Here you can find the key information regarding the listing of InterCapital CROBEX10tr UCITS ETF & InterCapital SBI TOP UCITS ETF on the ZSE.

Ticker: 7CRO and 7SLO

Underlying: CROBEX10tr and SBI TOP

Asset Manager: InterCapital Asset Management

First day & start of trading: Tomorrow (17.11.2020). Orders can be placed tomorrow from start of pre-market at 9 AM CET but first trades are expected after finish of listing ceremony around 11:15 AM CET

Listing price: Around 100 HRK for both ETFs (depending on the market interest when market opens)

Settlement: T+2

Market Maker: InterCapital Securities

Brokerage fee: 0% for our clients till end of 2020

Two important lessons were learned last week. First one is that the end of the pandemic is finally visible. The second one is that it’s still a bit far on the calendar, scheduled for end 2021, unless there is a breakthrough in distribution of the vaccine. What does all that mean for Croatian eurobonds? Find out in this brief research piece.

On Friday Croatian credit rating moved one step closer to being back in the investment grade bracket, at least according to credit rating agency Moody’s. While two other major credit rating agencies have already returned Croatian credit rating back to investment grade status as soon as in March (S&P) or June (Fitch) last year, Moody’s waited in order to gain some visibility on the progress of euro adoption and how much the Covid-19 pandemic would affect the overall economy. Speaking about the latter, there’s a striking coincidence between the timing of vaccine breakthrough (Pfizer published the news last Monday) and Croatian credit rating upgrade; although the credit rating agency is fully aware of how much tourism affects Croatian economy, it still looks as nothing more than a coincidence. To support this claim, note that other countries reliant on tourist inflows haven’t gotten a nod from the rating agency, so it seems that Moddy’s is simply improving it’s rating on the back of ERM II accession and the availability of EU funds to mitigate the ripple effects of the pandemic.

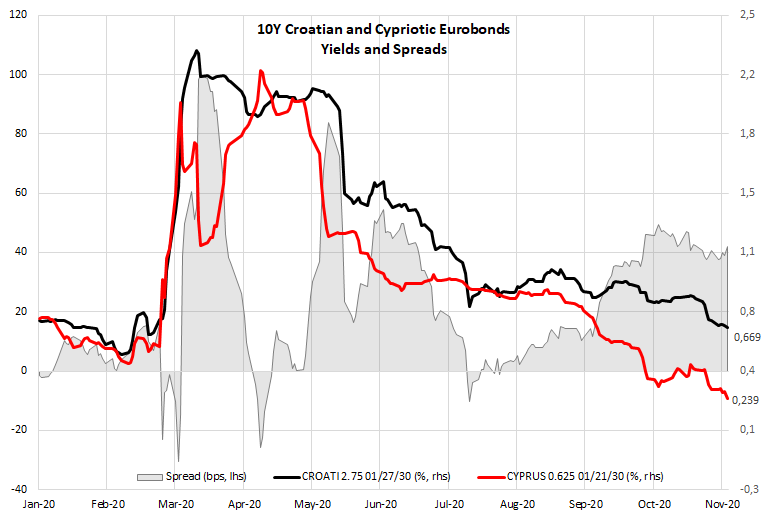

Rating upgrade is definitely good news, but don’t expect much from the Eurobond curve because a lot of good things are already priced in. To get a feeling of how Croatian Eurobonds are faring, take a look at the spread between 10Y Croatia (BBB-/BBB-/Ba1) and Cyprus (BBB-/BBB-/Ba2) currently at 42bps and on the path of contracting even further. It’s interesting to observe that last week’s vaccine news affected safe haven bonds and liquid HY such as Italy which both staged a limited sell off, but illiquid assets such as ROMANI and CROATI were protected from the drop in prices.

That’s a bit of a disappointment for accounts that are bullish on CROATI, but were looking for any sell off to upgrade their positions from neutral to overweight.

How come the sell off was so shallow? Well, first of all, ROMANI and CROATI tend to lag the overall environment by a day or two, and it’s worth remembering that’s exactly how much it took for the markets to shake off reflation fears. Note that by this morning German Bund already paired half of the losses made on Monday/Tuesday. The sell off might have been nothing more than a knee jerk reaction to vaccine news and once the selling pressure subsided, facts such as Republicans keeping the US Senate (making Biden’s fiscal job a bit harder than expected) and ECB’s PEPP extension on December 10th were once again playing a bigger role in fixed income valuation.

