On this week’s testimony to the Senate Banking Committee, Fed’s chair Jerome Powell said that it is time to retire the word transitory and that buying program could be ended few months earlier than expected before. In this article we are looking at the details of the Powell’s speech and the consequences on markets.

Last week, US president Biden nominated Mr Powell for a second term to serve as chair of Fed, and Lael Brainard as a vice chair after several weeks of speculations that Powell could be replaced by more dovish member. We do not know whether the decision changed anything in Fed but only a week after the decision Mr Powell sounded way more hawkish and decided to move the word transitory from his forward guidance after defending the term for months. On Monday, Mr Powell said that covid waves are inflationary as they reduce people’s willingness to work, resulting in higher wages and further deceleration in supply chains. However, market was more surprised on Tuesday when Fed’s governor said that inflation shouldn’t be described as transitory anymore and that “it is therefore appropriate, in my view, to consider wrapping up the taper of our purchases, perhaps a few months sooner”. On its latest meeting, Fed decided to start reducing monthly purchases by USD 15bn in both November and December meaning that from January Fed could decrease pace by USD 20bn or even more. That would imply end of the purchase program in May the latest or before if they decide to reduce by more than USD 20bn. Omicron is still big unknown, but it is obvious now that Fed can not tolerate inflation being at the highest levels in the last 30 years and not decelerating but the opposite. Oil pries fell dramatically in the last two weeks due to fears of new waves which will decrease inflation pace and most likely mark peak of the inflation in October. However, core inflation shows that inflation could stay above 2.0% for much longer than expected in the beginning of 2021.

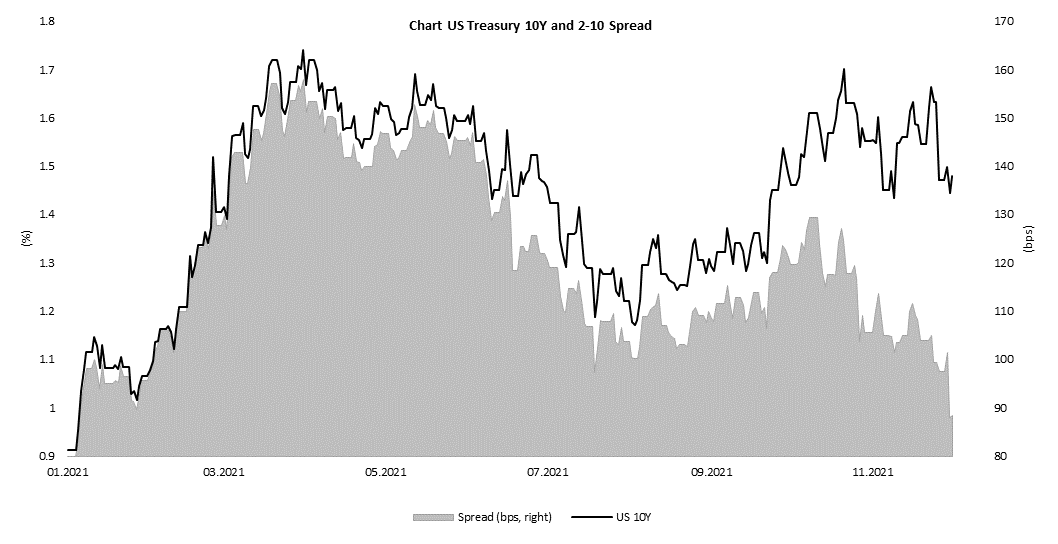

So how did market react on Powell’s remarks? First it is important to say that yield curves repriced significantly since last week due to fears of new variant of corona. On the chart submitted below you could see how yield on USTs fell sharply on Friday and Monday with UST reaching 1.40% on Tuesday before Powell’s testimony. However, Mr Powell surprised markets and yields shoot up with US 2y rising from 0.45% to 0.60% almost in a day, while yield on US 10Y increased by almost 10bps, resulting in further flattening of the US yield curve. In any way, seems like fear of new corona wave is stronger than this hawkish surprise as US 10Y is still below 1.50% and 20bps below the level (1.68%) seen last week.

Looking at the EUR benchmark, one would say that Powell did not end transitory era while omicron did not have the same impact on bund as it did on UST. That is most likely because EUR benchmark was already very high i.e., yields on 10Y paper are below -30bps and there were several explanations for this. We like the one that says that bund became quite rare while due to year end, buyers are looking for quality to close their balances. On the other hand, swap spreads are widening and showing that there are more and more investors who think that yields in eurozone are too low considering inflation that surprised us once again this week. In November, eurozone inflation stood at 4.9% YoY while core was at 2.6%, compared to 2.0% a month before.

