Here you can find the dates for the upcoming events of the regional companies.

| wdt_ID | Date | Ticker | Announcement | Country |

|---|---|---|---|---|

| 22 | 30.3.2023 | ATGR | Atlantic Grupa 2022 Annual Report | Croatia |

| 23 | 30.3.2023 | SFG | Sphera Franchise Group Ex-dividend date | Romania |

| 24 | 31.3.2023 | TLSG | Telekom Slovenije 2022 Annual Report | Slovenia |

Due to the nature of these events, they are subject to change (might be postponed or canceled).

This week we have seen a series of events that will be remembered in financial history. Two US banks collapsed which had driven extreme moves on the market making the ECB’s hike of 50bps look like a non-event. In this brief article, we are looking at the most important events of the week and describing what we expect to happen further.

As you may already know by sensationalistic media headlines, at the end of last week we saw two US banks collapsing. That prompted the US government and central bank to react and implement the new Fed program called BTFP (Bank Term Funding Program) under which the Fed plans to boost the liquidity of troubled banks. Obviously, when a big bank collapses, markets go wild, which was the case this time as well. Namely, yields on both sides of the Atlantic fell dramatically and the moves were comparable with the moves that happened on Black Monday. Just to put it in perspective, the yield on US 2-year Treasury paper fell from 5.05% on March 8th to 3.89% exactly a week later!

On Tuesday there were stories about other smaller banks having difficulties with liquidity, but the panic decreased due to the Fed and government reassuring investors that all the deposits will be guaranteed by the authorities. Nevertheless, on Wednesday investors were informed that Credit Suisse will not get more financing from its biggest stakeholders and that it will need liquidity injection or restructuring or even both and that restarted the panic. Yields once again went south together with equity markets while investors repriced Fed’s hiking cycle from 5.5% at the end of 2023 to 4 cuts until the end of the year with the terminal rate being at 4.75%. However, just like the Fed reacted almost immediately to the Silicon Valley Bank collapse, SNB did too, saying that if necessary, it will provide liquidity to CS. Credit Suisse confirmed that yesterday morning saying that it will borrow some CHF 50bn from the central bank. It was only Wednesday, and we already saw another bank close to collapsing, and we are talking about a bank that is way more important for the global financial market than the bank having deposits from Californian tech companies.

SNB’s CS rescue leaves us to what was meant to be the main event of the week which is the ECB’s monetary policy meeting. Just a few weeks ago, we heard Mr. Holzmann saying that ECB should hike several times by 50bps and the market priced EUR’s terminal rate very close to 4.0% for the end of this year. However, market tremors caused by troubled banks led some investors to think that ECB would abandon its price stability mandate to stabilize financial markets. Nevertheless, Ms. Lagarde and the team lifted rates by 50bps to 3.0% and confirmed that their first and most important task is price stability. However, in the statement, it was said that “the elevated level of uncertainty reinforces the importance of a data-dependent approach”. This means that in the absence of further shocks, the ECB should continue tightening its monetary policy by lifting rates further, which was confirmed by Ms. Lagarde saying that they have more ground to cover. The market’s reaction was rather mild, with bonds trading sideways while equity markets were flat.

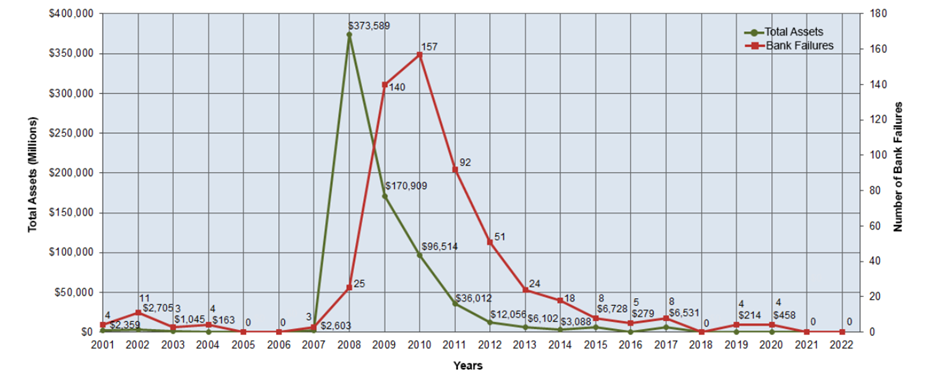

Talking about markets, it was all “calm” until the meeting was over. One hour after the US opened, equity markets started to rise significantly, and we are not quite sure of the reason. First, one could be that another troubled bank secured deposits from the big ones in the amount of USD 30bn while the second driver could be that the Fed once again enlarged its balance by staggering USD 300bn through the discount window facility program. Although Fed is currently in the QT phase and is still in a tightening cycle, it actually expanded its balance sheet in one week just to erase all QT that has been doing since April 2022. So, when Fed is doing QE although is saying that it’s tightening its policy, don’t fight it. Equity markets yesterday perfectly reflected that. For the end of this article, we just leave you with the chart showing US bank defaults since 2021. If the history rhymes, we are only at the beginning of the show.

Total assets of US banks and US bank defaults since 2001

Source: FDIC

As of February 2023, Fondul’s NAV reached RON 14.58bn, which would translate into a NAV per share of RON 2.5728, an increase of 16.7% YoY and a flat MoM development.

According to the latest Fondul Proprietatea’s NAV report (28 February 2023), Fondul reported a total NAV of RON 14.58bn (EUR 2.96bn), which translates into a NAV per share of RON 2.5728 (EUR 0.5229).

Comparing it on a YoY basis, the total NAV recorded an increase of 16.7%. Nevertheless, compared to January, NAV remained flat.

Fondul Proprietatea’s portfolio structure still remains focused on the power utility generation sector (76.5% of NAV) with Infrastructure (7.3%) and Power & Gas supply and distribution (7.1%) following. This is also why the three most significant holdings, Hidroelectrica, Aeroporturi Bucuresti, and Engie Romania amount to 84.4% of the total NAV of the Fund. However, most of those come only from Hidroelectrica with 76.5% as the biggest holding. In terms of the Fund’s portfolio structure, unlisted equities accounted for the vast majority of NAV, standing at 92.8%. Following them, we have Net Cash & Receivables with 5.9% and finally listed equities with only 1.3%. Further, we note that during February, no significant changes in Fondul’s portfolio occurred. Also, we remind and emphasize that at the start of this year, Fondul liquidated its position in OMV Petrom, which was previously the second biggest holding after Hidroelectrica with 5.6% of the fund’s NAV in the data for November.

Turning our attention toward the share price’s performance, during the month, the Company’s share price noted an increase of 3.4%, ending the month at RON 2.10 per share. The current discount to NAV per share stands at 18.4%.

Fondul Share Price & NAV per Share

Source: Bloomberg, InterCapital