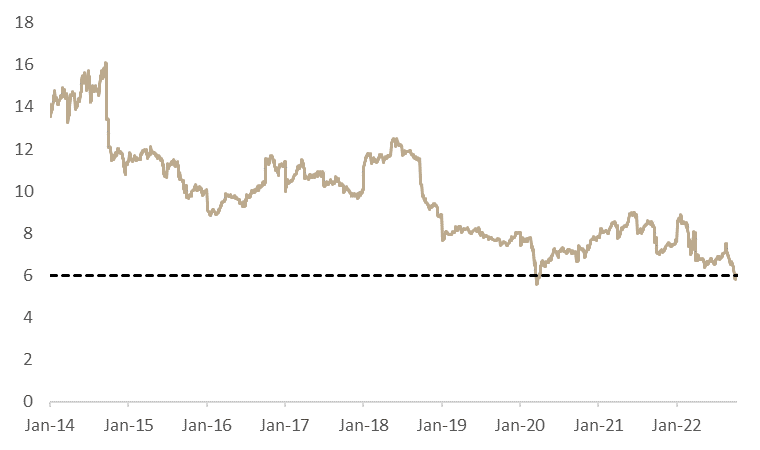

In this blog, we will focus on the valuation side of SBITOP and put the index in a wider perspective. We still find SBITOP to be a fairly solid long-term buy due to its current pricing at a P/E of 6.0x and relatively optimistic outlook, which we will explain in more detail.

In the recent blog, we looked at the market movement of regional and some global indices in the first 9 months of 2022 (you can read it here.) The data clearly showed that the last three quarters were quarters of stagnation and decline due to the negative sentiment in the market, which is expected to continue. Today, we decided to look at the valuation of SBITOP and put it in a wider perspective – comparing it to the S&P500 and looking at the historical relative ratio between indices.

First of all, one can notice the current SBITOP P/E multiple is substantially lower than its 8-year average of 9.7x, which we in find relatively attractive overall. Also, nothing unsurprising, the big recent decrease in multiple was recorded on a YTD level, with P/E decreasing all the way from 7.6x at the beginning of 2022 to the current 6.0x P/E.

SBITOP’s P/E [2014 – Jan 2022]

Source: Bloomberg, InterCapital Research

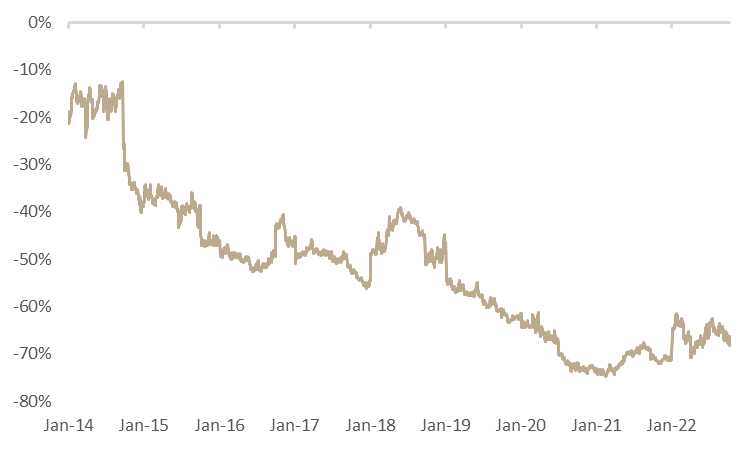

Looking at the US market, we can notice this market’s representative, S&P 500, is traded at a quite higher multiple than SBITOP. To put into comparison, Slovenia, which can be considered a pure value play, is traded at a significant discount to developed markets. SBITOP’s discount to developed markets still remains a large one. Taking into consideration that certain discount is reasonable (due to the regional specificities), we still find the valuation gap relatively wide.

SBITOP trading at a deep discount compared to developed markets – P/E gap [2014 – Oct 2022]

Source: Bloomberg, InterCapital Research

Light at the distant end of the tunnel

As we are all aware, we have a looming macroeconomic situation pointing into a recession, rising interest rates from both Fed and ECB, a still-present semiconductor shortage and war in Ukraine. But here, we’d like to emphasize the rising interest rates. What’s the industry that long-term benefits mostly from the rising interest rates and generally high-interest rates environment? Exactly, financials.

SBITOP composition

SBITOP currently has 35% of its weight in the financials, which is composed of NLB, Triglav and Sava Re. We previously mentioned the decrease in SBITOP’s P/E from 7.6x to 6x happened in 2022. Naturally, the decline in multiple was partially driven by financials. On a YTD level, financials took a pretty solid hit. The main reason for this is that higher interest rates drag the valuation of financial companies significantly. When the rates rise, naturally the outflow from equity happens and consequently, financials suffer just like the whole equity as an asset class.

