Index performance wise, 9M 2020 could be characterized as a quite challenging period for all regional markets. How does this performance compare to the previous years?

In 9M 2020, all indices observed a decrease of their respective main index, which can be seen in the graph below. Slovenian market observed the lowest index decrease of 8.6%, which could be attributed to a very solid share price performance of Krka, which takes up almost a third of the index.

Performance of Regional Indices in 9M 2020

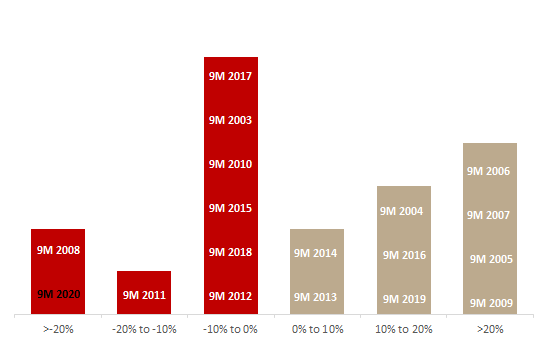

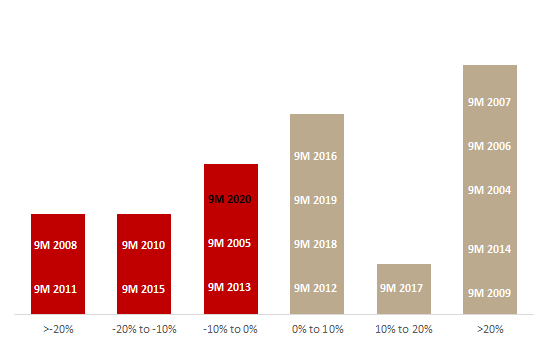

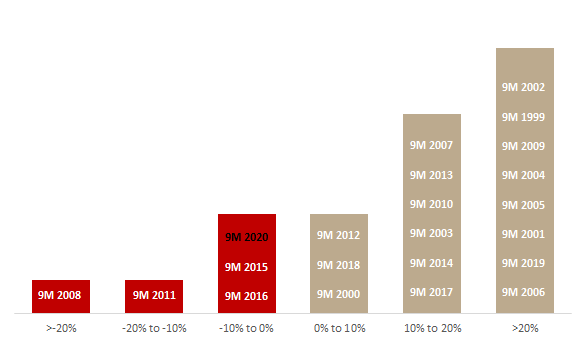

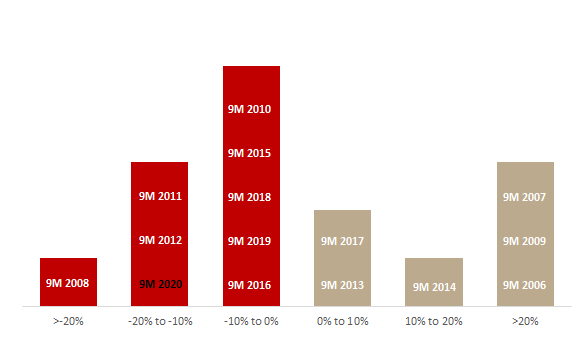

The following graphs show 9M return of each index on a spectrum from >-20% to >+20%. Note that the higher placement of a certain period on a graph represents a better (gold) or worse (red) index performance in the respective period.

CROBEX (9M 2003 – 9M 2020)

Source: Bloomberg, InterCapital Research

SBITOP (9M 2004 – 9M 2020)

Source: Bloomberg, InterCapital Research

BET (9M 1998 – 9M 2020)

Source: Bloomberg, InterCapital Research

BELEX15 (9M 2007 – 9M 2020)

Source: Bloomberg, InterCapital Research

Trading statistics for September show an average daily turnover of EUR 0.88m (-77% YoY). Meanwhile, the major index CROBEX ended September in red (-0.53%) at 1,608.54 points.

