For today, we decided to bring you an updated overview of the indebtedness and capital structure of Croatian companies using H1 2020 results.

For today, we decided to present you with a comparison of Croatian companies. To be specific, we observed how indebted Croatian companies are by comparing net debt to EBITDA (trailing 12 months) and % of debt financing. We also added how much additional debt these companies could take in order to reach 3xEBITDA.

Note that Adris Grupa and ZABA were excluded from the overview as Adris operates as a holding, while ZABA is a bank.

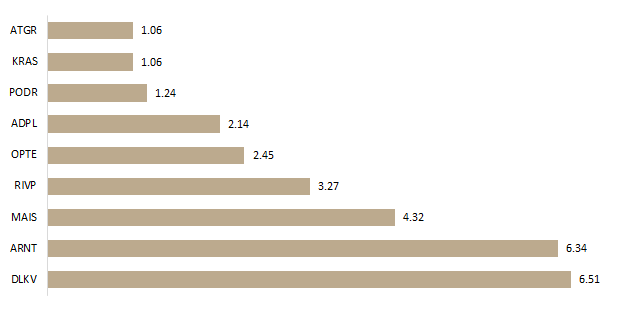

Net Debt/ EBITDA (trailing 12m)

Among observed companies Končar, HT and Ericsson Nikola Tesla operate at a negative net debt, meaning their cash position (short term financial assets + cash and cash equivalents) exceed their financial debt. Dalekovod has the highest indebtedness (of the observed companies) of 6.51x EBITDA. Next comes Arena Hospitality Group follows with a net debt/EBITDA of 6.34, compared to 2.09x EBITDA (FY 2019). Such an increase mostly came as a result of a negative EBITDA of HRK -37.1m recorded in H1 2020 (compared to HRK 29m in H1 2019). Two other tourist companies follow, Maistra and Valamar Riviera, with 4.32 and 3.27, respectively.

On the flip side, Atlantic Grupa is currently operating with historically low indebtedness which translates to 1.06x EBITDA.

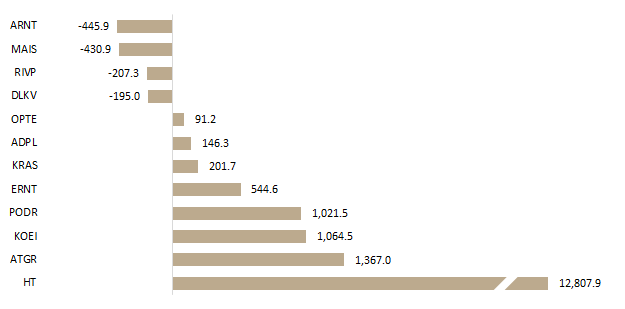

We also observed how much additional debt companies could take to reach 3xEBITDA which is in the region considered as a breaking point and red flag in terms of indebtedness.

This analysis provides information on the companies’ potentials for takeovers, but also the potential for an internal growth through additional borrowing. It’s important to point out that companies with net debt above 3xEBITDA are not necessarily too indebted as not all them are equal and their industries differ (and the other way around – certain industries are not prone to hold any leverage).

Potential Additional Debt (HRK m) to Reach 3x EBITDA

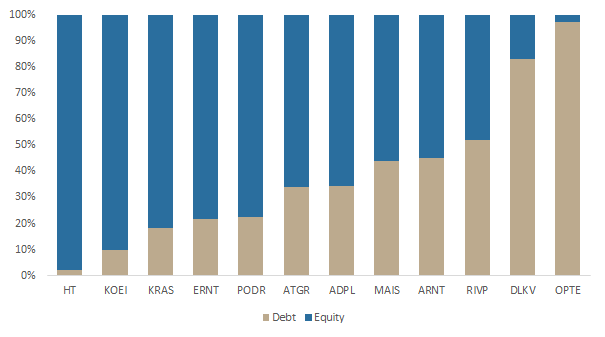

Turning our attention to the capital structure, of the observed companies, 9 of 12 are mostly equity funded. Of those, HT leads the list with 98% equity, followed with Končar 90%. On the flip side, Optima Telekom and Đuro Đaković are almost entirely debt funded with a capital structure of 97% and 83%, respectively.

Capital Structure of Croatian Companies

To put things into a perspective, the deal accounts for 0.6% of the company’s trailing 12m consolidated sales.

Yesterday Ericsson NT signed an agreement with the Ministry of Culture and Media worth around HRK 12m (excluding VAT) related to development and maintenance services information and communication system for the e-Culture project “Digitization of cultural heritage”.

To put things into a perspective, the deal accounts for 0.6% of the company’s trailing 12m consolidated sales.

The project is funded by the European Union, and its main goal is to establish information and communication solution that will enable safe storage of cultural heritage in digital form and online access to authorized persons, but also to citizens. The company states that the implementation of this solution is expected to further enhance digital connectivity between the public sector and citizens and enable new ways of using the information and communication infrastructure.

Zavod VZMD proposed a dividend payment of EUR 0.24 per share. At the current share price dividend yield is 17.5%.

Intereuropa received a counterproposal by the shareholder Zavod VZMD (Pan-Slovenian Shareholders’ Association) regarding the dividend payment in 2020. Zavod VZMD proposed a dividend payment of EUR 6.6m which translates into a dividend payment of EUR 0.24 per share. At the current share price dividend yield is 17.5%.

Proposed Ex-date is 16 September 2020.

As a reminder, VZMD already proposed EUR 0.4 dividend per share in late July, while a few days later Small Shareholders’ Association of Slovenia proposed a dividend payment of EUR 0.14 per share. The counterproposals are subject to approval at the GSM which will be held on 27 August 2020.