In today’s blog, we bring you part II of our analysis of the challenges that the Zagreb Stock Exchange faces in terms of liquidity, and more specifically, the possible solutions.

To give a quick recap, the main challenges that are affecting the liquidity on the ZSE are: Firstly, a continual reduction in total and equity turnover throughout the years, stemming from the reduced number of listed companies (either delistings or takeovers), and the lower number of overall trades. Secondly, there is a lack of incentives for large in scale private companies to do an IPO on the ZSE as compared to doing IPOs on foreign exchange markets where they can attract a lot more capital, and get better valuations, especially in the tech sphere. At the same time, we have a lack of new listings of government-owned companies. Next up, we have issues related to the current legal, or rather, transparency/ investor relations framework, as well as the current capital gains structure. Finally, there is a lack of domestic retail investor participation in the exchange, as Croats are still mainly real estate investors. All of these issues are described in more detail in part I of our blog. If you would like to read more about this, click here.

Now we will try to provide some of the possible solutions to these issues. It should be noted that due to the fact that the stock exchange is an interconnected market in which changing one thing does not only have an impact on the thing that the change is aimed at, but rather a domino effect on multiple systems of the exchange. This, however, does not have to be negative, as improving one factor might help alleviate some of the problems related to other issues. Due to the complexity of the issues, we decided to present the solutions as both short-term and long-term. Due to their nature, some of the solutions will overlap in both of these categories. Let’s start with the short term.

Short term solutions

Out of all the possible short-term solutions, the one that comes to mind first is the capital gains tax, which is payable in case of gains made on stocks, within the 2-year holding period. Even though the tax itself is something that a lot of countries around the world have implemented, combined with ZSE’s low liquidity, it only reduces incentives to invest or divest, thus further reducing liquidity. There are several options on how to make this system work better. The first one which could be implemented, and this is something that has already been done in European countries is the so-called ISA (Individual Savings Account). This refers to accounts in which a resident can invest up to a certain amount of EUR (for example, 20,000) into stocks, shares, deposits, UCITS Funds, or several other forms of financial investments. The reason these accounts are special is that they do not have to pay any capital gains or dividend tax on investments. This can allow individual investors to use stocks as a form of saving, without having to worry about a tax that will reduce their earnings. At the same time, this can also incentivize more daily trading of stocks (even though there still are transaction fees), which by extension, would lead to higher liquidity. Another possible solution would be, of course, the abolition of the capital gains tax altogether.

The second thing that could be done in the short-term (or rather started in the short-term), is improving the overall investor relations and transparency framework. This is particularly important for foreign investors who have numerous possibilities and markets to invest in, and thus we need to further improve the standards and engage investor relation teams to have those investors invest in Croatia. Otherwise, money will flow to other larger, more liquid frontier and/or emerging markets. In terms of transparency, increasing the requirements for listing on the stock exchange could also be helpful, even though it would surely lead to some companies getting delisted. Is this a bad thing though? We could look at some other regional exchanges for an answer. For example, if we look at Ljubljana Stock Exchange, we can see that it is a solid example that a higher number of listed companies does not equate to higher liquidity or a more efficient market, as it only has a fraction of listed companies as the ZSE does, but still maintains higher overall liquidity and turnover.

The third thing that can be done in order to improve the liquidity on the exchange is promoting new IPOs. Considering the paradox we saw in part I of this blog, where ZSE needs new IPOs to increase liquidity and the overall attractiveness of the exchange, while issuers need wider reach to educated investors such as the NYSE or the London Stock Exchange. We find that in order to attract large-scale IPOs domestically, we firstly need an IPO/listing of Government-owned large caps, something that we can also see an example of in one of our regional peer exchanges – Romania, in which the government listed Fondul Proprietatea. A similar strategy can help bring in new international investors, slowly push Croatia towards Emerging market status, and then, in the years to come, ZSE might have a real chance at having some of the new “champions” choose ZSE over foreign markets.

The last thing that can be started in the short-term is promoting retail investor education, through various programs. Considering that Croatia has such low participation in equity investments (Croats only hold 0.16% of all assets as stocks), programs launched by the exchange, or/and by the government could start to have a positive impact on the liquidity of the exchange. One of these programs could be the aforementioned investor saving accounts.

