With total assets of EUR 1.8bn at the end of 2020, Sberbank had a market share of approx. 4% of the banking assets in Slovenia. At the same time, Sberbank in Croatia had HRK 11.1bn of assets in Croatia, owning approx. 2% of the banking assets in Croatia.

NLB published an announcement on the LJSE stating that NLB is acquiring Sberbank Slovenia. Yesterday, the Bank of Slovenia issued a decision, in accordance with Article 116 of the Resolution and Winding-Up of Banks Act, to issue a resolution tool in respect of the sale of 100% shares issued by Sberbank banks. With total assets of EUR 1.8bn at the end of 2020, Sberbank had a market share of approx. 4% of the banking assets in Slovenia. This would indicate that the NLB’s market share would increase to roughly 30% in Slovenia. Sberbank’s customer loans amounted to EUR 1.2bn at the end of 2020. The transaction will complement NLB’s existing franchise in Slovenia, particularly in the corporate and SME segment which accounted for app. 55% of Sberbank’s net customer loans at the end of 2020.

At the same time, Single Resolution Board (SRB) has decided to transfer all shares of the group’s Croatian subsidiary Sberbank (615,623 in total) to Hrvatska Poštanska Banka (HPB). This means that Sberbank in Croatia will continue normal operations moving forward, albeit under HPB Group. As a reminder, Sberbank owns 2.2% of total assets in the Croatian banking system, making it the 8th largest bank in Croatia. At the same time, before this transaction, HPB owned 5.56% of total assets in the Croatian banking system, making it the 6th largest bank in the country. After the transaction, HPB will own 7.77% of the total assets, still maintaining its 6th place, just below Raiffeisen bank with 8.3% of total assets in Croatia. It should also be noted that HPB’s is owned in majority by the Croatian state.

When looking at Sberbank Slovenia’s transaction, it will add approximately EUR 1.0bn of risk weighted assets to NLB Group’s existing EUR 12.7bn of RWA at the end of 2021. This implies an RWA density of roughly 56%, which is slightly lower than NLB’s RWA density which as of the end of 2021 stood at 58.7%. NLB Group will at all times keep exceeding its Overall Capital Requirement and Pillar 2 Guidance (from 1 March 2022 onwards at 15.10% on a consolidated basis). Meanwhile, at the end of 2021, the Group’s CAR stood at 17.8%. We note that the pricing of the transaction was not yet announced, but it would be reasonable to assume that the acquisition was concluded at a significant discount, i.e. we would not be surprised to see negative goodwill from this transaction.

As a reminder, following the Russian invasion of Ukraine, the EU and the US adopted a sanctions package that has also had a quick and significant effect on the operations of Sberbank. Due to rapid liquidity deterioration, the ECB, announced on 28 February, that Sberbank Europe, a subsidiary of Sberbank, is failing or likely to fail. This assessment included both the Slovenian and Croatian branches of Sberbank. To read more about this, click here.

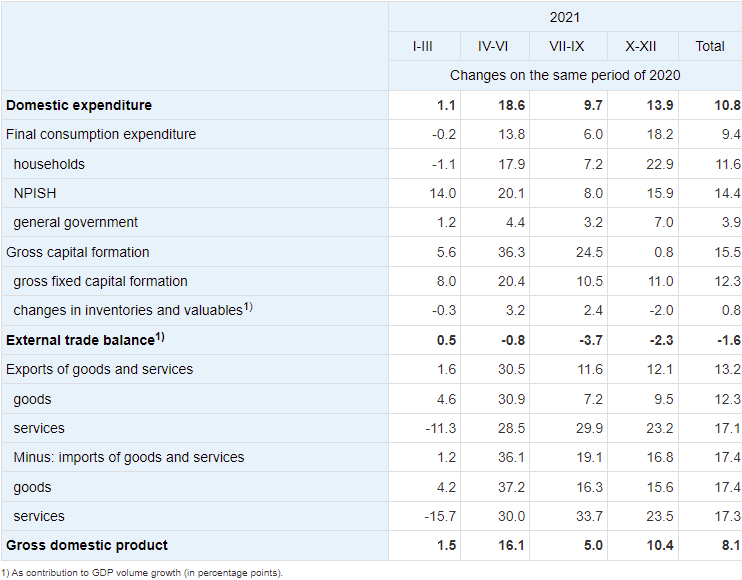

The Slovenian Statistical Office published its GDP figures for 2021, showing that in real terms, it increased by 8.1% YoY. At the same time, in Q4 2021, the GDP grew by 10.4% YoY.

In 2021, the Slovenian economy declined by 4.2%. Meanwhile, in 2021, GDP increased by 8.1% in real terms. Nominal GDP growth amounted to 10.9%, and GDP in current prices amounted to EUR 52.02bn.

