It turns out January 05th 2021 (US Senate elections) was a bit more important date that November 03rd, 2020 (US presidential elections). The blue wave outcome meant that yields might be poised to go a bit higher now, at least in the United States. How are CEE/SEE bond markets digesting the narrative and what can we expect in the weeks ahead? Find out in this brief article.

We’re off to a very volatile start of the year and throughout latest ten trading sessions fixed income markets were trying to reconcile blue wave in the United States (i.e., Democrats having all levers of power – the White House, House of Representatives and Senate) with still lousy economic data which founded dovish statements from global central bankers. The doves from Washington and Frankfurt were a tailwind for yesterday’s syndicate of new Spanish 10-year bonds – Spanish government placed SPGB 01. 04/30/31 at +0.114% YTM (SPGB 10/2030 + 4bps versus an indication of +8bps) and the tight spread caused the orderbook to collapse from 130bn EUR to about 55bn EUR (10bn EUR was placed, implying a 5.5x bid-to-cover). On top of that a new bout of volatility came yesterday evening when Matteo Renzi withdrew his ministers from the Italian government, risking it’s collapse and possible snap elections. Just to be sure – the Italian government hasn’t yet collapsed, there’s still a possibility of Renzi returning to the table and the overall horse trading between PM Conte and Renzi could drag on for weeks (although because of the spending plan that needs parliamentary approval ASAP, we believe it won’t drag for too long). But then early this morning President-elect Joe Biden announced new stimulus package, weighting 2tn USD and adding to the travails of fixed income investors who are a bit worried about the pace of bond supply this year. Good thing global central bankers have put a cap on the rise of global yields with their most recent dovish comments (as mentioned before, they are based on weak fundamentals which convey a message that US and EA economies are in no shape for higher interest rates), so fixed income traders were vaccinated against any deeper bond sell offs. It’s worth mentioning that the overall situation looks nothing like the taper tantrum of 2013. A bit of a history lesson – back in 2013 Ben Bernanke was very hawkish in Congressional Testimony and subsequent FOMC, causing 10Y yield to melt up from 1.6% to 3.0%. This time it really is different since both Powell and Lagarde, accompanied by their colleagues in Washington and Frankfurt, have been continuously sending dovish messages and it could be that they have learned their lessons from 2013.

But what is going on with regional bonds? Well, Slovenia placed dual tranche of bonds in the first week of 2021, in line with the pattern of behaviour seen in the last few years. Both SLOREP 0 02/12/2031 (placed at -0.096% YTM, Bund+48.4bps, 1.75bn EUR issued versus a book of 10.6bn EUR) and SLOREP 0.4875 10/20/2050 (placed at 0.381% YTM, Bund+55bps, 250mm EUR placed versus a book of 2.0bn EUR) are currently traded at prices slightly above the reoffers. The 2.0bn EUR worth of proceeds would probably be used to pay off the 1.5bn EUR outstanding bond maturing on 18th January and since the remaining 500mm EUR would not be sufficient to cover the loophole for 2021, we can expect more Slovenian auctions along the way.

