Have you noticed something unusual with this week’s risk-on environment? Core rates and equity are obviously up, SPX is again above 4.200, but USD appreciation is usually a mark of distress. This Bermudan triangle constituted of rates, equity and FX is a place where most of the explanations tend to disappear. What do we make of these unusual market circumstances? Our baseline explanation could be found in market segmentation theory (FX is looking at the debt ceiling, equity and rates at regional banks’ convalescence). And what are the implications on Croatian international bonds? Read in this brief research piece.

Confused with yesterday’s move in financial markets? Well. Let’s take it step by step.

Fixed income traders tend to exhibit market myopia in times like this since they focus only on macro data, turning a blind eye to the broader market sentiment. It’s true that US initial jobless claims came below the consensus estimate (242k actual versus 251k consensus, so 9k below market consensus), nevertheless, such a small difference is not sufficient to explain a sharp rise in yields and US equity. Instead, we focus on a small bit of information that came from US lender Western Alliance (WAL US Equity). It’s 67.7bn USD regional lender with 53.64bn USD of deposits (both figures are FY2022) that managed to report a +2bn USD rise in deposits from quarter end – a spark of information that together with positive news from PacWest Bancorp (PACW US Equity) managed to ignite a relief rally in US markets. Regarding PACW US Equity, in the most recent two trading sessions share price went from Tuesday’s close of 4.57 USD to yesterday’s 5.84 USD (staggering +27.8% gain).

In our talk with a handful of US equity traders, we found out that this move resembles a dead cat bounce since volumes were not special at all. Volumes were elevated, but they were not something extraordinarily high, a feature that would explain market sentiment turning a corner. In our opinion, it’s possible that an imminent end of US rate hikes that’s behind the corner and sound data about the return of deposits to troublesome regional banks might have caused investors to put some money into lenders like PacWest and Western Alliance. It was sufficient to launch the KBW Nasdaq Regional Banking Index by 7% yesterday and bring SPX north of 4.200 mark.

All of this looks like an ordinary risk-on event, right? Wrong. EURUSD went down from 1.840 to 1.0760 peak-to-through and USD appreciation is not normal in risk-on environment. EURUSD started coming down about three weeks ago when US debt ceiling debate intensified and gained momentum as June 01st started closing in.

This is odd, right? US politicians are assuring investors that US federal government would not let its debt come into arrears, nevertheless, the two sides of the aisle are reluctant to pass a deal. US federal debt market looks like an ocean compared to the small pond of US regional banks, meaning that the USD appreciation tells us we’re not out of the woods yet. On the other hand, when the debt ceiling debate gets cleared away and with pressures from around the world mounting to get it out of the way, EURUSD/US equities/US regional banks might be poised for more upside. In other words, if some of the equity traders were cutting their short exposure to US regional banks so they don’t get burned in a couple of weeks (this is a necessary condition to create a dead cat bounce), it was probably a smart thing to do.

