to worsening interest coverage ratio, higher financing costs, fading activity, and higher leverage. Also, small and medium-sized firms (SMEs) have benefitted less from the rebound in economic activity, as their profitability is still lagging behind that of large corporations. These companies might face a higher risk of insolvency if the economic situation deteriorates further. The sharp increase in energy prices may challenge certain business models and negatively impact the competitiveness of euro-area firms. Business confidence has already started to decline in the most energy-intensive sectors. At the same time, loan demand has increased for short maturities, reflecting the increased need of firms to cover higher production costs. This can also be seen in an increase in debt levels of sectors with high exposure to commodities. Going forward, it might become difficult to sustain high output prices as economic activity stagnates while supply pressures remain. Therefore, producers might have less pricing power than their international competitors to pass on higher costs and input prices to end users.

Household vulnerabilities are also rising

As expected, high inflation and fears of a recession are deteriorating euro area households’ economic outlook. As a result, consumer confidence and households’ expectations of their future financial situation have reached historical lows.

Consumer confidence, expectations of financial situation, and unemployment rate (January 2000 – October 2022, %)

Source: European Financial Review, November 2022

Even though the strong labour market (with an unemployment rate of 6.6% in September 2022) has thus far supported household incomes, inflation is continuing to squeeze real disposable incomes. Higher spending on items such as food and gas has influenced the post-pandemic rebound in consumer expenditures, but this is mostly price and not quantity driven. As the high savings rate recorded during the pandemic normalizes, households’ ability to cushion further price increases is declining.

In terms of indebtedness, household borrowing has thus far remained strong, although there are signs things are changing. Growth in lending for house purchases as well as consumption has remained stable, with September showing growth of 5.1% and 3.7%, respectively, but the growth trend seems to have halted. Further moderation in lending is expected, as higher interest rates on household credit as well as tightening of banks’ credit standards will lead to a reduction in loan demand from households.

Growth in lending to households and household indebtedness (January 2000 – September 2022, %)

Source: European Financial Review, November 2022

As the interest rates rise, some households might have issues servicing their debt. In the low-interest rate environment of the last decade, the share of new loans with fixed interest rates for periods longer than 5 years has increased steadily, reaching almost 70% across the euro area in H1 2022. This shields many households from having their existing debt repriced at higher interest rates in the short term. However, due to the increase in interest rates, the number of newly issued loans with longer fixed interest rates has started to decline. Furthermore, as a further tightening of credit standards is expected, low-income households, especially the ones with high individual indebtedness could be affected.

Overall, despite these challenges, households remain resilient. Even though excess savings are re-absorbed by inflation and net wealth has started to decline, the aggregate household balance sheet remains strong, supported by the current labour market. The rising inflation is continually affecting disposable income and thus consumption, which could slow down overall growth. This could worsen if the labour market environment deteriorates. The immediate impact of the higher interest rates is largely mitigated due to the large percentage of fixed interest rates, but newly issued loans would be affected by higher interest rates which would inadvertently increase the possibility of households being unable to service this new debt.

