Last night, NLB Group published an announcement of intent to launch an all-cash voluntary public takeover offer for all issued and outstanding shares of Addiko Bank, for the consideration of EUR 20.00 per share. Meanwhile, Agri Europe Cyprus already acquired 9.99% of Addiko shares for EUR 17.5 per share and published an offer today to acquire an additional 17% of Addiko shares, for EUR 16.24 per share (on cum dividend basis). Furthermore, Alta Pay Group, a Company owned by Davor Mucura recently bought 30% of Addiko shares in a package deal. NLB’s offer represents a P/B multiple of 0.47x, which is in line with the Group’s strategy of undervalued M&As in the last couple of years. If successful, we find this news to be beneficial for the Group and would help it achieve its recently announced 2030 business strategy. However, the positive outcome of this event is uncertain but could pose a huge upside.

NLB has announced its intention to launch an all-cash voluntary public takeover offer aimed at all issued and outstanding shares of Addiko Bank, for a consideration of EUR 20.00 per share on a cum dividend basis (meaning that all declared dividends in the interim would be deducted from this price).

NLB noted that the share price offer represents a very attractive and rare liquidity event for all Addiko shareholders to exit and sell their Addiko shares. This share price implies a premium of 22.15% compared to the six-month volume-weighted average share price of EUR 16.37. It all implies a premium of 4.99% compared to the closing price on 15 May 2024, just before the announcement. Finally, this represents a premium of 32.01% compared to the closing share price of EUR 15.15 on 22 March 2024, the last closing price before Agri Europe Cyprus Limited’s announcement on 25 March 2024 that it intended to launch a partial tender offer for shares in Addiko.

To understand this, we have to go back to that takeover bid. On 25 March 2024, Agri Europe Cyprus, owned by the Serbian businessman Miodrag Kostić, acquired a 9.99% share of Addiko Bank, for EUR 17.5 per share. Furthermore, it has announced an intention to acquire an additional 17% in Addiko for a price of EUR 16.24 (on cum dividend basis), for a total of 26.99% stake in the Bank. According to the Austrian Takeover Commission, the takeover was to be published “between 13 and 16 May 2024”, and was published today on the 16th. As such, it would seem that the move by NLB to offer a higher price at this time was aimed at not only acquiring the shares of the bank but also outbidding the offer by the said company.

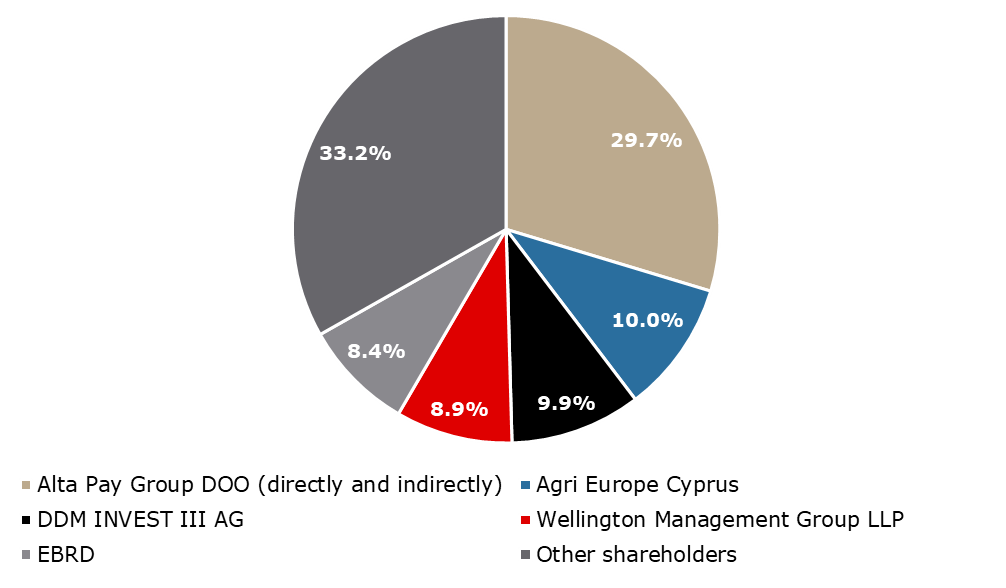

Furthermore, Alta Pay Group, a company owned by another Serbian businessman, Davor Macura, bought from several shareholders in a package deal app. 30% of Addiko Bank. The 30% consists of 9.63% owned directly by Alta Pay Group, 6.88% acquired from Dr. Jelitzka + Partner Gesellschaft fur Immobilienberatung und – verwertung GmbH, 6.73% acquired from WINEGG Realtitaten GmbH, and app. 6.43% was acquired from several minority shareholders. One of the reasons why Agri Europe Cyprus’s 17% takeover offer was delayed was due to the speculation that the two companies were working together, although both said that they were independent of each other.

Addiko Bank’s majority shareholder structure (according to the latest changes)

Source: Addiko Bank, InterCapital Research

For Agri Europe Cyprus’s takeover bid for 17%, the acceptance deadline lasts from 16 May 2024 until 27 June 2024. NLB noted that if it provides an offer memorandum for its offer in due course, its offer will qualify as a competing offer to the Agri takeover offer. In such a case, all Addiko shareholders that accept the Agri offer prior to the publication of the offer memorandum for the offer launched by NLB can withdraw from it, until four trading days prior to the end of the acceptance deadline (23 June 2024).

