Fixed income world is a weird place for outsiders. FOMC is hawkish, but yields are down, curve flatter and USD stronger. USD stronger versus a basket of currencies on lower UST yields? It’s time to tear up macro textbooks and take a close up on the narrative that’s playing out on global financial markets. What’s this narrative about? And what can we expect from Croatian local bond placement in the near future? Well, you’ll have to find out in this brief research piece.

Last week’s FOMC was interpreted as hawkish, however it appears that much more is dwelling beneath the surface. First of all, the median 2023 dot made two steps up and now median FOMC member expects two rate hikes in 2023. There is at least one hike expected in 2022 and on Friday James Bullard (hawk who’s eligible to vote starting from 2022) came forward with statement that his vote was for 2022 rate hike. FED also lifted inflation expectations for 2021, however kept 2022 and 2023 forecasts virtually unchanged. The result? Well, initial knee-jerk reaction was a sell off in bonds, but it was so short lived that nobody really even remembers it. A move of much stronger magnitude was a sharp drop in 10Y from 1.60% to the current 1.40% with broadly based yield curve flattening (5Y30Y took the brunt). At the same time the move down in equities painted a gloomy picture: yes, the markets might be preparing for a period od disinflation at some point in the future.

Why has that changed all of the sudden? One obvious reason was a drop in commodities with oil being the only notable exception: Bloomberg Commodity Index (BCOM Index) made a leg lower by 4.5% in the last two trading session, and that was with oil holding up. If WTI/Brent complex gives in, it has room to slide even more.

Why are commodities suddenly trading cheaper? One of the reasons is definitely Chinese announcement about using their reserves to drive down commodity prices, but the bulk of the move might have come from the fact that commodity supercycle might have been a crowded trade to begin with. So cheaper commodities definitely contributed to the move down on stocks and bond yields, FOMC providing a tailwind as well. Commodities trading a thad lower and the removal of FED policy mismanagement from the picture contributed to lower inflation expectations – you can look at 5Y5Y breakevens, but we prefer 5Y5Y OIS (S0042FS Index), which dropped from 2.11% to 1.63% since beginning June, meaning that now it’s traded 37bps above the levels recorded before the Georgia elections (January 5th).

Does this mean a complete shift in narrative? Big banks are not convinced and JPM called the yield curve flattening „technical“, advising the clients to stay UW US bonds. Deutsche sees things differently: they remind that CTAs are still very short bonds, US pension funds are UW bonds versus equities and rebalancing might add further downward pressure on US yields, while Asian investors have awoken and started buying US bonds. US banks have been in love with bonds for so long, and here’s the kicker – if loan growth slows down because of weaker consumer sentiment, they might continue to buy even more US fixed income. So is there a big shift in the narrative? Yes, in a sense that with the current flow setup, the top in US yields might have been reached at end March and might be contained going forward.

