On 9 July 2020, Krka announced another major share buyback program for which the company allocated a maximum amount of EUR 356.4m for a period of 36 months. As the leading brokerage in Croatia and Slovenia, we are proud to state that InterCapital is one of the brokers for this buyback. This is the first big share buyback program outside of Croatia in which InterCapital will participate.

We have decided to present you with a short analysis on bigger share buybacks we have a role in.

Usual reasons for a buyback:

- used to return cash back to its shareholders;

- the company wants to award their employees and management through stock rewards and option;

- the management deems that the stock is undervalued;

- the management wants to boost the company’s financial ratios (such as EPS);

- to prevent other shareholders from acquiring more shares (or a takeover).

Percentage of Larger Share Buybacks in Total Traded Volume in 2020 (so far) (%)

Source: InterCapital Research

When companies are run reasonably, the cash return decision comes as the final step in the process, meaning that the cash that they return to shareholders, through dividends or buybacks, should reflect a residual cash flow. Such buybacks are another way of returning cash to their shareholders, without impacting “good” investments (that make more than their hurdle rate).

Furthermore, buybacks can be helpful in a low liquidity environment. In such an environment, the investors bear the risk of not being able to sell their shares at a given point, as there are not many buyers at every point to buy the shares (at least at the market price). Buybacks can help reduce that risk as they add additional bids. Next, note that share buyback can be more beneficial from a tax perspective for certain investors. Besides that, share buyback is usually a strong signal from the management that the share is undervalued.

Share Buybacks in the Region

A company’s dividend and buyback policy to a certain extent reflects the confidence to generate projected earnings and cash flows. Therefore, if companies lack or reduced their confidence of generating their projected earnings, they might revisit their dividend policy, reduce the dividend payment or stop buybacks. The Covid-19 outbreak has definitely had a negative effect on most companies projected earnings, which in turn led a halt in buybacks and dividend payments for many companies in 2020. However, in 2020 despite the Covid-19 pandemic, there were a couple of regional companies which paid out a dividend, continued a buyback program or did both.

As visible on the graph above, Atlantic Grupa had the highest percentage of share buybacks in total traded volume so far in 2020 (23.2%). The buyback was done with the purpose of remuneration of the company’s employees and it accounted for 0.5% of the company’s total shares issued. Besides that, the company decided to payout a dividend of HRK 25 per share (DY: 2.1%) which you can read more about here.

Adris pref. follows with 20.1%, while the buybacks accounted for 1.2% of total shares issued, which is the highest of all observed companies. HT comes next, with 17.8%. The company also decided to pay a dividend of HRK 8 per share (DY: 4.5%).

Krka’s buyback accounted for 12.2% of the total traded volume so far this year. As a reminder, on 9 July 2020 AGM authorized the Management Board for the acquisition of treasury shares in the maximum number of 1,844,372. The maximum pecuniary amount allocated to the program is EUR 356.4m, while the duration of the program is 36 months. We note that the new buyback program is a continuation of an already conducted buyback in 2020.

It is also worth noting that this year Krka paid out a dividend of EUR 4.25 per share, translating into a quite attractive dividend yield of 5%. Note that the company has been paying out each year a higher dividend than the one paid for the previous year; while in 2020 the dividend was 32.8% higher than the one paid out in 2019. In H1, Krka was one of only two SBITOP constituents which observed a net profit increase (+15% YoY). Such solid results coupled with the high cash returns seen already in 2020 indicate that Krka has full confidence to generate the projected earnings and cash flows for the following periods.

Looking at the past couple of years on the Croatian and Slovenian market, one can notice that not many companies were performing share buybacks, at least not on a significant level. In these markets, companies still prefer paying out dividends over buybacks, as a way to return cash back to their shareholders. Contrary to the regional market, in the United States, share buybacks are preferred to dividends. When observing the S&P 500 companies since 2000, they have almost always returned more to their shareholders through buybacks than through dividends.

Shares Bought Back in 2020 Compared to Total Shares Issued (%)

Source: InterCapital Research

With the shares’ selling price agreed at RON 0.33 per share, the gross proceeds of the transaction amount to RON 561m.

Following up on Fondul Proprietatea announcing ABB offering for roughly 1.4bn shares in OMV Petrom, the company ended up announcing the agreement to sell 1.7bn existing shares in OMV Petrom by the accelerated bookbuild offering.

With the shares’ selling price agreed at RON 0.33 per share, the gross proceeds of the transaction amount to RON 561m. Note that represents a discount to market price of 5.4%. Subject to successful settlement completion, the Fund’s remaining participation in OMV Petrom is of 6.9973% of its share capital.

As a reminder, OMV Petrom will not receive any proceeds from the transaction.

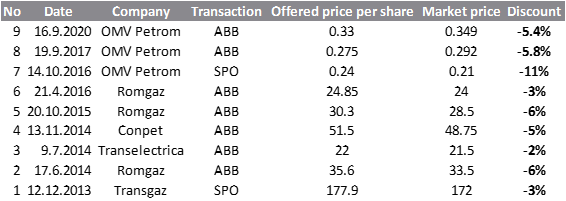

Overview of Transaction Discounts

Source: InterCapital Research