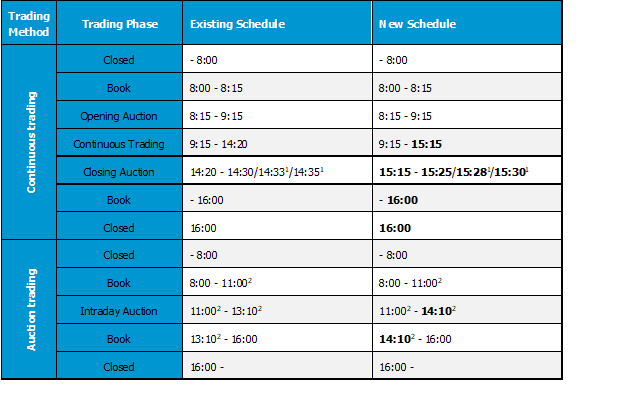

As of 23 November 2020, trading hours on the Regulated and SI ENTER market will be prolonged to 3.30 pm.

Earlier today LJSE announced the prolongation of trading hours on the Regulated and SI ENTER market. To be specific, LJSE intends to prolong the trading hours until 3.30 p.m. with the aim to increase the international comparability of the market.

The new trading schedule will enter into force on 23 November 2020 (with the transition to the upgraded version 9.0 of the Xetra® T7 system).

Change of Trading Schedule on the Regulated Market

Source: Ljubljana Stock Exchange

In the first 8 months of 2020, GWPs declined by 1.5% YoY. GWPs in non-life insurances grew 4.1% YoY, while life insurance decreased by 15.4% YoY.

Croatian Insurance Bureau published the GWP development in August 2020. Since the beginning of the year, GWP’s observed a slight decline of 1.5% compared to the same period last year. The total amount of GWPs collected reached HRK 7.407bn (includes insurers located in Croatia and insurers operating in Croatia but based in another EU country). The aforementioned decrease came solely on the back of the life segment which observed a strong decline of 15.4% YoY (or HRK -333.6m) to HRK 1.83bn. Such a decrease could arguably be attributed to the maturing of policies which were underwritten coupled with lower savings through life insurance and early termination of these policies. Meanwhile, non-life segment which traditionally accounts for the biggest portion of total GWPs, is still up by 4.1% YoY.

Croatia’s largest insurer, Croatia Osiguranje accounted for 27% of the market, showing a 0.4 p.p. YoY decrease.

Top & Bottom Performing Insurance Segments (Jan – August 2020 vs Jan – August 2019) (HRK m)

When observing GWPs by structure since the beginning of the year insurance against civil liability in respect of the use of motor vehicles (which accounts for 23.7% of GWPs) recorded a high increase of 9.7% YoY. Next, vehicle insurance (casco policy) which accounts for 12.12% of total GWPs recorded an increase of 2.33%. Health insurance observed also a solid YTD performance of +4.38%. Credit insurance observed a sharp decrease of 29.4% (or HRK 73.2m). This does not come as a surprise given the expected lower loan issuance activity in Croatia as a result of Covid-19 outbreak.

GWPs by Insurance Segment (%)

Fondul reported a total NAV of RON 10.42bn (EUR 2.15bn), which translates into a NAV per share of RON 1.6061 (+4% YoY).

According to the latest NAV report (31 August 2020), Fondul reported a total NAV of RON 10.42bn (EUR 2.15bn), which translates into a NAV per share of RON 1.6061.

When comparing it to the same period last year, their total NAV recorded a decrease of -2.8%, meanwhile due to the fund’s intensive buyback program, NAV per share increased by 4% YoY. Meanwhile, when comparing MoM, both Fondul’s NAV and NAV per share observed a solid increase of 3.1%.

When observing the portfolio structure, it remains traditionally oriented towards the power, oil and gas sectors, whereby the two largest holdings, Hidroelectrica and OMV Petrom account for 64.7% of the total NAV.

Turning our attention towards the share’s price performance, in August Fondul’s share price recorded a slight decrease of 0.8%, while as of 15 September, the share price amounted to RON 1.305, (+7.8% YTD). Note that the discount to NAV per share currently stands at 18.7%.

Utilizing Sustainalytics’ flagship ESG Risk Ratings, BVB’s goal is to make available top-line ESG research and ratings for the majority of companies listed on its Exchange, to promote responsible investing and highlight the importance of ESG standards among Romanian market participants.

Bucharest Stock Exchange (BVB) has launched the first ESG-focused initiative on the Romanian capital market, which aims to provide high-level ESG insights for BVB-listed companies.

Utilizing Sustainalytics’ flagship ESG Risk Ratings, BVB’s goal is to make available top-line ESG research and ratings for the majority of companies listed on its Exchange, to promote responsible investing and highlight the importance of ESG standards among Romanian market participants. The initiative also aims to encourage local companies to align their business strategies with ESG practices, which have witnessed a spectacular growth globally in recent years. Sustainalytics’ ESG Risk Ratings are designed to help investors identify and understand financially material ESG risks in their portfolio companies and how that risk might affect performance. The ratings measure a company’s exposure to industry-specific material ESG risks and how well a company is managing those risks. Comparable across all industries, Sustainalytics’ ESG Risk Ratings provide a quantitative measure of unmanaged ESG risk and distinguish between five levels of risk: negligible, low, medium, high and severe.

BVB added that they aim to develop the local ESG infrastructure starting from this first initiative, with the involvement of other market participants, by preparing and publishing presentation materials, guidelines for issuers and by launching new dedicated products.

We have recently published a blog on the importance of ESG practices. To read our blog on ESG click here.