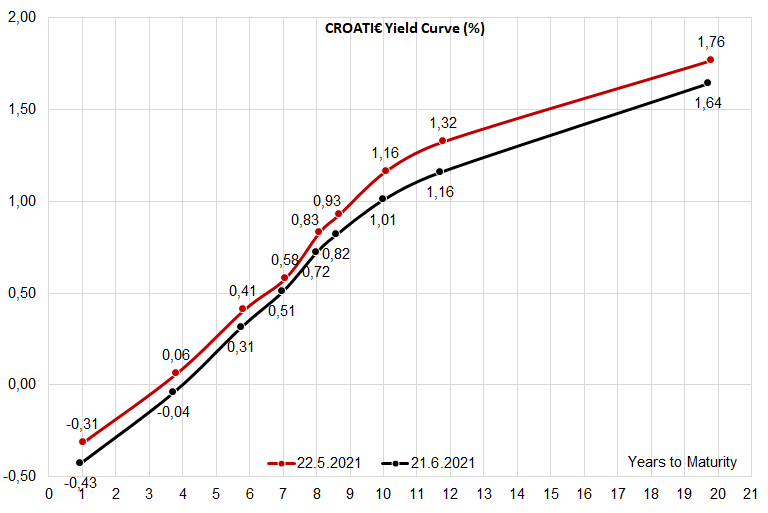

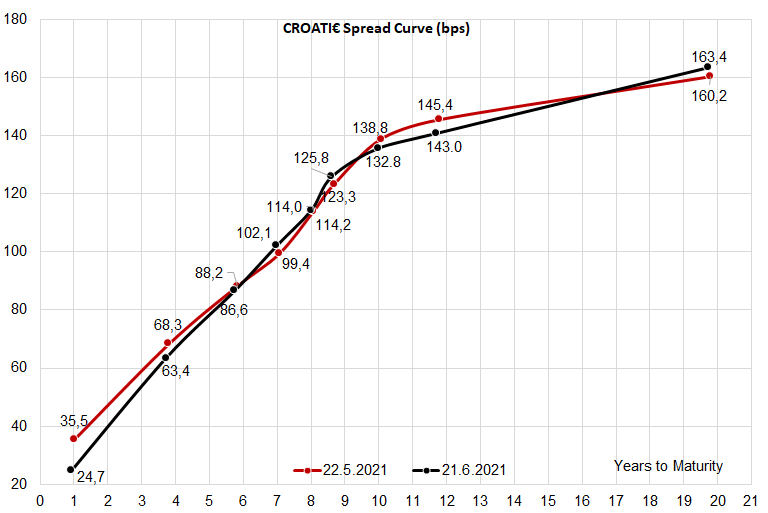

Any action on Croatian eurobonds? So far we have seen selling of shorter ones, like CROATI 3.875 05/30/2022 (larger lots around -0.31% YTM) and CROATI 3 03/11/2025 (around 0.0% YTM) with big buyers in CROATI 1.75 03/04/2041. With sizable bids on CROATI 1.75 03/04/2041, as well as REPHUN 1.5 11/17/2050 and longer dated ROMANIs, this feels like large UK insurance companies adding up duration and matching their assets with liabilities. We doubt there’s a Croatian account adding more CROATI 1.75 03/04/2041 to their portfolio since Croatian accounts were over-allocated in historic terms on the bond placements. However, most of the lots landed in HTM/HTC and now it’s a bit difficult to pull them out and sell outright. Focus of the local market is definitely away from eurobonds and on two interesting things. First is the EURHRK, whose slide below 7.4900 prompted the central bank to stage a small FX intervention (120mm EUR). The second event on our calendar is the local bond placement, which according to Bloomberg might take place as soon as next week. Our baseline scenario includes a 7Y HRK paper at about 0.45%-0.55% YTM, about 9.0bn-10.0bn HRK. With 6bn HRK of local bonds maturing the first week of July, net supply of some 3.0bn-4.0bn HRK would barely be enough to quench the thirst of local banks for HRK assets.

Dividend yield is 7.4%, while ex-date is 1 August 2021.

Telekom Slovenije held the GSM in which the shareholders approved a dividend payment of EUR 29.27m. This translates into a dividend payment of EUR 4.5 per share, which was (counter)proposed by the largest shareholder of the Group.

Dividend yield is 7.4%, while ex-date is 1 August 2021. The dividends shall be paid on 3 August 2021.

In the graph below, we are bringing you historical overview of the company’s dividends.

Telekom Slovenije Dividend per Share (EUR) & Dividend Yield (%) (2010 – 2021)

On Friday, NLBR decreased by 1.2%, closing at EUR 64.6 per share.

On Friday NLB went ex-date. NLB’s share price decreased by 1.2%, closing at EUR 64.6 per share. On 13 June, NLB held GSM where shareholders approved a dividend of EUR 0.6 per share for the first instalment of dividends. The second instalment will be on 18 October amounted to EUR 0.64 per share.

At the current share price, dividend yield is 0.93%

We note that the Management Board is entitled and obliged to cancel in part or in full the payment of the second instalment of the dividend if the payment would be in conflict with the regulations.

If the payment of the second dividend instalment is not cancelled, ex date will be 14 October 2021.

As a reminder, NLB did not pay out dividends in 2020.