On Tuesday a weak ZEW reading at 11:00 CET caused Bund futures’ price to move up slightly and this is the patter observable on other fixed income instruments as well, i.e. weak macro data = higher fixed income prices. To see why this is happening and which indicators might bring about more market volatility, skim read this research piece.

Last week’s ECB minutes were in the same tone as Draghi’s Sintra speech but were much less dovish than some expected. First of all, the ECB Governing Council foresees euro area HICP @ 1.2% in 2019, 1.4% in 2020 and 1.6% in 2021; this is a bit far from the 2.0% goal and would warrant possible actions from the Frankfurt-based institution. The expected inflation rates were changed last time at GC meeting in March, but in June even the Council had to acknowledge that inflation trend is considerable diverging from the target. Of course, this is the macroeconomic basis for the introduction of more monetary easing. The ECB minutes mimic almost everything Draghi already said in Sintra, expect for one thing: the speech in Portugal was unequivocal about the need to act, while the ECB minutes state that the need to act would be linked to further downside surprises. Nevertheless, the minutes do state that all of the tools would be used to counter weak growth and inflation, if needed.

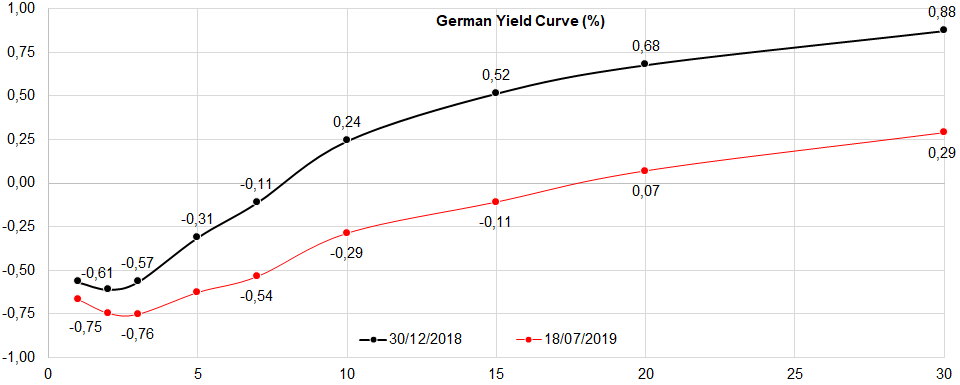

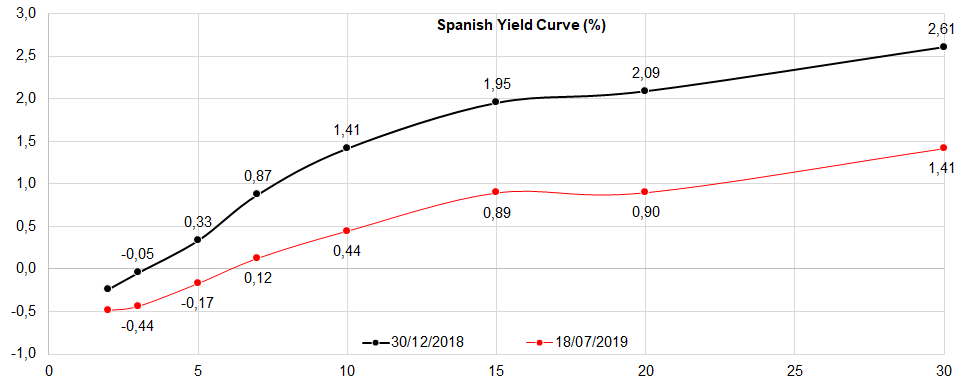

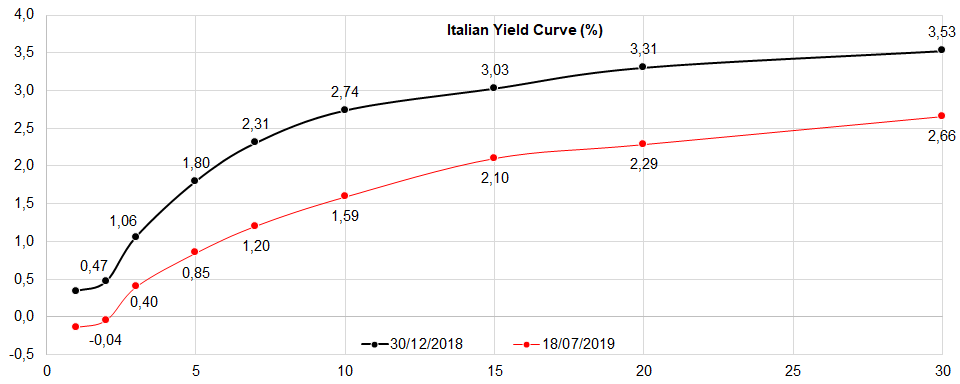

Even though the ECB Governing Council delivered a watered-down version of determination expressed in Sintra, still the wording was dovish enough to continue moving the European yield curves further to the South. Veteran traders would notice one more thing on the three charts submitted: all of them bull flattened YTD.

For instance, watch the 2Y10Y spread on all three of them: in case of Germany, since the beginning of the year the spread contracted from 85bps (0.24% -(-0.61%)) to 46bps (-0.75% -(-0.29%)); in case of Spain from 146bps (1.41% -(-0.05%)) to 88bps (0.44% -(-0.44%)), and finally, in case of Italy from 227bps (2.74% – 0.47%) to 163bps (1.59% -(-0.04%)). The bull flattening played out against the backdrop of political tensions between Brussels and Rome over Italian fiscal deficit and travails over government formation in Spain (repeated elections in fall are the likeliest scenario). Also, the flattening might be an indication that markets are expecting PSPP to be reactivated all over again since this particular instrument targets long term yields in particular.

Can the trend continue? Well, so far the European data conveyed a bleak macroeconomic blueprint which would warrant support from the monetary policy in order to sustain growth. Mr. Draghi mentioned in Sintra that so far the burden of ensuring macroeconomic growth and keeping euro area in one piece have been disproportionately placed on the shoulders on monetary policy (while fiscal stimulus hasn’t been used in appropriate magnitude) and so far the selection of officials who would be running the key European institutions indicates that the long term direction of European policies would not be changed significantly. This means that it’s up to ECB to once again save the economy and there’s only one way to do it – asset purchase. This is exactly what market is expecting in the midst of weak inflation and increased downside risks to the economic growth. The notion would be further reinforced should the economic data continue to deteriorate and for that keep an eye on German GDP data published on August 14th, 8:00 CET.

The rating is two steps above the one previously granted, putting it at Romania’s rating.

Transgaz published a document stating that the Fitch assigned the company a Long-Term Issuer Default Rating (IDR) of ‘BBB-‘ with a Stable Outlook. This would mean that the rating is two steps above the rating previously granted, putting it at Romania’s rating.

Fitch states that Transgaz’s BBB- rating mainly reflects its solid business profile as a concessionaire and operator of the gas transmission network in Romania as well as the expectation of a progressive contraction of international gas transit business deriving from traditional routes. The rating is supported by the country’s regulation for gas transmission and our expectation that a significant current investment related to the Bulgaria-Romania-Hungary-Austria corridor (BRUA) will be added to Transgaz’s regulated asset base (RAB), supporting future earnings.