Yesterday’s ECB meeting and the accompanying press conference were uneventful and did not generate any movements in the German yield curve. More important for the spread between 2-year and 30-year yields in the past couple of weeks were events in the US, mainly those connected to the US elections.

After the Governing Council of the ECB decided to keep the three key ECB policy rates unchanged, President Lagarde, at the following presser, did not offer any insight about the timing of the next cut and was pledging data (not data point!) dependence and a meeting-by-meeting approach. She has also said that the decision on September remains wide open, although it seems that the current baseline is a September cut, provided that the upcoming inflation prints align with their forecasts, which she has acknowledged is currently happening by saying how the incoming information supports their previous assessments.

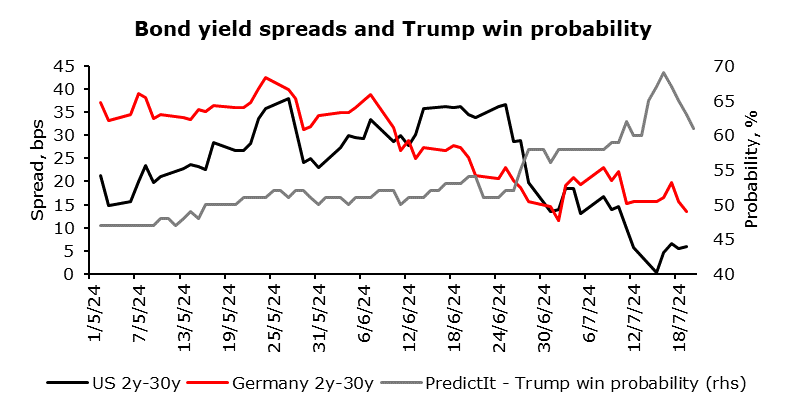

Examining the changes in the spreads between 2yr and 30yr bonds in Germany and the US reveals that the US curve has steepened around 35 bps in the past three weeks or so while the German curve has steepened as well, albeit by a much smaller amount, namely less than 10bps. The first catalyst was the debate held on the 27th of June, which, according to PredictIt, increased the likelihood that Trump will secure the win in the elections by 6%, bringing it to 58%. The second catalyst stemming from US election odds was an assassination attempt at a rally on the 13th of July that has raised the precepted odds of Trump replacing Biden. This higher prospect of a Trump 2.0 presidency affected the yield curve from two sides. First, the short end’s yield was downwardly pressured by the perceived influence that Trump might try to exert on the Fed, wanting them to lower rates. Second, the long end’s yield was upwardly pressured by Trump’s stance on taxes and the prospects of higher fiscal deficits that will need to be financed through longer-term coupon issuances. Of course, a significant part of that yield curve steepening was influenced by contributory US data, most notably higher unemployment (now at 4.1% ) and lower CPI reading. This positive information made the investors more confident that the Fed is going to start cutting soon (pricing 2.5 cuts by the end of the year), which is a positive signal for steepeners given that cuts mean lower rates and in this environment the re-emergence of the term-premia is expected to occur.

Returning to Germany and the EU, it seems that there were no spillover effects from the prospective Trump presidency. If his perseverance on the stance on Ukraine and NATO members’ spending on defence as a share of GDP remains in place, some extra financing is likely to be needed, affecting the long end of the Euro curve via elevated supply and higher term-premia. To summarize, with the cutting cycle already on the way, providing a further impulse to steepening of the EUR benchmark curve, and with political spillovers from the US, we believe that there is still some value left in playing the upcoming events through the steepness of various parts of the German yield curve.

Today, we bring you our updated overview of the indebtedness and capital structure of Slovenian companies that comprise the SBITOP index using the Q1 2024 results. It should be noted that we excluded NLB Banka, Triglav, Sava Re, and Equinox from this comparison due to the nature of their business operations.

