Dividend yield is 8.9%

Cinkarna Celje held the GSM yesterday in which the shareholders approved a dividend payment of EUR 16.4m. This translates into EUR 21 per share and is by EUR 10 per share higher compared to the initially proposed dividend.

We note that the dividend yield is 8.9%, while ex-date is 22 June 2021.

The market reacted positively to the mentioned news, as the share price increased yesterday by 2.55%.

In the graph below, we are bringing you a historical overview of the company’s dividend per share and dividend yield.

Dividend per Share (EUR) and Dividend Yield (%) (2012 – 2021)

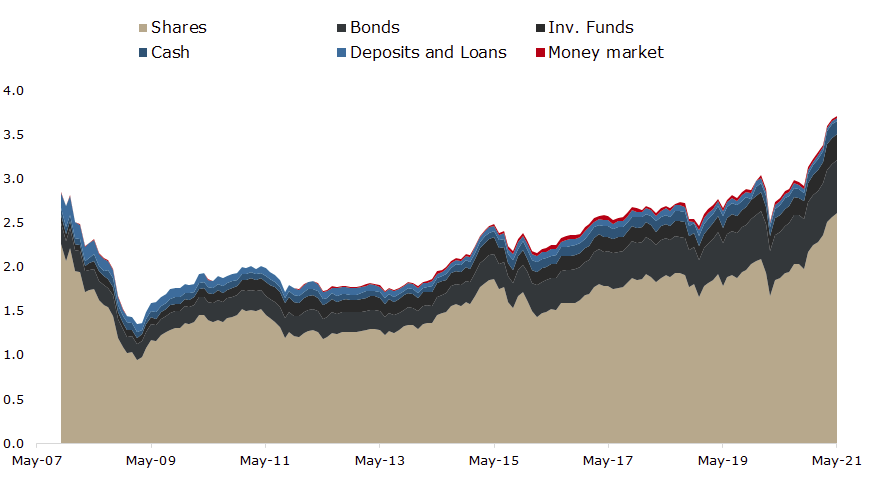

As of May 2021, Slovenian total assets under management are at the highest historical level of EUR 3.7bn, which represents 15.1% YTD growth.

For today, we decided to present you with a short asset structure analysis of Slovenian mutual funds. When looking at the graph below, one can notice that the Slovenian mutual funds have not significantly changed their asset structure during COVID-19 crisis.

As of May 2021, Slovenian mutual funds manage EUR 3.73bn, recording an increase for the seventh consecutive month (+0.5% MoM). More specifically, Slovenian UCTIS funds reached their high (in the observed period) since June 2007. This also represents 15.1% YTD growth. Following very high net contributions in April (EUR 47.3m) and March (EUR 72.9m), May’s contribution amounted to EUR 14.6m dropping by 69% MoM. We see a slight trend on Slovenian market in shift of retail investor focus from deposits to stocks and investment funds, as Slovenian’s gross excess savings have significantly increased during 2020 and pandemic times. A portion of that seemed to have been shifted to investment funds.

Turning our attention to the asset structure, as of May 2021, shares which account for 70.1% of the total assets (or EUR 2.6bn), observed a slight increase of 1.5% MoM. In May 2021, domestic equity holdings have reached EUR 64.76m, representing an increase of 3.1% MoM. This is still 14.4% lower than pre-pandemic times (January 2020). On the other hand, the vast majority (97.5%) of equity holdings of Slovenian mutual funds come from the foreign market.

Bonds come second, accounting for 16.2% (or EUR 602.5m), followed by investment funds with 7.8%.

Total Assets of All Slovenian UCITS Funds (May 2007 – May 2021) (EUR bn)