In January of 2021, GWPs increased by 1.2% YoY. GWPs in non-life insurances grew 5.1% YoY, while life insurance decreased by 13.8% YoY.

Croatian Insurance Bureau published the GWP development in January 2021.In the first month of 2021, GWP’s observed a slight increase of 1.2% YoY (or HRK 13.5m), indicating a relatively solid start of the year.

The total amount of GWPs collected reached HRK 1.137bn (includes insurers located in Croatia and insurers operating in Croatia but based in another EU country). The decrease was observed solely on the life segment which observed a strong decline of 13.8% YoY (or HRK -31.7m) to HRK 197.6m. Such a declining trend was witnessed throughout the entire pandemic while it could arguably be attributed to the maturing of policies which were underwritten coupled with lower savings through life insurance and early termination of these policies. Besides that, we note that the vast majority of the decrease in life segment (HRK 21.1m) came solely from one insurer Wiener Insurance, which has one of the highest market shares in life segment. Meanwhile, Croatia Osiguranje and Triglav noted a relatively positive result.

Non-life segment which traditionally accounts for the biggest portion of total GWPs (84% in Jan), is up by as much as 5.1% YoY (or HRK 45.24m). Croatia’s largest insurer, Croatia Osiguranje accounted for 25.5% of the market, showing a decrease of 2.1 p.p. YoY.

Top & Bottom Performing Insurance Segments (Jan – January 2021 vs Jan – January 2020) (HRK m)

When observing GWPs by structure since the beginning of the year insurance against civil liability in respect of the use of motor vehicles (which accounts for 19% of GWPs) recorded a high increase of 12% YoY (or HRK 22.99m). Strong growth of this type of insurance can be explained by both, increase in number of policies issued (3.8%) and increase in average policy value (7.9% YoY).

The second biggest category in Non-life insurance is vehicle insurance (casco policy) which accounts for 10% of total GWPs, and it recorded a decrease of 1.13%. The aforementioned decrease marks a break in positive trend of YoY growth seen in 2020. However, MoM development shows a mixed development of this segment in 2020 (mostly positive with sharp decreases in Q2).

Following two destructive earthquakes which struck central Croatia, two insurance categories ended up being in spotlight: fire and elemental insurance and other property insurance. Unsurprisingly, both segments have seen a solid increase since the earthquakes and noted one of the highest nominal increase in January.

Health insurance observed also a solid YTD performance of +12.15%. On the flip side, the steepest both nominal and relative decrease can be observed in the unit linked life insurance which showed an extremely high decrease of 59% or HRK 21.7m.

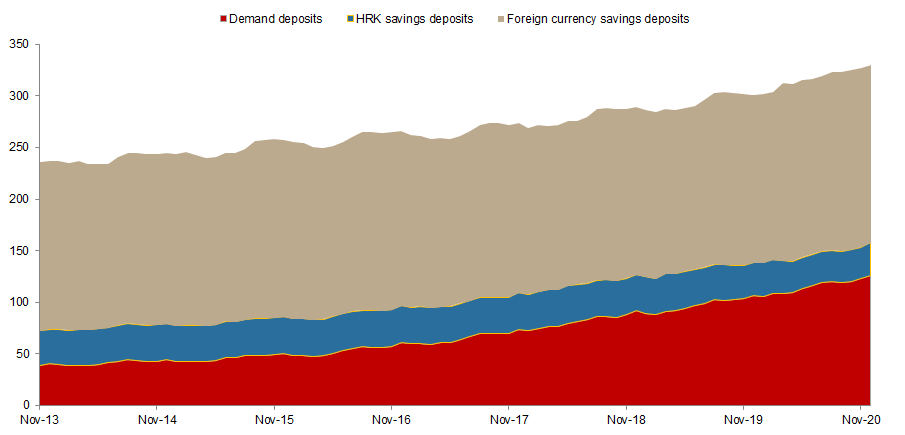

Total deposits in Croatia amounted to HRK 329.36bn, up by HRK 28.2bn in 2020.

According to consolidated statement of financial position for monetary financial institutions monthly published by Croatian National Bank (HNB), total deposits as of end 2020 amounted to HRK 329.36bn, representing a very solid increase of 9.4% YoY, while increasing +0.8% MoM. We note that this level of savings represents once again an all-time high, which indicates unwillingness of Croatian citizens to invest in riskier asset classes.

Such an increase could be attributed to a high growth of demand deposit money which increased by 18.9% YoY to HRK 126.2bn and which accounts for 38% of total deposits. The aforementioned increase does not come as a surprise as in the times of uncertainty demand deposits usually grow the most. In other words, 2020 was marked by lower spending and higher savings, which is an expected behavior during a crisis.

The increase was further backed by a rise in savings deposits, which amount to HRK 203.13bn (+2.5%). Meanwhile, local currency savings deposits have observed a decrease of -2.5% YoY and currently account for only 15.4% of total savings deposits. To be specific, local currency savings deposits amount to 31.2bn, while roughly 70% of them are pertaining to households. Also, Kuna savings deposits account for 9.5% of total deposits, while Foreign currency savings deposits account for 84.6% of all savings deposits and 52.2% of total deposits. Foreign currency saving has increased by 5.5% YoY, while showing a MoM decrease of 1.1%.

When observing solely households, they hold HRK 224.54bn in deposits, noting an increase of 3.2% (or HRK 18.83bn). We note that foreign currency deposits account for the vast majority of deposits (61%).

Deposits in Credit Institutions (HRK bn)

Source: HNB, InterCapital Research