Long Term solutions

In the long term, more improvements to the legal framework should be implemented, especially after Croatia joins the Eurozone. It should be noted that the Croatian National Bank already does a good job when it comes to keeping the EUR/HRK exchange rate stable, so investing right now in Croatia for a foreign investor isn’t difficult. However, with the approval of Croatia’s ascension into the Eurozone, some transactional costs will be mitigated, exchange rate risks will be removed, and Croatia’s credit rating will look even better (something that we can already see as Fitch, S&P Global, and Moody’s have upgraded Croatia’s credit rating last week) Combined with higher transparency and better adoption of the international financial reporting standards, as well as higher availability of financial reports in English, this should make investing in Croatian equity less “risky” and more attractive to foreign investors.

The next thing that could be done is in regards to both the retail and institutional investors. When it comes to retail investors, there should be more educational programs to show the various benefits of investing in the stock market. This should be done through as many avenues as possible, i.e. through the stock exchange itself, in universities and in high schools through curriculums that focus on financial knowledge, and through newsletters informing the older citizens on the benefits of investing. In general, and unfortunately, the level of financial investing knowledge in Croatia is pretty low, especially when it comes to investing in other forms of assets besides real estate, the most popular type of investment in the country.

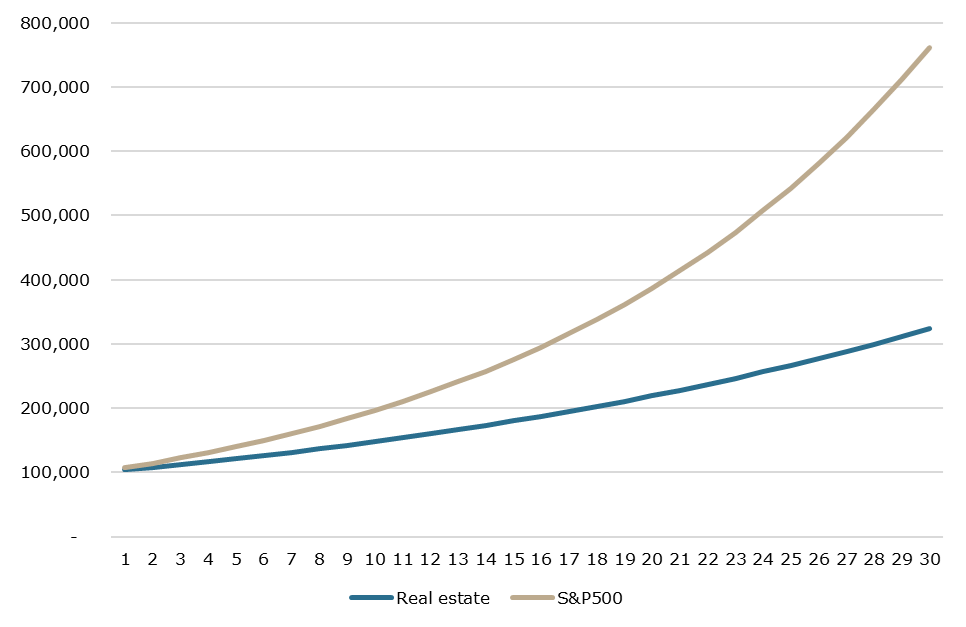

Considering the traditionally low investment volumes of Croatian retail investors into financial assets, and likewise, the tradition of investing in real estate as a form of investment, one has to ask themselves, why is this, and is this an investment that brings the best return? Let’s start with the why. The current real estate tax system in Croatia favors investments in this type of asset. Combined with the tradition of investing in these forms of assets, you get a lot of retail attraction towards them. But are they really the best form of investment? Let’s look at an example. On average, the overall return on a real estate asset is app. 4% yearly. If we compare that to investing in stocks, and in this case, let’s look at one of the most popular types of investment in the world, i.e. investing in the S&P500 index, of which the yearly return is on average, 7%, right away we can see the difference in returns. Let’s also estimate that this is an investment of EUR 100,000 (which is also one of the downsides of investing in real estate, as they require way higher amounts of capital to even get into). With all of that out of the way, let’s see how these compare over a longer time period, say 30 years.

Comparison of returns over a 30-year time period into real estate (4% yearly), S&P500 (7% yearly), (EUR)

Source: InterCapital Research

As can be seen from the graph, the difference is pretty profound. In particular, after 5 years, the investment into S&P500 yielded a 15% higher return than real estate. After 10 years, it yielded 33% higher returns. After 20 years, it yielded 77%, and after 30 years, it could lead to a 135% higher return. If we take into account the aforementioned fact that investing in real estate requires higher amounts of capital, while investing in stocks does not, the current hypothesis that investing in real estate makes more sense isn’t that viable.

