The transaction was concluded for an undisclosed amount. Following the transaction, the market share of the Petrol Group in Croatia will increase from 13% to 23%.

Petrol has announced on Friday that they have acquired a 100% interest in the company CRODUX DERIVATI DVA (Further: CRODUX). The deal was signed on 12 January 2021 with the seller, Mr Ivan Čermak. The transaction will be completed following the fulfilment of suspensive conditions, which include obtaining approvals from the relevant competition authorities.

The mentioned transaction was concluded for an undisclosed amount.

As a result of taking over CRODUX, Petrol Group will acquire 91 service stations. With over 200 points of sale, the market share of the Petrol Group in Croatia will increase from 13% to 23%.

The core business activity of CRODUX comprises import, storage, retail sale and wholesale of petroleum products in the Republic of Croatia. It has more than 1,150 employees and operates 91 service stations.

The acquisition of CRODUX is the largest transaction of Petrol in the past 10 years and represents the most significant one-time increase in the number of points of sale in the Group’s history.

In 2019, the company generated HRK 5.637bn or EUR 760m in sales revenue, with its net profit amounting to HRK 142.9m or EUR 19.3m. The company’s 2019 EBITDA amounted to HRK 316.5m or EUR 42.7m.

Note that Petrol is currently traded at EV/EBITDA of 6.5. Assuming a slightly higher multiple of 7 the transaction would imply EV of app. EUR 300m (considering 2019 results). Given that as of 2019 CRODUX operated with HRK 1.1bn (EUR 145.5m) of net debt this would also imply equity value of EUR 154.5m.

Further investing in widening of its service station network would substantially increase Petrol’s position on the market, so we see the aforementioned as supportive for the share price.

To read about Petrol’s Plan and Key targets for 2021 click here.

Petrol adds that there is still potential for the segment of selling petroleum products and merchandise, which accounts for the largest part of the Petrol Group’s EBITDA, to grow in the coming years, especially in the wider region of SE Europe.

The acquisition of CRODUX is consistent with the existing strategy as well as with the basis for developing a new Petrol Group strategy. The decision was taken also in the light of the fact that the Croatian market is closest to the Slovene market in terms of economic development, maturity of the petroleum product market, purchasing power and cultural characteristics.

Special purpose acquisition companies or SPACs have attracted some serious attention from investors in 2020 as they managed to raise the same amount of funds as traditional IPOs. However, considering the high risk involved with investing in such companies one cannot but wonder if this is a sign of investor overconfidence or are SPACs really an attractive investment opportunity.

What is a SPAC?

For starters, lets define what a SPAC actually is.A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering for the purpose of acquiring an existing company. Also known as “blank check companies,” SPACs have been around for decades but have become more popular just recently. As a matter of fact, SPACs managed to raise a record amount of IPO money in 2019. However, it did not stop there, in 2020 SPACs were able to break the record once again by raising a whopping USD 82.1bn, according to data from Dealogic. Note that this amounts to roughly the same amount raised through traditional IPOs in the US.

Money Raised in U.S. IPOs

How do SPACs work?

As mentioned earlier, SPACs acquire funds through an IPO which typically consists of common shares combined with a warrant. The warrant gives the holder the right to buy more shares at a fixed price at a later date. Note that investors who participate in the SPAC IPO are attracted to the opportunity to exercise the warrants so they can get more common shares once the acquisition target is identified and the transaction closes.

After the funds have been acquired through an IPO, they are usually held in government bonds until the SPAC’s Sponsor finds a suitable target to acquire. During that time, one would expect SPAC shares to trade at around their IPO price, however, in practice, SPACs will often trade at a premium to the IPO price as shareholders believe management will identify a compelling acquisition target.