At the same time, Cinkarna Celje and Krka operate with negative net debt, meaning their cash positions (short-term financial assets plus cash and cash equivalents) exceed their financial debt. Consequently, they were excluded from the net debt/EBITDA graph. Among the remaining Slovenian blue chips, Petrol has the highest net debt/EBITDA ratio at 1.8x. For several quarters, Petrol had been reducing its net debt/EBITDA ratio through improved EBITDA. However, in the first quarter of 2024, the company reversed this trend and recorded a higher ratio. Despite reducing its net debt by EUR 4.4 million compared to the end of 2023, Petrol’s EBITDA decreased by EUR 9.9 million (17% YoY), causing the ratio to rise. The decline in EBITDA resulted directly from a 19% YoY drop in sales revenue, driven lower sales on Other European markets. Slovenia petrol margins are still quite unfavorable which has resulted in decrease of EBITDA. Also EBITDA was down due to price regulation of natural gas in Slovenia and Croatia while compensation has not yet been received due to lack of approval for reimbursements from regulators/states. However, from a valuation perspective, one can conclude that the market already priced in expected further recovery/growth in Petrol’s profitability, taking the Group’s current P/E ratio of 21.56x into account.

Telekom Slovenije has a net debt/EBITDA ratio of 1.6x, a slight increase compared to the end of 2023. This change primarily stems from an increase in net debt, which grew by EUR 31.9 million (8.9%) since the end of 2023. Although TTM EBITDA experienced a 2.4% QoQ growth, translating to EUR 5.4 million in absolute terms, this increase was significantly lower than the rise in net debt. Given that Telekom Slovenije operates in the telecommunications industry, substantial investments in new infrastructure necessitate considerable cash, often financed through debt. As a result, the company’s net debt is relatively high compared to its EBITDA.

Net Debt/EBITDA

Source: LJSE, InterCapital Research

Among the observed companies, Luka Koper has the lowest net debt/EBITDA ratio at 0.3x, a slight increase since the beginning of the year. This increase is due to a rise in net debt by EUR 1.8 million (6.6% QoQ) coupled with a decrease in TTM EBITDA by EUR 1.7 million (1.8% QoQ).

The graph below illustrates how much additional debt the companies could take on to reach a net debt/EBITDA ratio of 3x, a threshold considered a red flag for indebtedness in the region. Krka, which has negative net debt due to its substantial cash holdings, could take on the most additional debt, exceeding EUR 2 billion.

Potential Additional Debt (EURm) to reach 3x EBITDA

Source: LJSE, InterCapital Research

We also examined the capital structure of the observed companies. Cinkarna Celje leads with virtually 100% equity, followed by Krka with 99.4%, Luka Koper with 84.1%, Petrol with 62.6%, and Telekom Slovenije with 61.5% equity in their financing structures. In the latest quarter, no major changes occurred in the capital structure of Slovenian blue chips.

Capital Structure of Select SBITOP Companies

Source: LJSE, InterCapital Research

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 17 | 26.7.2024 | WINE | Purcari ex-dividend date | Romania |

| 19 | 26.7.2024 | KOEI | Končar Q2 2024 Results | Croatia |

| 20 | 26.7.2024 | ADPL | AD Plastik Q2 2024 Results | Croatia |

| 21 | 26.7.2024 | EQNX | Equinox Q2 2024 Results | Slovenia |

| 22 | 29.7.2024 | HPB | HPB Q2 2024 Results | Croatia |

| 23 | 29.7.2024 | ARNT | Arena Hospitality Group Supervisory Board Meeting | Croatia |

| 24 | 30.7.2024 | ATPL | Atlantska Plovidba Audit Committee Meeting | Croatia |

| 25 | 30.7.2024 | ARNT | Arena Hospitality Group Q2 2024 Results | Croatia |

| 26 | 31.7.2024 | PETG | Petrol ex-dividend date | Slovenia |

| 27 | 31.7.2024 | SPAN | SPAN Q2 2024 Results | Croatia |

| 28 | 31.7.2024 | ATPL | Atlantska Plovidba General Assembly Meeting | Croatia |

| 29 | 31.7.2024 | ATPL | Atlantska Plovidba Q2 2024 Results | Croatia |

| 30 | 31.7.2024 | RIVP | Valamar Riviera Q2 2024 Results | Croatia |

| 31 | 31.7.2024 | SNP | OMV Petrom Q2 2024 Results | Romania |

| 32 | 31.7.2024 | TRP | TeraPlast Q2 2024 Results | Romania |

Due to the nature of these events, they are subject to change (might be postponed or canceled).