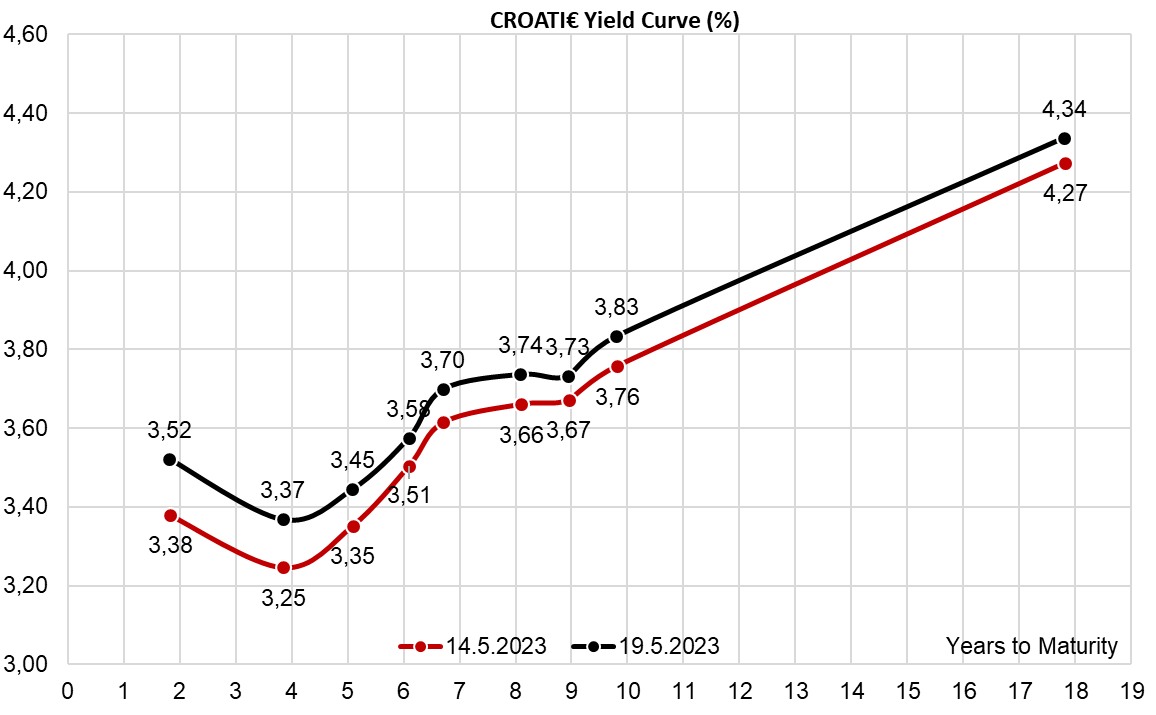

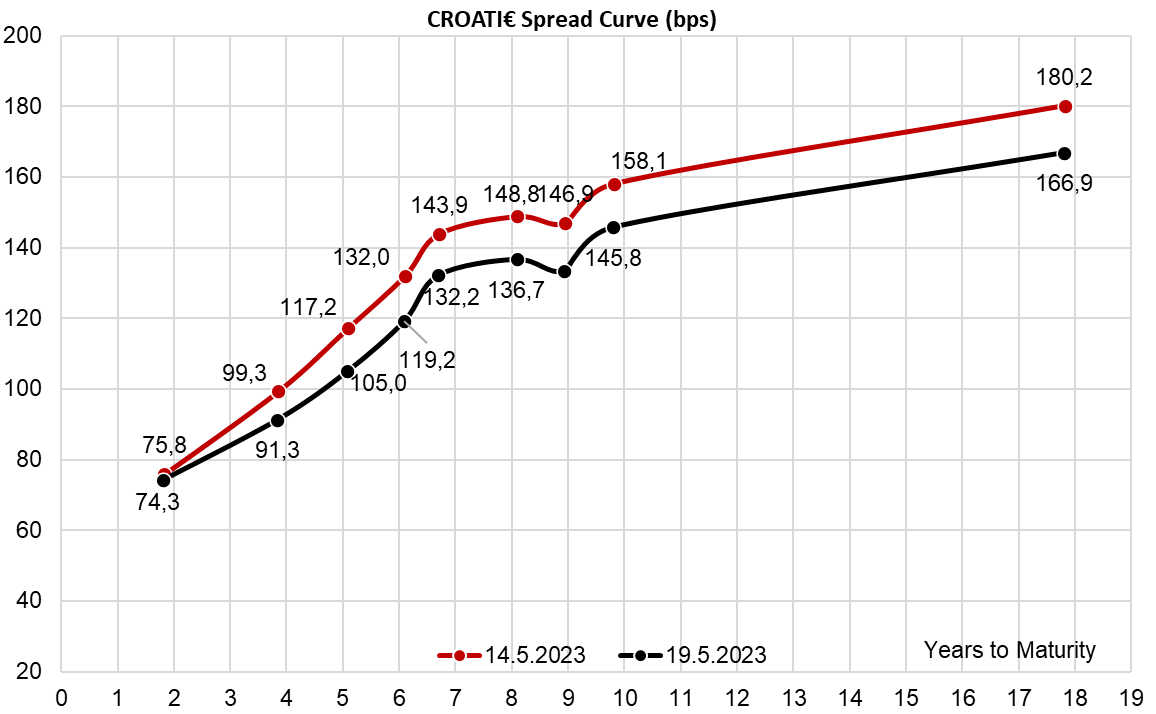

How are Croatian international bonds weathering the storm? It’s not a really big storm, but in a nutshell – yields are up, spreads are down. All of the sudden it was possible to buy larger chunks of CROATI 2.750 01/27/2030€ at 94.90 (3.62% YTM, B+126bps) and CROATI 1.500 06/17/2031€ at 85.00 (3.68% YTM, B+133bps). By taking a look at the black curves on both of the charts submitted, you can see that this is only a couple of bps above the BVAL mid, so nothing exceptional indeed. The reason Croatian accounts were reluctant to bid was the fact that new Croatian eurobond might be placed in a matter of weeks and most of our accounts are targeting high 140s above the Bund on maturity just slightly below 10 years.