Once a target has been identified, and eventually acquired, a SPAC merges with the company and the acquired company gets the SPAC’s spot on a stock exchange, enabling it to sell shares to the public. Note that over the years companies that have been taken to the market through a SPAC deal were young companies in new industries such as the cannabis, green technology, and sports-betting arenas, where SPACs scooped up corporations like DraftKings and Nikola. Just how young these companies can be is probably best portraited by the fact that in 2020, at least 15 SPAC acquisitions were of targets that had no revenue in the year prior to the acquisition, according to SPACInsider.

Time wise, SPACs have a specified period to identify an acquisition target and close the deal, which usually amounts to two years. If the SPAC sponsor cannot close an acquisition within the designated period, then the money is returned to the shareholders. Furthermore, SPACs have a specific feature to protect investors: Before one does a deal, its investors may redeem their shares for cash, collecting its IPO price, usually USD 10 per share, plus interest.

Overview of the number of SPAC IPOs

SPAC Price Performance

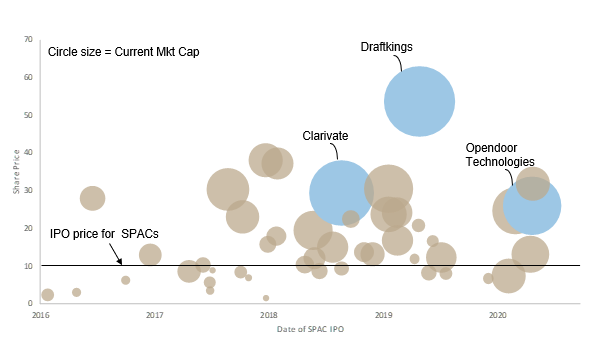

Although SPACs have clearly gained in popularity over the last couple of years, this can not be attributed to a steady return made by this asset class. Namely, we observed the largest 46 SPAC IPOs since 2016 which ended with an acquisition and as one can see from the chart below, more than a third of the observed SPACs are now trading below their IPO price. Note that we excluded warrants from our analysis. Considering the previously mentioned industries in which many popular SPAC acquisitions operate and the timing of the acquisition in the life cycle of the company, such volatile and uneven return aren’t really surprising. After all, many of these companies could easily still be considered as highly speculative.

Source: Bloomberg, InterCapital Research

Finally, despite the risk associate with them, SPACs seem to be successful at attracting investor interest which might also be attributed to the volatility of 2020’s markets which has forced many companies to delay going public. Second, it is possible that fears over a looming bear market have caused investors to seek opportunities to liquidate while markets are still relatively healthy. Therefore, an eventual calming of financial markets might also lead to the calming of SPAC activities and a focus shift back to more stable companies.

CNB will closely monitor health and economic trends and will reassess the existence of reasons for this decision by 30 September 2021 at the latest and may revoke the decision accordingly before its expiry.

Croatian National Bank (CNB) has published on Friday a Decision on temporary restriction of dividend payments, share buybacks (repurchase of own share), allocation of variable receipts and other forms of distribution. The temporary restriction is put in place until 31 December 2021.

CNB notes that the restriction was put in place in order to increase the resilience of credit institutions and maintain the stability of the financial system during the COVID-19 pandemic.

The COVID-19 pandemic has had significant negative consequences on the economic activity in Croatia, which were mitigated by a number of support measures for credit institutions and their clients, such as monetary policy measures to maintain favorable financing conditions, an adapted approach to supervision and a simplified regulatory framework for credit institutions and public measures to support the operations of the affected sectors.

Nevertheless, CNB adds that uncertainties regarding the impact of the current extraordinary health and economic circumstances on the operations of credit institutions in Croatia remain high. In such circumstances, the temporary distribution restriction strengthens the resilience of credit institutions to possible losses associated with the materialization of credit risk in the balance sheets of credit institutions.

The Croatian National Bank will closely monitor health and economic trends and will reassess the existence of reasons for this decision by 30 September 2021 at the latest, and may revoke the decision accordingly before its expiry.

As a reminder, ECB has recently lifted the dividend ban on banks with a cap on dividend and buybacks remaining below 15% of cumulated 2019-2020 profit. To read more about it click here.