It is not a surprise that most of the wealth of an average Croat comes from home ownership. For today we decided to look at the extent of their wealth exposed to real estate and whether they are underexposed to financial assets, particularly stocks.

For this we used the data by the European Central Bank collected in The Household Finance and Consumption Survey.

Very High Concentration of Wealth in Real Estate

Let us start with the obvious – real estate. Unsurprisingly, Croatians have traditionally preferred home ownership to renting. To be specific, 86.9% of households in Croatia have real estate wealth, which includes household’s main residence and other real estate property. This is significantly higher than the Euro area (64.7%), while for example, in Germany only 49.9% of households have real estate wealth.

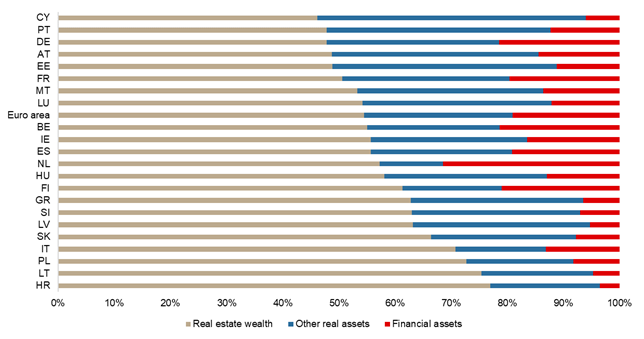

However, the fact that real assets account for 96.5% of total assets of Croatians could be seen as more startling. Of the total wealth, real estate wealth accounts for as much as 76.9%, by far the highest of 22 observed European countries. As a comparison, real estate wealth accounts for 54.5% of total assets in the Euro area.

Breakdown of Wealth by Asset Type (%)

Source: European Central Bank, InterCapital Research

Lowest % of Financial Assets Among 22 European Countries

An even more surpising fact is that Croatians have merely 3.5% of total assets in financial assets, by far the lowest of the observed countries, lower by as much as 15.6 p.p. than the Euro area. This is quite remarkable given the fact that financial assets do not only include shares, mutual funds, bonds etc. but also include sight and saving deposits, which we will touch apon further in the article.

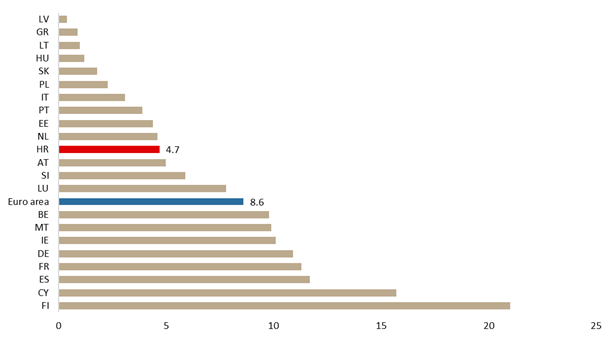

% of Households Owning Stocks

Source: European Central Bank, InterCapital Research

If we were to observe solely equities, 4.7% of total households own shares (publicly traded), which is quite lower than the Euro area (8.6%). In nominal terms, the median share ownership stands at EUR 2.1k, ahead of only Cyprus, Slovakia and Poland.

Breaking down by age groups, 6.9% of Croats between age 45 – 55 and 55 – 64 own shares, which are the highest age groups to own equities. On the flip side, only 0.2% of the youngest group (from 16 – 34) own shares.

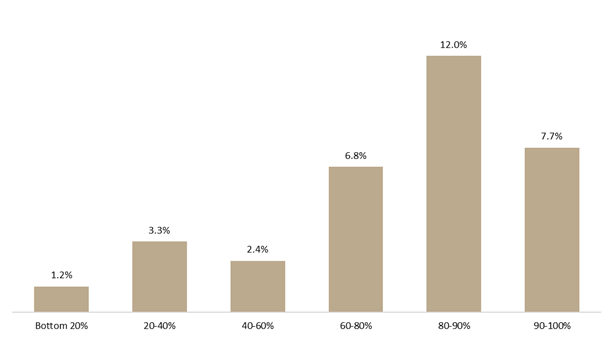

The data is not much better when looking at the wealthiest Croatians (90th percentile); 7.7% of them own shares, compared to 31.3% of the 90th percentile in Euro area. In terms of income, 8.2% of the highest earning Croats (90th percentile) own shares, compared to 25.4% in Euro area.

Turning our attention to mutual funds, only 1.4% of households are invested in mutual funds, ahead of only Cyprus and Latvia. Meanwhile, Euro area stands significantly higher at 10.2%.