Trading report for September shows quite an inactive trading month behind us as total equity turnover amounted to EUR 19.3m (or HRK 144.9m). This translates into an average daily turnover of EUR 0.88m, representing a sharp decrease of 77%. It is important to note that such a sharp decrease could mainly be attributed to a high turnover of Kraš in September of 2019, which you can recap on here. If we were to exclude the effect of Kraš, the average daily turnover is still down as much as 40.2%, which reveals a continuation of relatively low liquidity on the ZSE, which we have been witnessing throughout most of Q2 and Q3.

Of the total value traded in the period in September (excluding block transactions), HT generated HRK 26.1m or 19.9%, while Podravka generated HRK 11.1m. Atlantic Grupa comes third, accounting for 6.7% (or HRK 8.81m). Next come Dalekovod and Valmar Riviera with 6.2% and 6%, respectively. Ericsson NT follows with 5.7%. These five shares generated more than half of the turnover recorded by the entire (equity) market.

Share Price Performance of Croatian Blue Chips in September (%)

As visible in the graph, of the observed Croatian blue chips, Arena Hospitality Group observed the highest share price increase of 7.5%, followed by Podravka (+5.5%). On the flip side, Atlantska Plovidba recorded the highest decrease (of the observed companies) of 8.3%.

As a result of the above-mentioned share price performance of Croatian blue chips, CROBEX ended September in red (-0.53%) at 1,608.54 points. Of the sector indices, CROBEXkonstrukt noted the highest decrease of 5.55%, after witnessing a strong performance of +39.4% in August.

When observing the total equity market capitalization, it observed a decrease of 0.6% MoM, amounting to HRK 130.7bn (EUR 17.43bn).

In first 8 months of 2020, GWPs recorded an increase of 3.9%. Of that Non-life observed an increase of 4.77% while Life is up by 1.8%.

Yesterday, the Slovenian Insurance Association published their monthly update on the GWP development in Slovenia. In the first 8 months of 2020, the Slovenian insurance market observed an increase in both life and non-life segment, leading to a total GWP growth of 3.91% YoY, amounting to EUR 1.776bn.

Non-life segment, which accounts for 71.75% of the total GWPs, recorded also an increase of 4.77%. Such an increase came on the back of a very strong health insurance performance, which recorded an increase of 10.42% YoY and is the largest non-life item in Slovenia (24.56% of total GWPs). The increase arguably came mostly on the back of increasing prices of health insurance premiums.

It is noteworthy that land motor vehicles insurance observed an increase of 3.79%, amounting to EUR 228.8m. Meanwhile motor vehicle liability insurance witnessed an increase of 1.57%, amounting to EUR 198.1m. Credit insurance on the other hand, observed a sharp decrease of 24.8%. This does not come as a surprise given the expected lower loan issuance activity in Slovenia as a result of Covid-19 outbreak coupled with the restrictions on the consumer loans placed by the Bank of Slovenia in November 2019.

Turning our attention to the life segment, it also recorded a 1.8% YoY increase, amounting to EUR 501.7m. Within the segment, unit-linked life insurance observed a slight decrease of 1.7%.

GWPs by Insurance Segment (Jan – August 2020) (%)

Solely August 2020

When observing solely August, GWPs recorded a solid increase of 3% YoY. Such results further support the fact that Slovenian insurers were so far only slightly grazed by the Covid-19 crisis in terms of GWPs.

The mentioned increase came on the back of a solid non-life performance which observed an increase of 4.3% (or EUR 5.4m). Such an increase could be attributed mostly to a strong performance of Health insurance (+3.3% or EUR 1.7m) and land motor vehicles insurance (+6.3% or EUR 1.29m). On the flip side, a decrease was observed in Motor vehicle liability insurance of 4.1% (or EUR 0.76m) and credit insurance segment, which dropped by 21.1% (or EUR 0.67m).

The solid performance of the non-life segment was further boosted by a slight increase in in life insurance of 0.3% (or EUR 0.2m).