During 2023, A1 Croatia recorded revenue growth of 11.7% YoY, and EBITDA growth of 17.4% YoY. No net income data is available on the A1 Croatia basis. As Telecoms were able to increase their prices due to inflation indexation, A1 Croatia increased their prices by 8.5% in July 2023, which supported Q4 2023 results. Therefore, in Q4, total revenue of A1 Croatia increased by 12.3% YoY, while the EBITDA grew by 43.3% YoY.

A couple of days ago, one of the main competitors to Hrvatski Telekom, A1 Croatia published its results as part of the A1 Group FY 2023 results. While not a lot of details are available on the A1 Croatia level, what is available will be detailed in this overview.

Starting off with the total revenue, in 2023 it amounted to EUR 525m, growing by 11.6% YoY, while in Q4 this growth amounted to 12.1% YoY, totaling EUR 137m. On the Group level, A1 recorded total revenue of EUR 5.25bn, growing by 4.9% YoY, while in Q4 they recorded revenue of EUR 1.37bn, increasing by 2.3% YoY. As such, we can see that the Croatian market is growing faster than the Group level, contributing more to the overall growth. In terms of the services revenue, they amounted to EUR 425m in 2023, growing by 8.7% YoY, and EUR 108m in Q4 2023, increasing by 11% YoY.

A1 notes that in Croatia, the market dynamics remained roughly unchanged during Q4 2023, with results continuing to develop strongly. In the mobile business, A1 Croatia was focused on promoting its new product portfolio launched earlier in 2023 with integrated new business services, gaining customers with attractive handset offers, increasing ARPU, and protecting the customer base from aggressive actions by competitors through customized and personalized offers.

Meanwhile, in the fixed-line business, A1 Croatia leveraged its increased broadband coverage after significant fiber investments starting in the previous reporting year. A1 further notes that attractive TV and advanced broadband bundles played an important role in the successful customer acquisition throughout the year. Furthermore, intensive cost transformation programs are in place to help overcome the effects of inflationary pressures in Croatia.

A1 was also able to increase both the number of mobile subscriber base as well as the total number of RGUs. In the latter one, significant growth was recorded in the advanced broadband segment. A1 further notes that value-protecting measures were implemented in July 2023, which supported Q4 2023 results. Besides the growth in service revenues, equipment revenues also rose on the base of the increased share of flagship phone sales.

While no details on the cost side are available, A1 noted that core OPEX was reduced slightly compared to Q4 2022, and this was achieved despite the rising total workforce costs and higher electricity costs. Equipment margin also decreased during the same period.

Taking it all together, this led to an EBITDA of EUR 189m during 2023, and EUR 43m during Q4, growing by 17.4% and 43.3% YoY, respectively. This also meant that the EBITDA margin amounted to 36% in 2023, and 31.5% in Q4 2023, growing by 1.8 p.p. and 7 p.p. YoY, respectively.

While no details for the net income are provided on A1 Croatia basis, on the Group level, the net income amounted to EUR 646m in 2023, and EUR 145m in Q4, increasing by 1.7% and 9.8% YoY, respectively. This would also mean that the net income margin amounted to 17.3% in 2023, decreasing by 0.1 p.p. YoY, and 10.6% in Q4, growing by 0.8 p.p. YoY.

A1 Croatia Revenue, EBITDA comparison (2023 vs. 2022, EURm)

Source: A1 Group, InterCapital Research

In terms of total CAPEX, on the Group level, it amounted to EUR 1.09bn during 2023, growing by 15.7% YoY. Investments in the frequency spectrum amounted to a total of EUR 133m, of which EUR 111m (incl. interest) were into Croatia, and EUR 22m into Bulgaria. Excl. spectrum, CAPEX grew slightly by 2.6% YoY to EUR 959.6m, with increases in Austria, Bulgaria, Croatia, and Serbia, while investments decreased in Belarus and Slovenia.