% of Households Owning Stocks by Net Wealth

Source: European Central Bank, InterCapital Research

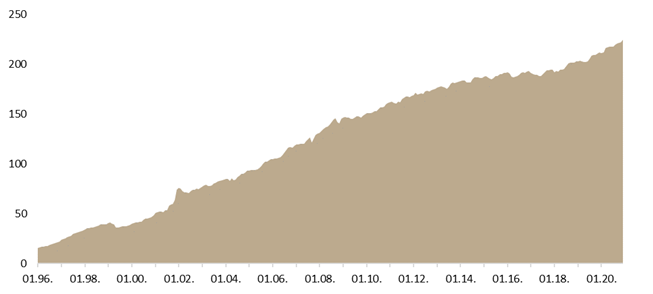

Croatians like to play it very safe – HRK 224.5bn in Deposits

According to Croatian National Bank, as of end 2020, households held HRK 224.54bn in deposits, representing an increase of 3.2% YoY and putting it on an all-time high. To put things into a perspective, this is larger than the current market cap of ZSE and LJSE combined. We note that looking at average deposits per capita would give us certainly a misleading figure, as according to ECB, top 46.6% of net wealth is concentrated among the top 10% of the wealthiest. However, the figure above indicates a relative unwillingness of the population to invest in even slightly riskier assets. Additionally, if we look at Croatian UCITS funds, their asset composition further backs the above-stated claim of Croats being quite conservative, as roughly two thirds of assets under management of all UCITS funds are related to bonds. As a comparison, in Slovenia, UCITS funds hold roughly the same percentage in equities.

Household Deposits (1996 – 2020) (HRK bn)

Source: HNB, InterCapital Research

So what does all of the above tell us? Well, it confirms quite a lot of popular beliefs, but, more importantly, it also shows the extent of untapped potential when it comes to a shift in wealth to financial assets, especially equities. With deposits and fixed income showing no yield, are Croatians going to dip their toes into equities? Time will tell.

Significantly lower than expected COR (62 bps – pre acquisition) and negative goodwill of KB acquisition (EUR 137m) led to a very strong bottom line performance of the Group.

NLB Group published their preliminary results according to which total net operating income amounted to EUR 504.5m, representing a 2% decrease YoY.

Profit before impairments and provisions amounted to EUR 210.5m, a mere 1% decrease YoY, supported by non-recurring income (the sale of NLB Vita and debt securities). Profit after tax amounted to EUR 268.9m (+38.95 YoY), strongly affected by the acquisition of Komercijalna banka, which had a net positive impact of negative goodwill in the amount of EUR 137.0m, and additionally established EUR 13.4m for expected credit losses on the performing portfolio for the Komercijalna banka group.

Excluding the impact of the acquisition, Group profit would amount to EUR 141.3m, representing a decrease of 27% YoY. Such a result significantly exceeded previous forecasts by the Group, mostly because of better-than-expected COR performance. We note that such a result is above our expectations as well, due to the same reason mentioned.

In total, NLB Group established impairments and provisions in the amount of EUR 71.4m, mostly related to the COVID-19 outbreak. The COR related to credit risk stood at 74 bps (NLB Group pre-acquisition 62 bps) – and was lower than guidance, mainly due to very solid asset quality trends in Slovenia and continuously successful NPL workout from legacy NPL stock. The Group applied very strict discipline to cost mitigation activities, driving costs down by 4% YoY, totalling EUR 293.9m and leading to a CIR of 58.3%.

CAR at 16.6%, with EUR 92.2m from 2020 profits already anticipated for dividend distribution, while excess capital above the regulatory requirement provides a robust basis for continued growth. Also important was the negative goodwill recognised in profits that is still subject to validation by the regulator prior to inclusion into the capital base.

The acquisition of Komercijalna banka Beograd at the end of December 2020 added EUR 4.3bn to the Group’s balance sheet, bringing NLB Group’s total assets to nearly EUR 20bn (EUR 19.6 billion).

We are very happy to see such a strong performance of the bank in very challenging times. The results are above our esimates and we find these quite supportive for the share price.

InterCapital remains dedicated to making investments into the region more attractive by supporting transparency and liquidity, and we thank our partners for supporting us in achieving this goal.

We are proud to announce that Končar Group renewed their Market Making agreements with InterCapital Securities.

Being a market maker means that InterCapital will continuously put both bid (buy) and ask (sell) orders on KOEI shares at a pre-defined spread. The idea is to enable investors to buy or sell the shares (up to a certain size) at any time within a reasonable volatility range.

InterCapital is already an established market maker in Croatia, covering 8 blue-chip companies, all part of the CROBEX index and 2 ETFs. According to our experience, the service accounts for a significant portion of the shares’ total turnover.

Besides that, in 2019, InterCapital reignited market making in Slovenia after 10 years, and currently provides the mentioned services to 5 Slovenian blue chips: Krka, Triglav, Petrol, Telekom Slovenije and Sava Re.

We are proud of having earned the company’s trust and will do our best to continue providing the best service possible.

To read more about the importance of market making click here.