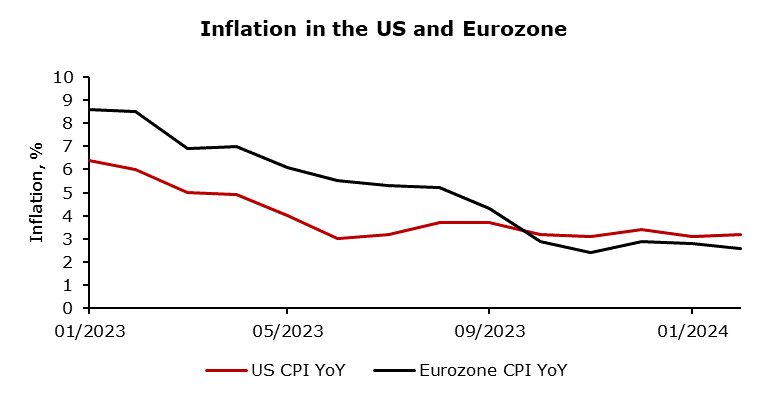

Recent inflation figures proved that inflation will not return to the targeted 2% inflation as soon as it was thought in December. Consequently, monetary policy delayed short-term interest rate cuts from March to June as central bankers needed more data to confirm the start of the rate-cutting cycle.

Inflation averaged 3.2% on a year-over-year basis since December in the US leading to stagnation of the disinflationary process. However, the Federal Reserve (Fed) may decide to cut three times this year, as they indicated in December, to prevent too much damage to the economy. In the Eurozone, inflation averaged 2.8% since December which is already close to the 2% target leading to more confidence that the European Central Bank (ECB) might cut before the Fed. The current rhetoric of the European Central bankers implies that the timing of the first cut is mostly likely in June due to weak economic data in the Eurozone and somewhat lower inflation than in the US. On the other hand, the Fed might delay rate cuts to further meetings as economic data continuously comes above market expectations, especially figures regarding the labor market. Discarding rate cuts in June or delaying them to meetings later in the year for the FED seems to be what the market expected before the meeting given the move in 2-year yields. Since the US 2Y- Treasury yield reached a low of 4.11% on the 12th of January financial markets predict that the Fed is not ready for the start of the cutting cycle.

Yesterday, Jerome Powell sounded dovish at the Fed meeting signaling the slowing of the quantitative tightening, and between the lines he announced the first rate cut in June. Inflation eased in recent months, however, it is still elevated and more data is needed to confirm further rate cuts. Also, signaling a rate cut in June might be crucial to stay neutral during the US presidential elections and prevent politicizing their decision. The decision led to the steepening of the US yield curve as front-end yields skyrocketed and long-term yields stood at about the same level as before the Fed meeting. Even after these dovish remarks, the Fed might delay rate cuts and the ECB will probably start with rate cuts in June given the economic situation. The median rate level for 2024 still lies at three rate cuts for the Federal Reserve. Today, the Swiss National Bank decided to unexpectedly cut rates by 25 bps driving bond yields higher, especially on the short end of the yield curve.

In conclusion, recent inflation figures have underscored the complexities facing central banks in navigating monetary policy. While the US grapples with elevated inflation averaging 3.2%, necessitating potential rate cuts by the Federal Reserve to prevent economic damage, the Eurozone’s near-target inflation of 2.8% offers room for the European Central Bank to act sooner. Market expectations suggest the Fed may delay rate cuts despite Chairman Jerome Powell’s dovish signals, possibly waiting until June or later meetings. The Swiss National Bank’s surprise rate cut further highlights the global monetary policy landscape’s fluidity. Overall, central banks are closely monitoring economic indicators to strike a balance between supporting growth and managing inflationary pressures, with the potential for rate cuts on the horizon, albeit with differing timelines and strategies across regions.

Source: Bloomberg, InterCapital

Yesterday, Telekom Slovenije went ex-date, and as a result, the Company’s shares declined by 4.9%, which is slightly below the DY of 5.1%, meaning that the share price effectively appreciated marginally.

The ex-date refers to Telekom Slovenije’s dividend payment this year, in the amount of EUR 6.2 DPS, and a DY of 10.2%. The payment date is due on 22 March 2024. However, we remind you that the total of EUR 6.2 will be paid out in two tranches and this ex-date refers only to the 1st tranch, amounting to EUR 3.1 per share or DY of 5.1% at the date before the announcement. The second instalment of EUR 3.1 will be paid out on 23 August 2024 (payment date), while the ex-date is set for 21 August 2024.

It should also be noted that the counterproposal received from VZMD, which asked for the dividend payment to be made in lump sum, instead of split into two to avoid extra costs, has not been voted upon. The reason is the fact that the initial proposal has been voted on and approved, and no vote on the counterproposal was then needed.

Below we provide you with the historical dividends per share as well as the dividend yields of the Company. If you want to read more about dividend approval and previous counterproposal, click here.

Telekom Slovenije dividend per share (EUR) and dividend yield (%) (2010 – 2024)

Source: LJSE, InterCapital Research