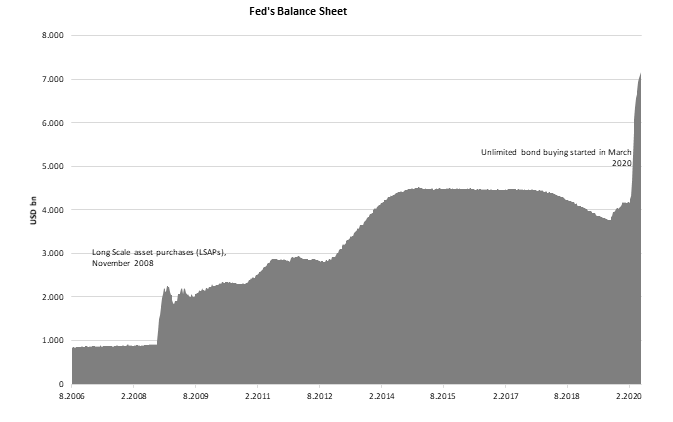

Last week Fed published interest rate projections that showed Fed fund rates should stay close to zero for the next two years. However, markets went risk-off due to fear of second wave of corona virus in China and rise of cases in biggest states in US. After equity indices corrected by 10%, Fed stepped in again saying that it will start buying individual corporate bonds and make its own fund, giving markets another injection of optimism which tightened spreads and pushed equity markets closer to their highs.

One week ago, the Fed left its policy unchanged but published its interest rate projections which show that most of the officials expect fed fund rates to stay at their bottom for the next two years and even beyond. Furthermore, analysts which hoped yield curve control could be introduced were not disappointed as Fed’s governor Jerome Powell stated that there was some discussion on yield caps. Until that day, June 11th markets have been skyrocketing with SPX jumping above 3200 levels, being in green YTD. However, fear of second wave in China and acceleration of new cases in Texas, California and several other states in US pushed investors into risk-off sentiment once again. On that day, major US equity index fell by almost 6.0% with 499 out of 500 stocks being in red while on Monday we have seen another round of selling as news from China and US worsened further. But on Monday Fed stepped in again.

On Monday, FED announced it “will begin buying a broad and diversified portfolio of corporate bonds to support market liquidity and the availability of credit for large employers”. In short, they will start buying individual corporate bonds (under its SMCCF program) with maturity of up to 5 years that are investment grade or being investment grade on March 22nd (fallen angels). SMCCF (Secondary Market Corporate Credit Facility) is one of 11 facilities that Fed uses to provide liquidity and stabilize prices and was already introduced in March when Fed stated that it will start buying corporate bond ETFs. Now the only change was that it will also create its own portfolio of individual bonds. When asked about corporate bond buying, Mr Powell said that “I don’t see us wanting to run through the bond market like an elephant snuffing out price signals”. Nevertheless, that was signal for market to go bullish once again, resulting in equity indices recovering from their recent correction.

On top of that, in his semi-annual testimony before US Congress, Mr Jerome Powell stated that Fed officials were looking into details on Reserve Bank of Australia and BoJ which implemented yield curve controls. Just to put things into perspective, BoJ had yields capped even before corona while RBA targets yield on 3-year Australian government bond at 0.25% with cash rate being at the same level. Bearing that in mind, Mr Powell said that Fed still did not decide to choose this tool but indicated that they might use it on some part of the curve if needed. That statement further strengthened Fed’s forward guidance provided on their meeting last week. Going on, Fed’s governor Clarida in his speech said that aggregate demand will decline relative to aggregate supply in near and medium term meaning that deflation trend could continue.

To sum it all, Fed continues with extremely loose monetary policy and its unconventional tools although we have seen some recovery in economic data. As recovery accelerates Fed could decrease number of used tools but in case of another wave and economic shutdown, more policies could be involved. Markets ask what is next? If they will be following Japan, equity buying is close.

Source: FRED, InterCapital

According to market indicators, total data traffic increased by 39.4% YoY in Q1, to a total of almost 500 petabytes, while in March, the realized data traffic increased by 62%.

Croatian Regulatory Authority for Network Industries (HAKOM) published an announcement regarding the Q1 data traffic in Croatia. HAKOM states that in the Q1 of 2020, the electronic communications market was affected by the changed working conditions caused by the COVID-19 epidemic. Work from home and teaching activities were mainly maintained via the Internet and, as expected, compared to the same period in 2019, the total data traffic and the number of minutes in the telephone mobile network grew.

According to market indicators, total data traffic increased by 39.4%, to a total of almost 500 petabytes, while in March, the realized data traffic increased by 62%. HAKOM adds that further growth is expected in the Q2 of this year. in Q1 2020 land line data traffic increased 21% YoY, while mobile data traffic that amounts to 28% of total traffic has increased 132% YoY.

The total number of outgoing minutes in the mobile network increased by 17% YoY. The total number of outgoing minutes in the mobile network is higher by about 11% QoQ, which differs from previous trends because in the last quarter of the year there is usually higher traffic due to the holidays. In the Q1 of 2020, there was no decline in roaming revenues due to the shorter period during which the borders were closed.

Of the broadband connections in the fixed network, the number of connections via fiber optic access technology continues to increase the most. More than 38% of users in the fixed network access the Internet at speeds greater than 30 Mbit / s, or over 11% at speeds greater than 100 Mbit / s. The number of 4D package users is still growing and in Q1 2020 growth has amounted to 22.1% YoY.

In Q1 total revenue in the electronic communications market decreased by 3.7% YoY. Despite lower total revenues, revenue growth was achieved in the broadband Internet access market by 2.9%, as well as in the pay-TV market for almost 4% YoY.

As Telekom Slovenije went ex-date yesterday, we are bringing you a brief overview of the company’s historical dividends, dividend yields and share price performance on ex-date.

As a reminder, the shareholders approved the proposal for the use of distributable profit, which amounted to EUR 30.2m in 2019. The shareholders approved the proposal to allocate EUR 22.8m for paying dividends, which amounts to EUR 3.50 gross per share, while the remainder in the amount of EUR 7.4m shall be carried over to the following year.

In the graph below you can see the historical overview of the company’s dividends and dividend yields.

Telekom Slovenije Dividend per Share (EUR) & Dividend Yield (%) (2010 – 2020)

Also, in the graph below, one can observe the historical movement of the share price on ex-date. As visible, the share price dropped by 4.44% yesterday (lower than its dividend yield), closing at EUR 47.4 per share. At the current share price, the company is traded at EV/EBITDA of 3.4.

Share Price Reaction on Ex-date vs Dividend Yield (%) (2015 – 2020)

At the current share price dividend yield is 9.9%. Ex-date is 3 July 2020.

Cinkarna Celje published the resolution of the GSM in which the shareholders approved the proposed the distribution of 2019 net profit. The company approved a dividend distribution of EUR 13.54m, which translates into EUR 17 dividend per share. Such a dividend per share is 40% lower compared to the one paid in 2019.

At the current share price dividend yield is 9.9%, while ex-date is 3 July 2020.

In the graphs below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.

Dividend per Share (EUR) and Dividend Yield (%) (2012 – 2020)

As a reminder, the company’s management board initially announced a dividend proposal of EUR 10.51m, which translates to a dividend of EUR 13.2 per share.