Sava Re expects a decrease in operating revenue between 5% – 7%, and a drop in net profit between 15% and 20%.

Sava Re published an assessment of Covid-19 on their operations. The assessment is based on the latest forecasts of economic trends issued by the Office of the Republic of Slovenia for Macroeconomic Analyses and Development, predicting a fall in Slovenian GDP of between 6% and 8%.

Sava Re prepared our assessment of the impacts on the profit for 2020 and the Company’s solvency position at the end of 2020 based on the following assumptions:

- In terms of impact on operations, two periods were observed. The first period stretching until the end of May, in which the Group expects a direct impact on insurance underwriting and contacts with customers but with a lighter claims burden, and the second period, from early June to the end of the year, in which we expect an indirect impact on operations due to lower GDP than originally forecast.

- Sava Re estimates that the largest loss of premiums compared to plan will be in non-life business, in motor business, primarily related to the decline in sales of new vehicles, lapsed registrations of vehicles, especially goods vehicles and purchase of narrower covers. Premiums are also expected to decline in travel insurance and assistance business.

- In life insurance, we expect that new business volume will decline as the result of restricted contact with customers. Reinsurance business is expected to shrink in the proportional business segment. Operating revenues of pension companies and the investment fund management company will decline because of a drop in assets under management as the result of falling financial markets.

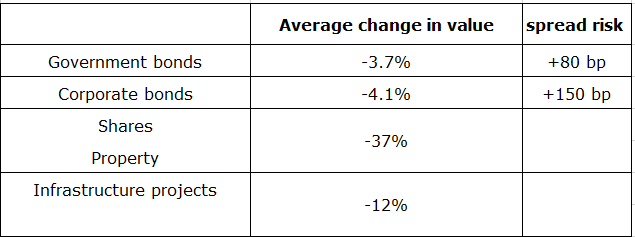

- Impacts on financial investments were calculated based on circumstances in financial markets as at 20 March 2020. The basis for calculating impacts was the revised estimated portfolio of financial investments compared to the planned 2020 figures, assuming that spread risk for debt instruments remains at the Q4 2019 level. The assessed impacts of COVID-19 show the following changes in the value of financial investments and the related spread risk for debt instruments:

Source: Sava Re

The estimated business results made considering the COVID-19 circumstances are strongest impacted by the assumptions relating to the movement in the value of the investment portfolio. If the year yields a positive development in financial markets (especially shares) compared to 20 March 2020, the impact will be smaller than the one assessed in this document.

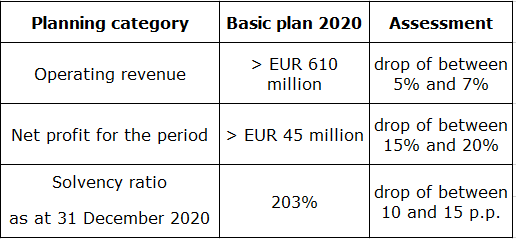

Based on the assumptions set out above, the Company assesses that the potential impact on the major planning categories of the Sava Insurance Group are:

Source: Sava Re

As the Croatian Bureau of Statistics published their report on CPI for March 2020, we are bringing you some key takes from it.

In March 2020, the prices of goods and services for personal consumption measured by the CPI increased by 0.2% on average. As compared to March 2019, they increased by 0.6%, while on the annual average they increased by 1.0%.

CPI (2018 – March 2020)*

Source: Croatian Bureau of Statistics, InterCapital Research

*Annual indices

YoY

When observing the main groups by purpose of consumption, compared to March 2019 the highest increase was recorded in the prices of Food and non-alcoholic beverages of 3.2%. Next come Restaurants and Hotels, with an increase of 2.8%. Health segment follows with an increase of 1.3% YoY. On the flip side, Trasnport segment recorded a decrease of 3.7%, as a result of a drop in fuel prices.

CPI Sector Breakdown – March 2020 (%)

Source: Croatian Bureau of Statistics, InterCapital Research

MoM

When observing the main groups by purpose of consumption, in March, the highest increase was recorded in the prices of Clothing and footwear, by 12.8% MoM on average, as a result of new collection of clothing and footwear. Next come the prices of Food and non-alcoholic beverages as well as in the prices of Communication, both of which increased by 0.4% on average. The prices of Furnishings, household equipment and routine household maintenance, recorded an increase of 0.3% on average, while the prices of Restaurants and hotels increased by 0.1% on average.

On the flip side, Transport segment witnessed a decrease of 3.1% on average in the prices on the back of lower prices of fuels for personal transport equipment. Next comes Education, which recorded a decrease of 1%, followed by Miscellaneous goods and services, which witnessed a decrease of 0.8%.

For today we decided to present you with a YTD share price peformance of listed European football clubs.

For football enthusiasts the current Covid-19 situation comes with an additional burden, as all major leagues are put on hold. Avid fans have turned to following the Belarusian league, the only European league still being played, while some are watching reruns of old matches. There is no doubt that the football industry has been severely impacted by the ongoing situation, which can be reflected in the fact that the value of football players worldwide has decreased by EUR 9.22bn, according to Transfermarkt. To put things into a perspective, that is 9 times higher than the current market value of the most valuable club in the world, Manchester City.

For today, we decided to look at the YTD share price performance of listed European football clubs. Back in the 1990s when competition prizes, sponsorship and TV rights were not as lucrative as today, many clubs decided to raise capital through an IPO in order to secure the funds need to purchase the best players and finance future results. European football clubs that decided to offer their shares to investors can be found in the STOXX FCTP index.

YTD Performance of FCTP Index

The ongoing situation has already negatively affected football clubs in many ways, like the ticket sales and broadcasting revenues as well as compensations received from UEFA. As a result, just like many global indices, FTCP observed a double-digit decrease on a YTD basis, 24.6% to be exact.

In the graph below, you can see the performance of certain FTCP index constituents with the addition of Manchester United. As visible from the graph, Turkish Trabzonspor recorded by far the best share price performance of +127.9% YTD. On the flip side, the biggest YTD decreases can be observed with 2 Italian clubs Roma and Juventus, which recorded a 42.2% and 38.1% decrease, respectively.

YTD Share Price Performance of Selected European Football Clubs (%)