In the last few weeks, we witnessed several events that made perfect combination for EM assets to rise. Joe Biden winning US presidential elections, deceleration of new corona cases in EU and news regarding vaccine, to name a few. CEE currencies did appreciate on the news but there were some country specifics that dragged few of them the other way. In this brief article we are looking at the main drivers and what to expect next on two interesting currencies, Hungarian forint and Czech koruna.

Second wave of corona virus cases started in the end of August 2020 and number of new cases overjumped the ones from spring very fast. In early September, governments across Europe were denying another lockdown bearing in mind price that economy paid in second quarter of 2020. Nevertheless, new cases rose so fast that health systems were significantly damaged, and governments did not have much choice but to impose another lockdown. From being one of the winners in the first wave, Czech Republic saw one of the highest rises of new cases (in relative terms) with more than 15.000 cases a day versus around 300 in the peak of first wave in spring. Despite Mr Babis being reluctant to close his country again and his health ministers resigning one by one, Czech Republic went into lockdown mode again on October 22nd and still is in the same mode. Countries across Europe followed, imposing partial or full lockdowns as numbers were hitting records.

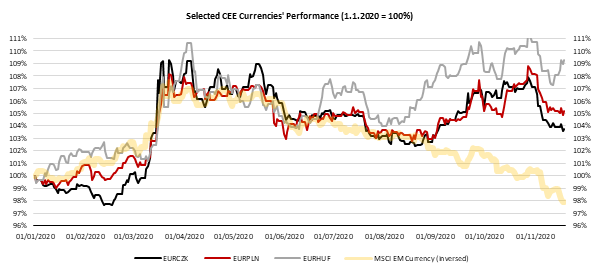

What market had to say on the above-mentioned scenario? Well, as you may see on the chart submitted below, Czech koruna depreciated strongly, coming close to its March’s lows (highs in terms of EURCZK) of 27.50 while its regional peer, Hungarian forint even overjumped these levels, but there were also other specific drivers.

Source: InterCapital, Bloomberg

Nevertheless, since October 22nd, there were few events that supported EM assets and number of new coronavirus cases did decelerate in Czech Republic. Namely, new cases started to decelerate even before lockdown was introduced hence number of active cases dropped significantly from the peak two weeks ago, from 150k people to 100k and is expected to continue falling. On the other hand, Mr Biden narrowly won US election which was characterized as EM positive event and Pfizer announced that its vaccine is 90% effective which made strong case for CZK to appreciate once again and today it is traded at 26.35 versus 27.50 two weeks ago, reflecting appreciation of 4.0%. Czech central bank also said a few words that encouraged local currency investors as it still forecasts higher interest rates next year. Some of the analysts called CNB a bit two hawkish, however I can see scenario in which much of the gap is filed next year and we see at least blip of inflation.

A bit south, situation in Hungary was similar considering that risk-on sentiment driven by global macroeconomic events supported the currency but not for long as there were few specific factors that dragged forint. Namely, as I type this article, EU leaders are gathering to discuss latest issues regarding EU budget and recovery funds as Hungarian and Polish governments vetoed the EU’s recovery fund due to a new mechanism linking EU funds to the rule of law. Rule of law mechanism was questioned by Poland and Hungary for the several months now but most of the investors thought of it as a bluff rather than serious note as both countries are great beneficiaries of the agreed EU funding programs. Now there is still not clear whether the rest of the countries will try to be harsher with Hungary and Poland or will they give them whatever they ask in favor of not vetoing and proceeding with the enormous EU fiscal packages as soon as possible. Due to its veto on the EU funding program and its possible consequences for Hungarian economy, Hungarian forint did reverse all the gains from global risk-on sentiment and is once again trading above 360 versus the single currency. Latest depreciation due to political reasons was not stopped by the central bank which stated that it will continue pumping money through its QE and will lower deposit rate in the future as it has more room for easing due to lower inflation rates in the last two months.

Both these currencies have high beta at global equity markets, they are both strongly (positively) correlated with euro and EM assets. However, their foreign and monetary policies are quite different. Hungarian government seems to be one of the loudest contesters of EU policies while its central bank is one of the most dovish banks in EU. On the other side, CNB is consistent with its modest hawkishness. That, among all other differences between two countries has driven the divergency between two currencies in the last several years.

In 9M of 2020, sales decreased by 3%, EBITDA decreased by 18.8% and net profit decreased by 26.6%.

