Georgia’s Senate vote showed that there will be blue wave after all and that revived reflation scares, due to large fiscal stimulus Joe Biden is asking for. However, Feds officials once again reacted quickly saying that interest rates and its QE should stay intact longer than some investors previously thought. On the other side of the Atlantic, ECB is continuing with its dovish talk and practically controls yield curve. In this brief article we are looking at the most important events in respect of interest rates in both US and EA and what we expect in the following period.

As we wrote in our last blog, global yields finally went up, but that did not last for long, especially in Europe. After the Senate elections in Georgia in the beginning of 2021 (which showed that democrats will control both house and senate first time since 2011), investors started to calculate whether blue wave could finally deliver reflation trade, which was one of the most mentioned trades last year.

Since the start of the corona crisis in March when inflation expectations dropped significantly, US 5y5y inflation swap increased from 1.30% to 2.35%, reaching levels last time seen in the beginning of 2019. In the same time US CPI YoY in December reached only 1.4%, highest since March 2020 but still way below 2.0%. CPI is expected to rise further in the following months due to base effect of energy prices and slump of prices in early stages of corona crisis. Furthermore, US and the rest of the world are accelerating their vaccine rollout that should secure economies to open rather in full capacity in H2 and to start fast recovery. All the above mentioned could finally lead to inflation reaching 2.0% this year and most likely hurt bond holders as yields on USTs are still lagging compared to inflation expectations. Well, after the blue wave was confirmed two weeks ago, treasuries sell-off accelerated and at one moment 10Y almost reached 1.20%, after being traded in tight range of 70-95bps for the whole Q4 2020. Nevertheless, central bank also has something to say on that matter, right?

After the “surge” of yields, several Fed officials stated that it is too early to start talking about monetary policy tightening which was mentioned few times in the end of the year. Vice Chairman Richard Clarida said that he does not expect any changes before 2022 as Fed wants to avoid taper tantrum scenario that investors saw in 2013 when US 10Y went from 1.60% to 3.0% in the matter of 5 months. Anyhow, after the comments by Feds officials, US10Y yield went down to 1.10% due to belief that central bank will leave monetary policy as it is until they are assured that economy is on the path of full recovery and in any case will postpone mentioned taper tantrum.

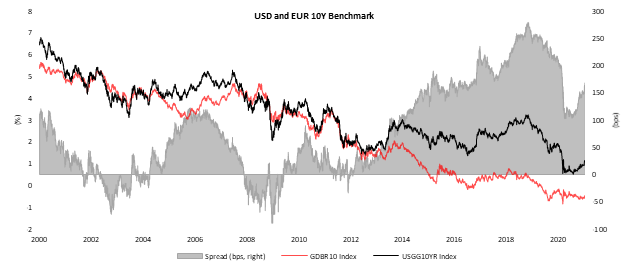

As US 10Y sold off to almost 1.20%, bund followed although at slower pace but reached -45bps, reflecting increase of some 15bps. Nevertheless, inflation expectations in euro area are quite lower compared to US and sovereign bond net supply is expected to be almost negative this year taking in account large QE that ECB decided to enlarge in the end of last year. Talking about inflation in euro area, yesterday we saw that HICP in December stood at -0.3% YoY, for the 4th consecutive month, driven by drag from tourism and other service sectors. Core inflation stood barely above zero, at 0.20% and there are no signs of recovery in the following period. However, inflation expectations continue rising despite inflation being at the bottom. Namely, EUR 5y5y inflation swap reached 1.33% (0.7% in March), levels last time seen in early 2019. Difference between US and EA is that inflation is slowly rising in US while there is no clear view whether we will see rise of prices in euro area soon despite of probable recovery of the economy. That combined with large QE by ECB ensured that large part of investors do not expect bund yield to go up too much this year or beyond. All in all, divergence between EUR and USD yields is increasing once again although we saw much higher spreads in the last few years when monetary policy of ECB was lagging by around 2 years compared to Fed. We expect divergence trend to continue this year, mainly due to PEPP but we see some risks of inflation in euro area overshooting expectations, at least for a short period in H2 once the economy gathers some steam.

Source: Bloomberg, InterCapital

As of end December 2020, NAV of Croatian Mandatory Pension funds amounted to HRK 119.07bn.

Pension funds could be seen as the key player on the Croatian capital market, as their current domestic equity holdings account for more than 40% of the free float market cap of ZSE. NAV of pension funds has witnessed a steady increase for each consecutive month since April, and as of end 2020 stood at HRK 119.07bn (+5.7% YoY or HRK 6.47bn). To put things into a perspective, such NAV is converging very closely to the entire equity market cap of the Zagreb Stock Exchange (excluding PBZ – to be delisted).

Looking at the MoM performance, NAV of Mandatory Pension funds is up by 0.7% after November noted the best monthly performance in 2020 (+2.1%). As a reminder, in March (the worst performing month for almost all asset classes) the pension funds recorded a decrease of 3.3% MoM or HRK 3.76bn.

It is also worth adding that in December net contribution payments amounted to HRK 606.5m (+3.4% MoM).

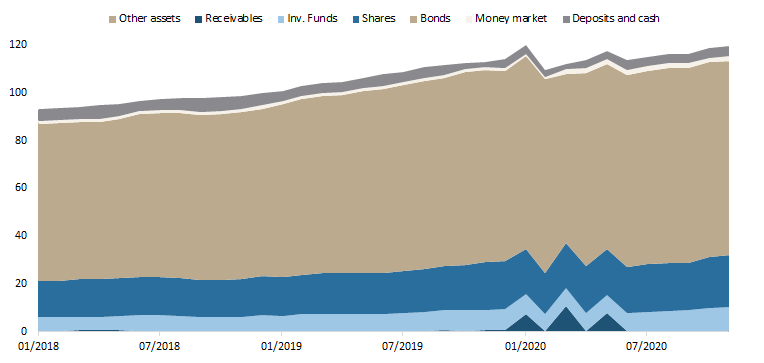

Asset Structure of Croatian Mandatory Pension Funds (December 2020)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research

Looking at the asset composition of pension funds, asset managers have not changed significantly their composition in 2020, which can be seen in the graph above. Bonds account for the vast majority of total assets (67.9%) which as of end 2020 amounted to HRK 81.19bn (increase of HRK 383.1m YoY or 0.9%). Shares come next, with 18.4% or HRK 22bn, representing an increase of as much as 10.8% MoM (or HRK 2.15bn). The mentioned increase could be attributed mostly to the solid increase in foreign shares by 23.8% or HRK 1.79bn. Meanwhile, domestic equity is up by 2.9% or HRK 362.3m. Unlike Croatian UCITS funds whose majority of equity holdings are foreign, mandatory pension funds have 57.8% (or HRK 12.7bn) of their equity holdings allocated in domestic shares.

Total Assets of Croatian Mandatory Pension Funds (2018 – 2020) (HRK bn)

Source: Croatian Financial Services Supervisory Agency, InterCapital Research