Regarding price decline, as a cherry on top – insurance valuation (Triglav and Sava Re) was also affected indirectly by rising interest rates (also a short-term effect). Due to the nature of their operations, insurances hold a lot of financial assets and some of them are classified as „Available for sale“. The change in the price of such instruments is recorded directly in equity (through comprehensive income), not through P&L. As a result of mentioned rising interest rates environment, equity and consequently, valuation, of the mentioned insurance companies directly took a hit.

Nevertheless, what are we trying to emphasize is – expectations. Financials (both banks and insurance companies) perform relatively better in higher interest rates, as banks can achieve higher Net Interest margins, while insurance can achieve higher future portfolio returns on their investments as current interest rates are higher. So, 35% of SBITOP’s weight in financials might have a relatively better performance over time on the market.

The largest contributors to the CPI growth on the annual level were Food and non-alcoholic beverages, which increased by 19.1%, followed by Restaurants and hotels, at 17.3%, and Furnishings, household equipment and routine household maintenance, at 15.7%.

The Croatia Bureau of Statistics (DZS) has published the latest monthly report of the changes recorded by the Croatian Consumer price indices (CPI), for the month of September. Starting off with the annual level, the CPI in Croatia increased by 12.8% in September 2022, while on a monthly level, it increased by 1.5% on average. Meanwhile, on the annual average, the growth of the CPI amounted to 8.6%. The 12.8% increase in the CPI surpassed the last 2 months (12.3%, in each case) record, marking the highest CPI annual growth rate in the Croatian history, accelerating the trend of inflation growth that started in the 2nd half of 2021.

CPI (January 2023 – September 2022, %)

Looking at the largest contributors to this growth, on the annual level, the highest increase in CPI was recorded in the following segments: Food and non-alcoholic beverages, which grew by 19.1%. Next up, we have Restaurants and hotels, which grew by 17.3%, and household equipment and routine household maintenance, which increased by 15.7%. Following them, we have Housing, water, electricity, gas and other fuels, which increased by 13.3%, Transport, which grew by 12.3%, Miscellaneous goods and services, with 10.7% growth, Clothing and footwear, with 10.1%, Recreation and culture, with 8.8%, and finally, alcoholic beverages and tobacco, with 4.2%.

This would mean that the trend we have witnessed for the last couple of months continues; not only does the overall inflation increase, which started with higher energy and food&beverage prices, but the pressure from higher inflation has been present on the market for so long, that it has spilled over to almost every industry. Now we have these “secondary” effects, with segments that aren’t directly affected by the main driver of the inflation growth (Russian invasion of Ukraine), increasing significantly. This mainly refers to categories such as Recreation and culture, and Clothing and footwear, but as mentioned, every category is affected.

Due to the composition and different weights in the CPI index measurements, these categories, even if equal, have a different effect on the CPI change. The highest weight in the calculation goes to Food and non-alcoholic beverages, which has 25.93% of the total, meaning that it contributed 4.95 p.p. to the CPI growth on the annual level, or more than one-third. Next up, we have Housing, water, electricity, gas and other fuels, which have 16.87% weight in the CPI calculation, meaning that is contributed 2.24 p.p. to the annual growth. Finally, We have Transport, which with 14.72% of the weight contributed 1.81 p.p. to the CPI growth. Other categories remained below 1 p.p. to the CPI growth contribution.

CPI change by categories – September 2022 (YoY, %)

Moving on to the monthly level, the CPI increased by 1.5% MoM on average. The story of this growth is somewhat different. The highest average increase in the CPI was recorded by Clothing and footwear, which increased by 21.2%, and contributed 1.24 p.p. to the CPI growth, however, this is due to new clothes and footwear collections. Other noteworthy categories include Housing, water, electricity, gas and other fuels, which increased by 2.9% (and contributed 0.49 p.p. to the growth), and Miscellaneous goods and services, which increased by 2.6% (+0.16 p.p. to overall growth). What is also interesting is the fact that Food and non-alcoholic beverages actually decreased MoM, by 0.2%, which could be contributed to the announced measures by the Croatian government, which limited the prices of a select basket of food products, effective 1 October 2022. Transport prices also declined, by 0.7% MoM, which again, could be contributed to the govt. price caps and announced measures.

What all of this data shows us is that prices in Croatia, like in the region, are still increasing, and moreover, they have spilled over to many different segments of the economy. As the Croatian government announced measures to help mitigate this inflationary pressure, we will see if those will prove to be successful, at least a month (by the end of October) to several months after their implementation. Even so, the main drivers of the inflation growth, i.e. the war in Ukraine, and the subsequent sanctions on Russia are still present and not winding down, so further inflation growth could be expected.