In Q4 2021, domestic consumption increased by 13.9%, household consumption expenditure grew by 22.9% (contributing the most to the overall GDP growth). Gross fixed capital formation increased by 11%, most evident in the investment in machinery and equipment (+21.9%). Imports also increased more than exports, continuing the trend from the previous two quarters. In total, imports were up 16.8%, while exports were up 12.1% in Q4. With the higher growth of imports than exports, the contribution of the external trade balance to GDP growth was negative (-2.3 p.p.). This trend of negative contributing net exports is likely to continue in 2022, as exports continue to recover due to improvements in the economic situation among Slovenia’s main trading partners. As imports will also be supported by consumer confidence and household spending, we expect trade balance to be neutral to GDP in 2022 and to start contributing positively from 2023.

On the yearly basis, the increase in domestic expenditure had a strong economic impact. After the decrease of -4.6% in 2020, it increased by 10.8% in 2021. Final consumption contributed more to GDP growth than gross capital formation. External demand also experienced an increase, with exports growing by 13.2% while imports grew by 17.4%. This would also mean that the external trade balance was lower than in 2020, amounting to HRK 2.76bn (as compared to EUR 4.33bn in 2020).

GDP by expenditures, constant prices, growth rates (%)

If we were to look at value-added by activities, at constant prices, financial and insurance activities had the largest relative growth in Q4 (at 12.2%), followed by Trade, transportation and storage, accommodation and food service activities with 11.6%, Other service activities with 10.7%, and Professional, scientific, technical, administrative and support services with 10.1%.

Atlantska Plovidba recorded a revenue increase of 147%, EBITDA growth of 663%, and a net profit of HRK 447.2m.

In 2021, Atlantska Plovidba transported 7.01m tons of cargo, which is an increase of 4.1% YoY. Of that cargo, 63.6% was coal, 25.2% was minor bulk, 9.3% was iron ore, while grain made up the remaining 1.86%.

At the moment, the Company operates 12 vessels, out of which 5 are classified as Panamax, 5 are classified as Supramax, and 2 are classified as Handy. Out of those, 4 are employed on a long-term lease (> 1 year), while 8 are employed on a short-term lease (< 1 year). In 2021, the fleet utilization rate amounted to 95.4%.

According to the Company, the average daily freight rate in 2021 increased steadily during the entire year, only starting to decline in December 2021. This means that in January 2021, it amounted to USD 11,428, while at its highest point, in November 2021, it amounted to USD 23,428, a 105% increase, declining to USD 22,529 in December, still representing a large 97% increase from the beginning of the year. This would mean that the average daily freight rate in 2021 amounted to USD 17,062.

Average Daily Freight Rate (USD)

The Company noted that since the beginning of 2021, a recovery on the market, especially driven by the Chinese economy (and its demand for coal and iron ore) had a positive impact on its operations. Combined with the Chinese government’s decision to ban coal imports from Australia, this caused more delays and redirection of exports towards Indonesia. This is most evidenced on the average daily rates on the spot market, with the Capesize category reaching USD 87,000, Panamax reaching USD 38,000, Supramax reaching USD 32,000, and Handysize reaching USD 30,000. Combined with the price of scrap increasing from USD 400/lt to USD 600/lt due to higher freight rates, this had an influence on the Company’s decision to start negotiating the construction of two new ships, in the Kamsarmax category.

In total, all these developments had a positive influence on the Company’s operating revenue, which increased by 147% and amounted to HRK 793.8m. Operating expenses amounted to HRK 297m, a 7% decrease YoY, mostly driven by value adjustments in the previous period. Material costs increased by 14%, while staff costs remained roughly the same.

With the higher operating revenue and lower operating expenses, EBITDA amounted to HRK 564.5m, an increase of 663% YoY. This would also mean that the EBITDA margin was significantly higher, amounting to 70.7% (as compared to 22.9% in 2020). Moving further down the P&L, the Company recorded an EBIT of HRK 496.7m, as compared to HRK 3.1m in 2020.

This would also mean that the Company’s net income to majority increased significantly, amounting to HRK 447.2m, as compared to a net loss of HRK -46.7m in 2020.

Atlantska Plovidba Key Financials (HRKm)

At the current share price, the dividend yield is 4.5%. The ex-dividend date is May 24 2022.

Electrica’s Board of Directors proposed the distribution of net profit for the financial year of 2021 in the form of dividends. This would amount to RON 152.8m being distributed as gross dividends, equaling a gross dividend per share of RON 0.45, and at the current share price, a DY of 4.5%.

The ex-dividend date will be on May 24 2022 and is subject to approval by the OGSM on April 20 2022. The payment date for the dividend is June 17 2022.

Electrica dividend payments and dividend yields (%)