There are also some things that institutional investors, and especially the pension funds (which play a crucial role in the Croatian equity market) could do. According to the latest report by the Croatian Financial Services Supervisory Agency, in May 2022, the 3 available categories of pension funds (A, B, and C), invest 55%, 34%, and 32% of their NAV into stocks, respectively. We find that pension funds could and should have an option to allocate more into equity positions. Furthermore, a larger push needs to be put in place for the general population, especially the younger ones, to choose or transfer their savings into the A category.

Finally, there are some solutions that are proposed at the EU level, such as the one for a capital markets union. Even though this is just in the planning phase, the core of the idea is providing a single market for capital across the EU, on which companies’ across the continent would be listed. This would by itself allow Croatian companies higher exposure to international investors, and as such would help with the liquidity issue. Unfortunately, no concrete details are currently available for this plan, and as the current macroeconomic situation is requiring a lot more focus on maintaining the growth of the EU and weathering the inflation shocks, ideas like this one are unlikely to be implemented at this time.

All in all, these are some of the possible solutions to the liquidity issues that ZSE faces. Most of these could be implemented individually, but implementing them together (and starting as soon as possible) could really get the ball rolling and improve the overall capital market situation in Croatia.

Moody’s upgraded Croatia’s foreign and domestic currency long-term issuer rating and foreign-currency senior unsecured debt rating to Baa2 from Ba1 with a stable outlook.

On Friday, Moody’s upgraded Croatia’s rating, following Fitch’s and S&P Global Ratings upgrades. Moody’s upgraded domestic currency long-term issuer rating and foreign-currency senior unsecured debt rating to Baa2 from Ba1 and upgraded Croatia’s outlook to – “stable”.

The agency said the upgrade of the rating to Baa2 is driven by the adoption of the legal acts formalizing Croatia’s adoption of the euro. As a reminder, Croatia will adopt the euro as its domestic currency on 1 January 2023. As a result, foreign currency risk for the government’s euro-denominated debt will be eliminated and government liquidity risk will be reduced. This is notable as Croatia’s share of government debt is currently over 70% denominated in euros. This has a significant positive impact on Moody’s assessment of the government’s fiscal strength as it eliminated the risk of a sudden and potentially significant increase in the local currency value of government debt relative to GDP, as a result of the potential devaluation of the local currency relative to the euro.

The agency also commented it sees Croatia’s euro adoption as credit positive for Croatia’s economic strength as it will remove both foreign currency risk and transaction costs from the private sector, encouraging further economic integration of Croatia with the euro area. Also, the ability of the country’s institutions to complete the rigorous process toward euro adoption within the planned time frame is seen as supportive of the strength of Croatia’s institutions and governance. Furthermore, Croatia’s adoption of the euro will also reduce foreign currency risks for the banking sectors and will have a positive impact on external vulnerability risks. As a euro area member, Croatia would in a future crisis stand to benefit from potential ECB support programs such as the asset purchase programs.

Stable outlook, as the agency said, was achieved by balancing the continued strength of Croatia’s economic and fiscal recovery from the initial shock of the coronavirus pandemic against risks of the macroeconomic and geopolitical environment in Europe, arising from boiling inflation and energy supply shock as a result of the Russian invasion of Ukraine.

The rationale for the stable outlook upgrade was Croatia’s strong recovery from the sharply negative impact of the coronavirus pandemic on the country’s tourism sector and overall economy in 2020. In the agency’s baseline scenario, Moody expects GDP growth to remain robust at 3% in 2022 with the debt burden continuing to decline at a more moderate pact.

The long-term country ceilings of Croatia for local and foreign currency bonds have been raised to Aa2 from A2. This increase reflects all benefits from the euro area’s strong common institutional, legal and regulatory framework, liquidity support, and other crisis management mechanisms.

Standard & Poor’s Global Ratings raised its long and short-term foreign and local currency sovereign credit ratings on Croatia to ‘BBB+/A-2’, with a stable outlook.

Following Fitch’s announcement of an increase to Croatia’s credit rating, Standard & Poor Global Ratings is the second agency to upgrade Croatia’s rating ahead of schedule. This would mean that Croatia’s short and long-term foreign and local currency sovereign credit rating has been raised from ‘BBB – /A-3’ to ‘BBB+/A-2’, with a stable outlook.

