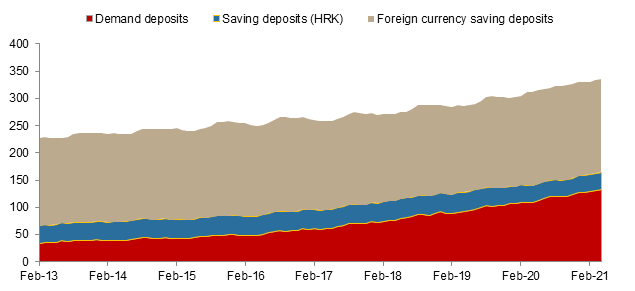

At the end of April 2021 total deposits in Croatia amounted HRK 335.2bn, up by HRK 2.1bn YTD.

According to the consolidated statement of financial position for monetary financial institutions which is monthly published by the Croatian National Bank (HNB), total deposits as of end February 2021 amounted to HRK 335.2bn, representing a solid increase of 7.7% YoY, while increasing 0.6% MoM. This amount represents once again an all-time high. The high level of savings indicates that Croatian citizens are unwilling to take on the risk of other asset classes.

This increase can be attributed to a high increase of 21.2% YoY in demand deposits, reaching HRK 132.4bn, which accounts for 39% of total deposits. As we are in a time of uncertainty the mentioned increase does not surprise. During the crisis, lower spending and higher savings are expected.

The increase was backed up by a slight rise in the total savings deposits, which amounted to HRK 202.8bn (+0.4% YoY) at the end of April. Also a small down trend in MoM change has been overturned resulting in a 0.5% MoM rise. For the first time in two years there has been an increase in local currency savings deposits. The 5.8% increase to HRK 32.2bn reflects lower belief in foreign currencies reflecting the COVID-19 pandemic influence on the surrounding countries. Foreign currency savings accounted for HRK 170.6bn, a 0.6% drop YoY. At the end of April 2021 the total saving deposits were 16% in the local currency and 84% in foreign currency, showing that Croatian institutions and citizens still do not prefer holding the their savings/assets in the Croatian Kuna.

When observing solely household deposits, they hold HRK 229.1bn, a share of 68% of total deposits. We note that foreign currency saving deposits account for 51% of total deposits.

Dividend yield is 0.8%. Ex-date is 15 June 2021.

Končar held the GSM in which the shareholders of the Group unanimously approved the dividend payment of HRK 5.8 per share. As a reminder, the Management Board initially proposed no dividend payment for 2021. In the meantime, Erste Plavi Mandatory Pension Fund submitted the counterproposal of HRK 5.8 per share, which was yesterday approved.

At the share price a day before the proposal, dividend yield is 0.8%.

The ex-date is 15 June 2021, while dividend shall be paid until (and including) 1 July 2021.

In the graph below, we are bringing you a historic overview of the company’s dividend per share and dividend yield.

Dividend per Share (HRK) and Dividend Yield (%) (2015 – 2021)

In May, SBITOP observed a very strong increase of 6.9%, ending the month at 1,138.94 points.

The Ljubljana Stock Exchange (LJSE) published their trading statistics for May 2021, showing an equity turnover of EUR 30.4m. This translates into an average daily turnover of EUR 1.45m (-3.3% MoM).

Of the total value traded in the period (excluding block transactions), Krka generated EUR 13.58m (or 48%), followed by NLB Group with EUR 3.7m (or 13%). Next come Triglav with EUR 2.4m (or 8%) and Petrol with EUR 2m (or 7%). Cinkarna Celje follows with EUR 1.89m or (+6.7%). These 5 shares generated 83.1% of the turnover recorded by the entire (equity) market.

When observing the total equity market capitalization, it observed a 5.4% MoM increase and currently amounts to EUR 8.55bn.

May showed continuation of a positive sentiment on the LJSE, with SBITOP increasing by as much as +6.9% MoM (ending May at 1,138.94 points). We note that all blue chips ended the month in green. Of those, Sava Re leads the list with an increase of 17.9%. NLB and Luka Koper follow, with very strong increases of 15% and 8.8%, respectively. Krka noted the lowest increase of 1%, closing the month at EUR 105.5 per share. We also note that, as of end May, SBITOP is up by as much as 26.5% YTD.

Performance of SBITOP Constituents in May 2021 (%)