The real estate market might be at a turning point

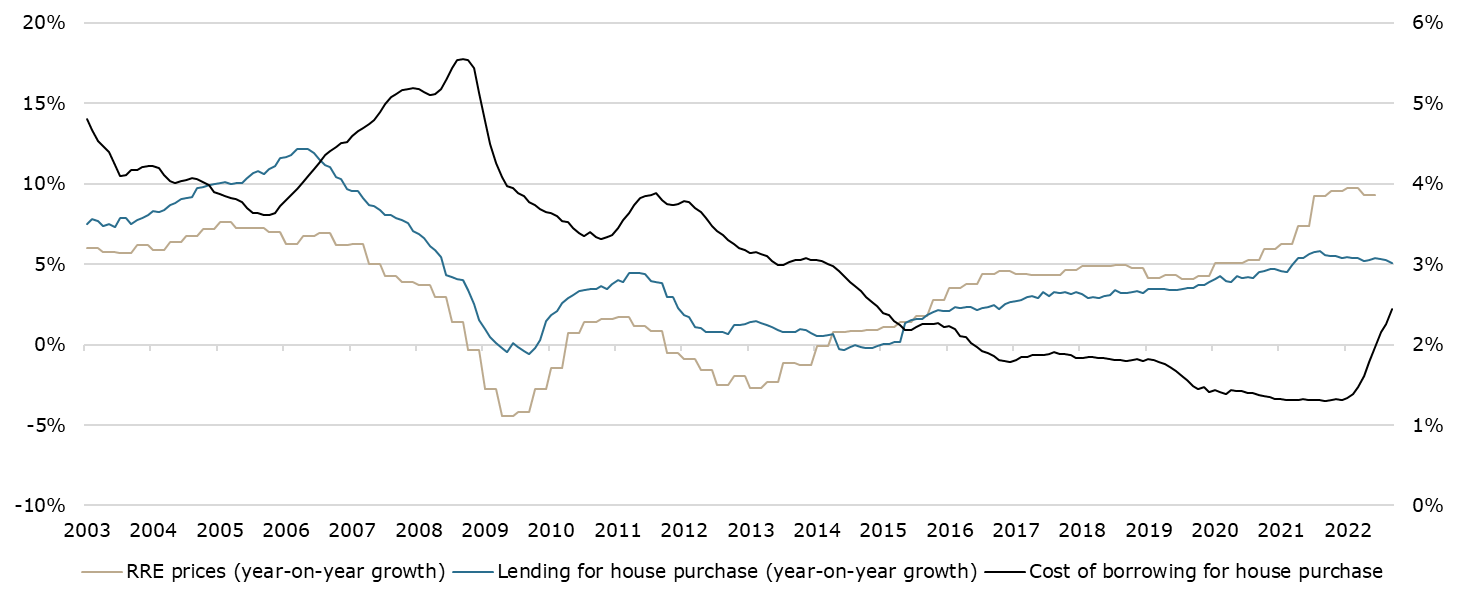

The euro area residential real estate (RRE) market has experienced strong price and lending growth, but forward-looking indicators suggest a slowdown. Nominal house prices grew by 9.3% YoY in H1 2022, leading to increasingly stretched valuations in some euro area countries as house prices exceed fundamentals. Housing loans have continued to show stable growth, but the increase in borrowing costs and further tightening of financial conditions are likely to reduce demand for new loans going forward. Euro area households are also less likely to buy or build a new home, while a lower share of construction companies expect construction prices to increase. As demand slows, the construction sector could come under pressure, which may lead to a rising number of defaults and declining investments.

Euro area RRE prices, mortgage lending, and cost of borrowing (January 2003 – September 2022, %)

Source: European Financial Review, November 2022

This would mean that after a long period of rapid expansion, euro-area real estate markets may have reached a turning point. Rising interest rates and forward-looking indicators are pointing toward moderation in RRE markets, but short-term downside risks have also increased, especially in countries where debt levels are elevated, and properties might be overvalued. As such, high uncertainty remains, and how the situation develops further will not only depend on the government support for households but will also be under the influence of geopolitical and macroeconomic developments.

By the end of October 2022, the Croatian insurance sector grew by 7.6% YoY. Of this, GWPs in the Non-life insurance segment increased by 10.6%, while GWPs in the Life insurance segment decreased by 1.95% YoY.

Recently, the Croatian Insurance Association (HUO), published the latest report on the changes and developments which were recorded by the Croatian insurance market, with cumulative YTD data, ending in October 2022. This report can give us an insight into how well the insurance sector is doing, what are the trends, and where they might lead us. In the report, we can see that the total GWPs in Croatia increased by 7.58% YoY, amounting to HRK 10.76bn. It should be noted that this includes both insurance companies in Croatia, as well as insurers that operate in Croatia but are based in other EU countries. Currently, the 2nd category only includes Sava osiguranje. The growth in GWPs was again driven by the increase in Non-life insurance, which grew by 10.6% YoY (or HRK 804.8m). On the other hand, Life insurance GWPs decreased by 1.95% YoY, amounting to HRK 2.37bn.

