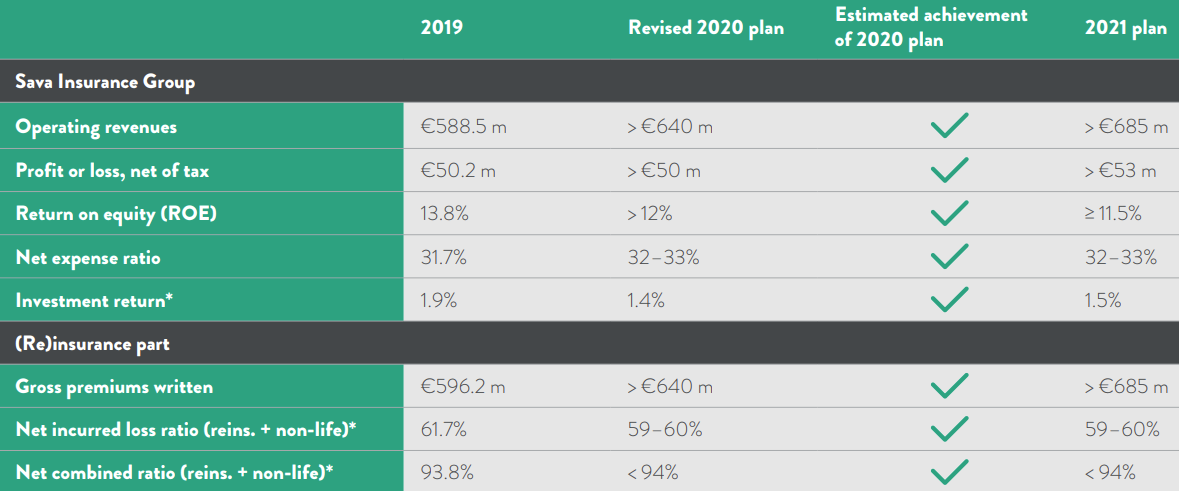

For 2021 the Group plans to generate more than EUR 685m in operating revenue a net profit above EUR 53m, which translates into a planned ROE of at least 11.5%.

Earlier today, Sava Insurance Group published their 2021 business plan. The management board believes that, given the impacts of the Covid-19 pandemic, the business plan is ambitious and has considered all key aspects required to support the Group’s sustainable long-term development, risk management and appropriate profit generation.

The Group’s operating revenue is planned to exceed EUR 685m in 2021, growing at a rate of approximately 5% in the Group’s strategic markets. In Slovenia, the Group is planning 2% growth in gross non-life insurance premiums, taking into account the expected slowdown in car sales and longer economic recovery from Covid-19. Gross life insurance premiums written in Slovenia are expected to grow by 23%, reflecting the FY inclusion of the life insurer Vita in the Group.

The Group’s non-life insurers outside Slovenia are planning their GWPs to grow by 8%. This increase mostly relates to the motor insurance business, in which companies wrote less in premiums in 2020 than planned due to Covid-19 impacts, whereas less of such adverse impact on premium volume is expected in 2021.

The Group’s life insurers outside Slovenia are also planning their GWPs to grow by 8%. In 2021, product and service development will mainly focus on preparing adaptable risk products tailored to selected customer groups and specific distribution channels.

The reinsurance segment expects GWPs to grow by 1% in 2021. The lower growth rate reflects more selective reinsurance underwriting focused on profitability, with steps taken towards de-risking the portfolio and further diversifying it in terms of regions and partners.

Sava Re 2021 Business Plan

Source: Sava Insurance Group

The key goals of the investment policy in 2021 remain maintaining low volatility and a high level of security of invested insurance contract assets, as well as to ensure high liquidity and risk diversification. The management expects that returns on financial investments will continue to be affected by low interest rates, which is why the planned rate of return is 1.5%. The investment portfolio structure will also remain relatively conservative in 2021, with a high share of bonds and other fixed-rate investments and a high credit rating profile, but with a slightly higher allocation to infrastructure and real-estate funds, and infrastructure debt.

We are happy to see a relatively ambitious target by the management, which is somewhat above our estimates for 2021.

In 2021, the Group expects operating income to reach HRK 3.4bn, representing an increase of 10% compared to their current FY 2020 estimate.