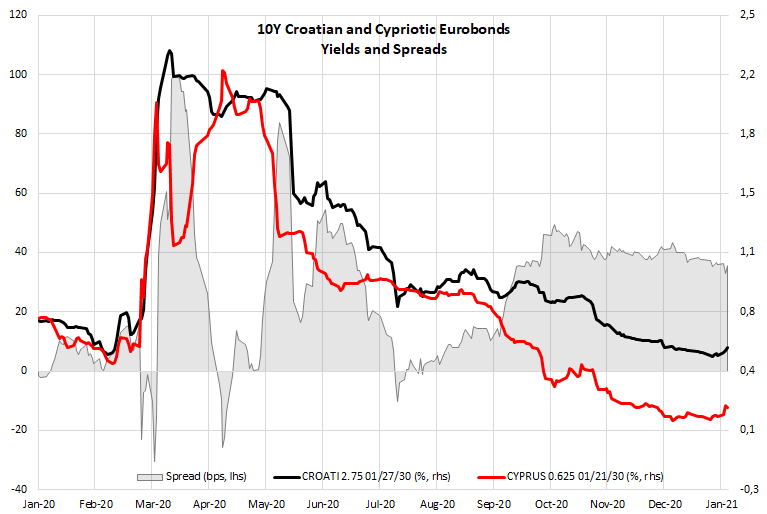

Croatian Eurobonds staged a minor price correction, but nowhere near the sell offs we used to see. Although we estimate that Italian political instability can always morph into something more vicious, we still think the probability of that happening is rather low. Meanwhile, CROATI 2.75 01/27/2030 is traded at 119.35 (0.54% YTM) which is 35.5bps above the Cypriotic yield of equal duration. Speaking about the spread between Croatia and Cyprus, the 10Y spread mid-point was 26bps in the last year, meaning that with the current setup Croatian bonds are traded some half a standard deviation above the mean.

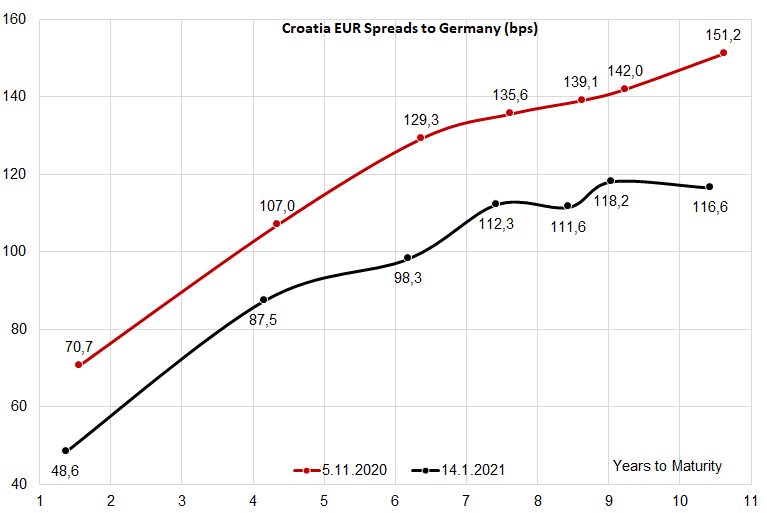

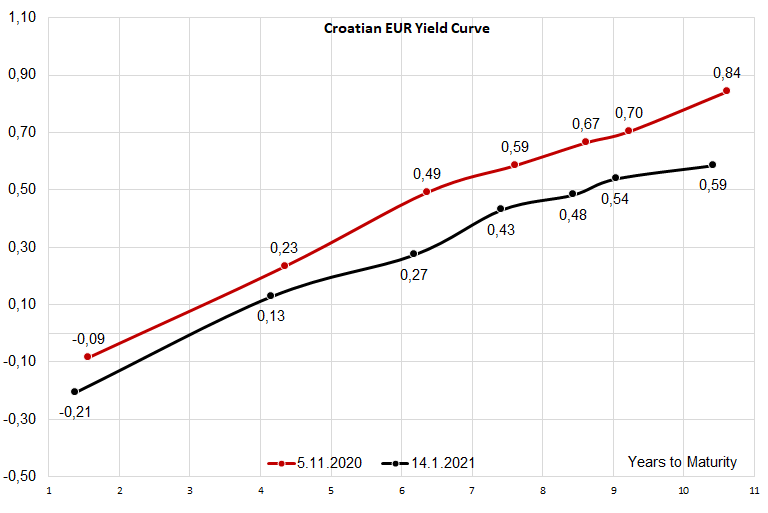

Looking at CROATI€ yield curve, two things stand out: yields are still lower compared to the levels recorded around US election date, and second, the spreads are significantly tighter. At the moment CROATI 2.75 01/27/2030 looks a bit undervalued from the spread perspective (0.54% is B+118.2bps, second dot from the right on the black line), but this might be because some institutional investors are preparing for the international bond placement which might happen in a month and a half.