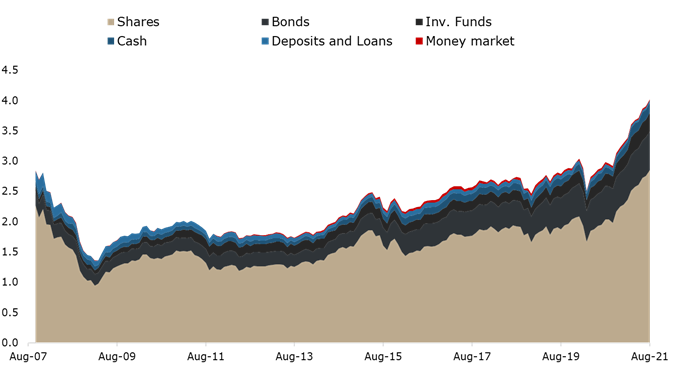

Over the first 8 months of 2021, net contributions in Slovenian mutual funds reached EUR 315m, which is higher than any (full) year since 2007 (available data).

As of August 2021, Slovenian mutual funds manage EUR 4.05bn, recording an increase for the 10th consecutive month (+3.1% MoM).

Moreover, total AUM of Slovenian UCTIS funds breached the 4bn EUR, reaching their all time high (since available data – June 2007), which also represents 25.2% YTD growth.

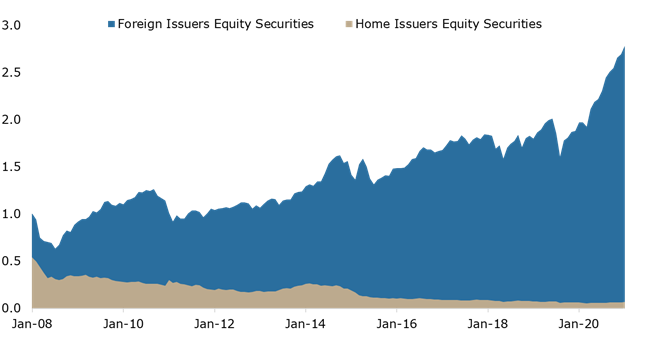

Equity Holdings of Slovenian UCITS Funds (EUR bn)

Following a continuous positive trend in net contributions in 2021, August’s contribution amounted to EUR 26.71m. Meanwhile, this year’s net contributions have reached EUR 315m so far. To put things into perspective, the net contributions seen in H1 2021 already by far surpassed total yearly contributions of every FY since 2007 (available data). In terms of the asset structure, as of August 2021, shares, which account for 70.5% of the total assets (or EUR 2.85bn), observed a slight increase of 3.5% MoM.

Of that, domestic equity holdings amounted to EUR 68.83m, representing an increase of 5% MoM and a drop of 9% when compared to pre-pandemic times (January 2020). However, on a YTD basis, domestic equity holdings are up by 19.1%.

On the other hand, foreign equity holdings have reached EUR 2.78bn and are making up the majority of Slovenian mutual funds. Bonds come second, accounting for 15.6% (or EUR 632.9m), followed by investment funds with 7.7%.

Slovenian Mutual Fund Asset Structure (EUR bn)

If we were to compare the Croatian market to the pre-Covid times (2019), one can observe that passenger car registrations in the first 8 months of 2021 are still down by 28%, while looking solely at August we see a 17% drop.

European Automobile Manufacturers Association (ACEA) has recently published eight months data for new passenger car registrations in the EU. During the eight months of 2021, EU demand for new cars grew by 11.2% YoY to reach little more than 6.8m units registered in total. However, note that by looking at H1 2021, results were up 25.2% YoY. Meanwhile, in both July and August, the demand for new cars dropped by 23.2% and 19.1%, respectively.

Most of the 27 markets in the region posted similar results, with significant drops in both July and August, while eight month results remained positive for most of the markets. Markets that reported drop in demand over the first eight months of 2021 are Belgium and Netherlands, by -3.5% and -3.4%, respectively. Major EU markets in eight month period performed as followed: Italy (+30.9%), Spain (+12.1%), France (+12.8%) and Germany (+2.5%).

By far the largest 8 month increase in the EU was realised in Greece (+41.9% YoY), followed by Croatia and Estonia with +36.7% and +33.0% respectively. On the other hand, in August car registrations across the European Union dropped by -19.1%. Portugal and Lithuania saw the biggest contraction in August, of -35.8% and -30.2%, respectively. During the month of August, the largest car markets posted double-digit declines: Spain (-28.9%), Italy (-27.3%), Germany (-23.0%) and France (-15.0%).

If we were to compare the Croatian market to the pre-Covid times (2019), one can observe that passenger car registrations in the first 8 months of 2021 are still down by 28%, while looking solely at August we see a 17% drop.

Turning our attention to the Russian market, over the first eight months of 2021 the market recorded 1 067 890 cars sold. Note that this represents an increase of 21.3% YoY. In August 2021 car sales decreased by -17% YoY, according to the AEB Automobile Manufacturers Committee.