Source: Bloomberg, InterCapital

Today, we bring you our updated overview of the indebtedness and capital structure of Slovenian companies which comprise the SBITOP index using the 9M 2021

results.

As all the companies which are part of the SBITOP index have published their 9M 2021 results, we decided to take a look into how indebted these companies are by comparing net debt to EBITDA. It should be noted that we excluded NLB Banka, Triglav, and Sava Re from this comparison.

At the same time, Cinkarna Celje and Krka operate at a negative net debt, meaning their cash position (short-term financial assets + cash and cash equivalents) exceeds their financial debt. Because of this reason, they were excluded from the net debt/EBITDA graph. To make up for this, we decided to show the differences in P/E and cash-adjusted P/E of these two companies. When comparing these two numbers in these companies, we can see that Cinkarna Celje has a P/E* of 6.54x, while they have a cash-adjusted P/E* of 5.15x. At the same time, Krka has a P/E* of 11.3x, whilst they have a cash-adjusted P/E* of 10.24x.

*Based on the price taken on November 30th, 2021

P/E and Cash-adjusted P/E

Out of the remaining companies (Telekom Slovenije, Petrol and Luka Koper), Telekom Slovenije has the highest net debt/EBITDA ratio of 2.43x. Considering that Telekom Slovenije operates in the telecommunications industry, where investments into new infrastructure (and thus the need for a lot of cash to finance these projects) are taken in the form of debt, the Company’s net debt is at a higher level in comparison to their EBITDA. It is also worth pointing out that YoY, the company managed to increase its EBITDA by over 20% (from EUR 144.5m to EUR 174m), whilst increasing its net debt by only 9.4% (from EUR 386.6m to EUR 422.9m). Next up, we have Petrol with a net debt/EBITDA of 1.69x. It should also be noted that Petrol achieved an EBITDA growth of 53.6% YoY, whilst reducing its net debt by 1.4%. Lastly, we have Luka Koper with a net debt to EBITDA of 0.68x. When considering the industry (shipping and port services) Luka Koper operates in, it comes as no surprise the need for cash to finance further port infrastructure investments. Even if this is not evident from the lower net debt/EBITDA, the Company currently has a net debt of EUR 30.9m, representing a 96% growth YoY (vs. 15.8m). During the same time, the Company increased its EBITDA by 7%, which means that if we were to compare net debt/EBITDA 9M 2020 vs. 9M 2021, it grew by 83% YoY (from 0.37x to 0.67x).

Net Debt/EBITDA

We looked at how much additional debt the companies could take in order to reach 3x EBITDA, which in the region is considered a breaking point and a red flag in terms of indebtedness.

Potential Additional Debt (EUR m) to reach 3x EBITDA

We also took a look at the capital structure of the observed companies, with all of them having over 70% of their funding from equity. Cinkarna Celje leads the way with 99.96% of equity, followed by Krka with 99.3%, Luka Koper with 85.8%, Telekom Slovenije with 75.7%, and Petrol, with 70.9%.

Capital Structure of Select SBITOP Companies

Cinkarna Celje publishes its business plan for 2022 as well as estimates for 2021 operations.

Starting with 2021 results, the company expects it will exceed the profit plan set for 2021 estimated at EUR 27.1m. This EUR 27m includes EUR of 2.6m of environmental provisions for ONOB (Bukovlžlak Non-Hazardous Waste Landfill). These provisions are expected to lower the result for Q4 2021. This estimate also includes the projected impact of the overhaul and loss of production of app. 4,500 tons of titanium dioxide in Q4 2021.

The focus of the company going forward remains on maximizing production capacity and using the market potentials by selling products with higher value-added. At the same time the goal is optimizing of production costs while implementing investment plans.

The company’s development activity follows a 5-year strategy, while development activities themselves are carried out according to trends or customer expectations. There is also a focus on the introduction of improvements in all processes that enable better product quality, achieve higher efficiency and machine capacity.

For 2022, the profitability plan exceeds the forecasts in the medium-term development strategy. Margins are expected to settle at a lower level, due to the company not forecasting increases in finished product prices, which could occur due to the rise in prices of raw material and energy, and changes in the macroeconomic conditions in the global industry. The planned net profit in 2022 is at EUR 20.1m.

To read the whole plan in detail, click here.