There’s also the question of distribution the vaccine. Although phase III of clinical trials confirmed that vaccine submitted by Pfizer/BioNTech called BNT162b2 is effective in 90% cases, the way it protects you from the virus is nothing short of revolutionary and this requires special handling of the vaccine. First of all, this is nothing like injecting weakened viruses in the blood stream so that your immune system can recognize them as foreign bodies. Instead, the vaccine developed by Ugur Sahin and Ozlem Tureci from German firm BioNTech is focused on mRNA giving the immune system instructions to recognize the virus “spike” protein. At the same time this means that the vaccine should be stored at -80°C and can endure only 24 hours on temperatures between -8°C and +2°C. In order to be vaccinated, each person should receive two doses one month apart. This means storing and distributing vaccine might be a bit slower than previously expected. On the other hand, BioNTech already purchased a production facility in Marburg which would be sufficient to lift the annual production to 750 million doses. Together with Pfizer, the couple could produce as much as 1.3 billion doses in a single year, which would be enough to vaccinate 650 million people. You see the point? That’s not nearly enough to claim fait accompli by the end of 2021 and that’s the reason why health officials around the world are looking for other producers, such as AstraZeneca, J&J etc. First vaccines are expected to be available by the end of January, but it would include a very narrow selection of people, namely elderly and health workers. In Friday’s Il Sole 24 Ore Domenico Arcuri, head of Italian anti-pandemic commission, stated that the first doses would arrive in Italy by end of January and would be sufficient to vaccinate about 1.7 million people. This is a good start, but doesn’t get Italy Covid-free before summer 2021; possibly not even before end-2021. Speaking about Croatia, the largest quantities of vaccine should be distributed by AstraZanenca (2.7 million doses) and Pfizer (1 million doses) and similarly to Italy the process of vaccination might be prolonged by EOY 2021.

Where does that leave us? The vaccine news by itself is not really a game changing event, at least not in the sense of the word that Covid has now been completely removed as a risk factor from the financial system. However, the end is now near. At this point in time, it’s important to start imagining how the post-pandemic world might look like – with public debt at all-time highs, it’s really a question can we anticipate any rate hikes in the future without adverse effects on the whole financial system. This means that even with vaccine in the picture, negative interest rates might stay around for longer than you have anticipated.

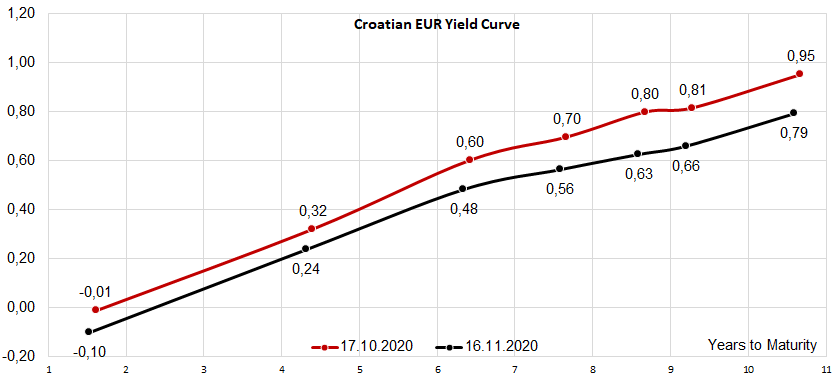

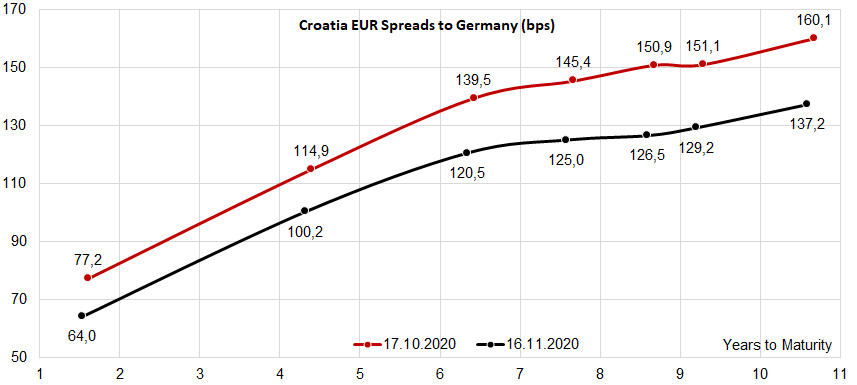

This is actually a good setup for Croatian Eurobond debt and if you’re a long term investor, then you haven’t completely missed the train. Note that CROATI 2.75 01/27/2030 is still traded at B+129.2bps, while in February 2020 this value was around B+90bps. The biggest value is still on CROATI 1.5 06/17/2031 which is traded at B+137.2bps (one month ago the spread was at B+160bps, as the chart suggests) and might be the top performer of Croatian Eurobond curve in days around ECB meeting. Also, be mindful that Croatia might be placing a new international bond throughout the first couple of months of next year, and this placement might drive a limited sell off coming from accounts seeking to cut their exposure in CROATI 1.5 06/17/2031 for the opportunity to purchase the new paper at bid plus a couple of basis points of NIP.