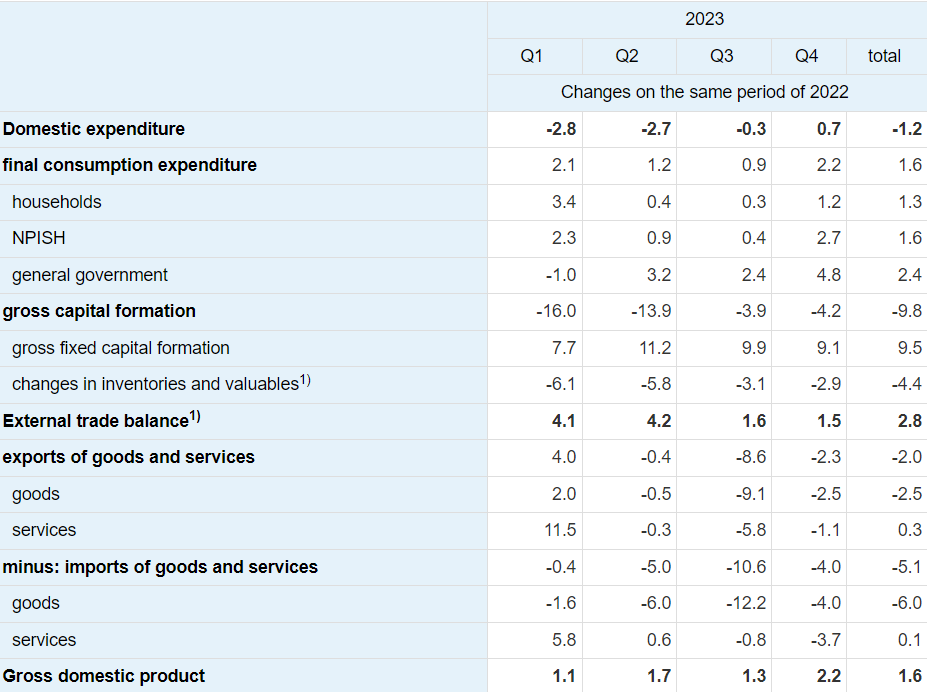

According to the latest GDP estimate released by the Slovenian Statistical Office, the country’s GDP grew by 1.6% YoY in 2023, and 2.2% YoY in Q4 2023. This is above the previous estimate by the Statistical Office (+1.3% YoY in 2023), and European Commission (+1.3% YoY). In this overview, we’ll detail what drove this growth.

Starting off with the Q4 data, domestic expenditure grew by 0.7% YoY, final consumption expenditure by 2.2%, while at the same time, capital formation declined by 4.2%, mostly due to a decrease in inventories. On the other hand, Gross fixed capital formation grew by 9.1%, mostly due to an increase in investment in buildings and structures. Household consumption also grew, by 1.2%. In terms of exports and imports, imports decreased by 4% YoY, while exports also decreased, albeit at a slower pace (-2.3% YoY). This resulted in a 2.2% YoY growth in Q4 2023.

Moving on to the yearly data, according to the first GDP estimate, GDP grew by 1.6% YoY in 2023. Of the GDP components, Gross fixed capital formation and household expenditure had a positive impact on the GDP growth, with Gross fixed capital formation increasing by 9.5%, while household expenditure grew by 1.3%. On the other hand, changes in inventories had a negative impact on GDP growth of 4.4 p.p. Furthermore, exports decreased by 2%, while imports decreased by 5.1%. Due to the larger decrease in imports, a higher external trade balance was recorded, contributing 2.8 p.p. to GDP growth.

Slovenian GDP YoY growth rates (quarterly, real GDP growth rates, Q1 2015 – Q4 2023, %)

Source: SURS, InterCapital Research

The increase in the gross fixed capital formation was expected, as both companies and the government continued investing during the year, albeit the focus was more and more on the Government spending later in the year, due to both the scope of infrastructure projects started by the Government, but also due to the slowdown in investment from companies in the latter part of the year, as higher interest rates on loans started ramping up. Furthermore, inflation, which on a decreasing trend, especially since the 2nd half of the year, also weighed in on investments. Costs, especially energy costs due to elevated prices of energy commodities due to the war in Ukraine, as well as employee costs due to said inflation, also slowed down investment sentiment from companies.

Household expenditure, one of the prime drivers of growth in developed economies was also weighted down by inflation, as real wage growth, despite increases was slowed. Furthermore, while unemployment is at record lows in Slovenia, wage growth was not significant in the current situation, while replacements could only be found from foreign workers, and the majority of companies aimed at keeping their workers, which all culminated in a slower real wage growth. In the situation of macroeconomic uncertainty, this also led to household expenditure being suppressed.

The Slovenian economy has been export-orientated for the last decade, i.e. after the GFC, with exports growing faster than imports. This led to a high external trade balance. While the same was true in 2023, it happened for the opposite reasons. This is because during the year both exports and imports dropped, but imports dropped faster than exports, leading to a continued higher external trade balance, which positively contributed to GDP growth. There are many reasons for why this happened, but the few main ones could be noted. Firstly, subdued household and company spending, which meant that demand for imported goods was lower. Furthermore, elevated prices of energy commodities also meant that there was less demand for them, also leading to lower imports. Combined with this, talks of recession in Slovenia’s main trading partners in the EU (most notably Germany), also meant that there was a drop in industrial production (again, most notably Germany) leading to reduced supply. This led to higher prices of various imported goods, as the costs of production also increased significantly under the influence of inflationary pressures. These pressures were especially noted in energy commodity prices, but also in wage growth in the countries where those goods are produced.

On the other hand, exports also slowed down, albeit at a slower pace, as the Slovenian economy was not hit as hard. At the same time, demand for Slovenian exports was subdued in the EU countries, as the same factors influenced a reduction in demand in them, as they did in Slovenia (apply the imports argument in Slovenia to imports in EU countries (exports from Slovenia), and you can see the picture more clearly).

Slovenian GDP by expenditures, constant prices, growth rates (%)

Source: SURS, InterCapital Research

According to the latest estimate of the Romanian GDP, it grew by 1% YoY in Q4 2023, while it decreased by 0.4% compared to Q3 2023. Furthermore, in 2023, it recorded a 2% increase YoY.

During Q4 2023, the Romanian GDP increased by 1% YoY for the seasonally adjusted series and 2.9% YoY for the unadjusted series. However, compared to the Q3 2023, the GDP decreased by 0.4% in real terms. Lastly, according to the first estimate for 2023, the GDP increased by 2% YoY.

Seasonally adjusted quarterly YoY GDP development (Q1 1996 – Q3 2023, %)

Source: Romanian National Institute of Statistics, InterCapital Research

We would like to note that no detailed data is available for this press release, with the more detailed release scheduled for 8 March 2024.