The agency said that the stable outlook reflects their expectation that Croatia’s economic growth would remain consistent over the coming two years, despite the inflationary pressure and the economic consequences of the current Russia-Ukraine conflict. They also expect the government to remain committed to the reform program, receive significant EU financing, and gradually rebuild the fiscal space lost in the aftermath of the pandemic.

The agency also commented on the potential for upgrades or downgrades to their rating. In terms of receiving an upgrade, the agency considers it plausible if Croatia’s economic growth accelerates beyond the agency’s current expectations, which would lead to an increase in economic wealth. In this case, fiscal consolidation and declining net general government debt is expected. Further European integration for Croatia, for example, through institutional improvements, within the judiciary, education, and business environment could also lead to an upgrade.

On the flip side, a downgrade could be considered if there is a considerably weaker fiscal position and structurally weaker economic growth than what the agency projects. This could come from the prolonged conflict in Ukraine, which would have increasingly severe pan-European economic consequences, or if there is a complete half of the European energy supply, which would surely increase the risk of a recession throughout the continent. Finally, high levels of emigration and an aging population represent a long-term risk to Croatia’s growth and public finances.

Moving on, the agency commented on the benefits of from ECB’s monetary policy.

According to the agency’s analysts, Croatia as a member of the eurozone will benefit from the monetary policy flexibility of the ECB, while the foreign exchange risks will decline in the heavily euro-based economy. Economic prospects are also positive if we consider the strong estimated tourism flows and solid near-term execution of EU-funded investments. At the same time, the agency considers that Croatia has a limited direct dependence on Russian hydrocarbon imports, especially because of the recent expansion of the Krk LNG terminal and advanced sea-borne oil supply substitution.

The accession should also eliminate any remaining exchange rate risks in the heavily euro-based economy, where about 75% of the banking sector assets and 67% of liabilities are denominated in euros. This will also reduce the foreign currency risks on the government’s balance sheet, which should in turn reduce Croatia’s share of govt. debt denominated in foreign currency from app. 70% to close to zero (it should be noted that even now, this debt is exclusively denominated in euros).

There were also comments on the growth projection, which got revised to 3.5%.

The agency revised its growth projection for the Croatian economy in 2022 from 2.5% to 3.5% on the back of resilient dynamics in H1 2022 and the expected strong tourism season, on par with pre-pandemic levels. In the medium term, the agency expects Croatia’s economy to settle on a solid growth path, backed by investments supported by EU financing and rebounding tourism. At the same time, the repercussions from the Russian invasion of Ukraine and inflationary pressures represent risks to the forecast. There are also some pandemic risks, as less than 60% of Croatia’s population was fully vaccinated against COVID-19, (as of 7 July 2022), compared with the EU average of 76%.

The agency also commented on the average inflation forecast for 2022, which currently stands at 8%.

This is due to the fact that the Russia-Ukraine conflict has added pressure on energy prices, which will have a strong impact on Croatia’s inflation outlook for 2022. The agency expects a considerable increase in inflation, with the CPI averaging at 8%, due to rising energy prices, increasing wages, and rising hospitality sector costs.

Lastly, S&P projects general govt. deficit at 3% of GDP in 2022. As the govt. has already introduced subsidy schemes to alleviate price pressures on fuel and energy, which will add 1.1% of GDP to the expenditure bill. Considering the current energy crisis, additional govt. subsidy schemes might be required in the 2nd half of 2022.

The highest growth in the CPI was recorded in transport prices, which increased by 20.3%, followed by Food and non-alcoholic beverages, which grew by 16.9%, and Restaurants and hotels, which increased by 14.6% YoY.

The Croatian Bureau of Statistics has published the monthly report on the developments of the Croatian CPI (Consumer price indices) for June 2022. Looking at the MoM data first, the prices of goods and services for personal consumption, increased by 1.1% on average. On a YoY basis, the CPI increased by 12.1% on average, while on the annual average it grew by 6.2%. The 12.1% YoY growth in the CPI marks one of the largest increases ever recorded in Croatia and continues the trend of increasing inflation that has started in the 2nd half of 2021.

CPI (January 2013 – June 2022, %)

Furthermore, if we were to look at the biggest contributors to this increase on an annual level, it was recorded in the following segments: Transport prices, which grew by 20.3% YoY, Food and non-alcoholic beverage prices, which increased by 16.9%, Restaurant and hotels, which grew by 14.6%, Furnishings, household equipment, and routine household maintenance, which increased by 11.7%. The story does not get better the further along we go, as all significant remaining categories recorded an increase in prices of over 5%, with Housing, water, electricity, gas, and other fuels growing by 9.6%, Clothing and footwear growing by 11.1%, Recreation and culture by 8%, and finally, Miscellaneous goods and services by 7.2%.