Petrol approves EUR 1.5 DPS, DY 6.3%, ex-date August 2nd.

Yesterday, Petrol published a resolution from their AGM in which the shareholders counterproposed and approved EUR 61.7m to be allocated for dividend payments. This translates to a dividend per share of EUR 1.5 and represents the same amount of DPS as the last year, when Petrol paid our EUR 30 DPS, but also approved a 20:1 share split.

At the current share price dividend yield is 6.3% Note that the ex-dividend date is August 2nd, 2023, while the payment date is August 4th, 2023.

In the graphs below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.

Dividend per Share (EUR) & Dividend Yield (%) (2013 – 2023)

*compared to the share price a day before the dividend approval

*after the share-split calculation

At the end of March 2023, the total loan amount of all Croatian financial institutions equaled EUR 41.7bn, representing an increase of 9.9% YoY, and 0.37% MoM.

The Croatian National Bank has published its latest monthly report on the changes recorded by the Croatian financial institutions, for the month of March 2023. In the report, we can see that the total amount of loans of all Croatian financial institutions amounted to EUR 41.7bn, which would mean that they grew by 9.9% YoY, and 0.37% MoM.

Breaking this growth down further, we can see that the largest contribution came from the loans issued to both households, as well as corporate clients. In fact, by the end of March 2023, household loans surpassed EUR 20bn mark, amounting to EUR 20.1bn, an increase of 1.0% (or EUR 202.9m) MoM, or 5.5% (or EUR 1.06bn) YoY. Corporate loans also continued their growth momentum, albeit slowing down on a monthly basis, with a growth of 0.24% (or EUR 33.7m), while on a YoY basis, they grew by 15.2% (or EUR 1.85bn). In total, the loans issued to corporate clients amounted to EUR 14.04bn.

Corporate and household loans growth rate (January 2015 – March 2023, %)

Source: HNB, InterCapital Research

Breaking the corporate loans further into 3 main categories, i.e. working capital loans, investment loans, and other loans, we can take a more detailed look at this development. The largest of these categories, investment loans, which accounted for 39.9% of the total corporate loans, increased by 0.91% (or EUR 50.7m) MoM, and 13.6% (or EUR 670.4m) YoY. The 2nd largest category, i.e. working capital loans (which account for 30.8% of the total) recorded a decrease of 1.0% (or EUR 44.9m) MoM, but an increase of 7.1% (or EUR 287m) YoY. Finally, the other loans category which accounts for the remaining 29.3%, recorded an increase of 0.68% (or EUR 27.9m) MoM, and 27.7% (or EUR 890.7m) YoY.

The increase in corporate loans is quite a good sign, especially in the current macroeconomic environment of high interest rates and geopolitical uncertainty. The continued growth of investment loans in particular is a piece of positive news, as these ones yield returns in the future, while the decline in working capital loans can be attributed to the seasonality & requirements of individual companies, and doesn’t have to represent a negative trend.

Moving on to households, housing loans still account for the majority of these loans (49.7% of the total) and have surpassed EUR 10bn mark for the first time in March 2023, increasing by 0.55% (or EUR 54.3m) MoM, and 9.48% (or EUR 866m) YoY. Next up, we have consumer loans, which with EUR 7.36bn account for 36.6% of household loans. These loans have increased by 1.4% (or EUR 103.2m) MoM, and 3.3% (or EUR 234.7m) YoY.

Composition of Croatian loans to households (October 2011 – March 2023, EURm)

Source: HNB, InterCapital Research

Taking a look at the value and volume of loans issued would not make much sense without looking at one of the most important factors influencing this development, the interest rates. Given that Croatia is part of the Eurozone, the interest rate hikes we are witnessing by the ECB will have an influence on the interest rates of newly issued loans. On average, the newly issued housing loans had an interest rate of 2.92%, representing an increase of 0.43 p.p. YoY, but a decline of 0.25 p.p. MoM. Consumer loans meanwhile, remained roughly unchanged MoM, but recorded an increase of 1.13 p.p. YoY, amounting to 5.45%. Finally, average corporate loan interest rates amounted to 3.92%, remaining unchanged MoM, but increasing by 2.19 p.p. YoY.

Average new housing and corporate loans interest rates (December 2011 – March 2023, %)

Source: HNB, InterCapital Research