So having all of this in mind, what is the possible shareholding that NLB could acquire to this offer, given that the two other majority shareholders (Agri Europe Cyprus at 9.99%, and Alta Pay Group at 30% combined)? If these two shareholders are unwilling to sell their shares at the said price, the maximum that NLB could acquire would be 60%, although given that the Offer just started, we would have to wait and see how the investors would react. Furthermore, given that NLB has no shareholding in Addiko, they would have a steeper road to climb as opposed to the other 2 said shareholders.

Finally, if achieved, this would allow NLB to expand its presence in Slovenia, Serbia, Bosnia-Herzegovina, and Montenegro, as well as indirectly enter a market they have been wanting to enter for a long time – Croatia. We find that this is a positive development for NLB, as it would offer strong synergies towards achieving the Company’s goals set out in its 2030 strategy, more on which you can read here.

As a result of this announcement, Addiko’s share price grew by 5% to EUR 20 per share. If the entire offer is accepted, this would mean that NLB values Addiko at EUR 386m (excl. treasury shares). This would imply a P/B multiple of 0.47x, which is in line with NLB’s strategy of acquiring banks that are significantly under-valued on the book. Lastly, If “only” 60% of shares are purchased, NLB would have to pay app. EUR 231.4m for them.

In Q1 2024, Telekom Slovenije recorded revenue growth of 4% YoY, an EBITDA increase of 10%, and a net income of EUR 12m, a 48% increase YoY.

Starting at the top of the P&L, Telekom Slovenije recorded revenue of EUR 169m, representing an increase of 4% YoY. This came because of higher prices for services and a higher number of users. So company realized higher sales of IT merchandise and services, as well as higher revenues from financial, eHealth, and insurance services, and finally, higher revenues on the wholesale market.

Breaking the revenue down by segments, revenues in the mobile segment of the end-user market increased by 2% YoY to EUR 64.7m, due to the higher revenues at IPKO, primarily due to an increase in the number of users. This was partly offset by lower revenues from the sale of mobile merchandise at Telekom Slovenije, but it also meant that associated costs were lower. Meanwhile, revenues in the fixed segment of the end-user market were 5% higher YoY and amounted to EUR 54m, primarily as a result of higher revenues from broadband services as a result of the growth in the number of users and sales of IT merchandise and services at Telekom Slovenije.

Revenues from additional services, which include revenues from financial services, eHealth services, and insurance, amounted to EUR 1.4m, growing by 13% YoY, with growth recorded across all categories. Next up, revenues from the wholesale market also grew by 8% YoY to EUR 42m, primarily from international wholesale traffic. On the other hand, other revenues and merchandise revenue decreased by 8% YoY to EUR 7m.

Telekom Slovenije revenue composition breakdown (Q1 2024 vs. Q1 2023, EURm)

Source: Telekom Slovenije, InterCapital Research

Moving on to operating expenses, they amounted to EUR 152m, growing by 1% YoY, mainly as a result of labour costs, which grew by 15% YoY to EUR 31.5m, while several other categories recorded decreases, most notably the cost of materials and energy, which declined by 42% YoY to EUR 5.6m. The increase in labour costs came due to the change in the method for the interim calculation of business and performance costs, with the estimated proportionate annual amount included in Q1 2024 results. Before, these effects were recorded at the time of payment or in the FY results. As such, this represents the normalization of effects for quarterly reporting.

Due to the revenue growth combined with slightly lower OPEX, EBITDA grew by 10% YoY to EUR 59.7m, implying an EBITDA margin of 35.3%, representing an increase of 2.1 p.p. YoY. The net financial result remained negative at EUR 3.6m but did record a slight 10% improvement YoY, mainly as a result of higher financial income, while fin. expenses remained roughly the same.

Finally, because of all of these positive changes, Telekom Slovenije recorded a net income of EUR 12.1m, growing by 48% YoY, and implying a net income margin of 7.2%, an increase of 2.1 p.p. YoY.

Telekom Slovenije key financials (Q1 2024 vs. Q1 2023, EURm)

Source: Telekom Slovenije, InterCapital Research

In terms of CAPEX, it amounted to EUR 45.8m in Q1 2024, decreasing by 2% YoY. Breaking this down, investment into Telekom Slovenije (Slovenia) amounted to EUR 44.9m, growing by 27% YoY, while investments into other companies in Slovenia declined by 85% YoY, to EUR 1.4m. Investments into Kosovo also decreased, by 77% YoY to EUR 1.7m.

For 2024, the Company set a target of EUR 717.4m in op. revenues, EUR 233.6m in EBITDA, EUR 43.2m in net income, and total investments of EUR 235.7m. If the current quarter is annualized, Telekom Slovenije would need to slightly increase its revenue, while in terms of EBITDA and net income, it would be able to surpass the goal if the current dynamic continues. Finally, the investments would have to increase by almost 30% if the 2024 objective is to be reached.