Total Croatia TTM (trailing twelve months) GWPs and Croatia osiguranje GWPs in October 2022 (HRKbn)

Source: HUO, InterCapital Research

Looking at these segments more closely, in the Life insurance segment, the largest market share is held by VIG, at 24.44% of the total market, which is an increase of 2.11 p.p. YoY, or growth of 7.3%, or in absolute terms, HRK 39.3m. Following them, we have Allianz Hrvatska, with a market share of 18.8%, representing an increase of 3.2%, or growth of 18.3% (or HRK 68.5m), making this the Company which grew the most in this segment. Next up, we have the largest Croatian insurance company, Croatia osiguranje, which has a market share of 11.2%, a decrease of 4.9 p.p. YoY, or a decline of 31.7% YoY (or HRK 122.6m). Finally, the only other Company with more than 10% market share is Agrm Life osiguranje, with a market share of 10.81%, which is an increase of 0.16 p.p. YoY, which would also represent growth of 12% YoY or HRK 117.9m in absolute terms. As Croatia osiguranje is combined (both Life and Non-Life), the largest insurance company in Croatia, the decline in the Life GWPs would be worrying. However, this is a deliberate strategy by the Company, reducing their exposure to the Life segment which carries very low margins, with more focus on Non-life insurance, which brings higher margins and profitability.

Speaking of Non-life insurance, Croatia osiguranje is the largest Company in this segment, with 28.93% of the market share, an increase of 0.88 p.p. YoY. This would also represent a yearly increase of 14.2%, or HRK 297.6m in absolute terms, meaning that not only did Croatia osiguranje grow faster than the overall Non-life market (which grew by 10.6%), but it also maintained its leadership position. Next up, we have Euroherc osiguranje, with a market share of 15.11%, which is a decrease of 1.07 p.p. YoY, while in growth terms, this represents an increase of 3.32% or HRK 40.2m. This means that compared to CO, Euroherc grew, but not as fast as the overall market, leading to a market share decrease. Next up, we have Adriatic osiguranje, which has 13.28% of the total Non-life market, which is an increase of 0.16 p.p. YoY, or in growth terms, an increase of 12% or HRK 117.9m. The remaining companies all recorded increases in their GWPs, but none increased faster than the market, leading to a decrease in market share, which the above-mentioned companies capitalized on.

Breaking the Non-Life insurance segments by types of insurance, in absolute terms, the largest increase was recorded by Insurance against civil liability in respect to the use of motor vehicles, which increased by 185.9m (or 7.46% YoY). Next up, we have other asset insurance, which increased by HRK 145.6m, or 17.6%, and Vehicle insurance (casco policy), which increased by HRK 143.6m (or 12.2%) YoY. The only other insurance policies which grew by more than HRK 50m were the following: Health insurance, which grew by HRK 62.8m (or 10.4%), Fire and elementary damage insurance, which grew by HRK 57.9m (or 8.3%), and finally, Loan insurance, which grew by HRK 56.7m, or 17.8% YoY.

Here we can see a couple of things. Firstly, vehicle and asset-related insurance growth is expected. These are the types of insurance policies that were invested in over a longer time frame and given their importance, this is to be expected. Secondly, however, we can see some cyclicality, both due to the macroeconomic situation but also the weather/time of the year. The increase in Health insurance and Fire and elementary damage insurance is exactly due to said time of the year, with higher levels of diseases and higher possibilities for damage from unexpected weather events. Loan insurance, however, could also be attributed to the increasing interest rate environment, which is affecting both current and new loan issuances.

Finally, looking at CO’s current market position, during the last 12 months, the Company collected 24.01% of all GWPs, which is a decrease of 0.16 p.p. YoY. In total, this would mean that the Company’s GWPs increased to HRK 3.02bn, an increase of HRK 206.9m YoY.