On Friday, Moody’s upgraded the Government of Croatia’s senior unsecured and long-term issuer ratings in foreign and local currency to Ba1 from Ba2 and changed the outlook to stable from positive.

Moody’s decision to upgrade Croatia’s ratings to Ba1 reflects the following key drivers:

ENHANCED INSTITUTIONAL CAPACITY AND POLICYMAKING AS THE COUNTRY ENTERS A CRITICAL PHASE OF EURO AREA ACCESSION

The first driver of the upgrade is based on Croatia’s progress towards euro-area accession and the associated strengthening of institutional capacity and policy making. On 10 July 2020, the euro-area finance ministers, the President of the ECB and the finance ministers and central bank governors of Denmark and Croatia formally approved Croatia’s entry into ERM II, which is one of the final steps prior to becoming a member of the euro area. The announcement amid the coronavirus disruption came against the background of Croatia’s comprehensive reform programme.

In Moody’s view, the successful completion of the reform programme speaks to the credibility of Croatia’s ambition to join the euro area. Moody’s believes that Croatia’s policy effectiveness has strengthened over the recent years. The government and the central bank have provided a more predictable and stable framework for economic activity in a very uncertain environment. The policy response to mitigate the impact of the coronavirus pandemic has been timely and efficient, with the central bank providing targeted support at times of market volatility.

Moody’s expects Croatia to continue to pursue sound economic and financial policies, as entering the euro area will require both sustainable economic convergence and readiness to participate in the banking union. On economic convergence, compliance with the convergence criteria is already advanced, as noted in the ECB’s 2020 convergence report.

From a macroprudential and banking perspective, Moody’s believes that the close cooperation between the ECB and the CNB and the inclusion of eight of the largest banks operating in Croatia under the ECB’s supervision will further enhance the system’s regulatory environment and promote the adoption of best practices.

CROATIA’S REDUCED EXPOSURE TO FOREIGN CURRENCY DEBT RISK

The second driver for the upgrade relates to Croatia’s strengthened fiscal credit profile despite the negative impact of the coronavirus pandemic. Under Moody’s Sovereign Ratings Methodology, a high share of foreign-currency denominated debt lowers fiscal strength considering the currency-depreciation risk that would trigger a sudden rise in interest costs and debt stock relative to GDP. In the case of Croatia, the tightly managed floating HRK-EUR exchange rate already mitigates this risk. Entering ERM II has further decreased this risk, as it brings Croatia closer to its predominant currency of issuance, the EUR. In 2019, 71.4% of Croatia’s general government debt was denominated in euros, down from 73.8% in 2016. By contrast, the share of HRK-denominated bonds rose from 22% to 28.4%.

Moody’s expects to fully eliminate the adjustment once Croatia effectively joins the euro area. Given the very uncertain environment and the need for Croatia to implement post-ERM II reforms, Moody’s believes Croatia could join the euro area towards 2025.

Regarding the government’s balance sheet, 2020 will mark a reversal in the declining debt trend against the backdrop of the coronavirus pandemic. Moody’s expects Croatia’s real GDP to contract by 8.6% this year, as both domestic and external demand are affected by the coronavirus pandemic. Accounting for 25% of GDP when considering direct and indirect effects, the Croatian tourism sector is strongly being affected by travel restrictions. As a result, Moody’s expects the fiscal deficit to reach 7.5% of GDP in 2020. This, in turn, is expected to push the debt-to-GDP ratio to 88.5% in 2020 and debt-to-revenues to 192.5%.

However, Moody’s expects the sharp deterioration in the debt metrics to be temporary and forecasts a gradual decline starting in 2021, when debt-to-GDP is expected to reach 86.7%, followed by 85.9% in 2022. The gradual reduction in public debt will be supported by a gradual economic recovery and a prudent fiscal stance as the government targets convergence towards the Maastricht criteria.

RATIONALE FOR THE STABLE OUTLOOK

The stable outlook reflects balanced credit strengths and challenges at the Ba1 rating level. Stronger- than-peers’ institutions and low susceptibility to event risk support the credit profile. Croatia’s fiscal strength combines a higher debt load compared to peers, while debt affordability is strong and foreign currency debt risk is declining with ERM II entrance. In terms of economic strength, Croatia’s much higher-than-peers’ wealth per-capita is somewhat offset by the country’s relatively smaller size, slower growing and more volatile economy.