In 9M of 2020, Cinkarna Celje generated sales of EUR 130.4m, representing a decrease of 3% YoY. Such sales reached 75% of the company’s FY 2020 sales plan. The reason behind the drop lies in several factors. First, the spread of the COVID-19 pandemic triggered a process of accumulation of pigment inventories by customers at the end of Q1, which positively impacted the top line. Secondly, the absence of Chinese producers in the European market at the beginning of the year added to the rise in demand. However, in Q2 lower production and higher inventories led to a decrease in sales. Still, according to the Management’s estimates, Cinkarna Celje’s decline in sales was smaller than the overall decline in sales in the titanium dioxide market.

The total value of exports in 9M 2020 reached EUR 119.3m, which is flat YoY and represents 77% of the annual planned sales to foreign markets.

Meanwhile in Q3 solely, sales improved compared to the the previous quarter due to better epidemiological situation. The company notes that their focus remains still on pigment titanium dioxide and streamlining the portfolio of strategic business areas, focusing on core program and abandonment of unprofitable activities.

Operating expenses in the first 9 months reached EUR 114.2m, representing a slight increase of 1.3%. Such an increase mostly came on the back of higher material costs. As a result of all of the above mentioned, EBITDA amounted to EUR 25.3m, representing a decrease of 18.8%. Meanwhile, EBITDA margin stood at 19.4%, which is a decrease of 3.7 p.p. YoY.

Operating profit amounted to EUR 16.2m, representing a decrease of 26.4%. However, note that in 2020 Cinkarna Celje changed the method of valuing stocks of finished products compared to previous years. This change increased the operating result in 9M and will reduce the operating result in the last quarter, and on an annual basis it will be annulled. The positive impact of the change on net profit in the first nine months amounted to EUR 1.9m.

Lastly, in 9M of 2020, Cinkarna Celje recorded a net profit of EUR 13.77m, representing a decrease of 26.6%.

Turning our attention to CAPEX, it stood at EUR 8.8m, which represents 44.2% of the planned funds. The amount is lower than planned mainly due to the interruption of non-urgent investment and maintenance works during the pandemic due to COVID-19. The majority of the invested funds were intended for the production of titanium dioxide for improvement product quality, ensuring the reliability of individual devices or processes, improving safe and healthy working conditions and reducing environmental impacts.

In 9M of 2020, Intereuropa recorded a decrease in sales of 7%, decrease in EBITDA of 13% and a decrease in net profit of 41.6%.

In first 9M of 2020, Intereuropa Group recorded sales revenue of EUR 111.6m, representing a decrease of 7% YoY. The decrease could be mainly explained by the the COVID-19 epidemic, which had a negative impact on all products, in particular land transport. Planned values were exceeded most during the first three quarters of 2020 by the parent company in Slovenia, and the subsidiaries in Bosnia and Herzegovina, Croatia and Ukraine, while the company in Montenegro recorded the most significant lag behind planned sales.

In terms of sales by business line, land transport accounts for 51% which observed a 11% YoY decrease to EUR 57.18m. Next comes Intercontinental transport with a decrease of 6% YoY to EUR 29.3m (accounting for 26% of total sales). The aforementioned decreases were partially offset by an improved result in Logistics solutions which were up by 3% YoY to EUR 20.46m (accounting for 18%).

In terms of sales by country, companies in Slovenia together generated 66% of the Group’s sales revenue, observing a 10% decline in sales revenue YoY. Sales were also down in Croatia, Bosnia and Herzegovina, Montenegro and Kosovo, most notably in the land transport segment, while sales growth was seen in the logistics solutions segment in Slovenia, Kosovo and Bosnia and Herzegovina. Sales were up in the intercontinental transport segment in Serbia, Croatia, Bosnia and Herzegovina, Montenegro and North Macedonia.

Operating expenses reached as much as EUR 107.7m, representing a decrease of 6.2%. Such a decrease could mostly be attributed to a decrease in cost of goods, materials and services by EUR 6.75m. As a result, EBITDA reached EUR 9.49m, which was 26% higher than planned, but down 12% YoY. The main reason for higher-than-planned EBITDA was the positive impact of higher sales revenue than planned. Such a result puts EBITDA margin at 8.5%, representing an increase of 1.3 p.p. YoY. Meanwhile, operating profit reached EUR 3.9m, representing a decrease of 27.6% YoY. However the company notes that such a result is 104% higher than their plan.

Going further down the P&L, net profit in the first 9m amounted to EUR 2.4m, representing a decrease of 41.6%.

Turning our attention to CAPEX, the Group invested EUR 1.05m in fixed assets during the 9M of 2020, which is a decrease of 30% YoY. Of that, EUR 300k was invested in property, while EUR 746k was invested in equipment and intangible assets. The company notes that a total of 15% of the entire investment plan was achieved.