Končar Group published yesterday their adopted 2021 business plan on the ZSE. The business plan for 2021 is based on the substantial number of contracts concluded, with which Končar ends the 2020 business year.

The value of transactions contracted (backlog) at the end of 2020 amounts to HRK 4.4bn, which represents a significant increase of c.31% since the beginning of the year when backlog stood at HRK 3.35bn.

In 2021, the KONČAR Group companies plan to generate operating income in the amount of HRK 3.4bn, which is a 10% increase compared to the business assessment for the current year. Revenue from sales in the Croatian market are planned to amount to HRK 1.4bn, which represents a 23% increase compared to the business assessment for 2020. The planned train delivery to HŽ Passenger Transport has a significant impact on the increase of revenue in the Croatian market. Further increase of export revenue is planned, in the amount of HRK 1.9bn. The share of export in total revenue from sales is 59%. The planned major export destinations are Germany, Sweden, Austria, Latvia, Hungary, North Macedonia and the United Arab Emirates. The total planned value of newly contracted transactions in 2021 is HRK 3.1bn, with a share of 58% in the foreign market.

Končar further adds that despite the pandemic, the Group has proved to be resilient to the crisis, primarily due to the functioning of the entire system and due to the capabilities and dedication of its employees. Although the uncertainty regarding further development and consequences of the pandemic remains great, the 2021 business plan predicts further business growth and improvement of operational efficiency.

The substantial number of contracts concluded, ensured liquidity and a stable balance sheet enable further growth and development of the Group in the next business year.

The loan bears a fixed interest rate of 4.3%, it is denominated in Serbian Dinars, with final maturity in 2025.

Arena Hospitality Group yesterday announced that through its local subsidiary, it has entered into a new HRK 32.0m (EUR 4.2m) loan agreement with AIK Banka, Belgrade in Serbia for the acquisition of Hotel 88 Rooms in Belgrade.

The completion of the acquisition of the hotel is expected during Q1 2021. The transaction value is HRK 45m and approximately HRK 32m will be funded from the new loan. The loan bears a fixed interest rate of 4.3%, it is denominated in Serbian Dinars, with final maturity in 2025.

Arena notes that the acquisition of 88 Rooms Hotel is another milestone of the Group pursuit of its strategy to further expand its business through the CEE region.

As a reminder, the Group has recently announced that they have also entered into a new EUR 24m loan agreement for the repositioning and redevelopment of Hotel Brioni in Pula. To read more about it click here.

The company entered into an agreement with EIB for providing up to EUR 100m in long-term loans.

Teleko Slovenije published an announcement on the LJSE stating that they have concluded a loan agreement with the European Investment Bank for providing up to EUR 100m in long-term loans that will allow the company to finance continued expansion and upgrade of its fibre optic access network with gigabit speeds throughout 2023.

Telekom Slovenije notes that they will continue to build its state of the art fibre optic access network both in urban centres, as well as in rural areas, including those, where there was no market interest (so-called white spots), or where there was a market interest, but no network has yet been built. This allows the company to provide internet access and communication services also in more remote and sparsely populated areas.

The Group has recently announced their 2021 business plan, which you can find here.

Through their acquisition, MedLife Group reaches a portfolio of 28 acquired companies.

Today MedLife Medical System has announced that is has acquired a majority stake (75%) in Pharmachem, making this their largest acquisition of the year and the first in the pharma sector. Pharmachem is known for their drug distribution services and has a strong warehouse network in Bucharest and in the entire country. In 2019, the company reached a turnover of RON 83.4m (+30% YoY). Through their acquisition, MedLife reaches a portfolio of 28 acquired companies.

MedLife believes that pharma sector will have an important role in the economic recovery of Romania as well as the population’s health maintenance in the next years, justifying their purchase. With the integration of Pharmachem into MedLife group, they plan to optimize the purchasing system at group level through their own network of pharmacies and hospitals. Furthermore, they plan to develop clickpharm.ro, an online pharmacy area, as well as other digitalization projects that will bring the right medicine closer to the patient, consistent with their observations of the consumers’ changing preferences during the pandemic.

For the next period, MedLife representatives intend to develop the acquisition program and expand investments. They are also targeting other transactions at the end of this year. And, on this line, once the named transactions will be completed and current transaction will be evaluated and approved by the Competition Council, they will be the first private medical company in Romania that exceeds EUR 250m in turnover.