Even though there has been a steady increase in inflation over the last couple of months, this month’s increase is profound as it recorded growth in inflation across all categories and growth that is not insignificant. The increase in transport and food prices is particularly significant, and even though these were the main drivers of the inflation since it started spiking in late 2021, a 20.3% and 16.9% increase YoY is considerable. Taking into account the gradual embargo of the Russian oil imports into the EU during 2022, as well as the current war in Ukraine threatening food supply, especially when it comes to wheat, sunflower, and other similar food, if the situation does not resolve itself, it is expected that inflation will only continue growing. We note this is the second consequent month of double-digit annual increase in prices and we can say we expect this trend to subside towards the year end in order for us to have single digit inflation growth in 2022.

At the same time, the increases across other categories mean that all industries are affected, something that has thus far proven not to be the case, at least not significantly. It should also be noted that the 3rd largest increase recorded, Restaurants and hotels can be attributed to the fact that the pandemic-related measures are completely gone. As June is usually considered „pre-season“ for Croatian tourism, and with high expectations for a good summer season with increased bookings similar to (or higher than) 2019, the growth in this category is also expected.

Taking a look at the largest contributors to the growth rate on the annual basis, Food and non-alcoholic beverages contributed 4.38 p.p., Transport 2.99 p.p., Housing, water, electricity, gas and other fuels 1.62 p.p., Furnishings, household equipment and routine maintenance contributed 0.74 p.p., Restaurants and hotels 0.73 p.p., while Clothing and footwear 0.65 p.p.

At the monthly level, the highest increase was recorded in Restaurants and hotels (+3.5%), followed by Transport prices (+2.1%), Recreation and culture (+1.8%), Food and non-alcoholic beverages (+1.7%), Furnishings, household equipment and routine household maintenance (+1.3%).

CPI change by categories – June 2022 (YoY, %)

Finally, looking at the CPI by selected groups, Goods increased by 14.5% YoY, Services by 5.3%, Energy by 22.2%, and Food, beverages and tobacco by 14.3%. The total increase without energy was 10%, while without energy and food, it was 7.1%.

Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 10 | 22.7.2022 | ERNT | Ericsson NT Q2 2022 Results | Croatia |

| 11 | 22.7.2022 | PODR | Podravka Q2 2022 Results | Croatia |

| 12 | 25.7.2022 | TRP | Teraplast Q2 2022 Results | Romania |

| 13 | 25.7.2022 | ATPL | Atlantska Plovidba Audit Committee Meeting | Croatia |

| 14 | 26.7.2022 | TRP | Teraplast Q2 2022 Results Conference call | Romania |

| 15 | 26.7.2022 | ATPL | Atlantska Plovidba Board of Directors Meeting | Croatia |

| 16 | 27.7.2022 | ADPL | AD Plastik Q2 2022 Results | Croatia |

| 17 | 27.7.2022 | ARNT | Arena Hospitality Group Supervisory Board Meeting | Croatia |

| 18 | 28.7.2022 | KOEI | Končar Q2 2022 Results | Croatia |

| 19 | 28.7.2022 | HT | HT Q2 2022 Results, Investor & Analyst Conference Call | Croatia |

| 20 | 28.7.2022 | ATGR | Atlantic Grupa Q2 2022 Results | Croatia |

| 21 | 28.7.2022 | SNP | OMV Petrom Q2 2022 Results | Romania |

| 22 | 28.7.2022 | SNP | OMV Petrom conference Call - Q2 2022 Results | Romania |

| 23 | 28.7.2022 | ARNT | Arena Hospitality Group Q2 2022 Results | Croatia |

| 24 | 28.7.2022 | DIGI | Digi update of the 2021 Annual report | Romania |

| 25 | 29.7.2022 | TLSG | Telekom Slovenije Ex-dividend date | Slovenia |

| 26 | 29.7.2022 | ATPL | Atlantska Plovidba Q2 2022 Results | Croatia |

| 27 | 29.7.2022 | RIVP | Valamar Riviera Q2 2022 Results | Croatia |

| 28 |

Due to the nature of these events, they are subject to change (might be postponed or canceled).