Yesterday, NLB revealed the terms regarding its newest bond issuance. EUR 500m will be issued in the form of green senior preferred notes. The interest rate amounts to 7.125% per annum. The notes’ issuance is set for 27 June 2023.

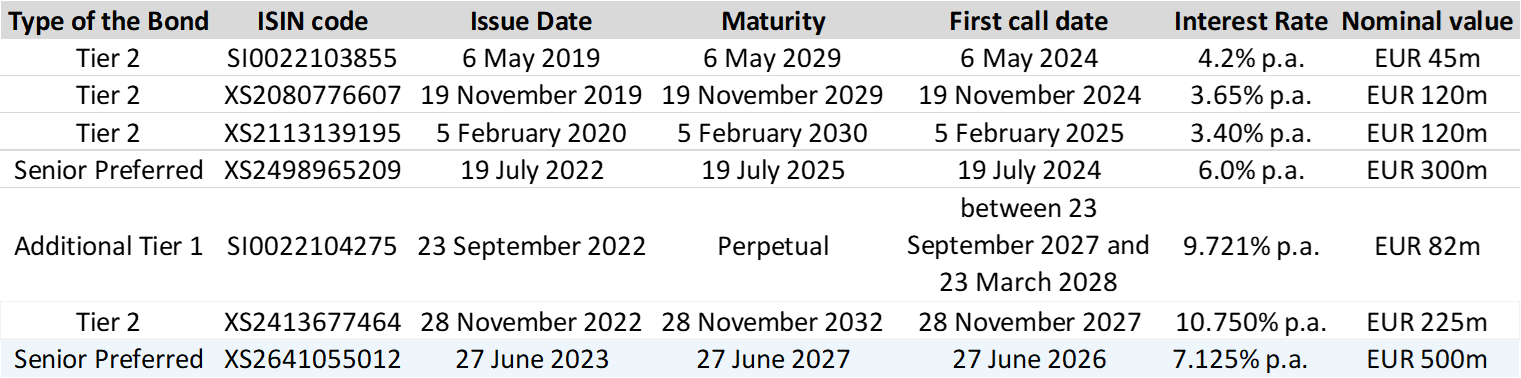

In the last couple of years, NLB has issued bonds in many different forms, including Tier 2 notes, Additional Tier 1, and Senior Preferred notes. The infographic detailing the outstanding bonds, as well as the newly announced bond, is available below:

NLB Group’s outstanding bonds and newly announced bond

Source: NLB Group

The newest bond issuance will be in the form of green senior preferred notes, in the nominal amount of EUR 500m. NLB has communicated many times over the previous year their intention to issue this bond, however, the issuance was expected in the EUR 300m to EUR 500m range. The reason for the issuance is the fulfillment of the MREL requirements, but it should be noted that EUR 300m would be enough for this. The higher amount issued then came as a result of strong demand for NLB’s bond, and according to the Company, they received a 4x oversubscription on the book.

The interest rate for the bond amounts to 7.125% per annum, and the issue price will be equal to 100% of the nominal amount. Furthermore, the Company noted that due to the strong demand for the note, they managed to tighten the spread by 75 bps, moving their yield from 7.875% to 7.125%. As a point of comparison, the Greek Bank managed to tighten the yield by 25 bps to 7% on the EUR 500m 6NC5 (6-year non-callable, 5 years callable) Senior Preferred notes.

NLB’s bond issuance is on 27 June 2023, the maturity date will be 27 June 2027, with the option for early redemption on 27 June 2026, meaning that this is a 4-year non-callable, 3-year callable bond. The ISIN code of the notes will be XS2641055012.

At the share price before the announcement, the dividend yield for the regular share (ADRS) amounted to 3.7%, while for the preferred share (ADRS2) it amounted to 4.1%. The ex-date is set for 26 June 2023.

Adris published the resolutions of its General Assembly meeting held yesterday. During the GSM, the Company approved EUR 2.35 dividend per share. This would be paid out of the retained earnings in the period from 2005 until 2011.

This would mean that the dividend yield before the proposed dividend amounted to 3.7% for the regular share (ADRS), while it amounted to 4.1% for the preferred share (ADRS2). The ex-date is set for 26 June 2023., while the payment date is set for 20 July 2023.

Below we provide you with the historical overview of Adris’s dividends per share and dividend yields.

Adris grupa dividend per share (EUR*, left) and dividend yield (%, right) (2013 – 2023)

Source: Adris Grupa, InterCapital Research

*Converted using CNB’s EUR/HRK exchange rate for the periods in question

At the closing price before the announcement, this would amount to a DY of 3.3%. Ex-date is set for 21 June 2023.

At the GSM meeting held on 19 June 2023, Mon Perin voted for the approval of the distribution of profit. According to the resolutions released by the Company, the EUR 0.18 DPS will be paid from the retained earnings in 2019 & 2021. At the closing price before the announcement, this would amount to a DY of 3.3%. The ex-date is set for 21 June 2023, while the payment date is set for 14 July 2023.

To remind you, Mon Perin was listed on the Zagreb Stock Exchange on 30 March 2022.

Mon Perin, a tourism & hospitality company, which was founded on a basis of developing „social entrepreneurship“, that is, having a specific ownership structure and investment strategy for the local community, has taken the next step and listed on the Zagreb Stock Exchange. The Company, which has been the cornerstone of development in the Bale – Valle county in Istria (contributing between 20% – 40% directly or indirectly to the county’s budget), currently has over 900 stakeholders.

Further, looking at Mon Perin’s FY 2022 results, a strong 38.7% YoY increase in sales was noted, a 30.8% YoY increase in EBITDA, and a net profit of EUR 3.2m (+61.4% YoY).

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 23 | 28.6.2023 | TLSG | Telekom Slovenije ex-date | Slovenia |

| 24 | 30.6.2023 | TTS | Transport Trade Services 2022 ESG Report | Romania |

Due to the nature of these events, they are subject to change (might be postponed or canceled).

*Ex-dates present here also include companies that haven’t yet held the GSM meeting, and thus the approvals haven’t been made yet.