Croatia osiguranje TTM market share (February 2011 – October 2022, %)

Source: HUO, InterCapital Research

During 9M 2022, Romgaz recorded a revenue increase of 209% YoY, an EBITDA increase of 60%, and a net profit of RON 2.24bn, +94% YoY.

The revenue of the Company during 9M 2022 amounted to RON 10.8bn, an increase of 209% YoY. Consolidated revenue from gas sales amounted to RON 9.28bn, an increase of 211% YoY. This increase can mainly be attributed to the significant rise in gas sale prices. At the same time, the quantity of gas deliveries decreased by 6.2% compared to the same period last year. Consolidated revenue from storage services increased by 65.6% YoY. In this category, capacity book services revenue grew by 45.9% (or RON 65.3m), while injection services grew by 211.5% (or RON 64m). Meanwhile, consolidated revenue from electricity sales increased by over 5.9x, with an increase in production of 97% YoY to 839.5 GWh.

Moving on to op. expenses, they increased by 252% YoY to RON 8.39bn. In this category, the cost of commodities sold decreased by RON 92.1m, as the cost of gas purchased for resale decreased by 93.4% (or RON 208.4m), given an insignificant quantity of gas purchased for resale. At the same time, the cost of imbalances from the power segment increased by over 4.8x (or RON 115.8m), following the unscheduled shutdown of CET Iernut in August 2022. However, the biggest driver of growth in this category is by far the other expenses, which grew by 565% YoY to RON 7bn. The biggest driver here came from the increase in taxes and duties, which increased by over 8x YoY to RON 6.54bn. Consolidated royalty expenses grew by RON 1.15bn (+330% YoY), while the windfall tax on revenue from gas sales increased by over RON 4.56bn (+12.5x) YoY. This includes the newly introduced (in 2022) contribution to Energy Transition Fund, which amounted to RON 293.9m.

Even with the significant increase in expenses, however, the Company recorded such a strong increase in revenue that profitability also recorded a noteworthy increase. EBITDA during 9M 2022 amounted to RON 2.89bn, an increase of 60% YoY. Despite this, however, the EBITDA margin recorded a significant drop, due to the higher proportion of OPEX in total revenue, and the significantly faster revenue that EBITDA growth. As such, the EBITDA margin stood at 26.8% in 9M 2022, a decrease of 24.9 p.p. YoY.

Moving further down the P&L, EBT amounted to RON 2.67bn, an increase of 97.8%, or RON 1.32bn YoY, due to the positive developments described above. The income tax for the period amounted to RON 431.9m, an increase of 124% YoY. This would imply an effective tax rate of 16.2%, an increase of 1.9 p.p. YoY. Finally, Romgaz’s net profit amounted to RON 2.24bn, an increase of 93.5% (or RON 1.08bn) YoY. This would imply a net profit margin of 20.7%, a decrease of 12.4 p.p. YoY.

Romgaz key financials (9M 2022 vs. 9M 2021, RONm)

Source: Romgaz, InterCapital Research

Romgaz also commented on its investments for 2022. For the year, they allocated a total investment budget of RON 5.72bn, assigned mostly to increasing the gas reserves and resources portfolio, to compensate for the natural decline of gas and electricity production. As of 30 September 2022, they used RON 5.46bn, which is slightly over 100% of the planned investment for 9M 2022, 95.4% of the total investment plan for 2022, and over 16.8x higher investment YoY.

If you would like to read the full Romgaz 9M 2022 report, click here.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 40 | 29.11.2022 | LKPG | Luka Koper Q3 2022 Results | Slovenia |

| 41 | 29.11.2022 | LKPG | Luka Koper summary of the business plan for 2023, 2023 business performance estimate | Slovenia |

| 42 | 30.11.2022 | UKIG | Unior Q3 2022 Results | Slovenia |

| 43 | 30.11.2022 | CICG | Cinkarna Celje Q3 2022 Results | Slovenia |

| 44 | 30.11.2022 | CICG | Cinkarna Celje performance plan for 2023 | Slovenia |

| 45 | 30.11.2022 | CICG | Cinkarna Celje financial calendar for 2023 | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).