The stable outlook also reflects Moody’s balanced view of the country’s prospects going forward. Croatia’s improved economic fundamentals and enhanced institutional capacity will provide resilience at the Ba1 rating level. At the same time, the stable outlook captures heightened risks for permanent scars with respect to Croatia’s economic and fiscal strength against the backdrop of the coronavirus’ new infection wave, with potentially a negative impact on both domestic and external demand.

In September, according to Croatian National Bank, deposits at banks increased 6% YoY reaching record value at HRK 323bn. Total loans issued by credit institutions amounted to HRK 271.6bn, representing an increase of 7.1% YoY.

According to consolidated statement of financial position for monetary financial institutions monthly published by Croatian National Bank (HNB) at the end of October, total deposits in September amounted to HRK 322.8bn, representing a solid increase of 6% YoY, while they were flat MoM. Such an increase could be attributed to a high growth of demand deposit money which increased by 17% YoY to HRK 119.4bn and which accounts for 37% of total deposits. Such an increase was partially offset by a solid decrease in savings deposits (-12%), which amount to HRK 203.4bn. Meanwhile, it is important to note that local currency savings deposits have observed a decrease of 12% YoY, as a point in time for taking over Euro as a local currency is getting closer. Local currency savings deposits amount to 29.9bn, while 73% of them are pertaining to households and 18% to corporates. Kuna savings deposits account for 9% of total deposits and 15% of savings deposits, while Foreign currency savings deposits account for 85% of all savings deposits. Foreign currency saving has increased 3% YoY, while MoM increase is at low 0.6%. In the times of uncertainty demand deposits usually grow the most, while savings deposits, both local and foreign currency, stand at HRK 203m and have grown 0.8% YoY. Savings at record levels shows unwillingness of Croatian citizens to invest in riskier asset classes despite their increase in financial literacy.

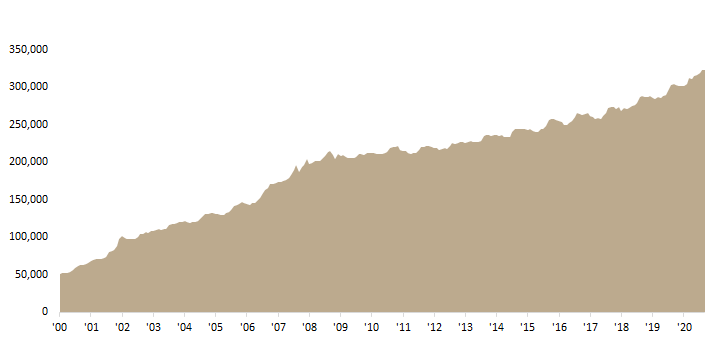

Deposits in Credit Institutions (HRK m)

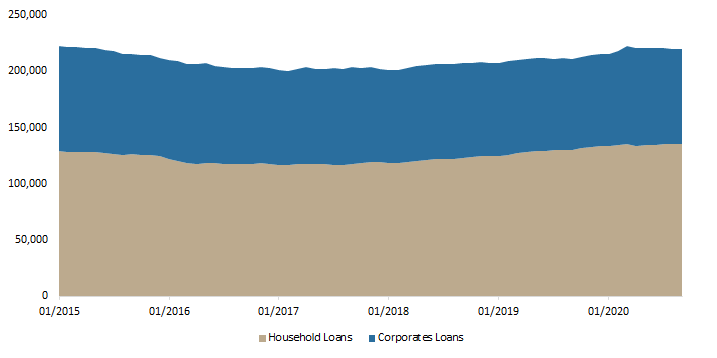

Total loans issued by credit institutions amounted to HRK 271.6bn, representing an increase of 7.1% YoY. Of that, 81% of it is pertaining to loans to corporates and households. Loans to households amounted to HRK 135.6bn (+4.2% YoY). If we were to observe the loan development to households MoM, one can observe only 0.3% increase as effects of pandemic have started to kick in. Corporate loans increased 5% YoY, which can be explained by prolonged pandemic times that is making corporates to turn more to credits. Loans to central state also increased 24% YoY which is due to issuance of HRK 6bn local currency loan to State for pandemic purpose.

When looking at loans’ currency structure we can see that local currency loans are growing at 15% YoY rate while FX loans grew only 1.2% YoY. The state loan for pandemic purposes taken in April is partially to blame for skewed increase in local currency. Still foreign currency loans make 53% of total loans, while foreign currency deposits have 54% share in total deposits. As loans (+7.1% YoY) have increased a little bit faster than deposits (6.2% YoY), loan deposit ratio at the end of Sep 2020, stands at the same level where it was a year ago, at 84%.

Total loans issued by credit institutions (HRK m)